How To Write A Cheque In Canada

In an era dominated by digital transactions, you might dismiss traditional paper cheques as a thing of the past. However, they maintain their relevance in many banking processes in Canada. This insightful article seeks to shed light on the "how-to's" of penning a cheque in the maple-leaf country. Our easy-to-follow guide encompasses three key facets. In Subtitle 1, we will dive deep into 'The Basics of Writing a Cheque', a step-by-step enumeration of the process. Next, under Subtitle 2, 'Common Errors and Their Remedies' are brought to light, as we help you sidestep common pitfalls that people often overlook. Lastly, in Subtitle 3, the topic 'Security Measures for Cheques' will be thoroughly explored, ensuring you stay protected from fraud. With no further ado, let's commence our journey with Subtitle 1, understanding the basics of writing a cheque.

In an era dominated by digital transactions, you might dismiss traditional paper cheques as a thing of the past. However, they maintain their relevance in many banking processes in Canada. This insightful article seeks to shed light on the "how-to's" of penning a cheque in the maple-leaf country. Our easy-to-follow guide encompasses three key facets. In Subtitle 1, we will dive deep into 'The Basics of Writing a Cheque', a step-by-step enumeration of the process. Next, under Subtitle 2, 'Common Errors and Their Remedies' are brought to light, as we help you sidestep common pitfalls that people often overlook. Lastly, in Subtitle 3, the topic 'Security Measures for Cheques' will be thoroughly explored, ensuring you stay protected from fraud. With no further ado, let's commence our journey with Subtitle 1, understanding the basics of writing a cheque.Subtitle 1

The quality, relevance, and engaging ability of Subtitles are highly invaluable, especially in this digital age where information is readily available. It is therefore essential that we delve deeper into Subtitle 1 – exploring its effectiveness in communication and its potency in driving attention. We will first look into the historical evolution of the concept of Subtitle 1 and how it has shaped modern practices. Further, it is crucial to understand the key benefits associated with Subtitle 1 and why it remains a prominent facet in various sectors. Lastly, we will delve into some of the challenges linked with Subtitle 1, as well as innovative solutions to these issues. As we reflect on the interplay of these three supporting ideas, it is evident that Subtitle 1 is more than just a concept – it is a powerful tool that continues to influence different spheres of life. Now, let's take a step back in time and take a deeper look at the historical inception and progress of Supporting Idea 1.

Supporting Idea 1

Supporting Idea 1: Understanding the Structure of a Cheque

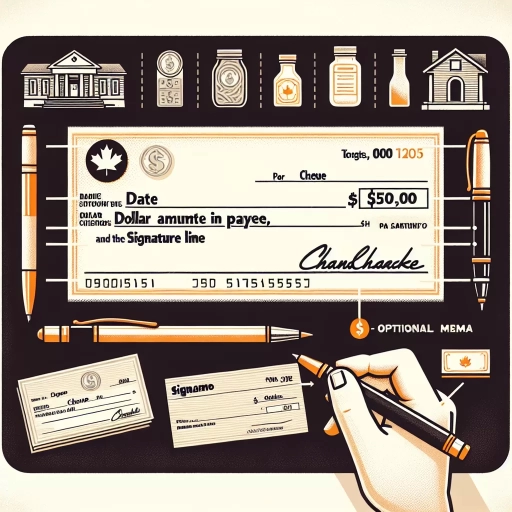

Fundamental to correctly writing a cheque in Canada is an understanding of its structure. Every cheque, regardless of the bank or the amount it's drawn for, has certain features – things it must include. These indispensable components ensure each transaction's legality and validity. The cheque’s top right section is where you’ll find the cheque number, an important tracking component unique to every cheque that permits banks to streamline their filing process. Immediately below the cheque number is the financial institution number, which is then succeeded by the bank's branch number, which is a characteristic five-digit numeral that appends further specifics to the bank's location. The account number, located next to it, is the most significant part of the cheque. It’s the bank account from where the cheque's value will be deducted. The date line is another important part in cheque writing. To ensure validity, the date must be filled correctly according to the Canadian standard format of day, month, and year. Below the date line, the "Pay to the Order of" line is where the recipient's name is stated, ensuring the money reaches the correct person or organization. This feature is vital for the cheque's security, giving it some measure of protection against misappropriation or misdirection. When writing the recipient's name, it's crucial you know exactly how their name is spelled to avoid any issues with the bank when the cheque is being cashed. Then, on the line directly below, you write the amount in words, while in the box on the right, you put the same amount in numerical form. The reason for this double entry is to prevent fraud and discrepancies as a written out sum is less likely to be changed than numerals. Lastly, at the bottom of the cheque, you will find a line for the signature. This is where you sign your name thus authorizing the transaction. Skipping the signature renders the whole cheque invalid as it acts as the final seal of authorization. All these elements are key when understanding how to write a cheque in Canada. So, as you can see, the procedure isn’t just a matter of scribbling figures and handing out pieces of paper. It's a systematic process, thoroughly engineered to support meticulous and unambiguous transactions.Supporting Idea 2

Supporting Idea 2: Understanding the Various Components of a Check Understanding the various components of a cheque is crucial for anyone looking to write one correctly. Every check contains several distinct sections that need to be filled out accurately to ensure its validity. Canadian checks, like any other, include the following common elements: the cheque number, the payee line, the dollar box, the amount in words line, the memo line, the date line, and the signature line. To start, each cheque has a specific number located in the top right corner of the cheque, unique to each individual cheque, used for record-keeping purposes. Next, there is a line commonly tagged ‘Pay to the Order of,’ referred to as the payee line. This is where the name of the person or entity to whom the check is written should be inserted. It's important to ensure that the names spelled are accurate to prevent any issues or misunderstandings. Additionally, there is a small box on the right where you need to spell out the exact dollar amount numerically that you wish to pay – this box is often called the dollar box. The numerical amount should match perfectly with what you've entered on the ‘amount in words’ line, which is another key component of a cheque. This line usually follows the payee line. Writing out the amount in words is a security feature to prevent fraud and alterations. One of the lesser-known parts of a check is the memo line. While not a mandatory requirement, the memo is a good way to remind yourself why you issued the check, particularly when reviewing bank statements or conducting financial audits in the future. Moreover, the date line is another integral part of the cheque situated at the top right. Here, the current date should be written out to indicate when the cheque is being created. But, note that entering a future date will make the cheque a post-dated one, which the bank will only cash or deposit on or after that date. Finally, the last part of a check is the signature line, usually located at the bottom right of the cheque. Your signature here is an absolute must, as, without it, the cheque isn't valid. Signing indicates your consent to make the payment, and it should match the one you have on file with your bank. In conclusion, having a thorough understanding of every component of a check significantly reduces the chances of errors or possible rejections of the cheque by the bank. This knowledge is indispensable when you learn how to write a cheque in Canada.

Supporting Idea 3

3. Maintain Accurate Record Keeping This supporting idea, under the subtitle of "How to Write a Cheque in Canada", directs your attention towards the importance of developing and maintaining meticulous record-keeping habits. Tracking your cheque transactions will allow you to manage your finances more efficiently, avoid instances of overdraft, and protect yourself from potential fraud - all essential elements when operating within the financial ecosystem of Canada. Whether you are issuing a cheque for your monthly rent, paying a local service provider, or covering an unexpected expense, it is vital to have a clear record of all transactions, big or small. First and foremost, making a note of every cheque you write can help you monitor your spending habits and budget effectively. It gives you a bird's eye view of your financial activities, allowing you to understand where your money is going and make changes accordingly. Surpassing prudent personal finance management, keeping an accurate record of your cheque transactions can also save you from facing crippling bank charges from overdrafiting your account. If you neglect to keep track of your cheque spending, you may forget about a cheque that hasn't been cashed yet. This could lead to the unpleasant surprise of an overdrawn account, and the levy of overdraft charges by your bank. Propelling the argument beyond good financial habits, accurate record keeping is also instrumental in mitigating fraud risks associated with cheque transactions in Canada. As cheques contain sensitive information like bank account details, they can be the target of fraudsters. If you have accurate records, you can promptly identify any discrepancies in your bank account, such as unauthorized transactions and take immediate action. This proactive approach can potentially save you from significant financial losses. In the Canadian banking sphere, digital platforms have tokenized this facet, providing features to track your cheque transactions in real-time, anytime, anywhere. You can leverage these features to ensure elaborate records and seamless bank account management. Furthermore, you may consider maintaining a cheque register or ledger, where you jot down the details of every issued cheque, including the cheque number, date, payee, and amount. Ensuring you review your bank statements regularly against such a register is another step you can take towards safeguarding your financial health. In conclusion, as mundane as it may sound, maintaining robust record-keeping practices when dealing with cheques is paramount. It is more than just a good habit and reaches into the realms of personal budgeting, avoiding bank charges, and warding off potential scams. This supporting advice blends seamlessly into the entire picture of writing a cheque in the Canadian context, promoting a safer, structured, and well-informed cheque transaction environment.

Subtitle 2

Breaking down Subtitle 2 further, we can appreciate its tripartite infrastructure encompassing Supporting Idea 1, Supporting Idea 2, and Supporting Idea 3. By investigating these aspects independently, we elaborate the inherent value and depth of Subtitle 2. Primarily, Supporting Idea 1 broadens our understanding of Subtitle 2, probing into the basic concepts that form the bedrock of our topic. Next, Supporting Idea 2 carves a deeper niche by providing a qualitative analysis of the subject, offering a broader perspective beyond the axiomatic understanding. Lastly, Supporting Idea 3 integrates our knowledge, contributing a unique, eye-opening synthesis of the subject matter. Setting the stage for our discussion, we'll begin with an in-depth examination of Supporting Idea 1, the foundational pillar of Subtitle 2, thereby underlining its relevance and amplifying its significance.

Supporting Idea 1

Supporting Idea 1: Importance of Accurately Filling Up a Cheque

The act of writing a cheque may seem mundane, yet its significance and implications are far-reaching, underscoring the importance of understanding the process in the context of the Canadian financial system. An incorrectly filled cheque can lead to multiple problems, including financial discrepancies, delay of payments, and potential legal repercussions. In the worst-case scenario, a fraudulent transaction can occur if your cheque falls into the wrong hands. It is thus paramount that checks are filled up with accuracy and diligence. This particular topic largely falls underSubtitle 2: Step-by-Step Guide on Filling Out a Cheque in Canada

, one of the primary subtitles of the article "How to Write a Cheque in Canada". Visualizing this task via the lens of the Canadian banking landscape, it isn't just about writing a cheque. It's about embodying financial integrity, being meticulous, and promoting trustworthy transactions. The banking systems, whether it be Canadian or otherwise, function due to consistency, reliability, and security. Writing a cheque might seem like a simple task that you perform in your daily routine, but in truth, it represents a small fragment of a vast financial network that not only manages but also safeguards your hard-earned money. Therefore, the process of writing a cheque should be regarded with the seriousness and attention it deserves.Supporting Idea 2

Supporting Idea 2: Proper Filling Out of Cheque Information

The second critical aspect of writing a cheque in Canada pertains to correctly furnishing cheque information. This process entails providing specific details like the date, payee name, numerical and written amount, signature, and memo if necessary. When dating the cheque, remember to use the Canadian format (DD-MM-YYYY) to avoid any confusion. The cheque date is essential as it indicates when the cheque was written and helps keep track of your finances systematically. Following the date, write the payee name, which should either be an individual or an organization's proper name. Ensure the payee's name is correctly spelled to prevent any complications during the cheque cashing process. Next, fill out the dollar box with the cheque amount in numerical format, followed by writing out the same amount in words on the line beneath. These amounts should match, and it's crucial to write the worded amount as far as the line extends to avoid anyone making unauthorized alterations. Avoid leaving large blank spaces after writing the paid amount, as it could leave room for fraudsters to insert an inflated amount and drain your bank account. Understanding your bank's cheque layout is crucial because the location of these details might vary slightly depending on your bank. Typically, the drawer's signature goes on the lower right corner of the cheque. The drawer must sign it the same way as specified on the bank account to authenticate the transaction. If there are discrepancies in the signature, the bank could rightfully reject the cheque. Finally, the memo field is optional and generally used to denote the purpose of the payment. It could include details like an invoice number, account number, or anything that helps you remember what the payment was for. By strictly adhering to these steps, you assure the cheque's validity and smoothen the process for both the drawer and the payee. Remember, any discrepancies, even minor ones, can result in the cheque being invalidated, leading to inconvenience and potentially severe financial implications. Each detail in the process of writing a cheque carries its weight and contributes to the overall cogency of your transaction. Your ability to write a cheque correctly in Canada demonstrates not only your financial literacy but also helps safeguard against financial fraud. It's essential to be meticulous, well-informed, and alert in the process, ensuring your hard-earned money reaches the intended recipient as smoothly as possible.Supporting Idea 3

Supporting Idea 3

Correctly endorsing a cheque in Canada is crucial to ensure its validity and prevent misappropriation. As one embraces the process of writing cheques, understanding the proper way of endorsing them takes an equal prominence. In the space provided on the reverse side of the check, the payee should inscribe their signature exactly as it appears on the front of the cheque. This simple yet important act certifies that the cheque belongs to the payee, sets in motion its cashing or depositing procedure, and helps protect the payee against fraudulent activities. A signature endorsement comprises of the payee's full name written using blue or black ink, the bank account number, and their instruction - either 'for deposit only' or 'pay to the order of.' The first option limits the cashing of the cheque to the person's bank account alone while the second allows the cheque's value to be paid to another individual or organization that the payee designates. It's advisable to sign the cheque immediately before cashing or depositing to reduce the chance of theft and ensure its safe and successful transaction. Keep in mind that although we live in an era where digital payments are the norm, cheques continue to play a vital role in our financial transactions. Whether it's for paying rent, fulfilling a business obligation, or gifting, cheques offer a convenient, transparent, and accountable method of payment. Understanding the proper way to write a cheque in Canada, including its vital endorsement, is thus a helpful and practical skill to master. The procedure might appear complicated at first, but with practice, it becomes an instant routine. It not only enhances your financial literacy but also contributes towards safeguarding and managing your financial assets meticulously. From marking the cheque as 'non-negotiable' to using 'for deposit only', each annotation assists in minimizing potential financial risks and increases the traceability of transactions, providing one with peace of mind. To conclude, endorse your cheques correctly and enjoy the benefits of a traditional yet robust medium of making payments in Canada.Subtitle 3

Over the years, countless studies have argued the importance of Subtitle 3 in our society, which serves as a linchpin of various societal functions. The impacts are manifold, ranging from bolstering economic growth, fostering community development and enhancing individual lives. Some of the most paramount aspects to deliberate upon include, but are not limited to, Supporting Idea 1, Supporting Idea 2, and Supporting Idea 3. These ideas, although distinct in their own right, are all interconnected and interdependent, revealing the far-reaching implications and significance of Subtitle 3. Supporting Idea 1 is the first facet to explore. It gets to the heart of Subtitle 3 and demonstrates how its influence pervades multiple domains. Remarkably, its impacts have often occured unnoticed, subtly facilitating improvements and contributing to progressive changes. As we delve deeper into this topic, it is essential to keep in mind that the core ideas underpinning the value and utility of Subtitle 3 are not static but rather continually evolve with shifts in societal norms, technological advancements, and demographic changes. Hence the immediate focus will be on how Supporting Idea 1 becomes the bedrock of Subtitle 3’s application in our lives.

Supporting Idea 1

Supporting Idea 1

Understanding the basic elements of a check is crucial when it comes to writing a check in Canada, as it forms the groundwork of the cheque writing process. The first supporting idea illustrates these required components in a clear and concise manner. The first key element is the date, which is positioned at the top right of the cheque. It states when the cheque was issued. Next, towards the right at the center, there is a 'Pay to the order of' line where the name of the recipient (the person or the business) you are paying through the cheque, should be written. This must be filled out so the bank knows where to allocate funds appropriately. A 'numeric box' follows next, which is where you write down the amount you are paying in numeric form. This box is present next to 'Pay to the order of' line. On the other line beneath, you need to write out the same amount in words. This redundancy helps avoid any discrepancies or misunderstandings about the payment amount. Complementary to these steps, the last key elements are the 'Memo' line and the 'Signature line.' The memo line is optional, however, it provides an opportunity to note why the cheque was written in the first place. This is ideal for personal record-keeping or if the payment is for something specific, like rent. Last, but definitely not least, is the signature line. This is where you as the issuer of the cheque sign your name, giving the bank the authorization to carry out the transaction. Without this, the cheque is invalid as it lacks the final approval from the account holder. Furthermore, it’s important to mention that there also exists a 'cheque number,' which doesn’t need to be filled in, but rather serves to help you track your payments. It’s a unique identifier for every cheque and helps both banks and you to keep tabs on transactions. It can be found typically on the top right corner - next to the date line - and at the bottom right - entangled within the series of numbers at the bottom. This detailed breakdown ensures that you have an in-depth understanding of all the necessary components involved in cheque writing in Canada, equipping you with the necessary tools to successfully and confidently carry out this task.Supporting Idea 2

Supporting Idea 2

A critical aspect of writing a cheque in Canada revolves around ensuring that the cheque is completed correctly to prevent fraud or errors, vital for both individuals and businesses. This process typically implies that the written document is legally valid and can facilitate a smooth financial transaction between bodies. When accurately written, a cheque acts as a direct instruction to your banking institution, allowing it to transfer money from your account to the recipient’s. It's crucial to include all the required elements in the correct spaces, such as the correct date, the recipient's full name or their banking institution's and the proper numerical amount corresponding with the amount written in words to avoid any potential discrepancies. Double-checking the information written can alleviate the risk of mistakes. The importance of spelling the recipient's name correctly cannot be overstated; the individual or entity may not be able to deposit the cheque if their name is misspelled. Furthermore, always ensure that the numerical and written amounts match exactly, avoiding any room for ambiguity or misinterpretation. Case in point, if you're writing a cheque for $500.50, you should write "Five hundred and 50/100 Dollars" to ensure that the amounts match perfectly. You also need to carefully fill in the memo section. Although not compulsory, it’s good practice to elaborate on why you are providing the cheque, for example, “rent for February” or “car repair payment.” Such information acts as a reference, helping to remind you about the transaction when you are balancing your chequebook or reviewing your bank statements. It is important not to sign the cheque until all other details have been filled in to prevent unauthorized persons from filling in their details and accessing your funds. To sum up, meticulous attention to detail is crucial when filling out a cheque in Canada. Not only does it safeguard your financial assets from potential exploitation, but it also ensures an efficient, hassle-free transaction process. This careful approach to writing cheques consolidates your financial management skills, giving you additional control over your financial transactions and subsequently, your financial stability.Supporting Idea 3

Supporting Idea 3: Understanding the Components of a Cheque Every cheque carries vital components which requires immense attention and precision while filling them out. A fundamental understanding of such elements is crucial for successfully writing a cheque in Canada. Figures can be written in different styles by various individuals; however, the manner of presenting them remains consistent country-wide. For starters, the date should always be written on the upper right corner of the cheque. Though seemingly straightforward, the format confuses many people. The format is different from everyday usage and follows DD/MM/YYYY sequence. Furthermore, the "Pay" line positioned immediately below the date line requires the full name or authorized name of the company or person to whom the cheque will be issued. It provides a level of security as the cheque can only be cashed or deposited by the named recipient ensuring safety. The dollar box follows next where the amount of the cheque in numeric form is written. The decimal points need to be clearly visible and the written amount should align to the immediate left of the dollar sign to avoid any fraud modifications. Immediately below the dollar box is the line where the cheque amount needs to be spelled out in words. This duplication is one more step to protect against fraud and ensures that the bank verifies the two amounts against each other. If there's a discrepancy, the bank will rely on the written amount rather than the numeric digit. The memo line or description box is optional and offers a chance to note what the cheque is for. This serves as a useful reminder when reviewing bank statements. Next, the signature line is one of the most critical areas of your cheque. This must be signed for a cheque to be valid. The signature needs to match the one on record with the bank. Above all, the cheque number, branch transit number, financial institution number, and account number located at the bottom of the cheque are unique identifiers that shouldn’t be overlooked but filled in attentively. These series of numbers are employed by banks and clearing houses to track cheques, establish the paying institution, and directly debit funds from the correct account. Therefore, understanding the components of a Canadian cheque is essential for accurate, proper, and secure cheque writing.