How To Pay Back Ceba Loan

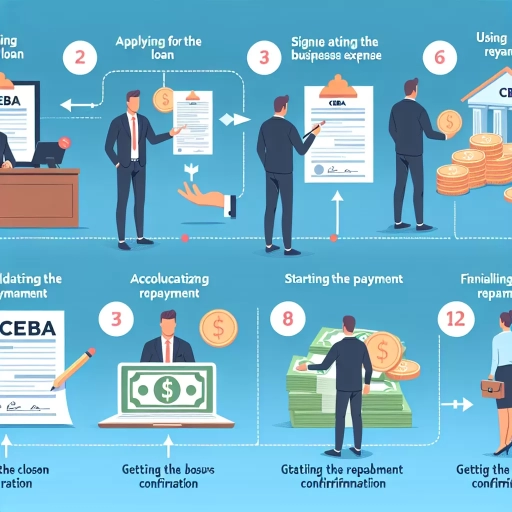

Here is the introduction paragraph: The Canada Emergency Business Account (CEBA) loan has been a vital lifeline for many small businesses and entrepreneurs during the COVID-19 pandemic. With its interest-free and forgivable terms, the loan has provided much-needed financial support to help businesses stay afloat. However, as the repayment period approaches, many business owners are left wondering how to pay back their CEBA loan. To ensure a smooth repayment process, it's essential to understand the loan's repayment terms, develop effective strategies for repayment, and be prepared to manage any challenges that may arise. In this article, we'll explore these key aspects of CEBA loan repayment, starting with a crucial first step: understanding the loan's repayment terms. By grasping the specifics of the loan's repayment schedule, interest rates, and forgiveness conditions, business owners can set themselves up for success and make informed decisions about their repayment plan.

Understanding the Ceba Loan Repayment Terms

Here is the introduction paragraph: The Canada Emergency Business Account (CEBA) loan has been a vital lifeline for many small businesses and entrepreneurs affected by the COVID-19 pandemic. With its favorable terms and conditions, the CEBA loan has provided much-needed financial support to help businesses stay afloat during these challenging times. However, as the loan repayment period approaches, it's essential for borrowers to understand the repayment terms to avoid any potential pitfalls. In this article, we'll delve into the key aspects of the CEBA loan repayment terms, including the loan amount and interest rate, repayment period and schedule, and prepayment and penalty fees. By understanding these critical components, borrowers can ensure a smooth repayment process and avoid any unnecessary costs. Understanding the Ceba Loan Repayment Terms is crucial to make informed decisions and avoid any financial burdens.

1. Loan Amount and Interest Rate

. Here is the paragraphy: When it comes to repaying your CEBA loan, understanding the loan amount and interest rate is crucial. The loan amount is the total amount borrowed, which in the case of CEBA is $40,000 or $60,000, depending on the type of loan you received. The interest rate, on the other hand, is the percentage of the loan amount that you will be charged as interest over the loan term. For CEBA loans, the interest rate is 0% until December 31, 2023, after which it will increase to 5% per annum. It's essential to note that the interest rate is only applied to the outstanding loan balance, not the entire loan amount. For example, if you borrowed $40,000 and have repaid $10,000, the interest rate will only be applied to the remaining $30,000. Understanding the loan amount and interest rate will help you plan your repayment strategy and make informed decisions about your loan. Additionally, it's crucial to review your loan agreement and consult with your financial institution if you have any questions or concerns about your loan terms. By doing so, you can ensure that you're on track to meet your repayment obligations and avoid any potential penalties or fees.

2. Repayment Period and Schedule

. The repayment period and schedule for a CEBA loan are crucial aspects to understand, as they directly impact your business's cash flow and financial planning. The repayment period for a CEBA loan is 5 years, with no interest or principal payments required in the first year. This interest-free and payment-free period allows your business to focus on recovery and growth without the added burden of loan repayments. After the first year, the loan enters a 4-year repayment period, during which you will need to make regular payments to repay the principal amount. The repayment schedule is typically set up as a monthly or quarterly payment plan, depending on your business's financial situation and cash flow. It's essential to review and understand your repayment schedule carefully, as missing payments can result in penalties and negatively impact your credit score. To avoid any issues, it's recommended that you set up automatic payments or reminders to ensure timely payments. Additionally, you may want to consider making extra payments or paying off the loan early to reduce the overall interest paid and free up more funds for your business. By understanding the repayment period and schedule, you can better manage your CEBA loan and make informed decisions to support your business's long-term success.

3. Prepayment and Penalty Fees

. Here is the paragraphy: When it comes to repaying your CEBA loan, it's essential to understand the prepayment and penalty fees associated with it. The good news is that you can repay your CEBA loan at any time without incurring any prepayment fees. This means you can make extra payments or pay off the loan in full whenever you want, without being charged a penalty. However, it's crucial to note that if you repay more than 75% of the loan by December 31, 2022, you will be required to pay a penalty of 5% of the outstanding loan balance. This penalty is designed to encourage borrowers to keep the loan for at least two years, allowing them to benefit from the 0% interest rate and 33% loan forgiveness. To avoid this penalty, you can choose to repay up to 75% of the loan by December 31, 2022, and then repay the remaining balance by the loan's maturity date. It's also worth noting that if you default on your loan, you may be subject to additional fees and penalties, so it's essential to make timely payments and communicate with your lender if you're experiencing any financial difficulties. By understanding the prepayment and penalty fees associated with your CEBA loan, you can make informed decisions about your repayment strategy and avoid any potential pitfalls.

Strategies for Repaying the Ceba Loan

Here is the introduction paragraph: The Canada Emergency Business Account (CEBA) loan has been a lifeline for many small businesses and entrepreneurs during the COVID-19 pandemic. However, with the loan's repayment terms looming, business owners are now faced with the challenge of repaying the loan while maintaining their financial stability. To avoid defaulting on the loan and incurring penalties, it's essential to develop a solid repayment strategy. This article will explore three key strategies for repaying the CEBA loan: creating a budget and payment plan, increasing cash flow and reducing expenses, and exploring alternative repayment options. By understanding these strategies and implementing them effectively, business owners can ensure a smooth repayment process and avoid any potential financial pitfalls. Before diving into these strategies, it's crucial to have a clear understanding of the CEBA loan repayment terms, which will be discussed in the next section.

1. Creating a Budget and Payment Plan

. Here is the paragraphy: Creating a budget and payment plan is a crucial step in repaying the CEBA loan. Start by reviewing your business's financial situation, including income, expenses, and debts. Make a list of all your monthly expenses, including rent, utilities, supplies, and employee salaries. Next, calculate your business's net income and determine how much you can realistically allocate towards loan repayment each month. Consider using the 50/30/20 rule, where 50% of your income goes towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment. Based on your budget, create a payment plan that outlines the amount you will pay each month, the payment frequency, and the payment method. You may want to consider setting up automatic payments to ensure you never miss a payment. Additionally, review your budget and payment plan regularly to ensure you are on track to meet your loan repayment goals. By creating a budget and payment plan, you can ensure that you are making timely and manageable payments towards your CEBA loan, and avoid any potential penalties or interest charges. It's also a good idea to prioritize your loan repayment by paying more than the minimum payment each month, this will help you to pay off the loan faster and reduce the amount of interest you owe. By following these steps, you can create a budget and payment plan that works for your business and helps you to successfully repay your CEBA loan.

2. Increasing Cash Flow and Reducing Expenses

. Here is the paragraphy: Increasing cash flow and reducing expenses are crucial strategies for repaying the CEBA loan. By boosting your business's cash inflows and minimizing unnecessary expenditures, you can allocate more funds towards loan repayment. To achieve this, consider implementing cost-saving measures such as renegotiating contracts with suppliers, reducing energy consumption, and streamlining operations to eliminate inefficiencies. Additionally, explore opportunities to increase revenue by expanding your customer base, introducing new products or services, or improving pricing strategies. You can also consider implementing a cash flow management system to track and manage your business's finances more effectively. By doing so, you can identify areas where you can cut costs and allocate those funds towards loan repayment. Furthermore, consider using the 50/30/20 rule as a guideline to allocate your business's income towards necessary expenses, discretionary spending, and debt repayment. By prioritizing debt repayment and making timely payments, you can pay off the CEBA loan efficiently and avoid accumulating interest charges. By implementing these strategies, you can increase your business's cash flow, reduce expenses, and make timely loan repayments, ultimately ensuring a successful repayment of the CEBA loan.

3. Exploring Alternative Repayment Options

. Here is the paragraphy: Exploring alternative repayment options is a crucial step in managing your CEBA loan. If you're struggling to make the regular payments, you may want to consider alternative repayment arrangements. The Canada Revenue Agency (CRA) offers a few options to help you manage your debt. One option is to make a pre-authorized debit agreement, which allows you to make regular payments automatically from your bank account. Another option is to make a lump-sum payment, which can help reduce the principal amount of your loan. You can also consider consolidating your CEBA loan with other debts, such as credit cards or personal loans, into a single loan with a lower interest rate and a longer repayment period. Additionally, you may want to explore income-driven repayment plans, which can help reduce your monthly payments based on your income and family size. It's essential to note that these alternative repayment options may have different interest rates, fees, and repayment terms, so it's crucial to carefully review the terms and conditions before making a decision. By exploring alternative repayment options, you can find a plan that works best for your financial situation and helps you pay back your CEBA loan successfully.

Managing Ceba Loan Repayment Challenges

Here is the introduction paragraph: Managing Ceba Loan Repayment Challenges: A Guide to Overcoming Financial Hurdles Repaying a Ceba loan can be a daunting task, especially for small business owners who are already navigating the challenges of running a business. However, with the right strategies and support, it is possible to overcome common repayment challenges and get back on track. In this article, we will explore three key areas that can help you manage Ceba loan repayment challenges: dealing with financial hardship and default, communicating with the lender and seeking support, and avoiding common repayment mistakes. By understanding these key concepts, you will be better equipped to navigate the repayment process and avoid potential pitfalls. To start, it's essential to have a solid grasp of the Ceba loan repayment terms, which we will discuss in the next section, Understanding the Ceba Loan Repayment Terms.

1. Dealing with Financial Hardship and Default

. Here is the paragraphy: Dealing with financial hardship and default can be a daunting experience, especially when it comes to managing CEBA loan repayment. If you're struggling to make payments, it's essential to address the issue promptly to avoid further complications. The first step is to communicate with your lender, explaining your situation and providing financial documentation to support your claim. This may lead to temporary payment deferrals or interest-only payments, giving you time to get back on your feet. However, it's crucial to understand that these measures are not a permanent solution and may impact your credit score. In extreme cases, defaulting on a CEBA loan can result in the Canada Revenue Agency (CRA) pursuing collection actions, including garnishing wages or seizing assets. To avoid this, consider seeking professional advice from a financial advisor or credit counselor, who can help you develop a personalized plan to manage your debt and get back on track. Additionally, exploring alternative funding options, such as a debt consolidation loan or a line of credit, may provide temporary relief. Ultimately, addressing financial hardship and default requires a proactive and informed approach, and by taking the right steps, you can mitigate the risks and work towards a more stable financial future.

2. Communicating with the Lender and Seeking Support

. Here is the paragraphy: Communicating with the Lender and Seeking Support When facing challenges in repaying a CEBA loan, it's essential to communicate openly and honestly with the lender. Borrowers should reach out to their lender as soon as possible to discuss their situation and explore available options. Lenders may offer temporary payment deferrals, interest-only payments, or other forms of assistance to help borrowers get back on track. Additionally, borrowers can seek support from financial advisors, accountants, or business consultants who can provide guidance on managing cash flow, reducing expenses, and increasing revenue. The Canadian government also offers resources and support for small businesses, including the Canada Business App and the Business Development Bank of Canada (BDC). By seeking help and communicating with the lender, borrowers can avoid defaulting on their loan and minimize the risk of damaging their credit score. Furthermore, lenders may be willing to work with borrowers to restructure their loan repayment plan, which can help alleviate financial stress and provide a more manageable repayment schedule. By taking proactive steps to address repayment challenges, borrowers can ensure they meet their loan obligations and maintain a positive relationship with their lender.

3. Avoiding Common Repayment Mistakes

. Here is the paragraphy: When it comes to repaying a CEBA loan, it's essential to avoid common mistakes that can lead to financial difficulties. One of the most significant errors is not creating a repayment plan. Without a clear plan, you may find yourself struggling to make payments, leading to late fees and interest charges. To avoid this, take the time to review your financial situation, calculate your monthly payments, and set realistic goals. Another mistake is not prioritizing your loan repayment. It's crucial to make your CEBA loan payments a priority, especially if you have other debts with higher interest rates. By paying off your CEBA loan first, you can avoid accumulating more interest and reduce your overall debt burden. Additionally, not taking advantage of the 0% interest rate during the first year can be a costly mistake. Make sure to make regular payments during this period to reduce your principal amount and save on interest. Finally, not communicating with your lender can lead to missed payments and penalties. If you're experiencing financial difficulties, reach out to your lender to discuss possible alternatives, such as a payment deferral or a temporary reduction in payments. By avoiding these common mistakes, you can ensure a smooth and successful CEBA loan repayment process.