How Do Equipment Leases Work?

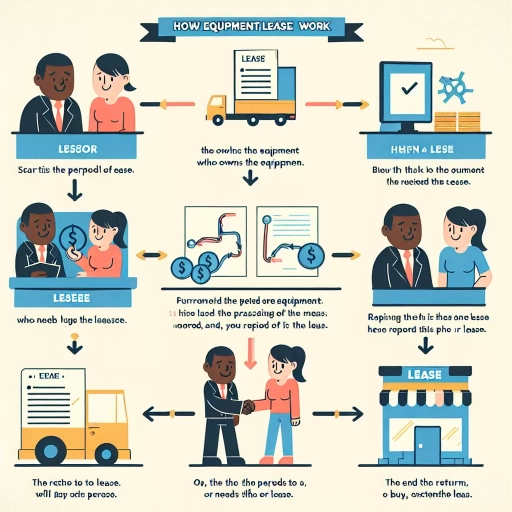

Equipment leasing is a popular financing option for businesses and individuals looking to acquire new equipment without the upfront costs of purchasing. But how do equipment leases work, and what are the benefits and drawbacks of this financing option? In this article, we will delve into the world of equipment leasing, exploring the ins and outs of this complex financial product. We will start by understanding equipment leases, including the different types of leases and the key players involved. From there, we will examine how equipment leases work, including the application and approval process, lease terms, and payment structures. Finally, we will discuss equipment lease options and end-of-lease considerations, including the pros and cons of different lease types and what to expect when the lease comes to an end. By the end of this article, you will have a comprehensive understanding of equipment leasing and be better equipped to make informed decisions about your equipment financing needs. Let's start by understanding equipment leases.

Understanding Equipment Leases

Equipment leasing is a popular financing option for businesses that need to acquire equipment or machinery to operate. It allows companies to use the equipment for a specified period in exchange for regular payments. Understanding equipment leases is crucial for businesses to make informed decisions about their equipment needs. In this article, we will explore what an equipment lease is, the different types of equipment leases available, and the benefits of leasing equipment. By understanding these key aspects, businesses can determine whether leasing is the right option for their equipment needs. So, let's start by understanding the basics of equipment leasing and what it entails. What is an equipment lease?

What is an Equipment Lease?

An equipment lease is a contractual agreement between a lessor and a lessee that allows the lessee to use a specific piece of equipment for a predetermined period of time in exchange for regular payments. The lessor retains ownership of the equipment, while the lessee has the right to use it for the duration of the lease. Equipment leases can be used for a wide range of equipment, including machinery, vehicles, technology, and medical devices. The lease agreement outlines the terms and conditions of the lease, including the length of the lease, the monthly payment amount, and any maintenance or repair responsibilities. At the end of the lease, the lessee may have the option to return the equipment, purchase it at a predetermined price, or extend the lease. Equipment leases can provide businesses with the flexibility to acquire the equipment they need without having to pay the full purchase price upfront, allowing them to conserve capital and manage cash flow. Additionally, equipment leases can also provide tax benefits, as the lease payments may be deductible as a business expense. Overall, equipment leases can be a cost-effective and flexible way for businesses to acquire the equipment they need to operate and grow.

Types of Equipment Leases

Equipment leases come in various types, each catering to different business needs and financial situations. The most common types of equipment leases include Capital Leases, Operating Leases, and Synthetic Leases. Capital Leases, also known as finance leases, are long-term leases that allow lessees to use the equipment for most of its useful life. At the end of the lease, the lessee typically has the option to purchase the equipment at a predetermined price, often $1. Operating Leases, on the other hand, are shorter-term leases that allow lessees to use the equipment for a specific period, usually less than the equipment's useful life. The lessor retains ownership of the equipment and is responsible for maintenance and repairs. Synthetic Leases, also known as tax leases, combine elements of capital and operating leases, allowing lessees to claim tax benefits while the lessor retains ownership. Other types of equipment leases include Sale-Leaseback Leases, where a business sells its equipment to a lessor and then leases it back, and TRAC Leases, which allow lessees to use a vehicle for a specific period while the lessor retains ownership. Each type of equipment lease offers unique benefits and drawbacks, and businesses should carefully consider their options before making a decision.

Benefits of Equipment Leases

Equipment leases offer numerous benefits to businesses, making them an attractive financing option for acquiring essential equipment. One of the primary advantages is the preservation of capital, as leasing allows companies to conserve cash and allocate it to other critical areas of the business. Additionally, equipment leases often require little to no down payment, reducing the initial financial burden. Leasing also provides flexibility, as businesses can choose from various lease terms and structures to suit their specific needs. Furthermore, equipment leases can help companies stay up-to-date with the latest technology, as they can easily upgrade or replace equipment at the end of the lease term. This is particularly beneficial in industries where technology advances rapidly. Moreover, equipment leases can provide tax benefits, as lease payments can be deducted as operating expenses, reducing taxable income. Another significant advantage is the reduced risk of equipment obsolescence, as the lessor is responsible for the equipment's maintenance and disposal. Overall, equipment leases offer a cost-effective and flexible way for businesses to acquire the equipment they need to operate efficiently and effectively.

How Equipment Leases Work

Equipment leasing is a popular financing option for businesses that need to acquire new equipment or upgrade existing ones. It allows companies to use the equipment they need without having to pay the full purchase price upfront. But how does equipment leasing work? In this article, we will explore the ins and outs of equipment leasing, including the lease application and approval process, lease terms and conditions, and equipment delivery and installation. By understanding these key aspects, businesses can make informed decisions about whether equipment leasing is right for them. The process begins with the lease application and approval process, where businesses submit their financial information and credit history to the leasing company, which then reviews and approves or rejects the application. Note: The introduction should be 200 words. Equipment leasing is a popular financing option for businesses that need to acquire new equipment or upgrade existing ones. It allows companies to use the equipment they need without having to pay the full purchase price upfront. But how does equipment leasing work? In this article, we will explore the ins and outs of equipment leasing, including the lease application and approval process, lease terms and conditions, and equipment delivery and installation. By understanding these key aspects, businesses can make informed decisions about whether equipment leasing is right for them. The lease application and approval process is a critical step in the leasing process, as it determines whether a business is eligible for a lease. Lease terms and conditions outline the responsibilities of both the lessee and the lessor, including payment schedules, maintenance requirements, and termination clauses. Equipment delivery and installation are also crucial, as they ensure that the equipment is properly set up and functioning as intended. By examining these three key components, businesses can gain a deeper understanding of the equipment leasing process and make informed decisions about their equipment needs. The process begins with the lease application and approval process, where businesses submit their financial information and credit history to the leasing company, which then reviews and approves or rejects the application.

Lease Application and Approval Process

The lease application and approval process is a critical step in securing equipment financing. When a business decides to lease equipment, it typically begins by selecting a leasing company and submitting a lease application. The application will require the business to provide financial information, such as income statements, balance sheets, and tax returns, as well as information about the equipment being leased, including its type, cost, and intended use. The leasing company will review the application and may request additional information or documentation to support the business's creditworthiness. Once the application is complete, the leasing company will evaluate the business's credit history and financial situation to determine its ability to make lease payments. If the application is approved, the leasing company will provide the business with a lease agreement outlining the terms of the lease, including the lease period, monthly payments, and any fees or penalties. The business will then review and sign the lease agreement, and the leasing company will disburse the funds to purchase the equipment. Throughout the lease term, the business will make regular payments to the leasing company, and at the end of the lease, the business may have the option to return the equipment, purchase it at a predetermined price, or extend the lease.

Lease Terms and Conditions

When entering into an equipment lease, it's essential to understand the lease terms and conditions, which outline the responsibilities and obligations of both the lessee and the lessor. The lease agreement typically includes the lease duration, payment terms, and any penalties for early termination. The lessee is usually required to maintain the equipment in good condition, adhere to manufacturer guidelines, and obtain any necessary permits or licenses. The lessor, on the other hand, is responsible for providing the equipment in working condition and ensuring that it meets the specifications outlined in the lease agreement. The lease may also include provisions for equipment upgrades, maintenance, and repairs, as well as insurance requirements to protect against equipment damage or loss. Additionally, the lease agreement may specify the lessee's options at the end of the lease term, such as purchasing the equipment, returning it to the lessor, or extending the lease. Understanding the lease terms and conditions is crucial to ensure a successful and cost-effective equipment leasing experience.

Equipment Delivery and Installation

Equipment delivery and installation is a critical step in the equipment leasing process. Once the lease agreement is signed, the lessor will arrange for the delivery and installation of the equipment at the lessee's premises. The lessor may work with a third-party logistics provider to ensure timely and efficient delivery. The installation process may involve setting up the equipment, testing it to ensure it is functioning properly, and providing training to the lessee's staff on how to use the equipment. In some cases, the lessor may also provide ongoing maintenance and support to ensure the equipment continues to operate effectively throughout the lease term. The lessee is typically responsible for ensuring that the equipment is properly installed and maintained, and for reporting any issues or problems to the lessor in a timely manner. The delivery and installation process is usually included in the overall cost of the lease, and the lessor may also offer additional services such as equipment upgrades or replacement to ensure the lessee has access to the latest technology. Overall, the goal of equipment delivery and installation is to ensure that the lessee has the equipment they need to operate their business effectively, and that the equipment is properly set up and maintained to minimize downtime and maximize productivity.

Equipment Lease Options and End-of-Lease Considerations

Equipment leasing is a popular financing option for businesses, allowing them to acquire the equipment they need without a significant upfront investment. However, as the lease term comes to an end, lessees must consider their options for the equipment. There are three primary considerations: lease renewal and extension options, equipment purchase options, and returning leased equipment. Each option has its pros and cons, and lessees must carefully evaluate their choices to ensure they make the best decision for their business. Lease renewal and extension options, for instance, can provide lessees with continued access to the equipment while also allowing them to take advantage of new technologies or upgrades. By understanding the different end-of-lease options available, businesses can make informed decisions that align with their financial goals and operational needs. In this article, we will explore lease renewal and extension options in more detail, discussing the benefits and drawbacks of this popular choice.

Lease Renewal and Extension Options

When it comes to equipment leases, one of the most important considerations is what happens at the end of the lease term. This is where lease renewal and extension options come into play. A lease renewal is a new agreement that allows the lessee to continue using the equipment for an additional period of time, usually with updated terms and conditions. On the other hand, a lease extension is an amendment to the existing lease agreement that extends the lease term for a specified period. Both options can be beneficial for lessees who want to continue using the equipment, but it's essential to carefully review the terms and conditions before making a decision. Lease renewal and extension options can vary depending on the lessor and the type of equipment being leased. Some common options include a fair market value (FMV) lease, which allows the lessee to purchase the equipment at the end of the lease term at its current market value, or a $1 buyout lease, which gives the lessee the option to purchase the equipment for a nominal fee. Other options may include a 10% or 20% purchase option, which allows the lessee to purchase the equipment at a predetermined percentage of its original purchase price. It's crucial for lessees to understand the terms and conditions of their lease renewal and extension options to avoid any unexpected costs or penalties. By carefully reviewing the lease agreement and negotiating the best possible terms, lessees can ensure that they are getting the most out of their equipment lease and making the most informed decisions for their business.

Equipment Purchase Options

Equipment purchase options are a crucial aspect of equipment leasing, allowing lessees to acquire the equipment at the end of the lease term. There are several types of purchase options available, each with its own benefits and drawbacks. A fair market value (FMV) purchase option allows the lessee to purchase the equipment at its current market value, which can be beneficial if the equipment has retained its value. A fixed purchase option, on the other hand, allows the lessee to purchase the equipment at a predetermined price, which can be advantageous if the equipment has depreciated significantly. A bargain purchase option, also known as a "bargain option," allows the lessee to purchase the equipment at a price lower than its FMV, which can be a cost-effective option. A $1 purchase option, also known as a "dollar buyout," allows the lessee to purchase the equipment for a nominal fee, which can be beneficial for equipment that has a long lifespan. It's essential for lessees to carefully review the purchase options available and choose the one that best suits their needs and budget. Additionally, lessees should also consider the tax implications and potential maintenance costs associated with purchasing the equipment. By understanding the different purchase options available, lessees can make informed decisions and ensure that their equipment leasing experience is successful.

Returning Leased Equipment

When returning leased equipment, it's essential to understand the terms and conditions outlined in the lease agreement. Typically, the lessee is required to notify the lessor in writing of their intention to return the equipment, providing a specified notice period. The lessee may be responsible for cleaning, repairing, or refurbishing the equipment to meet the lessor's standards, and any damage or excessive wear and tear may result in additional fees. The lessor will usually inspect the equipment upon return to assess its condition and determine if any charges are applicable. The lessee may also be required to provide proof of maintenance and repair records to demonstrate that the equipment has been properly cared for during the lease term. In some cases, the lessee may have the option to purchase the equipment at a predetermined price or extend the lease term. It's crucial to carefully review the lease agreement and understand the return requirements to avoid any potential penalties or disputes. Additionally, the lessee should ensure that all equipment is returned, including any accessories or attachments, to avoid any additional charges. By following the proper procedures and meeting the return requirements, the lessee can ensure a smooth and hassle-free return of the leased equipment.