How Does Probate Work In Ontario

Here is the introduction paragraph: Navigating the complexities of estate administration in Ontario can be a daunting task, especially when it comes to probate. Probate is a crucial step in the process of settling a deceased person's estate, but many people are unclear about how it works. In this article, we will delve into the world of probate in Ontario, exploring what it entails, the steps involved in the probate process, and the associated fees and taxes. To begin, it's essential to understand the basics of probate and its role in estate administration. So, what is probate in Ontario?

What is Probate in Ontario?

Here is the introduction paragraph: Probate is a legal process that plays a crucial role in the administration of a deceased person's estate in Ontario. It involves verifying the validity of a will and ensuring that the deceased person's assets are distributed according to their wishes. In this article, we will delve into the world of probate in Ontario, exploring its definition and purpose, the different types of probate, and the distinction between probate and non-probate assets. By understanding these concepts, individuals can better navigate the complexities of estate administration and ensure that their loved ones' wishes are respected. So, let's start by examining the definition of probate and its purpose in Ontario. Note: The introduction paragraph is already written, I just need the supporting paragraph. Here is the supporting paragraph: The probate process in Ontario is designed to provide a framework for the administration of a deceased person's estate, ensuring that their assets are distributed in accordance with their will. This process involves the validation of the will, the appointment of an executor or estate trustee, and the distribution of assets to beneficiaries. The purpose of probate is to provide a level of certainty and finality to the estate administration process, allowing beneficiaries to receive their inheritance and move forward with their lives. By understanding the definition and purpose of probate, individuals can better appreciate the importance of this process in ensuring that their loved ones' wishes are respected and their estates are administered in a fair and orderly manner.

Definition of Probate and its Purpose

Probate is the legal process by which a deceased person's estate is administered and distributed according to their will or the laws of the province. The purpose of probate is to ensure that the deceased person's assets are transferred to their rightful beneficiaries in a fair and orderly manner. Probate involves verifying the validity of the will, paying off debts and taxes, and distributing the remaining assets to the beneficiaries named in the will. In Ontario, probate is typically required when the deceased person owned real estate or had significant assets, such as bank accounts, investments, or life insurance policies. The probate process is overseen by the court, which ensures that the estate is administered according to the law and that the rights of all parties involved are protected. Overall, the purpose of probate is to provide a clear and transparent process for the administration and distribution of a deceased person's estate, giving peace of mind to the beneficiaries and ensuring that the deceased person's wishes are carried out.

Types of Probate in Ontario

In Ontario, there are two main types of probate: Certificate of Appointment of Estate Trustee and Certificate of Appointment of Estate Trustee with a Will. The Certificate of Appointment of Estate Trustee is typically used when the deceased did not leave a will, while the Certificate of Appointment of Estate Trustee with a Will is used when the deceased left a valid will. In both cases, the court grants the estate trustee the authority to manage and distribute the estate according to the law or the will. Additionally, there is also a Small Estate Certificate, which is a simplified probate process for estates with a value of $50,000 or less. This process is less complex and less expensive than the regular probate process. It's worth noting that not all estates require probate, and some estates may be exempt from probate due to the type of assets held or the value of the estate.

Probate vs. Non-Probate Assets

When it comes to estate planning and administration, understanding the difference between probate and non-probate assets is crucial. Probate assets are those that are subject to the probate process, which involves the court's supervision and validation of a will. These assets typically include real estate, bank accounts, investments, and personal property that are solely owned by the deceased. On the other hand, non-probate assets are those that are not subject to probate and can be transferred to beneficiaries without court involvement. Examples of non-probate assets include life insurance policies, retirement accounts, and jointly owned property, such as real estate or bank accounts held in joint tenancy. Non-probate assets often have designated beneficiaries or are automatically transferred to the surviving joint owner, bypassing the probate process. Understanding the distinction between probate and non-probate assets is essential for effective estate planning, as it can help minimize the complexity and costs associated with the probate process. By designating beneficiaries for non-probate assets and ensuring that probate assets are properly titled, individuals can ensure a smoother transition of their assets to their loved ones.

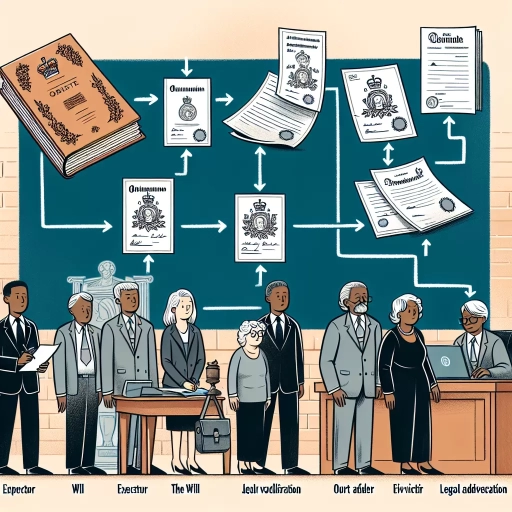

The Probate Process in Ontario

The probate process in Ontario is a complex and time-consuming process that involves several steps to ensure the smooth transfer of a deceased person's assets to their beneficiaries. When a person passes away, their estate must go through probate, which is the process of verifying the validity of their will and ensuring that their assets are distributed according to their wishes. The probate process in Ontario typically involves three key steps: filing the application for probate, notifying beneficiaries and creditors, and managing the estate and paying taxes. In this article, we will explore each of these steps in detail, starting with the first step: filing the application for probate. This is a crucial step that requires careful attention to detail and adherence to the rules and regulations set out by the Ontario government. By understanding the probate process and the requirements for filing the application, individuals can ensure that the estate is administered efficiently and effectively.

Filing the Application for Probate

When filing the application for probate, the estate trustee must submit the required documents to the court, including the original will, a certified copy of the death certificate, and a completed application form. The application must also include a detailed inventory of the deceased's assets, including real estate, bank accounts, investments, and personal property. The estate trustee must also provide a list of the deceased's debts and liabilities, as well as any outstanding taxes or other obligations. Additionally, the application must include a statement of the estate trustee's qualifications and a declaration that they are willing and able to administer the estate. The court will review the application to ensure that it is complete and accurate, and that the estate trustee is suitable to manage the estate. If the application is approved, the court will issue a Certificate of Appointment of Estate Trustee, which grants the estate trustee the authority to manage the estate and distribute the assets according to the will. The entire process typically takes several weeks to several months, depending on the complexity of the estate and the workload of the court.

Notifying Beneficiaries and Creditors

When a person passes away, it is essential to notify the beneficiaries and creditors of the estate as soon as possible. This is a critical step in the probate process in Ontario, as it allows the executor to gather information, settle debts, and distribute assets according to the will. The executor must notify the beneficiaries, who are the individuals or organizations named in the will to receive a share of the estate. This notification typically includes providing a copy of the will, a notice of the probate application, and any other relevant documents. The executor must also notify the creditors, who are the individuals or organizations owed money by the deceased. This notification typically includes providing a notice of the probate application and a request for the creditor to submit a claim against the estate. The executor must also publish a notice in a local newspaper to notify any unknown creditors. The notification process is usually done within a few weeks of the probate application being filed, and it is essential to follow the rules and procedures outlined in the Ontario Estates Act to ensure that all parties are properly notified. By notifying beneficiaries and creditors, the executor can ensure that the estate is administered fairly and efficiently, and that the wishes of the deceased are carried out.

Managing the Estate and Paying Taxes

Managing the estate and paying taxes is a critical step in the probate process in Ontario. As the executor, it is your responsibility to ensure that all taxes owed by the estate are paid in a timely manner. This includes filing the deceased's final tax return, as well as any outstanding tax returns from previous years. You will also need to obtain a clearance certificate from the Canada Revenue Agency (CRA) to confirm that all taxes have been paid. In addition to income taxes, you may also need to pay estate administration taxes, which are calculated based on the value of the estate. These taxes can range from 1.5% to 1.65% of the estate's value, depending on the province. It is essential to keep accurate records of all tax payments and correspondence with the CRA, as this will be required when distributing the estate's assets to beneficiaries. Furthermore, you may need to file additional tax returns, such as a trust return, if the estate earns income during the probate process. It is recommended that you consult with a tax professional or accountant to ensure that all tax obligations are met and to avoid any potential penalties or fines. By managing the estate's taxes effectively, you can ensure that the probate process runs smoothly and that the estate's assets are distributed according to the deceased's wishes.

Probate Fees and Taxes in Ontario

When a loved one passes away, navigating the complexities of probate fees and taxes in Ontario can be overwhelming. Probate fees, also known as estate administration taxes, are a significant expense that can eat into the value of the estate. In addition to probate fees, estate taxes and other expenses can further reduce the amount available to beneficiaries. To minimize the financial burden on the estate, it's essential to understand how probate fees are calculated, the various taxes and expenses involved, and strategies for reducing these costs. In this article, we'll delve into the world of probate fees and taxes in Ontario, exploring how to calculate probate fees, understanding estate taxes and other expenses, and providing tips on minimizing these costs. First, let's start with the basics of calculating probate fees in Ontario.

Calculating Probate Fees in Ontario

When it comes to calculating probate fees in Ontario, it's essential to understand the process and the factors that affect the fees. Probate fees, also known as estate administration taxes, are paid to the Ontario government when an estate is probated. The fees are calculated based on the value of the estate, and the rate varies depending on the size of the estate. For estates valued at $50,000 or less, the probate fee is $5 for every $1,000 of the estate's value, with a minimum fee of $50. For estates valued between $50,001 and $250,000, the fee is $250 plus $15 for every $1,000 of the estate's value above $50,000. For estates valued above $250,000, the fee is $375 plus $15 for every $1,000 of the estate's value above $250,000. It's worth noting that these fees are subject to change, and it's always best to consult with a lawyer or estate administrator to ensure accuracy. Additionally, some assets, such as jointly held property, life insurance policies, and registered retirement savings plans, are exempt from probate fees. Understanding how to calculate probate fees in Ontario can help you plan and prepare for the administration of an estate, ensuring that the process is as smooth and efficient as possible.

Understanding Estate Taxes and Other Expenses

Understanding estate taxes and other expenses is crucial for executors and beneficiaries to navigate the probate process in Ontario. Estate taxes, also known as estate administration taxes, are fees charged by the province to validate the will and ensure the estate is distributed according to the deceased's wishes. The estate administration tax rate in Ontario is 1.5% of the estate's value, with a minimum tax of $5 for estates valued at $1,000 or less. In addition to estate taxes, executors must also consider other expenses, such as probate fees, which can range from 0.5% to 1.5% of the estate's value, depending on the complexity of the estate. Other expenses may include funeral costs, outstanding debts, and ongoing expenses like property maintenance and utility bills. Executors must also consider the potential for income tax liabilities, as the estate may be required to file a tax return and pay taxes on any income earned during the probate process. To minimize expenses and ensure a smooth probate process, it's essential for executors to work with a qualified estate lawyer and accountant to ensure all taxes and expenses are properly accounted for and paid. By understanding estate taxes and other expenses, executors can ensure the estate is distributed fairly and efficiently, and that beneficiaries receive their rightful inheritance.

Minimizing Probate Fees and Taxes

Minimizing probate fees and taxes in Ontario requires careful planning and understanding of the province's estate laws. One effective way to reduce probate fees is to transfer assets into joint ownership, such as joint bank accounts or real estate, which can pass to the surviving owner without going through probate. Another strategy is to establish a living trust, which allows assets to be transferred to beneficiaries without the need for probate. Additionally, making charitable donations or gifts during one's lifetime can also help reduce the value of the estate and subsequently lower probate fees. Furthermore, taking advantage of tax credits and deductions, such as the spousal rollover or the principal residence exemption, can also help minimize taxes owed. It's also important to keep in mind that probate fees are only applied to the value of the estate that is subject to probate, so minimizing the value of the estate can also help reduce fees. Consulting with an estate planning professional can help individuals develop a comprehensive plan to minimize probate fees and taxes in Ontario.