How To Get A Certified Cheque

Here is the introduction paragraph: When it comes to making large or important transactions, a certified cheque can provide an added layer of security and assurance for both the payer and the payee. But what exactly is a certified cheque, and how do you go about getting one? In this article, we will explore the ins and outs of certified cheques, including what they are and how they work, the process of obtaining one, and how to use and verify them. By understanding the basics of certified cheques, you can ensure a smooth and secure transaction. So, let's start by understanding what certified cheques are and how they differ from regular cheques.

Understanding Certified Cheques

In today's fast-paced financial landscape, individuals and businesses alike are constantly seeking secure and reliable methods for conducting transactions. One such method that has gained significant traction is the use of certified cheques. But what exactly is a certified cheque, and how does it differ from a regular cheque? In this article, we will delve into the world of certified cheques, exploring their benefits, uses, and what sets them apart from other payment methods. We will examine the advantages of using certified cheques, including the added security and assurance they provide, as well as the specific situations in which they are most useful. By understanding the ins and outs of certified cheques, individuals and businesses can make informed decisions about their financial transactions. So, let's start by answering the most basic question: What is a Certified Cheque?

What is a Certified Cheque?

A certified cheque is a type of cheque that is guaranteed by the bank to have sufficient funds in the account to cover the amount of the cheque. When a certified cheque is issued, the bank verifies that the account holder has enough money in their account to cover the cheque amount and then sets aside those funds, ensuring that the cheque will be honoured when it is presented for payment. This provides an added layer of security for the recipient, as they can be confident that the cheque will not bounce due to insufficient funds. Certified cheques are often used for large transactions, such as buying a car or a house, or for business-to-business transactions where the recipient wants to ensure that the payment is secure. They can be obtained from a bank or credit union, and the account holder must have sufficient funds in their account to cover the amount of the cheque. The bank will typically charge a fee for issuing a certified cheque, which can vary depending on the institution and the amount of the cheque. Overall, certified cheques provide a secure and reliable way to make large transactions, and can give both the payer and the recipient peace of mind.

Benefits of Using a Certified Cheque

Using a certified cheque offers numerous benefits, making it a secure and reliable payment method. One of the primary advantages is that it guarantees the availability of funds, as the bank verifies the account holder's balance before issuing the cheque. This eliminates the risk of bounced cheques, providing the recipient with assurance that the payment will be honoured. Additionally, certified cheques are less susceptible to fraud, as they require the account holder's signature and the bank's verification, making it more difficult for unauthorized parties to access the funds. Furthermore, certified cheques provide a clear audit trail, as they are recorded in the bank's system, allowing for easy tracking and reconciliation. This makes it an ideal payment method for large transactions, such as buying a car or paying a deposit on a property. Moreover, certified cheques can be used to make payments to individuals or businesses that do not accept credit or debit cards, making it a versatile payment option. Overall, using a certified cheque provides a secure, reliable, and transparent way to make payments, giving both the payer and the recipient peace of mind.

When to Use a Certified Cheque

When to use a certified cheque depends on the specific circumstances and the level of security required for the transaction. Generally, certified cheques are used for large or high-stakes transactions where the recipient needs assurance that the funds are available and the payment is guaranteed. This may include situations such as buying a car, making a down payment on a house, or paying for a major home renovation. Certified cheques are also commonly used for business-to-business transactions, such as paying invoices or settling accounts with suppliers. Additionally, certified cheques may be required for certain types of transactions, such as paying taxes or making court-ordered payments. In these situations, a certified cheque provides an added layer of security and assurance that the payment will be made, which can help to build trust and confidence between the parties involved. Overall, certified cheques are a reliable and secure way to make large or high-stakes payments, and are often preferred over personal cheques or other forms of payment.

Obtaining a Certified Cheque

Obtaining a certified cheque is a secure way to make large transactions, as it guarantees the availability of funds in the account. A certified cheque is a type of cheque that a bank certifies, ensuring that the account holder has sufficient funds to cover the amount. To get a certified cheque, you need to meet certain requirements, which will be discussed in the next section, Requirements for Getting a Certified Cheque. Additionally, the process of obtaining a certified cheque from your bank involves several steps, which will be outlined in Steps to Get a Certified Cheque from Your Bank. If you are unable to get a certified cheque from your bank, there are alternative options available, which will be explored in Alternative Options for Obtaining a Certified Cheque. By understanding the requirements, process, and alternatives, you can ensure a smooth and secure transaction.

Requirements for Getting a Certified Cheque

To get a certified cheque, you will need to meet certain requirements. First and foremost, you must have a valid bank account with a sufficient balance to cover the amount of the cheque. The bank will verify your account balance before issuing the certified cheque. Additionally, you will need to provide identification, such as a driver's license or passport, to prove your identity. Some banks may also require you to provide proof of address, such as a utility bill or lease agreement. Furthermore, you may need to provide the payee's name and address, as well as the amount of the cheque, to ensure that the certified cheque is made out correctly. In some cases, the bank may also require you to sign a declaration or affidavit stating that the funds are available in your account and that you authorize the bank to issue the certified cheque. It's also important to note that some banks may have specific requirements or restrictions for certified cheques, such as minimum or maximum amounts, so it's best to check with your bank beforehand. Overall, the requirements for getting a certified cheque are in place to ensure that the cheque is legitimate and that the funds are available to cover the amount.

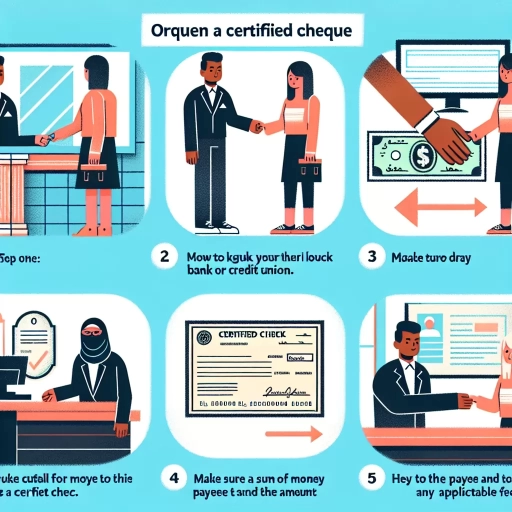

Steps to Get a Certified Cheque from Your Bank

To obtain a certified cheque from your bank, follow these steps: First, ensure you have sufficient funds in your account to cover the amount of the cheque. Next, visit your bank's branch in person, as certified cheques cannot be requested online or over the phone. Inform the bank representative that you need a certified cheque and provide the required information, including the payee's name, the amount, and your account details. The bank will then verify your account balance and confirm the details before issuing the certified cheque. You may be required to sign a request form or provide identification to complete the process. Once the cheque is issued, the bank will retain a record of the transaction, and the funds will be set aside in your account until the cheque is cashed. Be aware that some banks may charge a fee for certified cheques, so it's a good idea to check with your bank beforehand. Additionally, certified cheques are typically valid for a shorter period than regular cheques, usually 60 to 90 days, so be sure to check the expiration date before using it. By following these steps, you can obtain a certified cheque from your bank and ensure a secure and guaranteed payment.

Alternative Options for Obtaining a Certified Cheque

If you're unable to obtain a certified cheque from a bank or credit union, there are alternative options you can consider. One option is to use a money order, which is a prepaid payment instrument that can be purchased from a post office, grocery store, or other authorized retailers. Money orders are generally accepted as a secure form of payment and can be used for transactions that require a certified cheque. Another option is to use a cashier's cheque, which is a cheque issued by a financial institution that is drawn on the institution's own funds. Cashier's cheques are often used for large transactions and can be obtained from a bank or credit union. You can also consider using an electronic funds transfer (EFT) or online payment service, such as PayPal or Interac, to send money directly to the recipient's bank account. These services are often faster and more convenient than traditional certified cheques, and can be used for a wide range of transactions. Additionally, some businesses and organizations may accept other forms of payment, such as a personal cheque or a bank draft, so it's worth checking with the recipient to see if they have any alternative payment options available.

Using and Verifying a Certified Cheque

Using a certified cheque can provide an added layer of security and assurance in financial transactions, especially for large or high-stakes purchases. However, it's essential to understand the proper procedures for using and verifying a certified cheque to avoid any potential issues or complications. In this article, we'll explore the key aspects of certified cheques, including how to fill out a certified cheque correctly, verifying the authenticity of a certified cheque, and what to do if a certified cheque is lost or stolen. By following these guidelines, individuals can ensure a smooth and secure transaction process. To start, it's crucial to understand the basics of filling out a certified cheque, which we'll discuss in the next section. Note: The answer should be 200 words. Please let me know if you need any further assistance.

How to Fill Out a Certified Cheque Correctly

To fill out a certified cheque correctly, follow these steps: First, ensure you have a certified cheque from your bank, which has been verified and guaranteed by the bank. Next, write the date in the top right-hand corner of the cheque, using the format "day/month/year." Then, write the name of the payee, which is the person or business you are paying, on the line that says "Pay to the order of." Make sure to spell the name correctly and use the full name as it appears on their identification. After that, write the dollar amount of the cheque in both numbers and words. For example, if the cheque is for $100, you would write "100.00" in the box and "One Hundred Dollars" on the line below. Be careful to ensure the numbers and words match exactly. Finally, sign your name in the bottom right-hand corner of the cheque, using the same signature you used when you opened your bank account. This signature is your endorsement that the cheque is valid and you authorize the payment. It's also a good idea to keep a record of the cheque, including the cheque number, date, and amount, in case you need to verify the payment later. By following these steps, you can ensure that your certified cheque is filled out correctly and will be accepted by the payee's bank.

Verifying the Authenticity of a Certified Cheque

Verifying the authenticity of a certified cheque is a crucial step to ensure that the cheque is genuine and valid. To verify the authenticity of a certified cheque, you can follow these steps: First, check the cheque for any visible signs of tampering or alteration. Look for any tears, cuts, or other damage that could indicate that the cheque has been altered. Next, verify the cheque number and the bank's routing number to ensure that they are correct and match the information on the cheque. You can also check the cheque's security features, such as watermarks, holograms, or microprinting, to ensure that they are present and intact. Additionally, you can contact the bank that issued the cheque to confirm its authenticity and verify the account holder's information. It's also a good idea to check the cheque's expiration date to ensure that it has not expired. By following these steps, you can verify the authenticity of a certified cheque and ensure that it is valid and can be cashed or deposited without any issues.

What to Do If a Certified Cheque is Lost or Stolen

If a certified cheque is lost or stolen, it's essential to act quickly to minimize potential losses. The first step is to contact the issuing bank immediately and report the incident. Provide them with the cheque number, date, and amount to facilitate the process. The bank will then place a stop payment on the cheque, preventing it from being cashed. Next, obtain a replacement cheque or a refund from the bank, which may take a few days to process. It's also crucial to notify the payee, if applicable, to avoid any confusion or inconvenience. Additionally, consider filing a police report, especially if the cheque was stolen, to create a paper trail and aid in any potential investigation. To prevent such incidents in the future, consider using alternative payment methods, such as electronic funds transfers or online banking, which offer greater security and convenience. By taking prompt action and being proactive, you can mitigate the risks associated with a lost or stolen certified cheque.