How To Set Up Auto Deposit Scotiabank

Here is the introduction paragraph: Setting up auto deposit with Scotiabank is a convenient and efficient way to manage your finances. By automating your deposits, you can save time, reduce errors, and ensure that your funds are available when you need them. But before you can start enjoying the benefits of auto deposit, you need to understand how it works and how to set it up with Scotiabank. In this article, we will guide you through the process of setting up auto deposit with Scotiabank, troubleshoot common issues, and provide tips on how to manage your auto deposit effectively. First, let's start by understanding what auto deposit is and its benefits, which will help you appreciate the value of this feature and how it can simplify your financial life.

Understanding Auto Deposit and Its Benefits

Here is the introduction paragraph: Managing one's finances effectively is crucial in today's fast-paced world. One convenient and efficient way to do so is by setting up an auto deposit system. Auto deposit allows individuals and businesses to automatically transfer funds into their accounts, eliminating the need for manual deposits and reducing the risk of lost or stolen checks. By understanding how auto deposit works and its benefits, individuals can streamline their financial transactions and make the most of their money. In this article, we will explore the advantages of setting up auto deposit with Scotiabank, common uses of auto deposit for personal and business finances, and delve into the basics of auto deposit and how it works. So, let's start by understanding what auto deposit is and how it works.

What is Auto Deposit and How Does it Work?

Auto deposit is a convenient and secure way to receive recurring payments, such as paychecks, government benefits, or pension payments, directly into your bank account. It works by electronically transferring funds from the payer's account to your account, eliminating the need for paper checks or cash. To set up auto deposit, you typically need to provide your bank account information, including the account number and routing number, to the payer. The payer will then use this information to initiate the electronic transfer of funds into your account. Auto deposit is usually processed on the same day the payment is made, and you can access the funds immediately. This service is often free, and it can help you avoid waiting in line to deposit a check or worrying about lost or stolen checks. Additionally, auto deposit can help you manage your finances more efficiently, as the funds are deposited directly into your account, making it easier to track your income and expenses. Overall, auto deposit is a reliable and efficient way to receive recurring payments, and it can provide you with greater control over your finances.

Advantages of Setting Up Auto Deposit with Scotiabank

Setting up auto deposit with Scotiabank offers numerous advantages that can simplify your financial management and provide peace of mind. One of the primary benefits is convenience, as your paycheque or government benefits are deposited directly into your account, eliminating the need to physically visit a bank branch or ATM. This feature is especially useful for individuals with busy schedules or those who live far from a bank location. Additionally, auto deposit ensures that your funds are available immediately, allowing you to access your money as soon as it's deposited. This can help you avoid overdraft fees and late payment charges, as you'll have a clear picture of your account balance. Furthermore, setting up auto deposit with Scotiabank can also help you save time and reduce paperwork, as you won't need to worry about depositing cheques or filling out deposit slips. Overall, auto deposit provides a hassle-free and efficient way to manage your finances, allowing you to focus on more important things. By taking advantage of this feature, you can enjoy a more streamlined and organized financial life, with fewer worries and more control over your money.

Common Uses of Auto Deposit for Personal and Business Finances

Auto deposit is a convenient and efficient way to manage personal and business finances, offering numerous benefits and uses. For individuals, auto deposit can be used to receive paychecks, government benefits, and tax refunds directly into their bank accounts, eliminating the need for physical checks and reducing the risk of lost or stolen funds. Additionally, auto deposit can be used to make recurring payments, such as rent/mortgage, utility bills, and loan payments, ensuring timely payments and avoiding late fees. Furthermore, auto deposit can be used to transfer funds between accounts, making it easy to manage savings, investments, and emergency funds. For businesses, auto deposit can be used to pay employees, vendors, and contractors, streamlining payroll and accounts payable processes. It can also be used to receive payments from customers, reducing the need for paper invoices and checks. Moreover, auto deposit can be used to make tax payments, reducing the risk of penalties and interest. Overall, auto deposit provides a secure, efficient, and convenient way to manage personal and business finances, saving time and reducing the risk of errors and fraud.

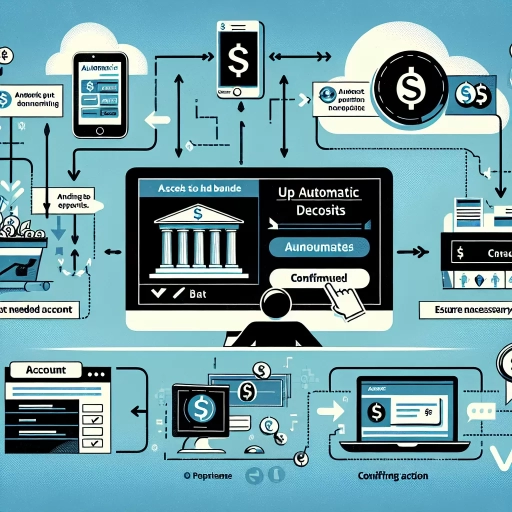

Setting Up Auto Deposit with Scotiabank: A Step-by-Step Guide

Setting up auto deposit with Scotiabank is a convenient and efficient way to manage your finances. To initiate the process, you will need to gather the required information and documents, which will be discussed in the next section. Once you have all the necessary details, you can log into your Scotiabank online banking account to initiate the auto deposit setup. After logging in, you will need to configure the auto deposit settings and schedule your deposits, ensuring that your funds are transferred smoothly and on time. By following these steps, you can enjoy the benefits of auto deposit and simplify your financial management. To get started, let's begin by gathering the required information and documents for auto deposit setup.

Gathering Required Information and Documents for Auto Deposit Setup

To set up auto deposit with Scotiabank, gathering the required information and documents is the first crucial step. You will need to provide your employer or payer with your Scotiabank account details, including your account number, transit number, and institution number. You can find this information on your Scotiabank debit card, a void cheque, or by logging into your online banking account. Additionally, you may need to provide a void cheque or a direct deposit form, which can be obtained from your employer or downloaded from the Scotiabank website. It's essential to ensure that the information you provide is accurate and up-to-date to avoid any delays or issues with your auto deposit setup. If you're unsure about any of the required information or documents, you can contact Scotiabank's customer support for assistance. By having all the necessary information and documents ready, you can quickly and easily set up auto deposit with Scotiabank and start enjoying the convenience of having your pay deposited directly into your account.

Logging into Your Scotiabank Online Banking Account to Initiate Auto Deposit

To initiate auto deposit with Scotiabank, the first step is to log into your online banking account. This can be done by visiting the Scotiabank website and clicking on the "Sign In" button located at the top right corner of the page. Enter your username and password in the required fields, and click on the "Sign In" button to access your account. If you have two-factor authentication enabled, you will receive a verification code via text message or email, which you will need to enter to complete the login process. Once you are logged in, you will be taken to your account dashboard, where you can navigate to the "Transfers" or "Deposits" section to set up auto deposit. Make sure you have the required information, such as your employer's name and payroll ID, to complete the setup process. If you encounter any issues during the login process, you can contact Scotiabank's customer support for assistance.

Configuring Auto Deposit Settings and Scheduling Deposits

To configure auto deposit settings and schedule deposits, log in to your Scotiabank online banking account and navigate to the "Transfers" or "Payments" section. From there, select the "Auto Deposit" or "Scheduled Deposits" option and follow the prompts to set up a new auto deposit. You will need to provide the required information, such as the deposit amount, frequency, and start date. You can choose to deposit funds on a one-time, weekly, bi-weekly, monthly, or quarterly basis. Additionally, you can set up multiple auto deposits for different accounts or payees. Once you have entered the required information, review and confirm the auto deposit settings to ensure accuracy. You can also modify or cancel existing auto deposits at any time. Furthermore, you can set up notifications to alert you when an auto deposit is processed or if there are any issues with the deposit. By configuring auto deposit settings and scheduling deposits, you can streamline your financial transactions and ensure timely payments.

Troubleshooting and Managing Your Auto Deposit with Scotiabank

Here is the introduction paragraph: Managing your auto deposit with Scotiabank can be a convenient and efficient way to handle your finances. However, like any automated system, issues can arise that require troubleshooting and management. To ensure a smooth experience, it's essential to know how to resolve common issues, update or change auto deposit settings and schedules, and monitor and reconcile transactions for accuracy and security. By understanding these key aspects, you can effectively manage your auto deposit and avoid potential problems. In this article, we will explore these topics in more detail, starting with resolving common issues with auto deposit, such as failed deposits or incorrect information.

Resolving Common Issues with Auto Deposit, Such as Failed Deposits or Incorrect Information

If you're experiencing issues with your auto deposit, such as failed deposits or incorrect information, there are several steps you can take to resolve the problem. First, check your account information to ensure that it's accurate and up-to-date. Verify that your account number, transit number, and institution number are correct, as incorrect information can cause deposits to fail. If you've recently changed your account information, ensure that the changes have been updated in the system. Next, check the status of your deposit to see if it's been processed or if there are any issues holding it up. You can do this by logging into your online banking or mobile banking app, or by contacting Scotiabank's customer service. If the issue is due to a technical problem, Scotiabank's technical team may be able to assist you in resolving the issue. Additionally, if you're experiencing issues with a specific deposit, you can try contacting the sender to see if there are any issues on their end. In some cases, the sender may need to re-initiate the deposit or provide additional information to complete the transaction. By taking these steps, you should be able to resolve common issues with your auto deposit and get your funds deposited into your account quickly and efficiently.

Updating or Changing Auto Deposit Settings and Schedules

Updating or changing auto deposit settings and schedules with Scotiabank is a straightforward process that can be completed online, through the mobile app, or by visiting a branch. To update your auto deposit settings, log in to your online banking account or mobile app and navigate to the "Transfers" or "Payroll" section. From there, select the account you want to update and click on "Edit" or "Change" to modify the deposit frequency, amount, or account information. If you need to change the deposit schedule, you can select a new frequency, such as weekly or bi-weekly, and choose the specific dates you want the deposits to occur. You can also add or remove accounts, update your payroll information, or change the deposit amount. Once you've made the necessary changes, review and confirm the updates to ensure they are accurate. If you're having trouble updating your auto deposit settings online, you can visit a Scotiabank branch or contact customer support for assistance. Additionally, you can also use the Scotiabank mobile app to update your auto deposit settings on-the-go, making it easy to manage your finances from anywhere. By updating your auto deposit settings and schedules, you can ensure that your pay is deposited into your account on time and that you have access to your funds when you need them.

Monitoring and Reconciling Auto Deposit Transactions for Accuracy and Security

To ensure the accuracy and security of your auto deposit transactions, it's essential to regularly monitor and reconcile them. This involves verifying that the deposited amounts match the expected amounts and that there are no unauthorized transactions. Start by checking your account statements and transaction history online or through the Scotiabank mobile app. Look for any discrepancies or suspicious activity, such as unexpected deposits or withdrawals. If you notice any issues, contact Scotiabank's customer support immediately to report the problem and request assistance. Additionally, consider setting up account alerts to notify you of large or unusual transactions, providing an extra layer of security and allowing you to respond quickly to any potential issues. By regularly monitoring and reconciling your auto deposit transactions, you can help prevent errors, detect potential fraud, and maintain the integrity of your account. This proactive approach will give you peace of mind and ensure that your auto deposit transactions are accurate and secure.