How Long Do E Transfers Take To Send

The speed at which e-transfers are processed has become a crucial aspect of modern banking, with individuals and businesses relying on the efficiency of these transactions to manage their finances effectively. The question on everyone's mind is, how long do e-transfers take to send? The answer to this question is not straightforward, as several factors come into play. In this article, we will delve into the world of e-transfers, exploring the factors that affect their speed, the different types of e-transfers and their processing times, and provide tips on how to optimize e-transfer speed. By understanding these aspects, individuals and businesses can better navigate the e-transfer landscape and make informed decisions about their financial transactions. So, what are the key factors that influence the speed of e-transfers? Let's start by examining the factors that affect e-transfer speed.

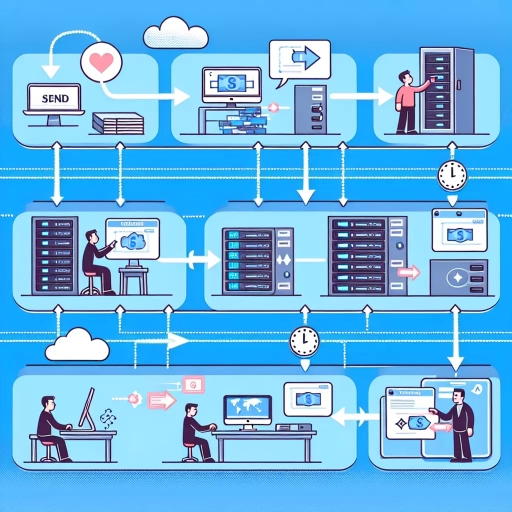

Factors Affecting E-Transfer Speed

The speed at which an e-transfer is processed depends on several factors. One of the primary factors is the recipient's bank processing time, which can vary significantly depending on the bank's efficiency and workload. Another crucial factor is the sender's bank processing time, as it can also impact the overall speed of the transaction. Additionally, the interbank transfer time, which is the time it takes for the funds to be transferred between banks, also plays a significant role in determining the e-transfer speed. Understanding these factors can help individuals and businesses better manage their financial transactions and plan accordingly. In this article, we will delve into the details of each of these factors, starting with the recipient's bank processing time.

Recipient's Bank Processing Time

The recipient's bank processing time is a crucial factor in determining the overall speed of an e-transfer. Once the sender initiates the transfer, the recipient's bank receives the funds and begins processing the transaction. The processing time can vary significantly depending on the bank's policies, technology, and workload. Some banks may process e-transfers immediately, while others may take several hours or even days to complete the transaction. On average, recipient banks take around 1-3 business days to process e-transfers, but this timeframe can be shorter or longer depending on the specific bank and the time of day the transfer is initiated. For example, if the transfer is sent during business hours, the recipient's bank may process it on the same day, whereas transfers sent outside of business hours may be processed the next business day. Additionally, some banks may have specific cut-off times for processing e-transfers, and transfers received after this time may be processed the following business day. Overall, the recipient's bank processing time is an essential factor to consider when estimating the overall speed of an e-transfer.

Sender's Bank Processing Time

Sender's bank processing time is a significant factor in determining the overall e-transfer speed. The processing time varies from bank to bank, and it can range from a few minutes to several hours or even days. Some banks have automated systems that process e-transfers quickly, while others may require manual intervention, leading to delays. Typically, banks with more advanced technology and larger resources tend to process e-transfers faster. For instance, major banks like Chase, Bank of America, and Wells Fargo usually process e-transfers within 1-2 hours, while smaller banks or credit unions may take 2-4 hours or more. Additionally, the sender's bank may have specific cut-off times for processing e-transfers, and if the transfer is initiated after this time, it may not be processed until the next business day. Understanding the sender's bank processing time is crucial to estimate the overall e-transfer speed and plan accordingly.

Interbank Transfer Time

Interbank transfer time refers to the duration it takes for funds to be transferred from one bank to another. This process typically involves a network of banks and financial institutions working together to facilitate the transfer. The time it takes for an interbank transfer to complete can vary significantly depending on several factors, including the type of transfer, the banks involved, and the time of day. In general, interbank transfers can take anywhere from a few hours to several days to complete. For example, same-day transfers may be possible if the transfer is initiated before a certain cut-off time, usually in the morning. However, if the transfer is initiated later in the day, it may not be processed until the next business day. Additionally, transfers between banks that do not have a direct relationship may take longer, as they may need to go through a correspondent bank or a clearinghouse. Overall, interbank transfer time can be affected by a range of factors, and it's essential to check with your bank or financial institution to determine the expected processing time for your specific transfer.

Types of E-Transfers and Their Processing Times

E-transfers have become a popular method of transferring funds electronically, offering a convenient and efficient way to send and receive money. There are several types of e-transfers, each with its own processing time and characteristics. In this article, we will explore three main types of e-transfers: Instant E-Transfers, Standard E-Transfers, and International E-Transfers. Understanding the differences between these types of e-transfers can help individuals and businesses make informed decisions about their financial transactions. Instant E-Transfers, for instance, offer the fastest processing time, allowing recipients to access their funds in a matter of minutes. This makes them ideal for urgent transactions or time-sensitive payments. Let's take a closer look at Instant E-Transfers and how they work.

Instant E-Transfers

Instant e-transfers are a type of electronic funds transfer that allows individuals to send and receive money instantly. This type of transfer is facilitated by the Interac network, which is a widely used payment system in Canada. With instant e-transfers, the sender can initiate a transfer using their online banking platform or mobile banking app, and the recipient can receive the funds in their account immediately. The processing time for instant e-transfers is typically instantaneous, with the funds being available in the recipient's account within seconds of the transfer being initiated. This makes instant e-transfers a convenient and efficient way to send and receive money, especially for urgent or time-sensitive transactions. Additionally, instant e-transfers are often free or low-cost, making them a cost-effective option for individuals and businesses alike. Overall, instant e-transfers offer a fast, reliable, and affordable way to transfer funds electronically, making them a popular choice for many Canadians.

Standard E-Transfers

Standard E-Transfers are the most common type of electronic fund transfer in Canada. They are typically processed through the Interac network, which is a widely used payment system in the country. Standard E-Transfers are usually processed within 30 minutes to a few hours, depending on the recipient's bank and the time of day. This type of transfer is often used for personal transactions, such as sending money to friends or family members, and is usually free or low-cost. Standard E-Transfers are also commonly used for online purchases and bill payments. To initiate a Standard E-Transfer, the sender must have the recipient's email address or mobile phone number, as well as their bank account information. The sender's bank will then send a notification to the recipient, who can then deposit the funds into their account. Overall, Standard E-Transfers are a convenient and efficient way to send money electronically in Canada.

International E-Transfers

International e-transfers have revolutionized the way we send and receive money across borders. With the rise of digital payment systems, individuals and businesses can now transfer funds electronically to anyone, anywhere in the world, at any time. International e-transfers are facilitated by a network of banks, financial institutions, and online payment platforms that enable fast, secure, and convenient transactions. The process typically involves the sender initiating a transfer through their online banking platform or a specialized e-transfer service, specifying the recipient's details and the amount to be transferred. The funds are then routed through a series of intermediaries, including correspondent banks and clearinghouses, before reaching the recipient's account. The processing time for international e-transfers can vary depending on the transfer method, the sender's and recipient's locations, and the time of day. Generally, international e-transfers can take anywhere from a few minutes to several days to complete, with some services offering faster processing times for an additional fee. Despite the varying processing times, international e-transfers offer a convenient, cost-effective, and secure way to send and receive money globally, making them an essential tool for individuals and businesses alike.

Optimizing E-Transfer Speed

Optimizing e-transfer speed is crucial in today's fast-paced digital landscape. With the increasing reliance on online transactions, individuals and businesses alike are seeking ways to expedite the process. To achieve this, it is essential to employ strategies that streamline the transfer process. Three key methods can significantly enhance e-transfer speed: utilizing online banking platforms, initiating transfers during business hours, and verifying the recipient's account information. By implementing these techniques, users can minimize delays and ensure timely transactions. For instance, using online banking platforms can significantly reduce processing times, allowing for faster transaction completion. This is because online platforms often have automated systems in place, which can quickly verify and process transactions, thereby reducing the need for manual intervention. By leveraging online banking platforms, users can take the first step towards optimizing their e-transfer speed.

Using Online Banking Platforms

Using online banking platforms is a convenient and efficient way to manage your finances, and it's especially useful when it comes to e-transfers. With online banking, you can initiate e-transfers from the comfort of your own home, 24/7, without having to visit a physical bank branch. Most online banking platforms allow you to set up and manage your e-transfers easily, with features such as the ability to add and manage recipients, set transfer amounts, and track the status of your transfers. Additionally, online banking platforms often provide real-time updates on the status of your e-transfers, so you can stay informed and up-to-date on when your transfer is expected to be processed. Furthermore, online banking platforms typically offer a range of security measures to protect your transactions, such as encryption and two-factor authentication, giving you peace of mind when sending and receiving money online. Overall, using online banking platforms is a fast, secure, and convenient way to manage your e-transfers, and it's an essential tool for anyone looking to optimize their e-transfer speed.

Initiating Transfers During Business Hours

Initiating transfers during business hours can significantly expedite the processing time of e-transfers. Most financial institutions operate on standard business hours, typically between 9:00 AM and 5:00 PM, Monday through Friday. When you initiate a transfer during these hours, it is more likely to be processed and cleared on the same day. This is because the banks' systems are usually more active and responsive during business hours, allowing for faster verification and processing of transactions. Additionally, many banks have dedicated teams that work during business hours to review and process e-transfers, which can further accelerate the transfer process. By initiating transfers during business hours, you can take advantage of these factors and increase the chances of your transfer being processed quickly and efficiently.

Verifying Recipient's Account Information

Verifying the recipient's account information is a crucial step in ensuring the smooth and timely processing of e-transfers. This verification process typically involves confirming the recipient's name, account number, and financial institution details. By verifying this information, the sender can avoid errors and delays that may arise from incorrect or incomplete account details. In most cases, financial institutions and online banking platforms have built-in systems to verify recipient account information, which can significantly reduce the risk of errors and speed up the e-transfer process. Additionally, some financial institutions may offer real-time verification services, which can provide instant confirmation of the recipient's account details, further expediting the e-transfer process. Overall, verifying the recipient's account information is an essential step in optimizing e-transfer speed and ensuring that funds are transferred quickly and efficiently.