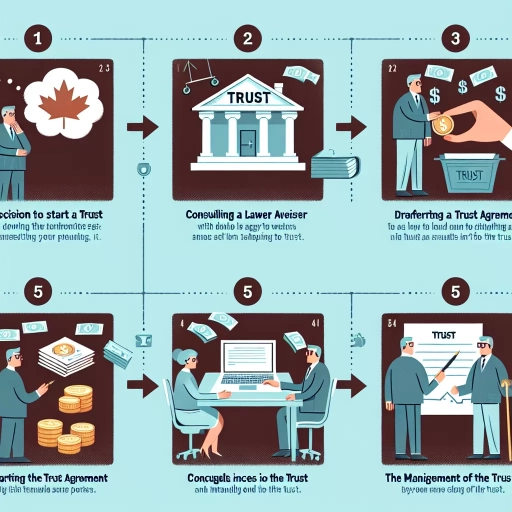

How To Set Up A Trust In Canada

Here is the introduction paragraph: Setting up a trust in Canada can be a complex and daunting task, but with the right guidance, it can be a valuable tool for managing assets, minimizing taxes, and ensuring the well-being of loved ones. To establish a trust, it's essential to understand the basics of trusts in Canada, including the different types of trusts, their purposes, and the laws that govern them. Before diving into the process, it's crucial to prepare the necessary documents and information, such as identifying the beneficiaries, determining the trust's assets, and selecting a trustee. Once the groundwork is laid, the trust can be established and administered, involving ongoing management and decision-making. In this article, we'll break down the process of setting up a trust in Canada, starting with the fundamentals. Let's begin by understanding the basics of trusts in Canada.

Understanding the Basics of Trusts in Canada

Here is the introduction paragraph: In Canada, trusts are a popular estate planning tool used to manage and distribute assets in a tax-efficient manner. However, understanding the basics of trusts can be complex and overwhelming, especially for those who are new to the concept. To navigate the world of trusts effectively, it's essential to start with the fundamentals. This includes determining the purpose of the trust, as different types of trusts serve distinct objectives, such as minimizing taxes, protecting assets, or providing for beneficiaries. Additionally, identifying the various types of trusts available in Canada, including inter vivos, testamentary, and bare trusts, is crucial in selecting the right trust for your needs. Finally, recognizing the key parties involved in a trust, including the settlor, trustee, and beneficiaries, is vital in ensuring the trust operates smoothly and efficiently. By grasping these essential concepts, individuals can gain a deeper understanding of the basics of trusts in Canada.

Determining the Purpose of the Trust

. Determining the purpose of the trust is a crucial step in setting up a trust in Canada. The purpose of the trust will dictate the type of trust to be created, the powers and duties of the trustee, and the rights and interests of the beneficiaries. In Canada, trusts can be established for various purposes, including estate planning, tax planning, asset protection, and charitable giving. For instance, a trust may be created to manage and distribute assets to minor children or individuals with disabilities, or to provide for the care and well-being of a loved one. Alternatively, a trust may be established to minimize taxes, protect assets from creditors, or to support a favorite charity. To determine the purpose of the trust, it is essential to consider the goals and objectives of the settlor, the needs and interests of the beneficiaries, and the applicable laws and regulations in Canada. A well-defined purpose will help ensure that the trust is properly structured and administered, and that the intended benefits are achieved. It is recommended that individuals seeking to establish a trust in Canada consult with a qualified lawyer or trust expert to determine the most suitable purpose and structure for their specific circumstances.

Identifying the Types of Trusts Available in Canada

. In Canada, there are several types of trusts available, each serving a unique purpose and offering distinct benefits. Understanding the different types of trusts is essential to determine which one best suits your needs. A testamentary trust, for instance, is created through a will and comes into effect after the grantor's passing. This type of trust is often used to manage assets for beneficiaries who are minors or have special needs. On the other hand, an inter vivos trust, also known as a living trust, is established during the grantor's lifetime and can be used to manage assets, reduce taxes, and avoid probate. A joint spousal trust is a type of inter vivos trust that allows spouses to transfer assets to each other without incurring taxes. A bare trust, also known as a nominee trust, is a simple trust where the trustee holds assets on behalf of the beneficiary, but has no discretion over the assets. An alter ego trust is a type of trust that allows individuals to transfer assets to a trust, while still maintaining control over the assets. A joint partner trust is similar to a joint spousal trust, but is used for common-law partners or business partners. A Henson trust is a type of trust that allows individuals to transfer assets to a trust for the benefit of a disabled beneficiary, while still maintaining government benefits. Understanding the different types of trusts available in Canada can help you make informed decisions about your estate planning and asset management. It is recommended to consult with a trust expert or lawyer to determine which type of trust is best suited for your specific needs and circumstances.

Recognizing the Key Parties Involved in a Trust

. In Canada, a trust is a legal arrangement where one party, known as the settlor, transfers assets to another party, known as the trustee, to manage for the benefit of a third party, known as the beneficiary. Recognizing the key parties involved in a trust is crucial to understanding how it operates. The settlor is the individual who creates the trust and transfers the assets into it. They may also be referred to as the grantor or donor. The trustee, on the other hand, is responsible for managing the trust assets and making decisions in the best interest of the beneficiary. Trustees can be individuals, corporations, or even a combination of both. The beneficiary is the individual or group of individuals who will ultimately benefit from the trust assets. They may be entitled to receive income or capital from the trust, or they may have a vested interest in the trust assets. In some cases, there may also be additional parties involved, such as a protector or an enforcer, who have specific roles and responsibilities in relation to the trust. Understanding the roles and responsibilities of each party is essential to ensuring that the trust is established and managed effectively, and that the interests of all parties are protected. By recognizing the key parties involved in a trust, individuals can better navigate the complexities of trust law in Canada and make informed decisions about their estate planning needs.

Preparing the Necessary Documents and Information

Here is the introduction paragraph: Preparing the necessary documents and information is a crucial step in establishing a trust in Canada. To ensure a smooth and successful process, it is essential to gather all required personal and financial information, create a trust deed or agreement that outlines the terms and conditions of the trust, and obtain any necessary licenses or registrations. By understanding the importance of these documents and taking the time to prepare them accurately, individuals can avoid potential pitfalls and ensure that their trust is set up correctly. In this article, we will delve into the specifics of preparing the necessary documents and information, providing a comprehensive guide to help individuals navigate this critical step in establishing a trust. By the end of this article, readers will have a solid understanding of the basics of trusts in Canada.

Gathering Required Personal and Financial Information

. Here is the paragraphy: When setting up a trust in Canada, it is essential to gather all the required personal and financial information to ensure a smooth and efficient process. This includes collecting identification documents, such as passports, driver's licenses, and social insurance numbers, for all individuals involved in the trust, including the settlor, trustees, and beneficiaries. Additionally, you will need to gather financial information, such as bank statements, investment accounts, and property deeds, to determine the assets that will be transferred into the trust. It is also crucial to gather information about the beneficiaries, including their names, addresses, and dates of birth, as well as any specific instructions or wishes the settlor may have regarding the distribution of the trust assets. Furthermore, you may need to gather information about any outstanding debts, taxes, or other liabilities that the trust may be responsible for. Having all this information readily available will help your lawyer or financial advisor to draft the trust agreement and other necessary documents accurately and efficiently. It is also important to note that the type of trust you are setting up, such as a living trust or a testamentary trust, may require additional information and documentation. By gathering all the required personal and financial information, you can ensure that your trust is set up correctly and that your wishes are carried out according to your intentions.

Creating a Trust Deed or Agreement

. Here is the paragraphy: When creating a trust deed or agreement, it is essential to include all the necessary details to ensure the trust is valid and effective. The trust deed or agreement should clearly outline the purpose of the trust, the names and roles of the settlor, trustee, and beneficiaries, and the terms and conditions of the trust. It should also specify how the trust assets will be managed and distributed, including any rules or restrictions on the trustee's powers. Additionally, the trust deed or agreement should include provisions for the appointment and removal of trustees, as well as the process for amending or terminating the trust. It is recommended that you consult with a lawyer or trust expert to ensure that your trust deed or agreement is properly drafted and meets all the necessary legal requirements. A well-drafted trust deed or agreement will provide clarity and certainty for all parties involved and help to avoid potential disputes or misunderstandings. Furthermore, a trust deed or agreement can be customized to fit the specific needs and goals of the settlor and beneficiaries, making it a flexible and effective estate planning tool. By taking the time to create a comprehensive and well-drafted trust deed or agreement, you can ensure that your trust is set up correctly and will achieve its intended purpose.

Obtaining Any Necessary Licenses or Registrations

. Here is the paragraphy: When setting up a trust in Canada, it is essential to obtain any necessary licenses or registrations. This may include registering the trust with the Canada Revenue Agency (CRA) and obtaining a trust account number. Additionally, the trust may need to be registered with the provincial or territorial government where the trust will be operating. This may involve filing articles of incorporation or a declaration of trust with the relevant government agency. Furthermore, the trust may need to obtain any necessary business licenses or permits to operate in a particular industry or location. For example, if the trust will be operating a business that involves the sale of goods or services, it may need to obtain a sales tax permit or a business license from the relevant provincial or territorial government. It is also important to note that some trusts may be exempt from certain licensing or registration requirements, such as charitable trusts or trusts that are established for a specific purpose, such as a trust for a minor child. It is recommended that you consult with a lawyer or other qualified professional to determine what licenses or registrations are required for your specific trust.

Establishing and Administering the Trust

Here is the introduction paragraph: Establishing and administering a trust is a complex process that requires careful consideration and planning. A trust is a legal arrangement where one party, known as the settlor, transfers assets to another party, known as the trustee, to manage and distribute according to the settlor's wishes. To ensure the trust is set up and managed effectively, it is essential to appoint a trustee and define their role, transfer assets into the trust, and manage and distribute the trust assets. In this article, we will delve into these critical aspects of establishing and administering a trust, providing you with a comprehensive understanding of the process. By the end of this article, you will have a solid foundation in the basics of trusts in Canada, enabling you to make informed decisions about your estate planning and asset management needs. Understanding the Basics of Trusts in Canada is crucial for individuals looking to protect their assets and ensure their wishes are carried out after they pass away.

Appointing a Trustee and Defining Their Role

. Here is the paragraphy: When setting up a trust in Canada, one of the most important decisions you'll make is appointing a trustee and defining their role. A trustee is responsible for managing the trust assets, making decisions, and carrying out the instructions outlined in the trust agreement. It's essential to choose a trustee who is trustworthy, reliable, and has the necessary skills and expertise to manage the trust effectively. The trustee's role can be defined in the trust agreement, and it's crucial to clearly outline their powers, duties, and responsibilities. This may include managing investments, distributing income and capital to beneficiaries, and making decisions about the trust's assets. The trustee may also be responsible for filing tax returns, keeping records, and communicating with beneficiaries. In some cases, you may want to appoint multiple trustees, such as a corporate trustee and an individual trustee, to provide an added layer of protection and expertise. It's also important to consider the potential risks and liabilities associated with being a trustee and to ensure that the trustee is aware of their obligations and responsibilities. By carefully selecting and defining the role of the trustee, you can help ensure that the trust is managed effectively and that the interests of the beneficiaries are protected.

Transferring Assets into the Trust

. Here is the paragraphy: Transferring assets into the trust is a crucial step in the trust setup process. This involves re-titling assets, such as real estate, investments, and bank accounts, in the name of the trust. The goal is to ensure that the trust owns the assets, rather than the individual, to avoid probate and minimize taxes. To transfer assets, the trustee will need to prepare and sign new ownership documents, such as deeds, titles, and account applications. It's essential to work with a lawyer or financial advisor to ensure that the transfer process is done correctly and in compliance with Canadian laws and regulations. Additionally, the trustee should also consider the tax implications of transferring assets into the trust, as this may trigger capital gains tax or other tax liabilities. By transferring assets into the trust, individuals can ensure that their assets are protected and distributed according to their wishes, while also minimizing the risk of disputes and costly legal fees. It's also important to note that not all assets can be transferred into a trust, such as RRSPs and TFSAs, which have specific rules and regulations governing their transfer. Overall, transferring assets into the trust requires careful planning and execution to ensure that the trust is set up correctly and achieves its intended purpose.

Managing and Distributing Trust Assets

. Here is the paragraphy: Managing and distributing trust assets is a critical aspect of trust administration. The trustee is responsible for managing the trust assets in accordance with the terms of the trust agreement and applicable laws. This includes investing the assets, collecting income, and paying expenses. The trustee must also ensure that the trust assets are distributed to the beneficiaries in accordance with the trust agreement. This may involve making distributions during the lifetime of the settlor, or after their death. The trustee must also ensure that the trust assets are distributed in a tax-efficient manner, taking into account the tax implications of the distributions. In some cases, the trustee may need to obtain the consent of the beneficiaries or the court before making certain distributions. The trustee must also keep accurate records of the trust assets and distributions, and provide regular accounting to the beneficiaries. Overall, managing and distributing trust assets requires careful planning, attention to detail, and a thorough understanding of the trust agreement and applicable laws.