How To Withdraw Resp

Understanding the Basics of RESP Withdrawal

What is RESP?

An RESP or Registered Education Savings Plan is a type of investment tool that is designed for parents to help them save for their child's post-secondary education. The best part about RESPs is that any income earned within the plan is not taxed as long as it remains in the plan. This helps your savings to grow more effectively over time. To get started, a subscriber, often a parent, opens an account in the name of a beneficiary, who is typically their child. They then make regular contributions, which can be matched by the government to an extent, dependent on your income.

How Does RESP Work?

An RESP functions on a subscription and contribution basis. The subscriber contributes a certain sum of money at regular intervals. The contributions made are then invested in equities, bonds, or other types of investments based on the risk tolerance of the subscriber. The income and gains generated from these investments grow tax-free until they are withdrawn. When the beneficiary is ready to attend post-secondary education, they can start withdrawing funds from the RESP. These withdrawals are referred to as Educational Assistance Payments.

RESP Contribution Limits and Guidelines

The ultimate contribution limit for an RESP is $50,000 per beneficiary. However, there is no annual contribution limit. The government provides a matching grant known as the Canada Education Savings Grant (CESG), the rate of which varies based on your income. The maximum CESG that a beneficiary can receive in a year is $600. Over the course of the beneficiary's lifetime, the maximum CESG is $7200. Considering these rules, it's important to plan your contributions carefully.

How to Successfully Withdraw from RESP

Eligible Education-Related Expenses

For RESP withdrawals to be considered non-taxable, they must be used for "eligible education-related expenses". These can include tuition fees, accommodation expenses, books, and more, depending on the institution. It is necessary that the beneficiary is enrolled in a qualifying educational program, which could be at a university, college, or other post-secondary institution. Before making a withdrawal, ensure that the expenses are eligible to avoid unnecessary tax implications.

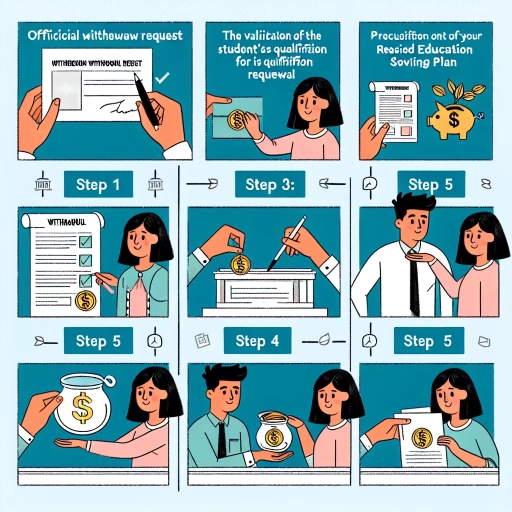

Fulfilling the Conditions for Withdrawal

Before a withdrawal can be made, certain conditions need to be met. Firstly, the RESP must have been opened for at least 10 years unless the beneficiary is already enrolled in a post-secondary institution. Second, the beneficiary must provide proof of enrolment at a recognized post-secondary institution. The subscriber will then need to determine the amount to be withdrawn and request the withdrawal from their financial institution.

Impact of RESP Withdrawals on Taxes

Typically, withdrawals from the contributions made to an RESP are not taxable. However, the Educational Assistance Payments are considered as the beneficiary's income and will be taxed at their marginal tax rate. It's important, therefore, to plan withdrawals in a way that minimizes the tax burden. As a general rule, making larger withdrawals in the earlier years of school when income might be lower could result in less taxes.

Mistakes to Avoid when Withdrawing from RESP

Over-Withdrawing

When making withdrawals from an RESP, it's essential to avoid taking out more than required. Over-withdrawing can potentially result in unneeded taxes and penalties. Note that any unused grant money should be returned to the government. So, it's important to calculate your expenses beforehand and withdraw just enough to cover them.

Misunderstanding the Tax Implications

As mentioned earlier, some withdrawals from an RESP will be taxed. It's crucial to understand these tax implications and plan accordingly. Misunderstanding how RESP withdrawal taxes work could lead to an unexpectedly hefty bill at tax time.

Not Planning Withdrawal Timing

The timing of RESP withdrawals is important to ensure optimal benefits. It is generally advised to take out as much EAP (grant and income) in the early years of post-secondary education when the student is likely to have lower income. Planning withdrawal timing strategically can help lessen the tax impact and ensure that all grant money is utilized before the plan must be collapsed at the end of the 35th year.