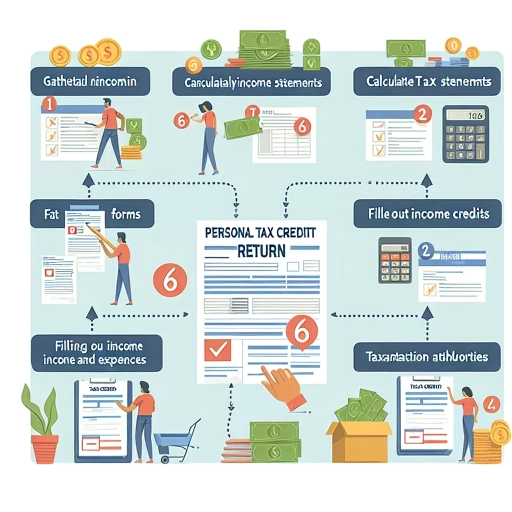

How To Fill Personal Tax Credit Return

Filing a personal tax credit return can be a daunting task, especially for those who are new to the process. However, with the right guidance, it can be a straightforward and even rewarding experience. To ensure a smooth and successful tax filing process, it's essential to understand the key steps involved. First, gathering necessary documents is crucial in providing accurate information and supporting your tax claims. This includes collecting receipts, invoices, and other relevant paperwork. Next, understanding tax credits and deductions is vital in maximizing your refund and minimizing your tax liability. This involves familiarizing yourself with the various tax credits and deductions available, such as the earned income tax credit and charitable donations. Finally, completing and submitting the tax return requires attention to detail and adherence to deadlines. By following these steps, you can ensure a stress-free and successful tax filing experience. So, let's start by gathering the necessary documents.

Gathering Necessary Documents

When it comes to gathering necessary documents, it's essential to be thorough and organized to avoid any last-minute stress or delays. Whether you're applying for a loan, filing taxes, or dealing with a legal matter, having the right documents in hand can make all the difference. To ensure you're well-prepared, it's crucial to collect personal identification documents, such as passports, driver's licenses, and social security cards. Additionally, gathering income-related documents, including pay stubs, W-2 forms, and tax returns, is vital for verifying your financial situation. Furthermore, collecting deduction and credit-related documents, such as receipts for charitable donations and medical expenses, can help you maximize your benefits. By taking the time to gather these essential documents, you'll be able to navigate complex transactions with confidence. To get started, let's begin with the first step: collecting personal identification documents.

Collecting Personal Identification Documents

Collecting personal identification documents is a crucial step in the process of gathering necessary documents for filing a personal tax credit return. This involves gathering documents that prove your identity, such as a valid passport, driver's license, or state ID. These documents are essential in verifying your identity and ensuring that you are eligible to claim the tax credit. Additionally, you may also need to collect documents that prove your relationship to dependents, such as birth certificates or adoption papers. It is also important to note that the documents required may vary depending on your individual circumstances, such as if you are a non-resident or have a disability. Therefore, it is essential to check with the relevant tax authority to determine the specific documents required. By collecting these personal identification documents, you can ensure that your tax credit return is processed efficiently and accurately.

Gathering Income-Related Documents

When it comes to gathering income-related documents, it's essential to have all the necessary paperwork in order to accurately report your income and claim the correct tax credits. Start by collecting your T4 slips, which show your employment income, as well as any T4A slips for scholarships, fellowships, bursaries, or research grants. If you're self-employed, gather your business financial statements, including your income statement and balance sheet. Don't forget to include any receipts for business expenses, as these can be claimed as deductions. If you have rental income, collect your rental income statements and any receipts for rental expenses. Additionally, gather any statements showing interest, dividends, or capital gains from investments, such as T5 slips or investment account statements. If you've received any government benefits, such as employment insurance or social assistance, be sure to include these statements as well. It's also important to gather any receipts for union dues, professional fees, or other employment-related expenses that may be eligible for a tax credit. By having all these income-related documents in order, you'll be able to accurately report your income and claim the tax credits you're eligible for, ensuring you receive the maximum refund you're entitled to.

Collecting Deduction and Credit-Related Documents

When it comes to collecting deduction and credit-related documents, it's essential to be thorough and organized. Start by gathering receipts for charitable donations, medical expenses, and business-related expenditures. These receipts can help you claim deductions on your tax return, reducing your taxable income. Additionally, collect documents related to mortgage interest, property taxes, and home office expenses, as these can also be deducted. If you're eligible for tax credits, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit, make sure to gather the necessary documentation, including proof of income, employment, and family status. Other important documents to collect include records of education expenses, childcare costs, and retirement contributions. By having all these documents in order, you'll be able to accurately claim deductions and credits on your tax return, maximizing your refund and minimizing your tax liability.

Understanding Tax Credits and Deductions

Tax credits and deductions are essential components of the tax system, allowing individuals and businesses to reduce their tax liability and increase their refund. Understanding these concepts is crucial for making informed decisions about tax planning and optimization. In this article, we will delve into the world of tax credits and deductions, exploring how to identify eligible tax credits, calculate tax deductions, and maximize tax savings. By grasping these concepts, individuals and businesses can take advantage of the tax system and keep more of their hard-earned money. To start, let's take a closer look at identifying eligible tax credits, which can provide significant tax relief for those who qualify.

Identifying Eligible Tax Credits

When it comes to filling out a personal tax credit return, identifying eligible tax credits is a crucial step in maximizing your refund. Tax credits are dollar-for-dollar reductions in the amount of tax you owe, and they can significantly impact your tax liability. To identify eligible tax credits, start by reviewing the tax credits available for the tax year. These may include credits for education expenses, child care, home improvements, and charitable donations. Next, gather all relevant documentation, such as receipts, invoices, and bank statements, to support your claims. You may also need to complete additional forms or schedules, such as Form 8863 for education credits or Form 5695 for residential energy credits. Be sure to carefully review the eligibility criteria for each credit, as some may have income limits, age restrictions, or other requirements. Additionally, consider consulting with a tax professional or using tax preparation software to ensure you are taking advantage of all the credits you are eligible for. By accurately identifying and claiming eligible tax credits, you can minimize your tax liability and maximize your refund.

Calculating Tax Deductions

Calculating tax deductions is a crucial step in the tax filing process, as it can significantly reduce an individual's tax liability. To calculate tax deductions, one must first identify the eligible deductions, which can include charitable donations, mortgage interest, medical expenses, and business expenses, among others. The next step is to gather all relevant receipts and documents to support these deductions. For example, if claiming a charitable donation deduction, one must have a receipt from the charity showing the date, amount, and type of donation. Similarly, if claiming a mortgage interest deduction, one must have a Form 1098 from the lender showing the amount of interest paid. Once all the necessary documents are gathered, one can use tax software or consult a tax professional to calculate the total deductions. The total deductions are then subtracted from the individual's total income to arrive at the taxable income. The taxable income is then used to calculate the tax liability, which can be reduced by applying tax credits. It is essential to note that tax deductions can vary from year to year, and it is crucial to stay informed about changes in tax laws and regulations to maximize deductions. Additionally, it is recommended to keep accurate records of all deductions, as the IRS may request documentation to support the deductions claimed. By accurately calculating tax deductions, individuals can minimize their tax liability and maximize their refund.

Maximizing Tax Savings

Maximizing tax savings is a crucial aspect of personal finance, and understanding tax credits and deductions is key to achieving this goal. By taking advantage of available tax credits and deductions, individuals can significantly reduce their tax liability, resulting in more money in their pockets. To maximize tax savings, it's essential to stay informed about the various tax credits and deductions available, such as the Earned Income Tax Credit (EITC), Child Tax Credit, and deductions for mortgage interest, charitable donations, and medical expenses. Additionally, individuals should keep accurate records of their expenses throughout the year, as this will help them identify eligible deductions and credits when filing their tax return. Furthermore, consulting with a tax professional or using tax preparation software can also help individuals navigate the complex tax code and ensure they are taking advantage of all the tax savings available to them. By being proactive and informed, individuals can maximize their tax savings and achieve their financial goals.

Completing and Submitting the Tax Return

Completing and submitting a tax return is a crucial task that individuals and businesses must undertake annually. The process involves several steps, including filling out the tax return form, reviewing and editing the tax return, and submitting the tax return electronically or by mail. To ensure accuracy and avoid any potential penalties, it is essential to approach each step with care and attention to detail. In this article, we will guide you through the process of completing and submitting a tax return, starting with the first step: filling out the tax return form. By following the instructions and tips outlined in this article, you can ensure that your tax return is accurate, complete, and submitted on time. So, let's begin by exploring the process of filling out the tax return form, which is the foundation of a successful tax return submission.

Filling Out the Tax Return Form

When filling out the tax return form, it's essential to provide accurate and complete information to avoid any delays or penalties. Start by gathering all necessary documents, including your identification, income statements, and receipts for deductions and credits. Ensure you have the correct form for your tax filing status, whether it's single, married, or self-employed. Begin by filling out the personal details section, including your name, address, and social security number. Next, report your income from all sources, including employment, self-employment, and investments. Be sure to include any tax-deductible expenses, such as charitable donations, mortgage interest, and medical expenses. If you're eligible, claim any tax credits, like the earned income tax credit or child tax credit. Don't forget to sign and date the form, and if you're filing jointly, have your spouse sign as well. If you're unsure about any part of the process, consider consulting a tax professional or using tax preparation software to ensure accuracy and maximize your refund.

Reviewing and Editing the Tax Return

Reviewing and editing the tax return is a crucial step in the tax filing process. It is essential to carefully review the return to ensure accuracy, completeness, and compliance with tax laws and regulations. Start by reviewing the personal and identification information, such as name, address, and social security number, to ensure it is accurate and up-to-date. Next, review the income and deduction sections to ensure all income is reported and all eligible deductions are claimed. Check for any math errors or discrepancies in the calculations. Verify that all required schedules and forms are attached and completed correctly. Additionally, review the return for any potential audit triggers, such as large deductions or income from unusual sources. It is also a good idea to have a tax professional or a second person review the return to catch any errors or omissions. Once the review is complete, make any necessary edits and corrections before submitting the return. A thorough review and edit can help prevent errors, reduce the risk of audit, and ensure the return is processed quickly and efficiently.

Submitting the Tax Return Electronically or by Mail

When it comes to submitting your tax return, you have two convenient options: electronic filing or mailing it through the postal service. Electronic filing, also known as e-filing, is a quick and efficient way to submit your tax return. You can use tax preparation software, such as TurboTax or H&R Block, to guide you through the process and ensure accuracy. Once you've completed your return, the software will transmit it to the tax authority electronically. This method is not only faster but also reduces the risk of errors and lost documents. On the other hand, if you prefer to submit your tax return by mail, make sure to use a secure and trackable method, such as certified mail or a courier service. Attach all required supporting documents, including receipts and identification, and ensure your return is signed and dated. It's essential to keep a copy of your return and supporting documents for your records. Regardless of the method you choose, make sure to submit your tax return by the deadline to avoid penalties and interest. If you're unsure about the submission process or have questions, you can contact the tax authority or consult with a tax professional for guidance.