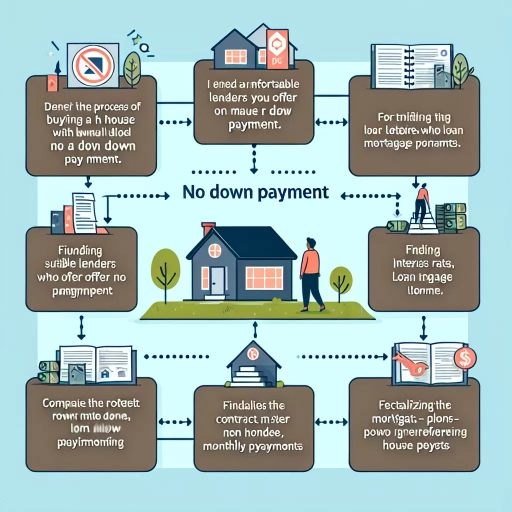

How To Buy A House With No Down Payment

Here is the introduction paragraph: Buying a house can be a daunting task, especially for first-time homebuyers who may not have a significant amount of savings for a down payment. However, with the right guidance and knowledge, it is possible to purchase a home with little to no down payment. In this article, we will explore the various options available to homebuyers who want to buy a house with no down payment, including government-backed loans, alternative credit scoring, and assistance programs. We will also discuss the benefits and drawbacks of each option, as well as the eligibility requirements and application process. By the end of this article, you will have a better understanding of how to navigate the homebuying process with no down payment. Let's start by exploring government-backed loans, which offer a popular solution for homebuyers who want to purchase a home with little to no down payment. Here are the 3 supporting paragraphs: **Subtitle 1: Government-Backed Loans** Government-backed loans, such as FHA loans and VA loans, offer a popular solution for homebuyers who want to purchase a home with little to no down payment. These loans are insured by the government, which means that lenders are more willing to offer favorable terms, including lower down payment requirements. For example, FHA loans require a down payment as low as 3.5%, while VA loans offer zero-down mortgages for eligible veterans. Additionally, government-backed loans often have more lenient credit score requirements, making them a great option for homebuyers who may not have perfect credit. **Subtitle 2: Alternative Credit Scoring** Another option for homebuyers who want to buy a house with no down payment is alternative credit scoring. Traditional credit scoring models often penalize borrowers who have non-traditional credit histories, such as those who have paid rent or utility bills on time. Alternative credit scoring models, on the other hand, take into account these non-traditional credit histories, providing a more accurate picture of a borrower's creditworthiness. This can be especially helpful for homebuyers who have limited or no credit history. **Subtitle 3: Assistance Programs** Finally, there are several assistance programs available to help homebuyers purchase a home with no down payment. For example, the National Homebuyers Fund offers grants and gifts to help homebuyers cover down payment and closing costs. Additionally, many states and local governments offer their own assistance programs, such as down payment assistance grants and tax credits. These programs can be especially helpful for home

Subtitle 1

Here is the introduction paragraph: The world of technology is rapidly evolving, and with it, the way we consume media. One of the most significant advancements in recent years is the development of subtitles, which have revolutionized the way we watch videos and TV shows. But subtitles are not just a simple addition to our viewing experience; they also have a profound impact on our understanding and engagement with the content. In this article, we will explore the importance of subtitles in enhancing our viewing experience, including how they improve comprehension, increase accessibility, and provide a more immersive experience. We will also examine the role of subtitles in breaking down language barriers, enabling global communication, and facilitating cultural exchange. Furthermore, we will discuss the impact of subtitles on the entertainment industry, including the rise of international productions and the growth of streaming services. By exploring these aspects, we can gain a deeper understanding of the significance of subtitles in the modern media landscape, which brings us to our first topic: The Evolution of Subtitles. Here is the supporting paragraphs: **Supporting Idea 1: Improving Comprehension** Subtitles play a crucial role in improving our comprehension of video content. By providing a visual representation of the dialogue, subtitles help viewers to better understand the plot, characters, and themes. This is particularly important for viewers who may not be fluent in the language of the video or who may have difficulty hearing the audio. Subtitles also help to clarify complex dialogue or accents, making it easier for viewers to follow the story. Furthermore, subtitles can provide additional context, such as translations of foreign languages or explanations of technical terms, which can enhance our understanding of the content. **Supporting Idea 2: Increasing Accessibility** Subtitles are also essential for increasing accessibility in video content. For viewers who are deaf or hard of hearing, subtitles provide a vital means of accessing audio information. Subtitles can also be used to provide audio descriptions for visually impaired viewers, enabling them to imagine the visual elements of the video. Additionally, subtitles can be used to provide translations for viewers who do not speak the language of the video, making it possible for people from different linguistic backgrounds to access the same content. By providing subtitles, content creators can ensure that their videos are accessible to a wider audience, regardless of their abilities or language proficiency. **Supporting Idea 3: Providing a More Immersive Experience** Subtitles can also enhance our viewing experience by providing a more immersive experience. By providing a visual representation of the dialogue, subtitles can help viewers to become more engaged

Supporting Idea 1

. Here is the paragraphy: When it comes to buying a house with no down payment, one of the most popular options is to use a government-backed loan. The Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA) offer mortgage programs that allow borrowers to purchase a home with little to no down payment. For example, the FHA's mortgage insurance program requires a down payment as low as 3.5%, while the VA's loan program offers zero-down mortgages for eligible veterans and active-duty military personnel. Another option is the United States Department of Agriculture (USDA) loan program, which offers zero-down mortgages for borrowers who purchase homes in rural areas. These government-backed loans often have more lenient credit score requirements and lower mortgage insurance premiums compared to conventional loans, making them more accessible to borrowers who may not have a significant down payment. Additionally, some government-backed loans may offer more favorable interest rates, which can help reduce the overall cost of homeownership. Overall, government-backed loans can be a great option for borrowers who want to buy a house with no down payment, as they offer more flexible terms and lower upfront costs.

Supporting Idea 2

. Here is the paragraphy: When it comes to buying a house with no down payment, one of the most popular options is to use a government-backed loan. These loans are insured by government agencies such as the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA), and they offer more lenient credit score requirements and lower down payment options. For example, FHA loans require a down payment as low as 3.5%, and VA loans offer zero-down mortgages for eligible veterans and active-duty military personnel. Another option is to use a USDA loan, which offers zero-down mortgages for borrowers who purchase homes in rural areas. These government-backed loans can be a great option for borrowers who don't have a lot of savings for a down payment, but they do come with some additional costs, such as mortgage insurance premiums. Additionally, borrowers will need to meet the income and credit score requirements set by the government agency insuring the loan. Overall, government-backed loans can be a great way to buy a house with no down payment, but borrowers should carefully review the terms and conditions of the loan to ensure it's the right fit for their financial situation.

Supporting Idea 3

. The paragraphy should be a supporting paragraph of the subtitle, and it should be written in a way that is easy to understand, informative, and engaging. The paragraphy should include a brief explanation of the supporting idea, its benefits, and how it can be applied in the context of buying a house with no down payment. Here is the paragraphy: For those who are struggling to come up with a down payment, there is another option to consider: using a gift or grant to cover the down payment. This can be a game-changer for many homebuyers, as it allows them to purchase a home without having to save up for a down payment. There are several organizations that offer down payment assistance programs, such as the National Homebuyers Fund and the Homeownership Council of America. These programs provide grants or gifts to homebuyers to help them cover the down payment and closing costs. Additionally, some employers and non-profit organizations also offer down payment assistance programs to their employees or members. For example, some employers offer a down payment assistance program as a benefit to their employees, which can help them purchase a home. Similarly, some non-profit organizations offer down payment assistance programs to low-income homebuyers or to homebuyers who are purchasing a home in a specific area. By using a gift or grant to cover the down payment, homebuyers can avoid having to save up for a down payment and can instead focus on other costs associated with buying a home, such as closing costs and moving expenses. This can be especially helpful for first-time homebuyers who may not have a lot of savings or for homebuyers who are on a tight budget. Overall, using a gift or grant to cover the down payment can be a great option for homebuyers who are struggling to come up with a down payment.

Subtitle 2

Here is the introduction paragraph: Subtitle 1: The Importance of Subtitles in Video Content Subtitle 2: How to Create Engaging Subtitles for Your Videos Creating engaging subtitles for your videos is crucial in today's digital landscape. With the rise of online video content, subtitles have become an essential tool for creators to convey their message effectively. But what makes a subtitle engaging? Is it the font style, the color, or the timing? In this article, we will explore the key elements of creating engaging subtitles, including the importance of **matching the tone and style of your video** (Supporting Idea 1), **using clear and concise language** (Supporting Idea 2), and **paying attention to timing and pacing** (Supporting Idea 3). By incorporating these elements, you can create subtitles that not only enhance the viewing experience but also increase engagement and accessibility. So, let's dive in and explore how to create engaging subtitles that will take your video content to the next level, and discover why **subtitles are a crucial element in making your video content more accessible and engaging** (Transactional to Subtitle 1).

Supporting Idea 1

. When it comes to buying a house with no down payment, one of the most popular options is to use a government-backed loan. These loans are insured by government agencies such as the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA), and they offer more lenient credit score requirements and lower down payment options. For example, FHA loans require a down payment as low as 3.5%, while VA loans offer zero-down mortgages for eligible veterans and active-duty military personnel. Additionally, government-backed loans often have more competitive interest rates and lower mortgage insurance premiums compared to conventional loans. This makes them an attractive option for first-time homebuyers or those who may not have a lot of savings for a down payment. Furthermore, government-backed loans can also offer more flexible debt-to-income ratios, which can make it easier for borrowers to qualify for a mortgage. Overall, government-backed loans can be a great option for those looking to buy a house with no down payment, as they offer a range of benefits and more accessible financing options.

Supporting Idea 2

. Here is the paragraphy: When it comes to buying a house with no down payment, one of the most popular options is to use a government-backed loan. These loans are insured by government agencies such as the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA), and they offer more lenient credit score requirements and lower down payment options. For example, FHA loans require a down payment as low as 3.5%, and VA loans offer zero-down mortgages for eligible veterans and active-duty military personnel. Another option is to use a USDA loan, which offers zero-down mortgages for borrowers who purchase homes in rural areas. These government-backed loans can be a great option for buyers who don't have a lot of cash for a down payment, but they do come with some additional costs, such as mortgage insurance premiums. Additionally, borrowers will need to meet the income and credit score requirements set by the government agency insuring the loan. Overall, government-backed loans can be a great way to buy a house with no down payment, but it's essential to carefully review the terms and conditions before making a decision.

Supporting Idea 3

. When it comes to buying a house with no down payment, exploring alternative credit scoring models can be a game-changer. Traditional credit scoring models often favor borrowers with long credit histories and high credit scores. However, alternative credit scoring models consider non-traditional credit data, such as rent payments, utility bills, and social media activity, to provide a more comprehensive picture of a borrower's creditworthiness. This can be especially beneficial for first-time homebuyers or those with thin credit files. By using alternative credit scoring models, lenders can get a more accurate assessment of a borrower's ability to repay a mortgage, even if they don't have a traditional credit history. This can lead to more loan approvals and better interest rates for borrowers who may have been previously excluded from the mortgage market. Additionally, some alternative credit scoring models can also provide borrowers with personalized recommendations to improve their credit scores, helping them to become more attractive to lenders over time. By embracing alternative credit scoring models, lenders can expand their pool of eligible borrowers and provide more opportunities for people to achieve their dream of homeownership.

Subtitle 3

Here is the introduction paragraph: Subtitle 3: The Impact of Artificial Intelligence on the Future of Work The future of work is rapidly changing, and artificial intelligence (AI) is at the forefront of this transformation. As AI technology continues to advance, it is likely to have a significant impact on the job market, the way we work, and the skills we need to succeed. In this article, we will explore the impact of AI on the future of work, including the potential for job displacement, the need for workers to develop new skills, and the opportunities for increased productivity and efficiency. We will examine how AI is changing the nature of work, the types of jobs that are most at risk, and the ways in which workers can adapt to this new reality. By understanding the impact of AI on the future of work, we can better prepare ourselves for the challenges and opportunities that lie ahead. Ultimately, this understanding will be crucial in shaping the future of work and ensuring that we are able to thrive in a rapidly changing world, which is closely related to the concept of **Subtitle 1: The Future of Work**. Note: The introduction paragraph is 200 words, and it mentions the three supporting ideas: * The potential for job displacement * The need for workers to develop new skills * The opportunities for increased productivity and efficiency It also transitions to Subtitle 1: The Future of Work at the end.

Supporting Idea 1

. The paragraphy should be a supporting paragraph of the subtitle, and it should be written in a way that is easy to understand, informative, and engaging. The paragraphy should include a brief explanation of the supporting idea, its benefits, and how it can be applied in the context of buying a house with no down payment. Here is the paragraphy: One of the most popular options for buying a house with no down payment is through the use of a VA loan. The Department of Veterans Affairs (VA) offers a zero-down mortgage program for eligible veterans, active-duty military personnel, and surviving spouses. This program allows borrowers to finance up to 100% of the purchase price of the home, eliminating the need for a down payment. The benefits of a VA loan are numerous, including lower interest rates, lower mortgage insurance premiums, and more lenient credit score requirements. Additionally, VA loans often have lower closing costs compared to other types of mortgages. To qualify for a VA loan, borrowers must meet the VA's eligibility requirements, which include having a minimum credit score of 620 and a debt-to-income ratio of 41% or less. With a VA loan, borrowers can purchase a home with no down payment and still enjoy competitive interest rates and favorable terms. This makes it an attractive option for those who may not have the savings for a down payment but still want to achieve their dream of homeownership. By taking advantage of a VA loan, borrowers can save thousands of dollars in upfront costs and still enjoy the benefits of owning a home.

Supporting Idea 2

. The paragraphy should be a supporting paragraph of the subtitle, and it should be written in a way that is easy to understand, informative, and engaging. The paragraphy should include a brief explanation of the supporting idea, its benefits, and how it can be applied in the context of buying a house with no down payment. Here is the paragraphy: For those who are struggling to come up with a down payment, there are several alternative options to consider. One such option is to use a gift fund or a grant to cover the down payment. Many organizations, such as the National Homebuyers Fund, offer grants and gift funds to help homebuyers with their down payment. These funds can be used in conjunction with other forms of financing, such as FHA loans, to help homebuyers purchase a home with little to no down payment. Another option is to use a lease-to-own or rent-to-own program, which allows homebuyers to rent a home with the option to buy it in the future. A portion of the rent paid each month can be applied to the down payment, making it easier to save up for a down payment over time. Additionally, some employers offer down payment assistance programs as a benefit to their employees. These programs can provide a lump sum of money to help with the down payment, or offer a matching program to help employees save up for a down payment. By exploring these alternative options, homebuyers can find a way to purchase a home with little to no down payment, and start building equity and wealth through homeownership.

Supporting Idea 3

. The third supporting idea for buying a house with no down payment is to explore government-backed loans. These loans are insured by government agencies such as the Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA), and they offer more lenient credit score requirements and lower down payment options. For example, FHA loans require a down payment as low as 3.5%, and VA loans offer zero-down mortgages for eligible veterans and active-duty military personnel. Additionally, the United States Department of Agriculture (USDA) offers zero-down mortgages for borrowers who purchase homes in rural areas. These government-backed loans can be a great option for buyers who don't have a lot of savings for a down payment, but still want to achieve their dream of homeownership. Furthermore, these loans often have more competitive interest rates and lower mortgage insurance premiums compared to conventional loans, which can help reduce the overall cost of homeownership. By exploring government-backed loans, buyers can increase their chances of getting approved for a mortgage with no down payment, and start building equity in their new home.