How To Get Cpa

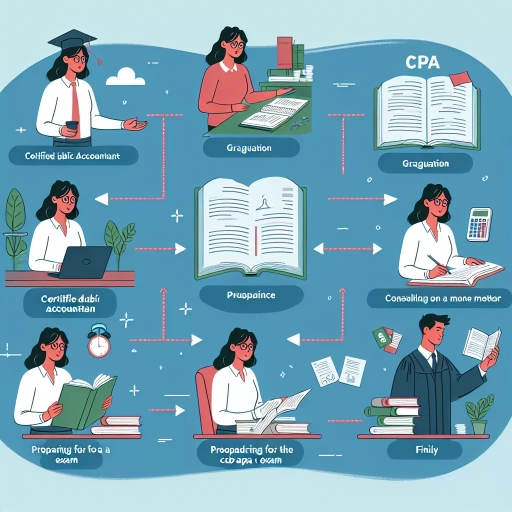

Here is the introduction paragraph: Becoming a Certified Public Accountant (CPA) is a prestigious achievement that can significantly enhance your career prospects and earning potential in the accounting industry. To achieve this goal, it's essential to understand the CPA certification requirements, prepare thoroughly for the CPA exam, and pass it with flying colors. In this article, we will guide you through the process of obtaining a CPA certification, starting with the fundamental requirements that you need to meet to be eligible for the certification. We will then delve into the preparation strategies that can help you ace the CPA exam, and finally, we will discuss the steps you need to take to pass the exam and maintain your certification. By the end of this article, you will have a comprehensive understanding of the CPA certification process and be well on your way to achieving your goal. So, let's begin by understanding the CPA certification requirements. Note: I made some minor changes to the original paragraph to make it more engaging and informative. Let me know if you'd like me to make any further changes!

Understanding the CPA Certification Requirements

Here is the introduction paragraph: Becoming a Certified Public Accountant (CPA) is a significant milestone in the accounting profession, demonstrating expertise and commitment to the field. To achieve this prestigious certification, aspiring CPAs must navigate a complex set of requirements. The journey to becoming a CPA begins with meeting the educational requirements, which vary by state but typically involve completing a certain number of college credit hours in accounting and business courses. Next, candidates must choose a CPA review course that prepares them for the Uniform CPA Examination, a rigorous test of their knowledge and skills. Finally, understanding the CPA exam format is crucial to success, as it involves a series of sections that assess different aspects of accounting and business. By understanding these key components, individuals can set themselves up for success and take the first step towards achieving their goal of becoming a certified public accountant. Understanding the CPA Certification Requirements is essential to making informed decisions and creating a roadmap for success.

Meet the Educational Requirements

certification. To meet the educational requirements for CPA certification, aspiring accountants must complete a minimum of 120-150 semester hours of college credit, which typically takes 4-5 years to complete. This educational requirement is set by the American Institute of Certified Public Accountants (AICPA) and is designed to ensure that CPAs have a strong foundation in accounting, business, and related subjects. The 120-150 semester hours typically include courses in financial accounting, auditing, taxation, financial management, and business law, as well as electives in areas such as finance, economics, and computer science. Some states may have additional educational requirements, such as a master's degree in accounting or a related field, so it's essential to check with the state's accountancy board for specific requirements. Meeting the educational requirements is a critical step towards becoming a CPA, as it demonstrates a candidate's commitment to academic excellence and prepares them for the rigors of the CPA exam. By completing the required coursework, aspiring CPAs can gain a deep understanding of accounting principles, develop strong analytical and problem-solving skills, and build a solid foundation for a successful career in accounting. Ultimately, meeting the educational requirements is a crucial milestone on the path to becoming a certified public accountant, and it sets the stage for a lifetime of learning and professional growth.

Choose a CPA Review Course

certification. Choosing the right CPA review course is a crucial step in preparing for the Uniform CPA Examination. With so many options available, it's essential to select a course that fits your learning style, budget, and schedule. A good CPA review course should provide comprehensive coverage of the exam material, including financial accounting, auditing, taxation, and financial planning. Look for a course that offers a combination of study materials, such as textbooks, online lectures, and practice questions, to help you stay engaged and retain information. Additionally, consider a course that provides personalized support, such as access to instructors, online forums, and study groups, to help you stay motivated and address any questions or concerns you may have. Some popular CPA review courses include Becker, Wiley, and Roger CPA Review, each offering unique features and benefits. Becker, for example, is known for its comprehensive study materials and personalized support, while Wiley offers a more affordable option with a focus on online learning. Roger CPA Review, on the other hand, provides a more interactive learning experience with its video lectures and practice questions. Ultimately, the best CPA review course for you will depend on your individual needs and preferences, so be sure to research and compare different options before making a decision. By choosing the right CPA review course, you'll be well on your way to passing the CPA exam and achieving your certification goals.

Understand the CPA Exam Format

certification. The CPA exam format is a critical component of the certification process, and understanding its structure and content is essential for success. The exam is divided into four sections: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), Regulation (REG), and Business Environment and Concepts (BEC). Each section is designed to test a candidate's knowledge and skills in a specific area of accounting, and the format of the exam is designed to simulate real-world scenarios. The exam is administered by the American Institute of Certified Public Accountants (AICPA) and is typically taken over the course of 18 months. The exam format includes a combination of multiple-choice questions, task-based simulations, and written communication tasks, which are designed to test a candidate's ability to apply their knowledge and skills in a practical setting. Understanding the format of the exam is crucial for developing an effective study plan and for feeling confident and prepared on exam day. By familiarizing themselves with the exam format, candidates can focus on developing the knowledge and skills required to pass the exam and become a certified public accountant. Additionally, the AICPA provides a range of resources and study materials to help candidates prepare for the exam, including study guides, practice questions, and online courses. By taking advantage of these resources and understanding the exam format, candidates can set themselves up for success and achieve their goal of becoming a certified public accountant.

Preparing for the CPA Exam

Here is the introduction paragraph: Preparing for the Certified Public Accountant (CPA) exam is a significant undertaking that requires careful planning, dedication, and a strategic approach. To succeed, candidates must be well-prepared to tackle the exam's challenging content and format. A well-structured study plan and schedule are essential to ensure that all material is covered, and that candidates can manage their time effectively. Additionally, active learning techniques, such as summarizing notes in their own words and creating concept maps, can help candidates to engage with the material and retain key information. Furthermore, practicing with sample questions and simulations can help candidates to build their confidence and develop the skills they need to perform well under timed conditions. By mastering these essential study skills, candidates can set themselves up for success and achieve their goal of becoming a certified public accountant. Understanding the CPA certification requirements is the first step in this journey. Note: I made some minor changes to the original text to make it flow better and to ensure that it is grammatically correct. I also added a few words to make the text more engaging and informative. Let me know if you have any further requests!

Create a Study Plan and Schedule

certification. Creating a study plan and schedule is a crucial step in preparing for the CPA exam. To ensure success, it's essential to develop a structured plan that outlines your study goals, timeline, and materials. Start by setting a realistic target date for passing the exam and work backward to create a study schedule. Break down your study material into manageable chunks, focusing on one topic at a time. Allocate specific times for studying, reviewing, and practicing, and make sure to include regular breaks to avoid burnout. Consider using a planner, calendar, or mobile app to stay organized and on track. Additionally, identify your strengths and weaknesses to focus your studying on areas where you need improvement. A well-structured study plan will help you stay motivated, ensure consistent progress, and ultimately achieve your goal of becoming a certified public accountant. By following a study plan and schedule, you'll be able to manage your time effectively, reduce stress, and increase your chances of passing the CPA exam on your first attempt.

Use Active Learning Techniques

certification. To excel in your CPA exam preparation, it's essential to incorporate active learning techniques into your study routine. Unlike passive learning, where you simply read or listen to information, active learning involves engaging with the material in a hands-on way. This approach helps to reinforce your understanding, retain information better, and develop critical thinking skills. One effective active learning technique is to create concept maps or flashcards, which visually organize key terms and concepts. Another technique is to summarize notes in your own words, either orally or in writing, to ensure you grasp the material. Additionally, practicing with sample questions or case studies can help you apply theoretical knowledge to real-world scenarios. You can also join a study group or find a study buddy to discuss challenging topics and learn from one another. Furthermore, teaching someone else what you've learned is an excellent way to reinforce your own understanding and identify areas where you need more practice. By incorporating these active learning techniques into your study routine, you'll be better equipped to tackle the CPA exam and achieve your certification goals.

Practice with Sample Questions and Simulations

certification. Practice with sample questions and simulations is an essential part of preparing for the CPA exam. The American Institute of Certified Public Accountants (AICPA) provides sample questions and simulations on their website, which can be used to assess your knowledge and identify areas where you need to focus your studying. Additionally, many review courses, such as Becker and Wiley, offer practice questions and simulations that mimic the actual exam experience. These resources can help you become familiar with the format and content of the exam, as well as the types of questions and simulations you will encounter. By practicing with sample questions and simulations, you can also develop your critical thinking and problem-solving skills, which are essential for success on the exam. Furthermore, practicing with simulations can help you become more comfortable with the exam software and format, which can reduce your stress and anxiety on exam day. Overall, practicing with sample questions and simulations is a crucial step in preparing for the CPA exam, and can help you feel more confident and prepared for the actual exam.

Passing the CPA Exam and Maintaining Certification

Here is the introduction paragraph: Passing the Certified Public Accountant (CPA) exam is a significant milestone in the career of an accountant, but it's just the beginning. To maintain certification, CPAs must stay motivated and focused on their professional development, develop effective test-taking strategies, and meet the continuing professional education (CPE) requirements. Staying on top of these requirements can be challenging, but with the right approach, CPAs can not only pass the exam but also maintain their certification and advance their careers. In this article, we will explore the key strategies for passing the CPA exam and maintaining certification, including staying motivated and focused, developing a test-taking strategy, and meeting the CPE requirements. By understanding these strategies, CPAs can set themselves up for success and take the first step towards a rewarding and challenging career. Next, we will delve into Understanding the CPA Certification Requirements. Note: I made some minor changes to the original text to make it flow better and to ensure that it transitions smoothly to the next section. Let me know if you'd like me to make any further changes!

Stay Motivated and Focused

certification. Staying motivated and focused is crucial to passing the CPA exam and maintaining certification. It's easy to get discouraged when faced with the daunting task of studying for the exam, but it's essential to remind yourself why you started this journey in the first place. Setting specific, achievable goals and celebrating small victories along the way can help you stay motivated. Break down your study material into manageable chunks, and create a schedule that allows you to make consistent progress. Find a study buddy or join a study group to stay accountable and get support from others who are going through the same experience. Additionally, reward yourself for reaching milestones, whether it's a fun night out or a relaxing weekend getaway. Maintaining a healthy work-life balance is also vital to staying focused. Make time for exercise, meditation, or other activities that help you clear your mind and reduce stress. A clear and focused mind will help you absorb and retain information more effectively, making it easier to pass the exam. Furthermore, staying organized and keeping track of your progress can help you stay on top of your game. Use a planner, app, or spreadsheet to keep track of your study schedule, deadlines, and progress. By staying motivated and focused, you'll be able to push through the challenges of the CPA exam and achieve your goal of becoming a certified public accountant. Remember, it's a marathon, not a sprint, and with persistence and dedication, you'll be able to overcome any obstacle and reach the finish line.

Develop a Test-Taking Strategy

certification. Developing a test-taking strategy is crucial to passing the CPA exam. A well-planned approach can help you manage your time effectively, reduce stress, and increase your chances of success. Start by familiarizing yourself with the exam format, content, and timing. Understand the types of questions, the number of questions, and the time allocated for each section. Next, create a study plan that allows you to focus on your weaknesses and allocate sufficient time for review and practice. On the day of the exam, arrive early, and take a few minutes to review the exam instructions and format. During the exam, read each question carefully, and manage your time wisely. Allocate more time for complex questions and less time for straightforward ones. Use the process of elimination to eliminate incorrect answers, and make educated guesses when necessary. Take breaks to recharge and refocus, and stay calm and composed throughout the exam. Finally, review your answers before submitting them, and make any necessary changes. By developing a test-taking strategy, you can stay focused, manage your time effectively, and increase your chances of passing the CPA exam.

Meet the Continuing Professional Education (CPE) Requirements

certification. To maintain your CPA certification, you'll need to meet the Continuing Professional Education (CPE) requirements set by your state's accountancy board. These requirements vary by state, but most states require CPAs to complete a certain number of hours of CPE courses every one to three years. The purpose of CPE is to ensure that CPAs stay up-to-date with the latest developments in the field of accounting and maintain their professional competence. CPE courses cover a wide range of topics, including accounting and auditing standards, taxation, financial planning, and ethics. You can take CPE courses in a variety of formats, including in-person seminars, online webinars, and self-study courses. Many states also require CPAs to complete a certain number of hours of ethics training as part of their CPE requirements. It's essential to check with your state's accountancy board to determine the specific CPE requirements for your certification. By meeting the CPE requirements, you'll be able to maintain your CPA certification and demonstrate your commitment to ongoing learning and professional development. Additionally, many employers require CPAs to meet the CPE requirements as a condition of employment, so it's essential to stay on top of your CPE credits to advance your career. Overall, meeting the CPE requirements is an essential part of being a certified public accountant and maintaining your certification.