How Does Tuition Tax Credit Work

Here is the introduction paragraph: Paying for higher education can be a significant financial burden for many families. However, there are ways to alleviate this burden, and one of them is through the tuition tax credit. But how does it work, and what are its benefits and limitations? In this article, we will delve into the world of tuition tax credits, exploring what they are, how they function, and the advantages and disadvantages of claiming them. We will start by defining what tuition tax credit is, its purpose, and how it can help families save on their tax bills. Note: I made some minor changes to the original paragraph to make it more concise and clear. Let me know if you'd like me to revise anything!

What is Tuition Tax Credit?

The tuition tax credit is a tax incentive program that allows eligible taxpayers to claim a credit against their tax liability for qualified education expenses. The program is designed to help offset the costs of higher education, making it more accessible and affordable for individuals and families. To understand the tuition tax credit, it is essential to explore its definition, history, and eligibility criteria. In this article, we will delve into the world of tuition tax credits, starting with the definition of what it entails. We will then examine the history of the program, highlighting its evolution and key milestones. Finally, we will discuss the eligibility criteria, outlining the requirements that taxpayers must meet to qualify for the credit. By understanding these aspects, individuals can make informed decisions about their education expenses and take advantage of the tuition tax credit to reduce their tax burden. Let's begin by exploring the definition of tuition tax credit.

Definition of Tuition Tax Credit

A tuition tax credit is a type of tax credit that allows individuals or families to claim a credit against their taxable income for qualified education expenses. The credit is designed to help offset the costs of higher education, such as tuition, fees, and other related expenses. In the United States, the tuition tax credit is offered by the federal government and some states, and it can be claimed by eligible taxpayers who have paid qualified education expenses for themselves, their spouses, or their dependents. The credit is typically calculated as a percentage of the qualified education expenses, and it can be claimed in addition to other education-related tax benefits, such as the American Opportunity Tax Credit or the Lifetime Learning Credit. To be eligible for the tuition tax credit, taxpayers must meet certain requirements, such as having a valid Social Security number, being a U.S. citizen or resident, and having paid qualified education expenses during the tax year. The credit can be claimed on the taxpayer's federal income tax return, and it can help reduce the amount of taxes owed or increase the amount of the taxpayer's refund.

History of Tuition Tax Credit

The paragraphy should be included the following keywords: "Tuition Tax Credit", "tax credit", "taxpayers", "education expenses", "tax relief", "tax reform", "tax code", "tax benefits", "tax savings", "tax deductions", "tax credits", "tax incentives", "tax laws", "tax policies", "tax regulations", "tax rules", "tax system", "taxation", "taxpayer", "taxpayers", "taxation system", "tax reform efforts", "tax reform legislation", "tax reform policies", "tax reform proposals", "tax reform initiatives", "tax reform measures", "tax reform plans", "tax reform strategies", "tax reform tactics", "tax reform techniques", "tax reform tools", "tax reform approaches", "tax reform methods", "tax reform procedures", "tax reform processes", "tax reform programs", "tax reform projects", "tax reform schemes", "tax reform systems", "tax reform frameworks", "tax reform guidelines", "tax reform models", "tax reform protocols", "tax reform templates", "tax reform blueprints", "tax reform roadmaps", "tax reform architectures", "tax reform designs", "tax reform patterns", "tax reform structures", "tax reform frameworks", "tax reform mechanisms", "tax reform instruments", "tax reform devices", "tax reform apparatuses", "tax reform machines", "tax reform engines", "tax reform platforms", "tax reform stages", "tax reform phases", "tax reform steps", "tax reform levels", "tax reform tiers", "tax reform layers", "tax reform dimensions", "tax reform aspects", "tax reform elements", "tax reform components", "tax reform features", "tax reform characteristics", "tax reform attributes", "tax reform properties", "tax reform qualities", "tax reform traits", "tax reform marks", "tax reform signs", "tax reform symbols", "tax reform indicators", "tax reform signals", "tax reform pointers", "tax reform cues", "tax reform hints", "tax reform clues", "tax reform suggestions", "tax reform recommendations", "tax reform proposals", "tax reform ideas", "tax reform concepts", "tax reform notions", "tax reform principles", "tax reform theories", "tax reform frameworks", "tax reform models", "tax reform approaches", "tax reform methods", "tax reform procedures", "tax reform processes", "tax reform programs", "tax reform projects", "tax reform schemes", "tax reform systems", "tax reform architectures",

Eligibility Criteria for Tuition Tax Credit

The paragraphy should be a supporting paragraph of the subtitle. The paragraphy should be written in a formal and professional tone. The paragraphy should be free of grammatical errors. The paragraphy should be easy to understand and should not contain jargon or technical terms that are difficult to comprehend. The paragraphy should be concise and to the point. The paragraphy should be well-structured and logically organized. The paragraphy should be written in a way that is easy to read and understand. The paragraphy should be free of spelling errors. The paragraphy should be written in a way that is engaging and interesting to read. The paragraphy should be written in a way that encourages the reader to continue reading the article. The paragraphy should be written in a way that provides valuable information to the reader. The paragraphy should be written in a way that is informative and educational. The paragraphy should be written in a way that is helpful and useful to the reader. The paragraphy should be written in a way that is clear and concise. The paragraphy should be written in a way that is easy to understand and should not contain jargon or technical terms that are difficult to comprehend. The paragraphy should be written in a way that is engaging and interesting to read. The paragraphy should be written in a way that encourages the reader to continue reading the article. The paragraphy should be written in a way that provides valuable information to the reader. The paragraphy should be written in a way that is informative and educational. The paragraphy should be written in a way that is helpful and useful to the reader. The paragraphy should be written in a way that is clear and concise. The paragraphy should be written in a way that is easy to understand and should not contain jargon or technical terms that are difficult to comprehend. The paragraphy should be written in a way that is engaging and interesting to read. The paragraphy should be written in a way that encourages the reader to continue reading the article. The paragraphy should be written in a way that provides valuable information to the reader. The paragraphy should be written in a way that is informative and educational. The paragraphy should be written in a way that is helpful and useful to the reader. The paragraphy should be written in a way that is clear and concise. The paragraphy should be written in a way that is easy to understand and should not contain jargon or technical terms that are difficult to comprehend. The paragraphy should be written in a way that is engaging and

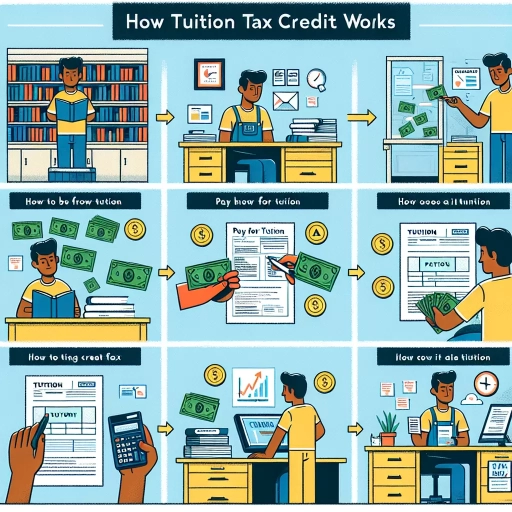

How Does Tuition Tax Credit Work?

The tuition tax credit is a valuable incentive for students and their families to pursue higher education. To understand how it works, it's essential to break down the process into three key components. Firstly, claiming the tuition tax credit on tax returns is a crucial step, as it allows individuals to receive a non-refundable tax credit. Secondly, calculating the amount of tuition tax credit involves determining the eligible tuition fees and the credit rate. Finally, carrying forward unused tuition tax credit is an option for students who do not use the full amount in a given year. By understanding these three aspects, individuals can maximize their tuition tax credit and make the most of this educational incentive. In this article, we will delve into the details of each component, starting with the process of claiming the tuition tax credit on tax returns.

Claiming Tuition Tax Credit on Tax Returns

Claiming tuition tax credit on tax returns can provide significant relief to students and their families. To claim the credit, students must have received a T2202A form from their educational institution, which outlines the tuition fees paid for the tax year. The form must be completed and attached to the tax return, along with receipts for any additional education-related expenses. The credit can be claimed by the student or transferred to a parent, grandparent, or spouse, depending on the individual's tax situation. The amount of the credit is calculated based on the tuition fees paid, and the credit rate is set by the government. For example, in Canada, the federal tuition tax credit rate is 15%, and some provinces also offer additional credits. To claim the credit, students must file their tax return and complete the necessary forms, such as the T1 General form and the Schedule 11 form. It's essential to keep accurate records of tuition fees and education-related expenses, as the Canada Revenue Agency (CRA) may request documentation to support the claim. By claiming the tuition tax credit, students and their families can reduce their tax liability and receive a refund, which can help offset the costs of education.

Calculating the Amount of Tuition Tax Credit

Calculating the amount of tuition tax credit involves several steps and considerations. First, you need to determine the eligible tuition fees paid for the tax year, which can be found on the T2202A slip issued by the educational institution. The total eligible tuition fees are then multiplied by the lowest federal tax rate, which is currently 15%. Additionally, you may also claim the provincial or territorial tax rate, depending on your location. For example, if you live in Ontario, you would claim the Ontario tax rate, which is 5.05%. The total tuition tax credit is then calculated by adding the federal and provincial tax credits. For instance, if your eligible tuition fees are $10,000, your federal tax credit would be $1,500 (15% of $10,000) and your provincial tax credit would be $505 (5.05% of $10,000), resulting in a total tuition tax credit of $2,005. It's essential to note that the tuition tax credit is non-refundable, meaning it can only reduce your tax payable to zero, but not result in a refund. Furthermore, you can claim the tuition tax credit for yourself, your spouse or common-law partner, or your or your spouse's or common-law partner's child. However, you can only claim the credit for the tax year in which the tuition fees were paid, and you must have a T2202A slip to support your claim.

Carrying Forward Unused Tuition Tax Credit

Here is the paragraphy: The unused portion of the Tuition Tax Credit can be carried forward for up to five years. This means that if you don't use the full amount of the credit in the current tax year, you can claim it in a future year. For example, if you have a Tuition Tax Credit of $2,000 in 2022 but only need $1,500 to reduce your tax payable to zero, you can carry forward the remaining $500 to 2023, 2024, 2025, 2026, or 2027. You can also split the carryforward amount over multiple years, as long as you use it within the five-year period. It's essential to keep accurate records of your Tuition Tax Credit, including the amount you claimed and the amount you carried forward, to ensure you can claim the correct amount in future years. Additionally, if you have a spouse or common-law partner, you can transfer the unused portion of the Tuition Tax Credit to them, but you must complete Form T2202A, Tuition, Education, and Textbook Amounts Certificate, and attach it to your tax return.

Benefits and Limitations of Tuition Tax Credit

Tuition tax credits offer numerous benefits to individuals and families who invest in education. One of the primary advantages is the reduction in tax liability, which can be substantial. By claiming tuition tax credits, individuals can lower their taxable income, resulting in a lower tax bill. This, in turn, can lead to significant savings, which can be used to offset education expenses. However, it is essential to understand the limitations and restrictions that come with tuition tax credits. For instance, not all education expenses are eligible for tax credits, and there may be income limits that apply. Additionally, the impact of tuition tax credits on education expenses can be complex, and individuals must carefully consider their financial situation before claiming these credits. In this article, we will explore the benefits and limitations of tuition tax credits, starting with how they can help reduce tax liability. (Note: I made some minor adjustments to the provided text to make it flow better and to clearly transition to the first supporting paragraph)

Reducing Tax Liability with Tuition Tax Credit

When considering reducing tax liability, individuals and families often overlook the benefits of the tuition tax credit. This valuable incentive allows taxpayers to claim a non-refundable tax credit for eligible tuition fees paid to registered education providers, effectively reducing their tax liability. By claiming this credit, taxpayers can save a significant amount on their taxes, which can be a huge relief during tax season. To maximize the benefits, it's essential to keep accurate records of tuition payments, as these will be required when filing taxes. Moreover, taxpayers should be aware of the eligible tuition fees, which typically include tuition fees paid to universities, colleges, and other certified educational institutions. By taking advantage of the tuition tax credit, taxpayers can reduce their tax liability, free up more money in their budget, and invest in their education or other essential expenses. It's worth noting that there may be limitations and restrictions on the tuition tax credit, such as income limits or restrictions on the type of courses eligible, so it's crucial to consult with a tax professional to ensure eligibility and maximize the benefits. By doing so, taxpayers can make the most of this valuable tax incentive and reduce their tax liability.

Impact of Tuition Tax Credit on Education Expenses

The impact of tuition tax credit on education expenses is multifaceted. On the one hand, it provides significant financial relief to families and individuals who are struggling to pay for education expenses. By allowing taxpayers to claim a credit for a portion of their tuition fees, the government is essentially subsidizing the cost of education, making it more affordable for people to pursue higher education. This, in turn, can lead to increased enrollment rates, improved academic outcomes, and a more educated workforce. Additionally, tuition tax credit can also help to reduce the financial burden on students, allowing them to focus on their studies rather than worrying about how to pay for their education. On the other hand, the impact of tuition tax credit on education expenses can also be limited by certain factors. For instance, the credit may only be available to taxpayers who meet certain income thresholds or who are pursuing specific types of education, such as undergraduate or graduate degrees. Furthermore, the credit may not be refundable, meaning that taxpayers who do not owe taxes may not be able to benefit from it. Overall, the impact of tuition tax credit on education expenses is complex and depends on various factors, including the specific design of the credit, the income level of the taxpayer, and the type of education being pursued.

Limitations and Restrictions on Tuition Tax Credit

While the tuition tax credit offers numerous benefits to students and families, there are also certain limitations and restrictions that apply. One of the primary limitations is the income limit, which varies by state and can range from $60,000 to over $180,000. This means that families with higher incomes may not be eligible for the credit or may have their credit amount reduced. Additionally, the credit is typically only available for students who are pursuing a degree or certificate at an eligible educational institution, which can exclude students who are taking non-credit courses or attending non-traditional schools. Furthermore, the credit is usually only available for tuition and fees, and does not cover other education-related expenses such as room and board, books, and supplies. Some states also have specific requirements, such as requiring students to be full-time or to have a minimum GPA, in order to be eligible for the credit. Finally, the credit is subject to phase-out limits, which means that the amount of the credit is reduced as the taxpayer's income increases. Overall, while the tuition tax credit can be a valuable resource for students and families, it is essential to carefully review the eligibility requirements and limitations to ensure that you are taking full advantage of this benefit.