How To Receive Interac E-transfer

Understanding Interac E-Transfer

What is Interac E-Transfer

Interac E-Transfer is a modernized way of transferring money from one account to another digitally rather than through traditional physical means. It involves email and mobile phone applications, making it an incredibly convenient money transfer option. The technology utilizes the infrastructure for online banking and is integrated into the systems of participating financial institutions. It has gained popularity due to its ease, speed, and security.

Why Using Interac E-Transfer

There are several benefits to utilizing Interac E-Transfers. First, it provides the convenience of sending and receiving money in a matter of minutes, thereby eliminating the need for time-consuming traditional bank transfers. Second, it offers a high level of security, with each transaction encrypted and requiring a security question to ensure the money goes to the right person. Lastly, the service is accessible across a wide range of financial institutions, making it a viable option for the majority of Canadians.

How Interac E-Transfer Works

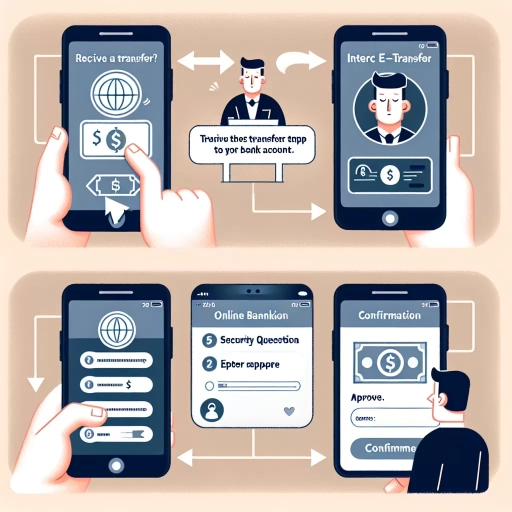

Interac E-Transfers occur within the secure environment of your online banking service. You start by logging into your account, then selecting the option to send an E-Transfer. You enter the recipient's email address or mobile number, the amount you want to send, and a security question. The recipient receives a notification regarding the transfer and will answer the security question to deposit the funds into their account. This seamless process makes Interac E-Transfer an efficient method of transferring funds.

Steps to Receive Interac E-Transfer

Notification of Transfer

When someone sends you money through Interac E-Transfer, you will receive a notification either via email or SMS. The notification will have a link that will guide you on how to deposit the money. It's important to note that the notification will not come directly from the sender - it will be from the Interac E-Transfer service itself.

Accessing the Funds

To access the funds sent to you, you will need to click on the link in the notification and select your bank from the list of participating financial institutions. Afterward, you'll be asked to answer the security question set by the sender. If you answer correctly, you will have access to the funds. Keep in mind that in some cases, the money may not be immediately available, depending on the policies of your bank.

Depositing the Money

Once you've gained access to your funds, you can choose to deposit them into any of your accounts. The good news is, almost all major banks in Canada support automatic deposits, so money transferred to you via Interac E-Transfer can go directly into your account without needing to answer a security question. However, this is a feature that must be set up in advance.

Key Takeaways for Successful Interac E-Transfer

Security Measures

Interac E-Transfers are generally safe, but it's essential to take extra precautions to protect your money. Make sure the security question is something only you and the sender know, as criminals have been known to intercept notifications if they can guess the answer. It's also critical not to share your banking information with anyone.

The Role of the Financial Institution

Your financial institution plays a critical role in facilitating a successful Interac E-Transfer. They are responsible for implementing the technology that powers the service, but they also provide security measures to ensure the safety of your money. They should be your point of contact if you have any issues with a transfer.

Be Wary of Scams

Scammers often exploit digital convenience. If you get an unexpected Interac E-Transfer message, be cautious. Genuine E-Transfer notifications always come from notify@payments.interac.ca, so check that first. Do not click any links in a suspicious email or text message. If you are uncertain, contact the sender to confirm, or reach out to your financial institution for verification.