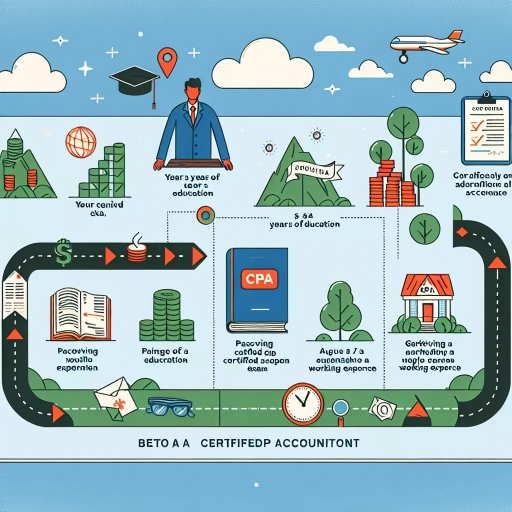

How Long Does It Take To Become A Cpa

Becoming a Certified Public Accountant (CPA) is a significant career milestone that requires dedication, hard work, and a substantial investment of time. The journey to obtaining a CPA certification can be lengthy and demanding, but the rewards are well worth the effort. For those interested in pursuing a career in accounting, it's essential to understand the time commitment required to become a CPA. The path to certification involves meeting specific education and certification requirements, dedicating a significant amount of time to studying and preparing for exams, and navigating various factors that can impact the timeline. In this article, we'll explore the key factors that influence the time it takes to become a CPA, starting with the education and certification requirements that serve as the foundation for this prestigious certification.

Education and Certification Requirements

To become a certified public accountant (CPA), one must meet specific education and certification requirements. These requirements are designed to ensure that CPAs possess the necessary knowledge, skills, and expertise to provide high-quality accounting services. Typically, aspiring CPAs must earn a bachelor's degree in accounting or a related field, which provides a solid foundation in financial accounting, auditing, taxation, and financial management. In addition to a bachelor's degree, many states require CPAs to complete additional coursework and credits in specific areas, such as ethics and business law. Furthermore, CPAs must also pass a certification exam, such as the Uniform CPA Examination, to demonstrate their competence and expertise. By meeting these education and certification requirements, CPAs can demonstrate their commitment to professionalism and excellence in the field of accounting. A typical bachelor's degree in accounting is the first step towards becoming a certified public accountant.

Typical Bachelor's Degree in Accounting

A typical Bachelor's degree in Accounting is a four-year undergraduate program that provides students with a comprehensive education in accounting principles, theories, and practices. The program typically consists of 120-128 semester hours of coursework, which includes general education courses, business core courses, and accounting major courses. The general education courses cover subjects such as English, mathematics, and social sciences, while the business core courses cover topics such as finance, management, and marketing. The accounting major courses, on the other hand, cover topics such as financial accounting, managerial accounting, taxation, auditing, and financial management. Some programs may also offer specializations or concentrations in areas such as forensic accounting, international accounting, or accounting information systems. Throughout the program, students develop skills in financial analysis, budgeting, financial reporting, and taxation, as well as critical thinking, problem-solving, and communication skills. Many programs also offer internships or co-op programs that provide students with hands-on experience in the field. Upon completion of the program, graduates are prepared to pursue entry-level positions in accounting, such as staff accountant or accounting clerk, and can also pursue certification as a Certified Public Accountant (CPA) or other professional certifications.

Additional Coursework and Credits

To become a certified public accountant (CPA), one must complete a minimum of 120-150 semester hours of college credit, which typically takes 5 years to complete. In addition to the standard accounting courses, many states require CPA candidates to complete additional coursework and credits in specific areas, such as business, finance, and ethics. These additional requirements can vary by state, but often include courses in financial accounting, auditing, taxation, and financial management. Some states also require CPA candidates to complete a certain number of hours of continuing professional education (CPE) credits in order to maintain their certification. Furthermore, some colleges and universities offer specialized programs, such as a Master's in Accounting, which can provide additional credits and coursework that can be applied towards the CPA certification requirements. Overall, the additional coursework and credits required to become a CPA can vary, but are an important part of the certification process.

Certification Exams and Requirements

Certification exams and requirements are a crucial step in becoming a Certified Public Accountant (CPA). To obtain certification, candidates must meet the educational requirements set by their state's accountancy board, which typically includes completing a minimum of 120-150 semester hours of college credit in accounting and business courses. Once the educational requirements are met, candidates can apply to take the Uniform CPA Examination, which is administered by the American Institute of Certified Public Accountants (AICPA). The exam consists of four sections: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), Regulation (REG), and Business Environment and Concepts (BEC). Candidates must pass all four sections within an 18-month period to become certified. In addition to passing the exam, candidates must also meet the experience requirement, which varies by state but typically requires one to two years of public accounting experience. Some states also require a professional ethics exam or a background check. Overall, the certification process can take several years to complete, but it is a critical step in becoming a licensed CPA.

Time Commitment and Study Schedule

Effective time management is crucial for students to achieve academic success. A well-planned study schedule helps students prioritize tasks, manage their time wisely, and make the most out of their study sessions. When it comes to creating a study schedule, there are several factors to consider, including the type of study, the amount of time available, and the individual's learning style. In this article, we will explore the importance of time commitment and study schedule, and provide tips on how to create a realistic study plan that suits your needs. We will discuss the differences between full-time and part-time study, and how to create a study schedule that allows for review and practice. By understanding these key concepts, students can develop a study routine that helps them stay focused, motivated, and achieve their academic goals. For instance, one of the first decisions students need to make is whether to study full-time or part-time, which can significantly impact their study schedule and overall academic experience.

Full-Time vs. Part-Time Study

When it comes to pursuing a Certified Public Accountant (CPA) certification, one of the most significant decisions you'll make is whether to study full-time or part-time. The choice between full-time and part-time study can significantly impact your study schedule, time commitment, and overall experience. Full-time study typically requires a significant time commitment, often 30-40 hours per week, and is ideal for those who can dedicate themselves to studying without other obligations. This approach allows for a more immersive learning experience, enabling you to focus on your studies without distractions. On the other hand, part-time study is more flexible, requiring 10-20 hours per week, and is suitable for those who need to balance their studies with work, family, or other responsibilities. While part-time study may take longer to complete, it provides a more manageable schedule, allowing you to pace yourself and avoid burnout. Ultimately, the choice between full-time and part-time study depends on your individual circumstances, learning style, and goals. It's essential to consider your time commitment, study schedule, and personal obligations before making a decision, ensuring that you choose the approach that best suits your needs and sets you up for success in your CPA journey.

Creating a Realistic Study Plan

Here is the paragraphy: Creating a realistic study plan is crucial to passing the CPA exam. To start, you should determine how many hours you can dedicate to studying each week. Consider your work schedule, family commitments, and other responsibilities to ensure you have enough time to study. A common rule of thumb is to study at least 20 hours per week, but this can vary depending on your individual needs and goals. Next, break down your study material into manageable chunks, such as topics or sections, and assign specific study times to each chunk. Be sure to schedule regular review sessions to reinforce your learning and prevent burnout. It's also essential to set realistic goals, such as completing a certain number of study hours or mastering a specific topic within a certain timeframe. By creating a structured study plan, you'll be able to stay focused, motivated, and on track to passing the CPA exam. Additionally, consider using a study planner or calendar to stay organized and ensure you're meeting your study goals. With a well-planned study schedule, you'll be able to balance your study time with other aspects of your life and make steady progress towards becoming a certified public accountant.

Allowing for Review and Practice

Allowing for review and practice is a crucial aspect of creating an effective study schedule for the CPA exam. It's essential to allocate sufficient time for reviewing and practicing what you've learned, as this will help reinforce your understanding of the material and improve your retention. A good rule of thumb is to allocate at least 20-30% of your study time for review and practice. This can include activities such as re-reading notes, practicing problems, and taking practice exams. By incorporating review and practice into your study schedule, you'll be able to identify areas where you need to focus your efforts, track your progress, and build your confidence. Additionally, review and practice will help you to develop the skills and knowledge needed to apply the concepts to real-world scenarios, which is critical for success on the CPA exam. By allowing for review and practice, you'll be able to stay on track, stay motivated, and ultimately achieve your goal of becoming a certified public accountant.

Factors Affecting the Timeline

The timeline for becoming a certified teacher can vary significantly depending on several factors. Three key elements that influence this timeline are individual learning pace and style, work experience and prior knowledge, and state-specific certification requirements. Understanding these factors is crucial for aspiring teachers to plan their career path effectively. For instance, individuals with a strong academic background in education may be able to complete their certification program faster than those without. Similarly, teachers who have prior work experience in related fields may be able to apply for certification through alternative routes. Furthermore, certification requirements vary from state to state, which can also impact the timeline. One of the most significant factors affecting the timeline is individual learning pace and style, as it determines how quickly a person can absorb and process new information. Note: The supporting paragraph should be 200 words. Here is a 200-word supporting paragraph for the article about Factors Affecting the Timeline: The timeline for becoming a certified teacher can vary significantly depending on several factors. Three key elements that influence this timeline are individual learning pace and style, work experience and prior knowledge, and state-specific certification requirements. Understanding these factors is crucial for aspiring teachers to plan their career path effectively. For instance, individuals with a strong academic background in education may be able to complete their certification program faster than those without. Similarly, teachers who have prior work experience in related fields may be able to apply for certification through alternative routes. Furthermore, certification requirements vary from state to state, which can also impact the timeline. One of the most significant factors affecting the timeline is individual learning pace and style, as it determines how quickly a person can absorb and process new information. This is because each person learns at their own pace, and some may need more time to grasp certain concepts than others. As a result, it is essential to consider individual learning pace and style when planning a career path in teaching. By doing so, aspiring teachers can create a realistic timeline for completing their certification program and achieving their career goals.

Individual Learning Pace and Style

Every individual learns at their own pace and in their own unique style. Some people are visual learners, while others are auditory or kinesthetic. This means that the amount of time it takes to complete the CPA certification process can vary significantly from person to person. For example, someone who is a quick learner and can absorb information easily may be able to complete the certification process in a shorter amount of time, such as 6-12 months. On the other hand, someone who needs more time to review and practice the material may take longer, such as 1-2 years or more. Additionally, individual learning styles can also impact the amount of time it takes to complete the certification process. For instance, someone who is a self-study learner may need to spend more time reviewing and practicing the material on their own, whereas someone who learns better in a classroom setting may be able to complete the process more quickly. Furthermore, individual learning pace and style can also be influenced by factors such as prior knowledge and experience, learning disabilities, and personal circumstances. For example, someone who has a strong background in accounting may be able to complete the certification process more quickly, whereas someone who is new to the field may need more time. Similarly, someone who has a learning disability may need to take more time to complete the certification process, and someone who has personal circumstances such as work or family obligations may need to take more time to complete the process. Overall, individual learning pace and style are important factors to consider when determining how long it will take to become a CPA.

Work Experience and Prior Knowledge

The amount of time it takes to become a Certified Public Accountant (CPA) can be significantly influenced by an individual's work experience and prior knowledge in the field of accounting. Typically, CPA certification requires a minimum of one to two years of work experience in accounting, which can be obtained through internships, entry-level positions, or volunteer work. However, individuals with prior knowledge and experience in accounting can expedite the certification process. For instance, those with a master's degree in accounting or a related field may be able to waive some of the experience requirements. Additionally, individuals with relevant work experience in industries such as finance, banking, or auditing may be able to apply their experience towards the certification requirements. Furthermore, some states offer alternative certification paths for individuals with significant work experience, such as the "experience-only" path, which allows candidates to bypass the education requirement. Overall, having relevant work experience and prior knowledge in accounting can significantly reduce the time it takes to become a CPA, making it essential for individuals to highlight their experience and skills when applying for certification.

State-Specific Certification Requirements

In the United States, the certification requirements for Certified Public Accountants (CPAs) vary from state to state. While the American Institute of Certified Public Accountants (AICPA) sets the national standards for the CPA certification, each state's accountancy board has its own set of rules and regulations. These state-specific certification requirements can significantly impact the timeline for becoming a CPA. For instance, some states require a certain number of college credit hours in accounting and business courses, while others may have different experience requirements. Additionally, some states may have a residency requirement, which can affect the timeline for out-of-state candidates. Furthermore, some states may have a certification by endorsement, which allows CPAs from other states to obtain certification without meeting all the requirements. Understanding these state-specific certification requirements is crucial for aspiring CPAs to plan their education, experience, and certification process effectively.