The Complete Guide of the Norwegian Krone

Follow Norwegian Krone Forecast March 20, 2024

Current Middle Market Exchange Rate

Prediction Not for Invesment, Informational Purposes Only

2024-03-19

Summary of Yesterday

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-18

Summary of Last Month

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-17

Summary of Last Week

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-16

Summary of Yesterday

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-15

Summary of Yesterday

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-14

Summary of Yesterday

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

2024-03-13

Summary of Yesterday

- Opening:

- Closing:

- Difference of Opening & Closing:

- Daily High:

- Daily Low:

- Difference of Daily High & Low:

Statistical Measures

- Mean:

- Standard Deviation:

Trend

Where to purchase Norwegian Krone?

Recent News

2024-03-12

Everything You Need to Know About Norwegian Krone

The **Norwegian Krone**, symbolized as **NOK**, is not just a form of currency but also a symbol of Norway's rich history and robust economy. Its evolution from the Scandinavian Monetary Union's era in the 19th century to the modern, electronically managed monetary system of today mirrors the progression of Norway's largely oil-dependent economy. This currency, which is subdivided into 100 øre, continually demonstrates its resilience in the face of fluctuating oil prices and global economic shifts. Furthermore, it plays a critical role in driving Norway's monetary policy decisions, influenced by the Norges Bank—the country's central bank. The Krone's distinct design, with images of historical figures and scenes capturing Norway's exquisite landscapes, embodies the country's cultural heritage and natural wealth. A discussion of the Norwegian Krone, therefore, is not complete without considering the impacts of economic variables such as inflation, interest rates, and trade balances. To grasp the breadth of this topic, one must blend financial acumen with a historical perspective. The Norwegian Krone is indeed more than a medium of exchange; it is a narrative communicating the evolving economic story of Norway.

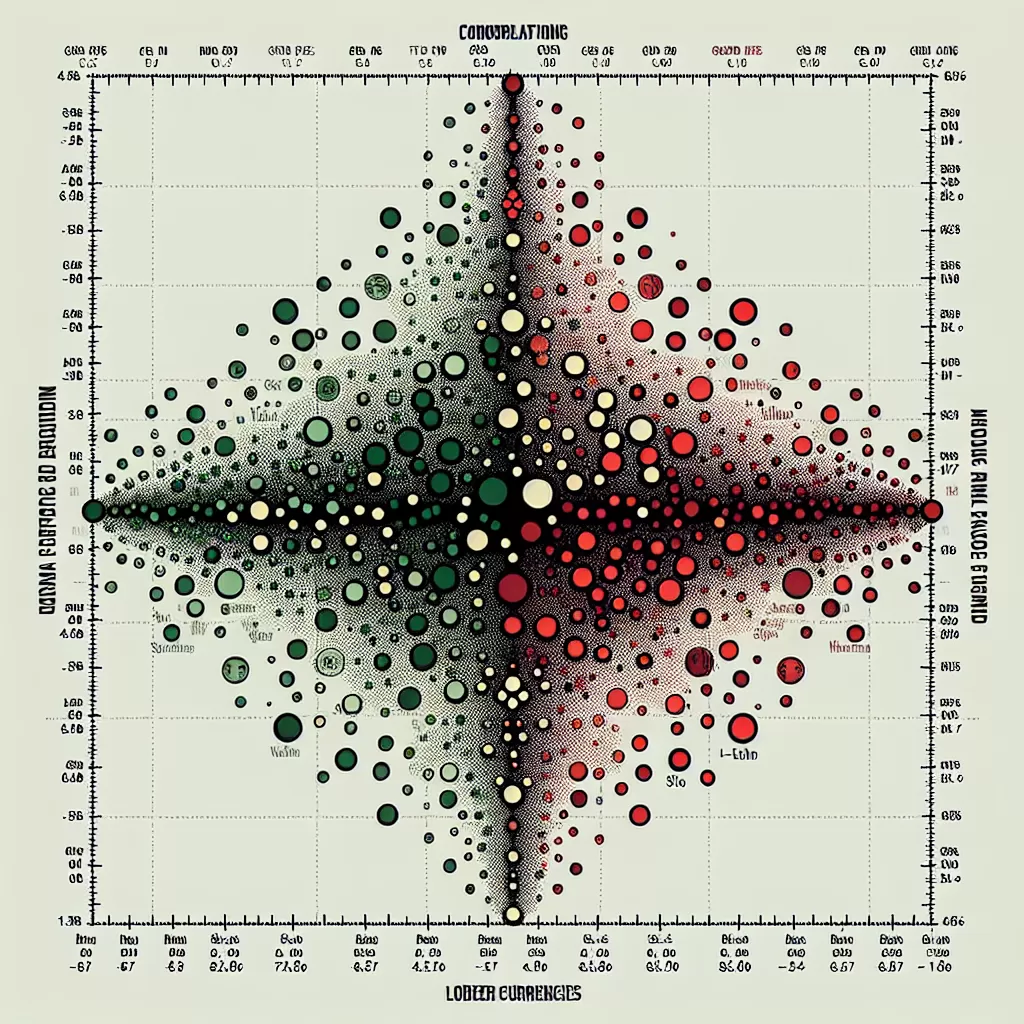

Correlation Coefficient of Norwegian Krone with Other Currencies

The Norwegian Krone, known for its geopolitical importance and its indicative stance in the Scandinavian economy model, holds a critical position in the global financial framework. This article will delve into the intriguing topic of the correlation coefficient of the Norwegian Krone with other international currencies. We'll explore the sophisticated, dynamic, and somewhat unpredictable realm of international finance, where currencies dance to the beat of global economic trends, geopolitical developments and market speculations. Here, the inherently elusive construct of correlation coefficients becomes a key tool: a statistical measure that gauges the strength and direction of a relationship between two variables, in this case, exchange rates. For the Norwegian Krone, its correlation with other currencies reveals intriguing links to trade patterns, monetary policies and economic stability, among other factors. These relationships have far-reaching implications - from national import/export businesses to tourists deciding if Norway will be their next holiday destination. So, fasten your seatbelt as we delve deep into the world of foreign exchange, examining how the Norwegian Krone moves in synchrony (or not) with its global counterparts. In turn, this study offers a window into the broader narrative of global finance and macroeconomic conditions, cementing the Norwegian Krone as more than just a national currency – but a significant player on the world stage.

Understanding the Correlation Coefficient: A Brief Introduction

The Norwegian Krone is the official currency of Norway, and its evolution, design, and economic impact are great exemplifications of the intriguing interaction between currency, economics, and history. Since its introduction in 1875, replacing the Norwegian speciedaler, the Krone has been a pivotal economic tool in Norway's emergence as a global player. The Krone's design has evolved over time, presenting a blend of Norway's rich history, culture, and illustrious personalities. Notably, these designs have showcased renowned Norwegians such as Kirsten Flagstad and Sigrid Undset, amplifying the nation's cultural identity. Furthermore, the Krone is not just physical notes and coins but also includes electronic Krone, highlighting Norway's alignment with global trends towards digital currencies. Econimically speaking, the Krone is vitally influential in shaping Norway's economy. Its value fluctuation relative to other currencies has repercussions on Norway's foreign trade, investment, tourism, and even domestic economic stability. Norway's central bank, Norges Bank, employs monetary policy tools such as interest rate manipulation to stabilize and control the Krone's value. When the Krone weakens against other currencies, Norwegian exports become more competitive, supporting local companies. However, a weak Krone also means that import costs rise, which can induce inflation and curb purchasing power. Speaking of inflation, it is an economic phenomenon reflecting the general rise in prices over time, which usually erodes the value of money, including the Krone. But a moderate level of inflation is sometimes seen as a sign of a dynamic economy, prompting Norway's central bank to adopt an inflation target of 2%. This serves an important function in guiding monetary policy targets, influencing interest rates, and ultimately, the overall performance of the Norwegian Krone. To comprehend the journey of the Norwegian Krone is to venture into a fascinating intersection between currency, economics, and history ‐ revealing that currency is not just a medium of exchange but also a vibrant reflection of a nation's story.

Examining the Relationship between Norwegian Krone and Euro

The Norwegian Krone (**NOK**), the official currency of Norway, has established a complex yet significant relationship with the Euro (**EUR**), which is the primary currency for European Union members. The **exchange rate between NOK and EUR** is of crucial importance to the Norwegian economy given Norway's substantial trading links with the Eurozone. Variation in the exchange rate can have a profound impact on numerous economic constituents, such as **export competitiveness**, **inflation**, and **foreign investments**. A strong Krone (low NOK/EUR exchange rate) makes Norwegian exports more expensive in the Eurozone, possibly reducing the volume of Norwegian goods and services purchased by European consumers. Conversely, a weak Krone (high NOK/EUR exchange rate) makes Norwegian imports from the Eurozone more expensive, which can drive up the cost of living in Norway and contribute to inflationary pressures. The **Norges Bank**, which is the central bank of Norway, implements monetary policies that can affect the NOK/EUR exchange rate. On one hand, the Norges Bank may try to keep the Krone weak if the Norwegian economy is highly reliant on exports. However, they must carefully manage this strategy to avoid stoking inflation. In addition, Norway's economy and hence the value of its currency, is significantly influenced by **oil prices**. This link is due to the country's substantial oil reserves and its status as a leading oil exporter. A surge in oil prices often translates to a stronger Krone as demand for NOK increases in the global currency market. Thus, Norway's currency is considered a petro-currency. Furthermore, European Central Bank's (**ECB**) monetary policy also plays a significant role in the NOK/EUR exchange rate. When the ECB lowers interest rates or introduces a quantitative easing program, investment flows could divert from the Euro to other currencies like the Norwegian Krone, strengthening the latter. In conclusion, the relationship between the Norwegian Krone and the Euro is affected by a wide range of factors – from monetary policy decisions in Norway and the Eurozone, to global oil prices. Hence, forecasting the NOK/EUR exchange rate can be challenging but crucial, as shifts in this rate can have substantial implications for Norwegian economic health and progress.

Impact of the US Dollar on the Value of Norwegian Krone

The impact of the US dollar on the value of the Norwegian Krone (_NOK_) is an influential factor heavily entrenched in the dynamics of global economics and correlations within the foreign exchange (_FORX_) markets. Geography and abundant natural resources make Norway one of the world's significant exporters of a range of commodities. Its heavy reliance on the oil and gas sector links the _NOK_'s value directly with international crude oil prices. As oil is primarily priced in US dollars globally, it unavoidably ties the Norwegian economy and by extension its currency, the _NOK_, to the movements of the US dollar. The US dollar to _NOK_ exchange rate expresses the equivalent value of both currencies against each other, reflecting economic conditions in both countries. The US economy's relative strength or weakness, underpinned by factors like interest rates, inflation, and political stability, can influence the _NOK_. When the US dollar is strong, it implies that the US economy is doing well, and more investors are willing to store their currency in dollars, increasing the demand for the dollar. This increment in demand can ultimately depreciate the _NOK_, creating a surge in the USD/NOK exchange rate. On the other hand, when the US economy is weak and the dollar depreciates, it can result in the appreciation of the _NOK_, leading to a drop in the USD/NOK rate. Such a scenario often prompts investors to seek alternative currencies or commodities, like oil, as a store of value. Consequently, with increased investment in Norwegian commodities due to their significant oil exports, the _NOK_ can gain against the dollar. Furthermore, decisions by central banks, especially the Federal Reserve (_Fed_ in the US) and Norges Bank in Norway, regarding monetary policy significantly impact the USD/NOK rate. When the _Fed_ raises interest rates, it often leads to an appreciation of the dollar as foreign investors may move their funds to the US to get higher returns, leading to a depreciation of the _NOK_. Conversely, rate increases by Norges Bank could strengthen the _NOK_ relative to the US dollar. While the _NOK_ carries strong links to oil prices and the US dollar, elements of domestic economic policy and stability, geopolitical factors, and global economic trends, all collectively influence its strength and stability. It's also worth mentioning that advancements in technology and digitization are revolutionizing global finance, thus potentially impacting the conventional dynamics of currency exchange in the future. By laying out these points in a more-in-depth fashion, one can deliver a comprehensive analysis of how the US dollar's movements influence the Norwegian Krone.

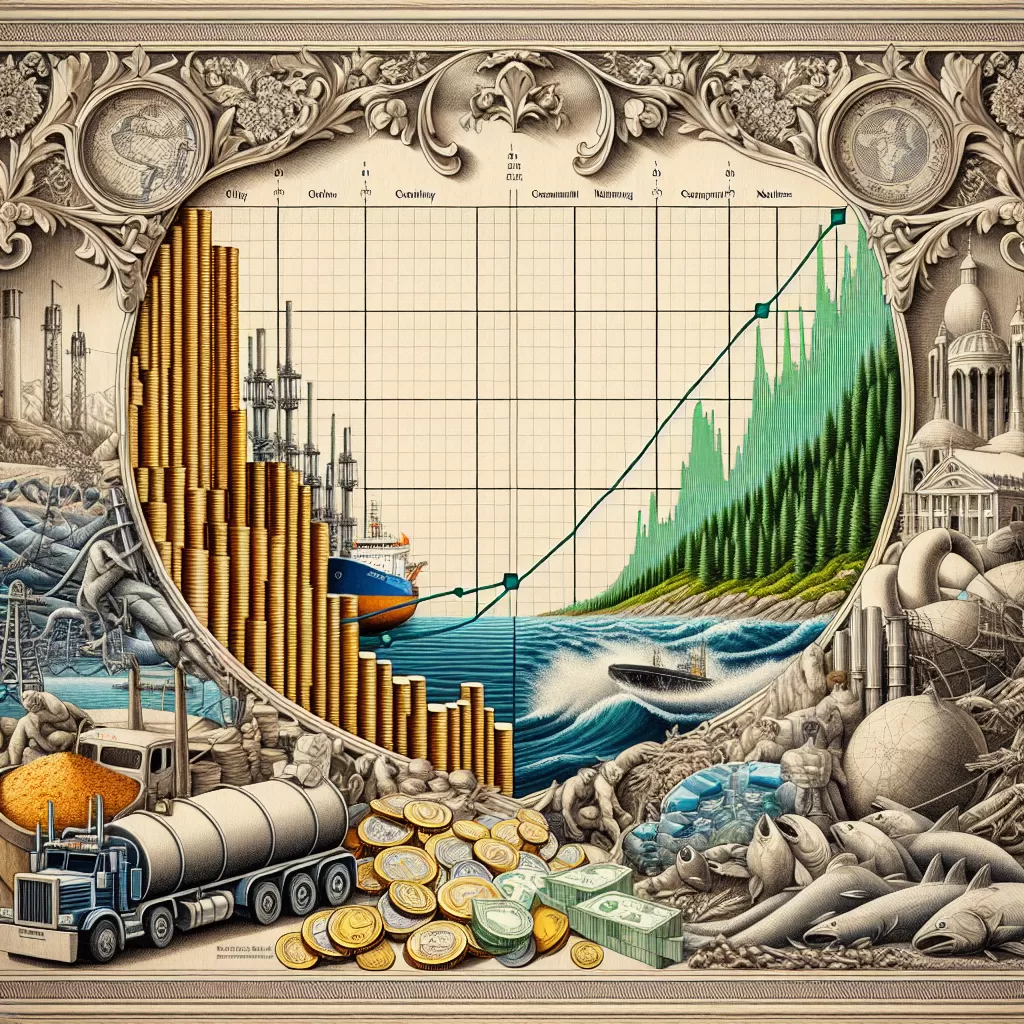

Exploring the Correlation Coefficient between Norwegian Krone and Nature Resources

The Norwegian Krone (NOK), the official currency of Norway, has a complex and intriguing historical relationship with the nation's numerous natural resources. Embodying a multidimensional dynamic, the strength and value of the Krone have seen fluctuations directly proportional to changes in Norway's resource management strategies and global market demands. This paper aims to delve into the intricate correlations between the Norwegian Krone and Norway's vast natural resources. We will explore various financial trends, economic downturns and booms, all finely interlaced with the procession of Norway's rich natural assets, including but not limited to oil, gas, minerals and fish stocks. In particular emphasis will be placed on the era of oil discovery in the late 1960s which significantly revolutionized Norway's economy, and consequently, the value of its Krone. The analysis will provide a profound glimpse into Norway's unique attribute of having its currency so robustly anchored in its natural resources. It is expected that this exploration will not only provide valuable insights into any unique dependencies and impacts but will also illuminate the potential future trajectories for the Krone in light of ongoing resource extraction trends and future resource potential.

The Impact of Natural Resources on the Value of Norwegian Krone

Norway's remarkable economy is largely fueled by its copious natural resources, particularly oil and gas, and these play a significant role in the value of the Norwegian Krone (NOK). The name "krone" translates to "crown" in English, symbolizing its place as the country's royal currency since being introduced in 1875. It's crucial to understand that Norway is one of the world's largest exporters of petroleum products. This means that the international oil prices directly affect the NOK's exchange rates. When oil prices are high, the revenues from oil exports increase, making the NOK stronger. The income from oil exports is an integral part of Norway's economy representing over 20% of GDP, hence, a robust oil market significantly bolsters the nation's economic health as well as the Krone's value. Environmental policies and trends can also indirectly affect the NOK as they influence oil demand. For example, a global shift towards green energy may decrease the demand for petroleum products and thereby could potentially weaken the Krone. Furthermore, Norway's government has a prudential approach in managing the wealth generated from these natural resources. The Government Pension Fund Global, the world's largest sovereign wealth fund, was primarily funded by oil revenues. It serves as a financial safety net for the Norwegian people, ensuring the wealth from natural resources benefits not just current, but also future generations. By investing in multiple international portfolios, it seeks to diversify the risk associated with economic downturns in the oil and gas sector. The Norwegian Central Bank, Norges Bank, plays a proactive role in ensuring the value of the Krones via its monetary policies. When inflation is too high or the economy is overheating due to high oil prices, the central bank may increase interest rates to stabilize the economy. Conversely, rate cuts may be deployed when the economy needs a boost. In summary, the abundance of natural resources, especially oil and gas, have a significant impact on the value of the Norwegian Krone. Economic policies of the Norwegian Government and the central bank's monetary policy decisions in response to the global oil market also play crucial roles in maintaining the health of Norway's economy and, by extension, the value of their currency. It's a complex system involving international energy markets, environmental trends, and savvy economic policies that all converge to influence the value of the Norwegian Krone.

Understanding the Role of Norway's Nature Resources in Shaping its Currency

Norway's abundant natural resources have played a significant role in shaping its currency, the **Norwegian Krone** (NOK). The prosperous economy of Norway is highly indebted to the vast reserves of oil, gas, fisheries, and other natural resources. When oil was discovered in the North Sea in the 1960s, it led to a significant shift in Norway's economic landscape, having a profound cascading effect on the value of the Norwegian Krone. The foundation of the **Government Pension Fund Global** (also informally referred to as the "Oil Fund") in 1990 solidified the intimate relationship between oil revenue and NOK, where surplus wealth produced by Norwegian petroleum income is deposited. This fund aids Norway's government in counteracting the effects of oil price fluctuations on the Krone, ensuring economic stability despite volatilities in the international oil market. Moreover, Norway's robust control over its natural resources and prudent fiscal policies facilitates a well-managed currency environment. The Norges Bank, or **The Central Bank of Norway**, is instrumental in shaping the monetary policy that affects the Krone’s value. Armed with revenues from natural resources, the bank has very effectively used interest rate policies and foreign exchange rate policies to balance inflation, stabilize the currency and stimulate economic growth. However, Norway's heavy reliance on natural resources also comes with risks. The value of the Krone can be susceptible to fluctuations in international commodity markets. High demand and increased prices for oil often result in the appreciation of the Norwegian Krone. Conversely, a decline in oil prices can lead to a devaluation. This inherent volatility, termed the **'Petroleum Effect'**, has a direct bearing on the Krone. In conclusion, the ties between Norwegian natural resources, particularly oil, and its currency, the Norwegian Krone, are deeply intertwined. The resilience and prosperity of the Norwegian economy primarily mirror the judicious management of these vital resources and the prudent fiscal and monetary policies enacted by the Norwegian government.

Exploring the Dependency of Norwegian Krone on Nature Resource Production

As we delve into analyzing the **Norwegian Krone's dependency on natural resource production**, it is critical to recognize that Norway's economic pedestal has been significantly built upon its abundant natural resources. Norway, as a substantial exporter of fossil fuels, hinges its currency value to a great extent on global energy prices. For instance, the **Norwegian Krone** often NOK strengthens when oil and gas prices escalate and weakens when they descend. The oil industry, in particular, has become a financial lifeline for Norway, accounting for nearly half of the country's exports and a fifth of its Gross Domestic Product (GDP). Thus, the correlation between the Krone and oil prices tends to be positive. Moreover, the Norwegian Krone's reliance on natural resources does not end with fossil fuels. Other exponentially growing industries like Hydroelectricity and Fisheries have indirectly affected the value of the Krone. Norway possesses a copious supply of fast-flowing rivers and high mountains that make it ideal for hydroelectric power production, which represents **96% of the country's electrical production**. Fisheries have also existed as a pillar of Norway's economy, contributing to about 1-2% of its GDP. This intense dependency of the Norwegian Krone on natural resource production shouldn't be underestimated as it imposes both opportunities and threats. On one hand, the increase in exports and a rise in global prices of these commodities could escalate the value of the Krone, thereby promoting economic prosperity. On the other hand, the **Norwegian Krone** can be extremely volatile due to fluctuating commodity prices, hence exposing the economy to a degree of risk. Economic diversification is one strategy that could alleviate such vulnerability. By promoting growth in other sectors such as IT and technology, Norway could dilute its dependency on volatile industries. Not only would this provide a greater stability to Norwegian Krone, but it could also offer a robust platform for sustainable economic growth in the future. In essence, the **Norwegian Krone** stands as a prime example of how a currency can be directly linked with the country's natural resource production. With the magnificent and unpredictable nature of these resources, it adds another layer of complexity to the economic and monetary scenario of countries like Norway. Nonetheless, the reinforcement of diversification policies could perhaps churn out a steadfast path for the Norwegian Krone's journey ahead.

The Global Impact of the Norwegian Krone

The Norwegian Krone (NOK), the official currency of Norway, has an intriguing story that unfolds through its evolution, design, and economic impact experienced worldwide. Introduced in 1875, it became a part of a monetary union with Sweden and Denmark till 1914, reflecting resilience and adaptability through historical periods. It's not just a tool for exchange, but an embodiment of Norwegian identity, with notes featuring themes from the country's maritime history and glimpses of its iconic landscapes. The Krone's value often depends on the state of the oil industry, given Norway's prominent global role as an oil exporter. Unpredictable oil prices have led to variations in the Krone's value, having ripples across global markets. Despite the volatility, Norway’s conservative fiscal policies have fostered relative economic stability. Understanding the Krone is therefore a journey through Norway's history, economic strategy, and context within the global economy. This elegantly intertwines the nuances of currency, economics, and history while illuminating the significant global impact of the Norwegian Krone. As we delve deeper, this narrative will shed light on how a single currency can epitomize a nation's identity and influence global economic relations.

The Role of the Norwegian Krone in International Trade

The **Norwegian Krone** (NOK), Norway’s official currency since 1875, plays a pivotal role in international trade, particularly due to the country’s vast natural resources, such as oil and gas. As a commodity currency, the Krone's value is intrinsically intertwined with the global demand and pricing for these commodities. Norway, having one of the largest petroleum industries, sees its Krone often fluctuating with oil price swings on the global market. Notably, the 2014 oil crisis caused a significant drop in the Krone's value, vividly demonstrating this correlation. Moreover, NOK's impact extends to the realm of **forex trading**, where it's traded as a pair with other major currencies. With Norway's robust economy, low unemployment rates, and housing growth—the Krone exhibits strong fundamentals attracting investors who speculate on currency value movements. The governance of the Krone lies in the hands of **Norges Bank**, Norway’s central bank responsible for implementing monetary policies, including interest rate setting, which influences the currency's global standing. Throughout its history, the bank has made nimble adjustments to navigate tumultuous economic periods, such as the shift from the gold standard to a floating exchange rate system in 1875, the introduction of Mitchell, Phelan, and Co. banknotes in 1877, and the transition to an inflation-targeting regime in 2001. These actions aimed to stabilize the Krone’s value, hence mitigating the risk of currency volatility to Norway's economy. Furthermore, the Krone's design encapsulates Norway's rich history and cultural heritage, from depictions of historically significant Norwegians to motifs inspired by the country's dramatic landscapes and architecture. The 2017 redesign even saw the introduction of a pixelated motif, reflecting Norway's technological advancement. In conclusion, the Norwegian Krone is not just a medium of exchange but also a reflection of the country's economic health, rich history, and cultural vibrancy. It serves as a strategic player in international trade, subject to fluctuations driven by global demand for key commodities and the overall state of the world economy.

Monetary Policy and the Stability of the Norwegian Krone

The Norwegian Krone (NOK), the national currency of Norway, holds a significant role in both the local and international economic landscape. Introduced back in 1875, it emerged as part of the Scandinavian Monetary Union, alongside the Danish krone and the Swedish krona, creating a unified economic environment until World War I. As a pillar of Norway's modern economic system, the NOK gets its stability from an effective monetary policy implemented by **Norges Bank**, the country's central bank. The monetary policy in Norway aims for stability in the nation's currency, the NOK. Here, stability refers to stable inflation, low and stable inflation expectations, and stable developments in output and employment. *Inflation targeting regime* forms the cornerstone of this policy. Ever since its introduction in 2001, it has played a significant role in ensuring price stability, a reliable foundation for economic growth, and maintaining an expected inflation rate of approximately 2%. Foreign exchange rate policy is a critical component of monetary policy and the stability of the Krone. Instead of having a fixed exchange rate that references a strong currency like the Euro or USD, Norway prefers a *floating exchange rate*. The advantage of this system is that it allows the currency to adjust to changes in economic fundamentals, thereby facilitating economic adjustments to shocks. Another element pivotal to the stability of the NOK is the oil sector. Norway is one of the world's leading petroleum exporters, and hence, changes in global oil prices greatly influence the Krone exchange rate. For instance, a spike in oil prices often strengthens the Krone, thanks to the country's net exporter status. Predictably, an inverse scenario leads to its devaluation. Subsequently, **fiscal policy** also plays a significant role in stabilizing the Norwegian Krone. The government, using the measure of the Government Pension Fund Global (often known as the Oil Fund), distributes the petroleum income to reduce the impact of oil price fluctuations on the Norwegian Krone evolution. In conclusion, the stability of the Norwegian Krone reflects the economic principles deeply entrenched in Norway's history, as well as shrewd policies and prudent banking practices. It is managed by a well-regulated and effective combination of monetary and fiscal policies. The Krone’s stability also has a significant bearing on the broader economic health of the country, affecting purchasing power, trade, and international relationships.

The Influence of the Norwegian Krone on Global Financial Markets

The **Norwegian Krone**, or **NOK**, serves as Norway's primary currency and plays an integral role in global financial markets. Introduced to Norway in 1873 after the Scandinavian Monetary Union was formed, it replaced the previous currency, the "speciedaler." The Agricultural Bank of Sweden developed the Union with the cooperation of Denmark and Norway, setting the stage for the creation of the Krone. Its value is primarily driven by **Norway's economic performance**, particularly its prominent role in the oil and gas sector. Norway is one of the world's largest exporters of petroleum, and as such, fluctuations in global oil prices significantly impact the value of the Krone. For example, when oil prices rise, the value of the Krone often strengthens in conjunction; when oil prices fall, the Krone generally weakens. The link between oil prices and the NOK's value has prompted the moniker "petrocurrency" to be befitted to the Krone. Another stem of influence is **monetary policy**, set forth by Norway’s central bank, *Norges Bank*. The bank uses policy tools such as interest rates to control inflation and stabilize the Krone’s value. By changing interest rates, Norges Bank can influence the Krone's attractiveness to foreign investors, which ultimately impacts its exchange rate. Thus, surveillance of Norway’s monetary policy is crucial for those planning to trade NOK or invest in the Norwegian economy. Nevertheless, **inflation** is a key concern when considering the health and value of the NOK. Over time, inflation can erode the purchasing power of money, reducing its value. The Norges Bank's goal is to manage inflation in Norway in a way that promotes economic stability and growth. Keeping inflation low and stable is considered integral to maintaining the Norwegian Krone's strength and stability. Being a non-Eurozone member, Norway's control over its monetary policy and its currency value offers a unique model of economic resilience. Not fixed against any basket of currencies, the Krone fluctuates freely against other currencies. This characteristic allows the NOK to act as a barometer of global risk sentiment, swinging with changes in investor confidence. In conclusion, the **Norwegian Krone's influence** extends far beyond the Nordic region, shaping global financial markets due to its association with oil prices, its monetary policy, and its pivotal role in a globally prominent export sector. Possessing understanding about these dynamics is critical for those intending to navigate the landscape of global finance and the Norwegian economy in particular.

Economic Development Influenced by the Norwegian Krone

Norway, internationally acclaimed for its economic stability and prosperity, owes a significant share of its financial success to the strength and strategic management of its official currency; the Norwegian Krone (NOK). As an expert in currency, economics, and history, it's fascinating to explore how the NOK has been steered over the years to preserve its value and to support the broader vision of Norway's economic development. Introduced in 1875, the Krone has weathered world and regional financial crises, inflation, and shifts in the global oil market. Its resilience is largely attributed to Norway's robust policy framework, where transparency, inflation targeting, and fiscal responsibility play pivotal roles. This paragraph will delve into understanding the evolution, design, and economic impact of the Norwegian Krone within both the domestic and international contexts. We'll discuss how the Krone has influenced and been influenced by economic policy, inflation, and Norway's reliance on its oil sector. As we proceed, you'll gain insight into how Norway's monetary policy decisions concerning the Krone have helped maintain Norway's enviable position in global economic rankings, such as high gross domestic product (GDP) per capita and low unemployment rate. Furthermore, we'll explore how the Krone's stability has fostered healthy investment climates, boosting both domestic infrastructure development and foreign direct investment. This exploration of the Norwegian Krone serves as a solid case study of astute currency and economic management.

Impact of Norwegian Krone on Norway's Trade

The Norwegian Krone (NOK) has significantly influenced the trading landscape in Norway since its introduction in 1875, under the Scandinavian Monetary Union. As Norway's principal currency, it plays a central role in determining the price of goods and services, and consequently, influences trade levels both domestically and internationally. With Norway being a rich resource country, a considerable part of its economy revolves around the export of natural resources such as oil, gas, and seafood. So, the value of the Krone has a direct impact on the price of these goods in the global market. When the Krone strengthens against other currencies, exports from Norway become more expensive, which can potentially lessen demand. Conversely, a weaker Krone makes exports cheaper and more appealing to foreign markets, boosting trade. The monetary policy carried out by Norges Bank, Norway's central bank, which controls the inflation rate through the adjustment of interest rates, has substantial effects on the value of the Krone. A higher interest rate can attract foreign investments, thereby increasing the value of the Krone. However, the benefits reaped from a strong Krone are multi-faceted, contributing to the nation's overall economic health. It curtails inflation by reducing the cost of imported goods and services, which comprise a significant proportion of Norwegian household consumption. A strong Krone also lowers the external debt burden, as it reduces the cost of servicing foreign-denominated loans. Yet, the volatile nature of the Norwegian Krone, primarily due to its sensitivity towards changes in oil prices, poses significant challenges. Norway's economic reliance on oil exports links the value of the Krone to fluctuations in global oil prices. A sudden drop in oil prices can lead to a weaker Krone, potentially stirring inflation and reducing purchasing power. In conclusion, the impact of the Norwegian Krone on Norway's trade is profound and multifaceted. Its value influences the competitiveness of Norwegian goods in the international market, the inflation rate, consumer purchasing power, and the nation's external debt burden. Hence, careful monitoring and management of the Krone is crucial for maintaining economic stability and fostering healthy trade relations.

Correlation between the Norwegian Krone and the Oil Industry

The Norwegian Krone, Norway's official currency since 1875, plays a significant role in forming a clear picture of Norway's economic landscape. Its peculiar correlation with the global oil industry is intriguing, to say the least. The **Norwegian economy is heavily reliant on the oil industry**, thus drawing a direct line of impact on the strength or weakness of the Krone. Technically speaking, Norway is the largest oil producer and exporter in Western Europe. As such, its economy (consequently the Krone) is largely impacted by changes in global oil prices. When oil prices **escalate**, revenues from Norway's oil exports **increase**, thus stimulating economic growth. The increased demand for the Krone triggered by these oil exports inflates the Krone's value on the currency exchange markets. Conversely, during periods of low oil prices, oil revenues decrease, often leading to a recession in the economy. As a result, the demand for the Krone declines, and its value falls in relation to other currencies. The **Norwegian government** has put in place policies to ensure long-term wealth stability by establishing the Government Pension Fund Global (GPFG). The GPFG invests surplus revenue derived from the oil industry, which in turn reduces the economy's exposure to volatile oil prices. This strategy effectively cushions Norway from the extreme swings in oil prices, maintaining a moderate effect on the Norwegian Krone and the country's economic stability. Overall, Norway's economic health is, to a significant extent, dependent on the performance of the oil industry. To fully appreciate the nuanced relationship between the Norwegian Krone and the oil industry, one must delve into macroeconomic fundamentals, national financial policies, and global economic trends. This underscores the pressing need for stakeholders and investors to be well-versed in understanding how shifts in oil prices can convey implications on the Krone's performance. By doing so, they can strategically maneuver and ideally capitalize on these shifts, whether they manifest as risks or opportunities. In summary, the Norwegian Krone's correlation with the oil industry is a cornerstone knowledge point in the realm of currency economics. This relationship not only paves the way for insightful economic analysis, but it also contributes to a more comprehensive understanding of the intricacies that come with national currencies in oil-dependent economies, inscribed dialetically in the narrative of global economic affairs.

Effects of Currency Exchange Rates on the Norwegian Krone's Value

The **Norwegian Krone** (NOK), as a floating exchange rate currency, naturally undergoes shifts in value, either appreciating or depreciating based on factors governing the currency exchange market. Drawing from economics, **supply and demand**, foreign exchange reserves, and economic stability are predominant determinants of these fluctuations. Given Norway's relatively small but highly influential economy, trade plays a significant role. When Norway exports more goods and services - particularly its renowned oil and gas products, there's an increased demand for NOK resulting in strong performance against other currencies. Conversely, when imports outstrip exports, the currency may depreciate due to a surplus of NOK in the market. **Inflation** also substantially influences the value of the Norwegian Krone. In a scenario where Norway's inflation rate is lower than that of its trading partners, the Krone is likely to appreciate due to perceived increased purchasing power. Consequently, the central bank often adjusts monetary policy to stabilize inflation, preventing drastic shifts in the value of the Krone. The *Norges Bank*, Norway’s central bank, implements changes in interest rates to achieve this balance. When interest rates are high, currency value tends to increase because it attracts foreign capital seeking higher returns. In tandem with the economic state, investors' sentiment significantly affects currency values. By showing a robust, reliable banking system, coupled with low national debt and a consistent GDP growth, Norway assures investors of its financial resilience. Thus, a positive view of Norway's financial future can result in an increase in the Krone's value. Just as importantly is the role of Norway's substantial **foreign exchange reserves**, largely composed of the world's largest sovereign wealth fund, the _Government Pension Fund Global_. This fund's considerable size and investment diversification provide a stabilizing influence on the Krone. In sum, the Norwegian Krone's value is inherently tied to a matrix of economic and societal elements. Understanding these can help predict future trends and mitigate potential risks inherent in currency exchange.

Understanding the Impact of Inflation on the Norwegian Krone

The **Norwegian Krone** is the official currency of Norway, a wealthy Scandinavian nation with a robust, mixed economy. It's important to understand the impact of **inflation** on this currency, as it is a key economic indicator that can significantly influence the country's monetary policy and overall fiscal health. Inflation, a measure of the rate at which the overall cost of goods and services is increasing, can render a broad impact on the Krone. A high inflation rate can diminish the value of the Krone, potentially leading to higher interest rates and dampening economic growth. Conversely, low or moderate inflation can contribute to the overall stability of the Norwegian economy and enhance the purchasing power of the Krone. Therefore, the repercussions of inflation on the Norwegian Krone are paramount, both for domestic economic considerations and for its standing in international finance. Unpacking the dynamics of inflation and their implications for the Krone can better equip us in understanding Norway's economic landscape, and the various factors that can sway the strength and stability of its currency, henceforth serves as a mirror reflecting the nation's prosperity and development.

How Inflation Rates Affect the Value of Norwegian Krone

The Norwegian Krone, represented by the code NOK, is the official currency of Norway and its dependent territories. The currency has a colorful history and a profound impact on the economy, which is determined by the interplay of **inflation rates**, market dynamics, and **monetary policy**. Inflation plays a cardinal role in shaping the value of the NOK. As the **general level of prices escalates**, the purchasing power of the Krone decays, implying that a higher number of Kroner would be required to purchase the same amount of goods or services as before. Each year, Norway's central bank (Norges Bank) sets an **inflation target** to ensure price stability and sustain economic growth. When inflation veers off this target, the central bank amends its monetary policy to adjust inflation to the desired rate, typically approximately 2%. Adjustments include meddling with the **policy interest rate**, which inevitably influences the exchange rate of the NOK. When Norges Bank increases the policy rate, it makes the NOK more attractive to foreign investors, as they can benefit from higher interest earnings. As a result, an influx of foreign investors racing to acquire NOK can appreciate its value against other currencies. On the flip side, lowering the policy rate has the opposite effect and depreciates the NOK's value. The correlation between inflation and exchange rates can be traced back historically to when Norway shifted from a gold standard to a fiat monetary system during the **Second World War**. Since then, inflation has been a significant driver in determining the value of the NOK, which has led to several economic fluctuations. The late 1980s and early 1990s saw a notable time of economic instability when Norway experienced a banking crisis which led to high inflation rates and a significant devaluation of the Krone. But, the vast **natural resources** of the country, particularly its oil and gas reserves, have time and again acted as a cushion against complete economic collapse. It's crucial to note that inflation is not inherently detrimental, because, in controlled amounts, it can stimulate consumption and investment, fostering economic growth. However, unchecked or hyperinflation can lead to economic volatility and the devaluation of the currency. Therefore, managing and monitoring inflation rates is crucial to maintaining the value of the Norwegian Krone and the overall health of the Norwegian economy. In conclusion, the value of the Norwegian Krone is intricately linked with inflation rates. While the Norges Bank employs various monetary policy tools to manage these rates, other factors such as economic crises, natural resources, and market dynamics strongly influence the currency's stability. As such, understanding these complexities is fundamental to predicting the trajectory of the NOK's value in the global marketplace.

Historical Inflation Trends and the Norwegian Krone

The **Norwegian Krone** is a vital part of the Scandinavian nation's economic framework and has seen several fluctuations relative to inflation trends that are worth discussing. Historically, Norway follows a managed float monetary policy, allowing the Krone's value to adjust according to market conditions and effectively cope with inflationary pressures. The 20th century saw significant monetary shifts, such as the move to the gold standard in 1874 and the abandonment of metal backed currencies post World War I, resulting in a free-floating Norwegian Krone. During these transitions, the Norwegian government aimed to maintain price stability while avoiding destabilizing cycles of inflation and deflation. However, like most economies, Norway wasn’t spared from inflationary trends, most notably in the 1980s during the global oil crisis which influenced a surge in the consumer price index, depreciating the Krone's value. The Norwegian central bank, _Norges Bank_, handles inflation by using interest rates as a tool to stabilize the economy. In times of high inflation, the bank increases interest rates, making loans more expensive, slowing down economic activity and consequently curtailing inflation. Likewise, in times of low inflation, interest rates are reduced to stimulate economic activity. A key landmark for Norway's inflation management was the introduction of the inflation-targeting regime in 2001, where Norges Bank explicitly aimed for inflation of approximately 2% over time, increasing predictability in the economy. Recently, the impact of global events has also affected the Krone's value. The 2008 financial crisis and 2020's COVID-19 pandemic presented the challenges of low inflation and economic downturn. In response, Norges Bank applied expansionary monetary policies, significantly decreasing interest rates to stimulate spending and investment and counteract deflationary trends. Therefore, even in the face of adversity, Norway's active management of the Krone's value through monetary policy has ensured a notable degree of economic stability. In conclusion, the Norwegian Krone's historical flux is deeply rooted in the world economic landscape, demonstrating Norway's adaptability to domestic and global inflationary trends. As such, the Krone and its management via monetary policy represent not only an intriguing study of a currency's evolution in response to inflation, but also an embodiment of Norway's robust and change-resilient economy.

Future Predictions: Inflation Impact on the Norwegian Krone

The Norwegian Krone has had a varied past, bearing witness to various significant economic transformations such as the gold standard and its subsequent dissolution. However, recent times have posed new challenges for the Krone. The looming shadow of inflation, particularly in a post-pandemic world, prompts a closer examination of its future impact on the Norwegian Krone. Inflation is a general increase in prices and fall in the purchasing value of money. While moderate or controlled inflation can indicate a healthy economy, high inflation negatively affects savings and spending as the value of the Krone decreases, leading to uncertain economic scenarios. In the past, Norway's central bank, Norges Bank, has implemented a tightly managed floating exchange rate system with inflation targeting to stabilize the Krone and price levels. These historical monetary policies have seen success and demonstrate the Norwegian government's commitment to protecting the Krone's value. Moving forward, the future of the Norwegian Krone will largely depend on the impact of global economic and financial environments. Along with that, domestic economic factors like oil prices, as Norway is a significant oil exporter, and foreign investments will play significant roles in shaping the Krone's value. Moreover, the success of anti-inflationary policies hinges on a critical variable – economic growth. Stable economic growth is key to maintaining low inflation rates. Future economic progress will thus have a profound impact on the Norwegian Krone, affecting everything from its international standing to its domestic purchasing power. Prediction is a challenging task, especially in a volatile global economy. It is essential to consider multiple scenarios that could unfold in future projections of inflation. However, with historical context and current economic indicators, we can anticipate that the Norwegian government will continue adjusting its monetary policy, while aiming for a healthy balance between economic growth and inflation, to maintain the Krone's stability. In conclusion, keeping an eye on inflation is crucial for the future of the Norwegian Krone. By monitoring and proactively responding to inflationary tendencies, Norway can ensure the ongoing strength and health of its currency. Above all, the evolution of the Norwegian Krone underscores the importance of active management and sound economic policies in navigating an uncertain financial future. The Norwegian Krone's journey is far from over, and its descent or ascent will primarily depend on the successful navigation of the inflationary tides.

Understanding Norway's Monetary Policy: A Deep Dive into the Norwegian Krone

The evolution, design, and economic influence of any given currency provide an informative lens through which to observe a country's economic history and monetary policies. This pertains significantly to the Norwegian Krone, a currency deeply rooted in Norway’s rich history and its progressive economic system. In this article, we'll delve into an in-depth understanding of the distinctive attributes of the Norwegian Krone, its relation to Norway’s Monetary Policy, and its potential impact on global economics. Our exploration will encompass fascinating historical insights, dynamic inflections in design due to economic and political factors, and an account of how this northern European currency contributes effectively to shaping Norway's economic landscape. In considering the performance of the Krone under various economic situations such as inflation, we'll illuminate Norway’s approach to managing its monetary policy within its unique socio-economic context. This journey through the life of the Norwegian Krone exemplifies not only the strength and resilience of Norway's economy, but it also suggests intriguing possibilities for the future of international monetary policy. Our deep dive into the Norwegian Krone promises a well-rounded understanding of this unique currency in the arena of global economy.

'

'The History and Evolution of the Norwegian Krone

The **Norwegian Krone** (NOK), the official currency of Norway and its dependent territories, has an intriguing history and evolution steeped in Norway's rich cultural narrative. Established in 1875 when Norway joined the Scandinavian Monetary Union (SMU), the Krone replaced the previous currency, Norwegian Speciedaler, aligning it with Sweden’s and Denmark’s currencies, the Krona and Krone. While the laws maintaining the SMU were abolished in 1924, Norway chose to retain the Krone as its independent currency. From that point, its economic journey has been deeply influenced by fluctuations in global economic scenarios and Norway’s oil-fueled economy. The Norwegian Krone has experienced several phases of turbulence due to factors such as inflation, consequences of oil price changes and shifts in monetary policy. The most significant adjustment was later in the 20th century, when Norway decided, like many other countries, to *"float"* the Krone, setting it free to find its own international value. This was in response to global economic developments and the need to manage oil wealth more flexibly. The Krone's design, quite like its history, reflects Norway's rich cultural heritage and natural beauty. Banknotes depict images of oceanic landscapes, wildlife, and excerpts from Norwegian literature, while coins often feature monarchical symbols and representations of historical events. In terms of its economic impact, the Krone is significantly influenced by Norway’s substantial oil and gas sector, which accounts for a large portion of its exports. In good times, when oil and gas prices are high, the Krone tends to appreciate. However, during periods of low oil and gas prices, its value can fall. One notable feature of Norway's monetary policy is the Government Pension Fund Global, where a portion of the country's oil revenues is invested overseas, helping to moderate the effects of oil price volatility on the Krone. From its nascence within the Scandinavian Monetary Union to its free-floating, oil-influenced current state, the Norwegian Krone is undoubtedly tightly woven into Norway’s economic, political and even cultural fabric. Its future will continue to be influenced by global economic developments, changes in the oil and gas markets, and domestic monetary policy decisions. With splendid design imbued with national identity and a tenacious survival story, the Krone serves as a vibrant symbol of Norway's economic resilience and cultural heritage.

Key Factors Affecting the Value of the Norwegian Krone

The Norwegian Krone, Norway's official currency, has its value impacted by a range of **key factors** that have historical, economic and policy-driven ramifications. Its evolution, dating back to 1875, has closely intertwined with the nation's diverse economic undertakings and progressive monetary policies. Firstly, Norway's rich endowment of **oil reserves** plays a significant role. Norway is Europe's largest oil producer and the world's third largest natural gas exporter, which inevitably binds the Krone's value to global oil prices. Whenever there is fluctuation in global oil prices, it directly impacts the Norweigan Krone, either strengthening or weakening its position in the forex markets. Next, the financial decisions made by **Norges Bank**, Norway's central bank, majorly influence the value of the Krone. The bank sets interest rates and, just like any other currency, when an interest rate hike occurs, it often strengthens the currency as it attracts foreign capital due to the potential of higher returns. Similarly, when the bank decreases interest rates, the Krone tends to weaken. The country's socio-economic policies, particularly those aimed at preserving its vibrant welfare state, can profoundly influence the Krone's value. Norway, known for its **progressive economic policies**, has a keen focus on wealth redistribution and its policy of maintaining a high level of social equality often involves large-scale public sector spending. Such spending can sometimes result in inflationary pressure that impacts the value of the Krone. Lastly, the Norwegian Krone is subject to **global market conditions**. Being a highly open economy, Norway is heavily influenced by global economic trends. Be it a recession in the US or an economic turmoil in the Asia-Pacific, overseas developments can sway the Krone's value dramatically. To conclude, the Norwegian Krone, like any other national currency, embodies a complex interplay of diverse factors. Understanding these factors not only offers insights into its past evolution and present state but also allows for forecasting future trends. Therefore, continually keeping an eye on these aspects is crucial for anyone interested in the currency markets especially dealing with the Norwegian Krone.

Norway's Monetary Policy: An Analysis of its impact on the Norwegian Krone

The **Norwegian Krone** (NOK) is the official currency of Norway, a nation known for its strong monetary policy and economic stability. Its currency symbol is **kr**, which is an abbreviation of krone, meaning crown in English. As a primary representation of Norway's economy, the Krone's evolution and value greatly reflects the nation's financial health and development. Historically, the Norwegian Krone was introduced in 1875 when Norway joined the Scandinavian Monetary Union (SMU) alongside Denmark and Sweden. The SMU aimed to merge the three countries' currencies into one, a strategy facilitated by the equal value gold standard. However, the union was dissolved during World War I with the abandonment of the gold standard, leading to each country retaining its independent currency. Norway's modern monetary policy overseen by the **Norges Bank**, the nation’s central bank, primarily aims at maintaining low and stable inflation. The **inflation targeting** regime adopted by the Norges Bank in 2001, centers on keeping the annual consumer price inflation close to 2%. This approach is believed to contribute to economic stability with maintained purchasing power of the citizens, while supporting rebalancing sustainable development of the economy in periods of stress. The Norges Bank also ensures the implementation of effective exchange rate mechanisms, often using **policy rate decisions** and **foreign exchange interventions** to influence the currency's value. These tools have been critical in managing the Norwegian Krone's performance against peer currencies, thereby controlling imports, exports, and foreign investments. In an open economy like Norway, fluctuations in the krone's exchange rate can have significant impacts on inflation and output, making it a vital aspect of monetary policy. The relative stability of the Krone in recent years is a testament to the effectiveness of these strategies. Looking at the financial and commodity markets, there's significant influence of Norway's significant petroleum industry on the krone's value. As a large exporter of oil and gas, changes in global commodity prices can create volatility in the krone’s exchange rates. It is essential to note that the Norges Bank's commitment to economic resilience has continually worked to absorb such shocks while safeguarding the economy and the currency. Overall, the analysis of the Norwegian Krone presents a rich understanding of Norway's robust monetary policy and its central bank's competency in maintaining currency stability. This stability and the consistent performance of the krone are what consistently position Norway as one of the world’s wealthiest nations.

Norwegian Krone Banknotes

-

Norwegian Krone (NOK) 100 Banknotes

-

Norwegian Krone (NOK) 1000 Banknotes

-

Norwegian Krone (NOK) 200 Banknotes

-

Norwegian Krone (NOK) 50 Banknotes

-

Norwegian Krone (NOK) 500 Banknotes