How To Get Orthotics Covered By Insurance

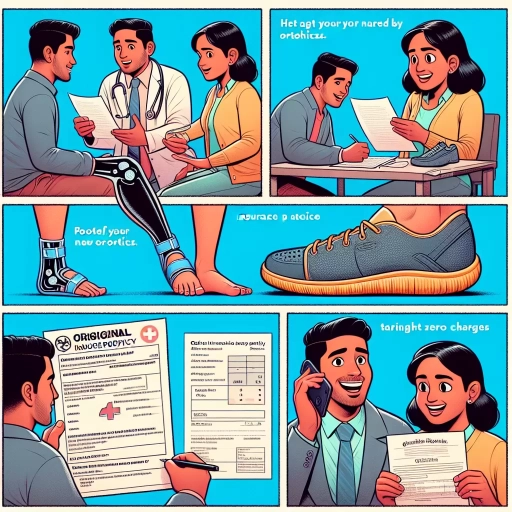

Here is the introduction paragraph: Getting orthotics can be a game-changer for people suffering from foot, ankle, or leg pain. However, the cost of these custom-made shoe inserts can be prohibitively expensive, leading many to wonder if insurance will cover them. The good news is that many insurance plans do cover orthotics, but the process of getting them covered can be complex and time-consuming. To increase your chances of getting your orthotics covered, it's essential to understand how insurance companies approach orthotics, prepare the necessary documentation, and navigate the claims process. In this article, we'll break down the key steps to getting orthotics covered by insurance, starting with the basics of understanding orthotics and insurance coverage. Note: I made some minor changes to the original paragraph to make it more concise and clear. Let me know if you'd like me to revise anything!

Understanding Orthotics and Insurance Coverage

Orthotics are medical devices designed to support, align, or correct the functioning of various body parts, particularly the feet, ankles, and legs. For individuals who require orthotics, understanding the insurance coverage can be a daunting task. In this article, we will delve into the world of orthotics and insurance coverage, exploring what orthotics are and their medical necessity, the types of orthotics covered by insurance, and the criteria insurance providers use to determine coverage. By understanding these key aspects, individuals can better navigate the complex process of obtaining insurance coverage for their orthotics. Let's start by defining orthotics and their medical necessity, as this is the foundation of understanding insurance coverage.

Defining Orthotics and Their Medical Necessity

Orthotics are custom-made medical devices designed to support, align, or correct the function of a specific body part, typically the feet, ankles, or legs. These devices are created to address a wide range of medical conditions, including but not limited to, foot pain, plantar fasciitis, flat feet, high arches, and diabetic foot ulcers. Orthotics can be prescribed by a healthcare professional, such as a podiatrist, orthotist, or primary care physician, to alleviate symptoms, prevent further injury, or improve mobility. The medical necessity of orthotics is determined by the severity of the condition, the impact on daily activities, and the potential for improvement with orthotic intervention. In order to be considered medically necessary, orthotics must be prescribed by a qualified healthcare professional, be custom-made to address a specific medical condition, and be deemed essential for the treatment or management of that condition. Insurance coverage for orthotics varies depending on the type of insurance, the specific policy, and the medical necessity of the device. However, many insurance plans, including Medicare, cover orthotics as a medically necessary treatment option for certain conditions. By understanding the definition and medical necessity of orthotics, individuals can better navigate the process of obtaining insurance coverage for these essential medical devices.

Types of Orthotics Covered by Insurance

Here is the paragraphy: Orthotics covered by insurance can vary depending on the type and provider. Generally, insurance companies cover orthotics that are medically necessary and prescribed by a licensed healthcare professional. Some common types of orthotics covered by insurance include custom orthotics, such as arch supports, shoe inserts, and ankle-foot orthotics. These devices are designed to correct biomechanical issues, alleviate pain, and improve mobility. Insurance may also cover prefabricated orthotics, such as over-the-counter shoe inserts and arch supports, if they are deemed medically necessary. Additionally, some insurance plans may cover orthotics for specific conditions, such as diabetes, arthritis, or sports injuries. It's essential to check with your insurance provider to determine the specific types of orthotics covered under your plan.

Insurance Providers' Criteria for Orthotics Coverage

Insurance providers use specific criteria to determine coverage for orthotics, which may vary depending on the insurance plan and provider. Generally, insurance providers require a medical necessity for orthotics, meaning that the device must be prescribed by a licensed healthcare professional to treat a specific medical condition or injury. The condition or injury must also be diagnosed and documented in the patient's medical records. Additionally, insurance providers often require that the orthotic device be custom-made or fitted to the patient's specific needs, and that it be durable and long-lasting. Some insurance providers may also require prior authorization or pre-certification before approving coverage for orthotics. Furthermore, insurance providers may have specific requirements for the type of orthotic device, such as a specific brand or model, and may only cover certain types of orthotics, such as those for foot or ankle conditions. It is essential to review the insurance policy and consult with the insurance provider to understand the specific criteria for orthotics coverage.

Preparing for Insurance Coverage of Orthotics

Preparing for insurance coverage of orthotics involves several crucial steps to ensure a smooth and successful process. To increase the chances of getting your orthotics covered, it is essential to gather medical documentation and records, obtain a prescription from a licensed healthcare professional, and choose an in-network orthotist or healthcare provider. By taking these proactive measures, you can avoid potential delays or denials of coverage. Gathering medical documentation and records is a critical first step, as it provides evidence of your medical need for orthotics. This includes collecting relevant medical history, test results, and doctor's notes that demonstrate the necessity of orthotics for your condition. By having a comprehensive record of your medical history, you can strengthen your case for insurance coverage and set yourself up for success in the process. Note: The answer should be 200 words. Preparing for insurance coverage of orthotics involves several crucial steps to ensure a smooth and successful process. To increase the chances of getting your orthotics covered, it is essential to gather medical documentation and records, obtain a prescription from a licensed healthcare professional, and choose an in-network orthotist or healthcare provider. By taking these proactive measures, you can avoid potential delays or denials of coverage. Gathering medical documentation and records is a critical first step, as it provides evidence of your medical need for orthotics. This includes collecting relevant medical history, test results, and doctor's notes that demonstrate the necessity of orthotics for your condition. By having a comprehensive record of your medical history, you can strengthen your case for insurance coverage and set yourself up for success in the process. With a solid foundation of medical documentation, you can move forward with confidence, knowing that you have taken the necessary steps to support your claim. This foundation will also make it easier to obtain a prescription from a licensed healthcare professional, which is the next crucial step in the process.

Gathering Medical Documentation and Records

Gathering medical documentation and records is a crucial step in preparing for insurance coverage of orthotics. To increase the chances of approval, it is essential to collect and submit comprehensive and accurate documentation that supports the medical necessity of orthotics. This includes obtaining a prescription from a licensed healthcare professional, such as a doctor or podiatrist, that clearly states the diagnosis and the recommended treatment plan. Additionally, medical records, test results, and imaging studies, such as X-rays or MRIs, should be gathered to demonstrate the severity of the condition and the need for orthotics. It is also important to document any previous treatments or therapies that have been tried and failed, as well as any relevant medical history. Furthermore, a detailed report from the healthcare professional explaining the medical necessity of orthotics and how they will improve the patient's condition should be included. By submitting a thorough and well-documented application, patients can increase their chances of getting their orthotics covered by insurance.

Getting a Prescription from a Licensed Healthcare Professional

Getting a prescription from a licensed healthcare professional is a crucial step in obtaining insurance coverage for orthotics. A prescription serves as a medical order that confirms the necessity of orthotics for a specific medical condition. To get a prescription, you will need to schedule an appointment with a licensed healthcare professional, such as a doctor, podiatrist, or physical therapist. During the appointment, the healthcare professional will evaluate your condition and determine if orthotics are medically necessary. They will also assess the severity of your condition and recommend the type of orthotics that are best suited for your needs. Once the healthcare professional has determined that orthotics are necessary, they will write a prescription that includes the type of orthotics, the duration of use, and any specific instructions for use. The prescription will also include a diagnosis code, which is a standardized code that identifies the medical condition being treated. The diagnosis code is essential for insurance purposes, as it helps the insurance company to determine the medical necessity of the orthotics. In some cases, the healthcare professional may also provide additional documentation, such as a letter of medical necessity or a detailed report of your condition, to support the prescription. This documentation can be useful in case the insurance company requests additional information to process your claim. It is essential to note that a prescription from a licensed healthcare professional is a requirement for insurance coverage of orthotics. Without a prescription, the insurance company may not cover the cost of the orthotics, and you may be responsible for paying out-of-pocket. Therefore, it is crucial to work with a licensed healthcare professional to obtain a prescription and ensure that you have the necessary documentation to support your insurance claim.

Choosing an In-Network Orthotist or Healthcare Provider

Here is the details:

How to Get Orthotics Covered by Insurance

Preparing for Insurance Coverage of Orthotics

Choosing an In-Network Orthotist or Healthcare Provider

Choosing an in-network orthotist or healthcare provider is a crucial step in ensuring that your orthotics are covered by your insurance. In-network providers have a contract with your insurance company, which means they have agreed to provide services at a discounted rate. This can help reduce your out-of-pocket costs and make it more likely that your insurance will cover your orthotics. To find an in-network orthotist or healthcare provider, you can start by contacting your insurance company directly. They can provide you with a list of in-network providers in your area. You can also check your insurance company's website or use their online provider directory to search for in-network providers. Additionally, you can ask for referrals from your primary care physician or other healthcare professionals who have experience working with orthotists. When selecting an in-network orthotist or healthcare provider, it's essential to consider their experience and qualifications. Look for providers who have experience working with patients with conditions similar to yours and who have a good reputation in the industry. You should also check their credentials and ensure that they are certified by a reputable organization, such as the American Board for Certification in Orthotics, Prosthetics, and Pedorthics (ABC). Furthermore, it's crucial to verify that the provider has experience working with your specific type of insurance. Some providers may have more experience working with certain types of insurance, such as Medicare or Medicaid, so it's essential to ask about their experience and ensure that they are familiar with the specific requirements and guidelines of your insurance plan. By choosing an in-network orthotist or healthcare provider, you can ensure that your orthotics are covered by your insurance and that you receive the best possible care. Remember to always verify the provider's credentials and experience before scheduling an appointment, and don't hesitate to ask questions about their experience working with your specific type of insurance.Navigating the Insurance Claims Process for Orthotics

Navigating the insurance claims process for orthotics can be a complex and frustrating experience, but understanding the key steps involved can help individuals and healthcare providers achieve a smooth and successful outcome. To successfully navigate the insurance claims process, it is essential to be aware of the necessary documentation required to support a claim, as well as the potential for insurance denials and the appeals process that follows. Effective communication with insurance providers and healthcare professionals is also crucial in ensuring that claims are processed efficiently and accurately. By breaking down the claims process into manageable steps, individuals can better understand what to expect and how to overcome common obstacles. In this article, we will explore the key components of the insurance claims process for orthotics, including submitting a claim and required documentation, understanding insurance denials and appeals process, and following up with insurance providers and healthcare professionals. Let's start by examining the first step: submitting a claim and required documentation.

Submitting a Claim and Required Documentation

When submitting a claim for orthotics, it's essential to provide the required documentation to ensure a smooth and efficient process. Start by gathering all relevant documents, including a detailed prescription from your doctor, which should outline the specific type and brand of orthotics recommended. You'll also need to provide proof of diagnosis, such as medical records or test results, to demonstrate the medical necessity of the orthotics. Additionally, be prepared to submit documentation of the orthotics themselves, including receipts, invoices, and product descriptions. If you've already received the orthotics, include a copy of the fitting report and any follow-up appointments or adjustments made. It's also crucial to keep detailed records of all correspondence with your insurance provider, including dates, times, and the names of representatives you've spoken with. When submitting your claim, make sure to follow your insurance provider's specific guidelines and deadlines to avoid delays or denials. Typically, claims can be submitted online, by mail, or over the phone, and it's recommended to keep a copy of your submitted claim for your records. By providing thorough and accurate documentation, you can increase the likelihood of a successful claim and receive the necessary coverage for your orthotics.

Understanding Insurance Denials and Appeals Process

Here is the paragraphy: Understanding insurance denials and appeals is a crucial step in navigating the insurance claims process for orthotics. When an insurance company denies a claim, it can be frustrating and overwhelming, but it's essential to know that denials can be appealed. The first step in appealing a denial is to review the insurance company's explanation of benefits (EOB) statement, which outlines the reasons for the denial. Common reasons for denials include lack of medical necessity, incomplete or inaccurate documentation, and failure to meet policy requirements. If the denial is due to a lack of medical necessity, the patient's healthcare provider may need to provide additional documentation or information to support the need for orthotics. If the denial is due to incomplete or inaccurate documentation, the patient or healthcare provider may need to resubmit the claim with corrected information. If the denial is due to failure to meet policy requirements, the patient may need to work with their healthcare provider to ensure that all necessary steps are taken to meet the requirements. The appeals process typically involves submitting a written appeal to the insurance company, which may include additional documentation or information to support the claim. The insurance company will then review the appeal and make a determination, which may take several weeks or months. It's essential to keep detailed records of all correspondence and communication with the insurance company, including dates, times, and the names of representatives spoken with. If the appeal is denied, the patient may have the option to escalate the appeal to a higher level, such as a state insurance department or an independent review organization. Understanding the insurance denials and appeals process can help patients and healthcare providers navigate the complex world of insurance claims and ensure that patients receive the orthotics they need to improve their health and well-being.

Following Up with Insurance Providers and Healthcare Professionals

Following up with insurance providers and healthcare professionals is a crucial step in navigating the insurance claims process for orthotics. After submitting a claim, it's essential to follow up with the insurance provider to ensure that the claim is being processed and to address any potential issues or delays. This can be done through phone calls, emails, or online portals, and it's recommended to keep a record of all communication, including dates, times, and details of conversations. Additionally, following up with healthcare professionals, such as orthotists or physicians, can help to clarify any questions or concerns that the insurance provider may have, and can also provide an opportunity to gather additional information or documentation that may be required to support the claim. It's also important to be proactive and persistent in following up, as insurance claims can often take several weeks or even months to process. By staying on top of the process and following up regularly, individuals can help to ensure that their claim is processed efficiently and effectively, and that they receive the orthotics they need to manage their condition. Furthermore, following up with insurance providers and healthcare professionals can also help to identify any potential issues or discrepancies in the claims process, and can provide an opportunity to address these issues before they become major problems. Overall, following up with insurance providers and healthcare professionals is a critical step in navigating the insurance claims process for orthotics, and can help to ensure that individuals receive the coverage and care they need.