45k A Year Is How Much An Hour

Understanding the Basic Wage Calculation

Basics of Wage Calculation

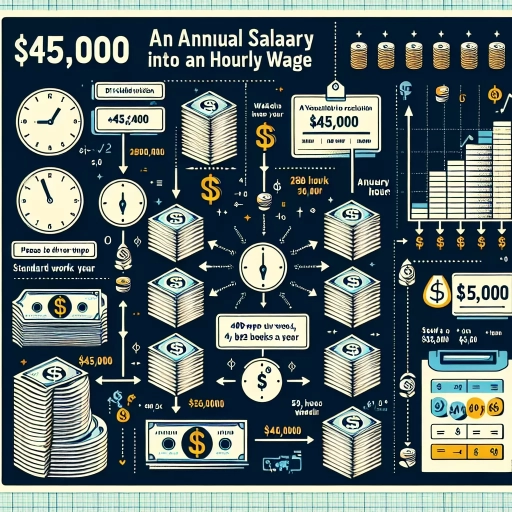

If you are wondering how much 45k a year is when broken down hourly, first we need to understand the basic wage calculation. Essentially, an annual salary is the total of what an employer pays an employee in a year. To determine the hourly wage, it is necessary to divide this annual income by the total number of hours worked within the year.

Regular Working Hours

Most full-time jobs consider a 40-hour workweek as standard. Adding this up, this equals to 2,080 hours of work in a year, assuming the worker takes no vacation or sick days. This calculation simply takes the 40 hours per week and multiplies it by 52 weeks in a year. Bear in mind, this would also include public holidays and weekends.

The Wage Conversion

By knowing the total number of hours worked in a year, we can now determine how 45k a year translates to an hourly wage. The calculation would be as follows: 45,000 / 2,080 = approximately 21.63. This means that a person making 45k per year is making around $21.63 per hour.

Factors That Might Influence Your Hourly Wage

Varying Hours Worked

For some workers, 40 hours per week might not be the standard. Individuals working in variable shift work or industries with longer standard hours, such as healthcare or law enforcement, may be working more (or less) than 40 hours in any given week. In this case, you would adjust the hourly wage calculation accordingly to reflect the accurate number of hours you work each week.

Benefits and Deductions

Another factor to consider when thinking about your hourly wage is the other benefits that your employer might provide. These can include health insurance, retirement contributions, or paid vacation days. If these benefits are included in your compensation, it could effectively increase your hourly rate. On the other hand, deductions from your salary such as taxes and social security, might decrease your net hourly wage.

Overtime and Extra Pay

Overtime is another factor that can greatly influence what your effective hourly wage might be. For instance, if you are eligible for overtime pay and frequently work more than 40 hours in a week, your annual income (and therefore hourly wage) might be considerably higher than you calculate based on a standard 40-hour work week.

Comparing a $45K salary to the Minimum Wage and Cost of Living

Comparison to the Minimum Wage

When considering whether a $45K salary is reasonable, it can help to compare this wage to the federal or state minimum wage. As of 2020, the federal minimum wage in the United States is $7.25. This equates to a yearly salary of approximately $15,080 - a significantly lower amount than $45K.

Comparison to the Living Wage

A stark reality for many people is that the cost of living often outstrips the legal minimum wage, making it necessary to earn a 'living wage'. The living wage is an estimated amount of money an individual or family needs to cover basic costs of living without assistance. If you're earning $45k a year, comparing this figure to the estimated living wage in your area can give another point of reference.

Cost of Living Differences in Various Locations

Another fundamental thing to bear in mind when comparing wages is the effect of location on the cost of living. $45,000 may be quite a comfortable salary in a rural or suburban area with a low cost of living, but could be barely sustainable in high-cost cities like San Francisco or New York. Factors like housing, transportation, groceries, and other basic expenses all need to be considered in this comparison.