How To Read A Void Cheque

Understanding the Basics of a Void Cheque

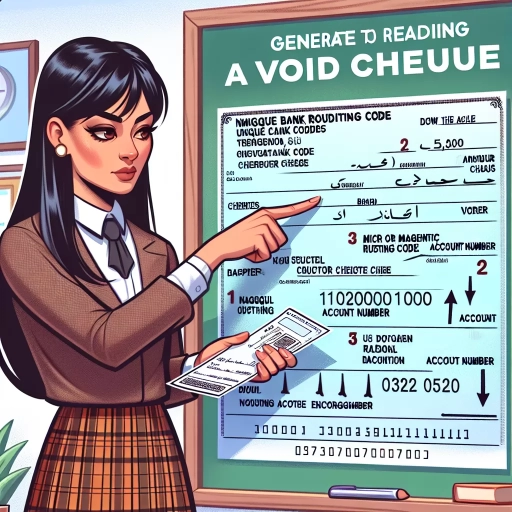

The Structure of a Void Cheque

A void cheque is a type of cheque that has the word "VOID" written across it, preventing the cheque from being filled out or cashed. It is used to provide the necessary banking information without the risk of the cheque being used improperly. Understanding the structure of a void cheque is essential in reading it. The numbers at the bottom of the cheque represent unique identifiers to your banking account and banking institution. By providing them, you are allowing someone to deposit money into, or withdraw money from your account, such as in setting up a pre-authorized debit.

The Uses of a Void Cheque

Void cheques are primarily used to provide banking information. For instance, if you want to set up a direct deposit for a pay check or benefits with your employer, you might be asked for a void cheque. Your bank account details are necessary for the direct deposit arrangement to be set up. Additionally, void cheques are used in setting up pre-authorized payments. From utility bills, to mortgage payments, or even loan installments, void cheques can be used to set up recurring automatic payments.

How to Void a Cheque

Voding a cheque is a simple and straightforward process, but it must be done correctly to prevent misuse. It involves writing the word "VOID" in large, clear letters across the front of the cheque. When voiding the cheque, make sure the "VOID" does not obscure the numbers at the bottom. Those numbers are important bank and account identifiers. It's important that the "VOID" is clear and prominent, to prevent anyone from attempting to use the cheque for fraudulent purposes.

Breaking Down the Elements of a Void Cheque

Understanding the Cheque Number

The cheque number is typically found in two places on the cheque: the upper right-hand corner, and the bottom, within the string of numbers. This number is a unique identifier of the cheque itself. Every cheque from your account will have a different cheque number. Keeping track of your cheque numbers can help you manage your account, avoid bank errors, and identify fraudulent cheques.

Deciphering the Bank and Branch Code

The bank and branch code, also referred to as the sort code or the routing number, is found at the bottom of the cheque. This set of numbers identifies your specific banking institution and branch. When setting up direct deposits or automatic payments, these numbers are used by the other party’s bank to know which institution to go to in order to process the transaction.

Adding Up the Account Number

The account number on a void cheque is the last set of numbers at the bottom. This number is unique to your individual bank account. When you provide a void cheque, you are essentially giving the receiver the information necessary to deposit or withdraw money from this specific account. Understanding your account number can also help in managing your finances effectively and avoiding bank errors.

Ensuring the Safe Use of a Void Cheque

Keeping Your Details Secure

When providing a void cheque, it's crucial to remember that you are sharing sensitive information that could be miss-used if it falls into the wrong hands. Therefore, always ensure that the cheque is properly voided, and only provide it to trusted sources. It's also advisable to keep a record of whom you have given a void cheque to prevent misuse.

Dealing with Non-Chaque Banking

In the age of internet banking, you may not have a chequebook. This doesn't have to be a problem. Many banks provide a "Void Cheque Information" document that can be printed directly from your online banking platform. This document contains the same information as a void cheque and can be used in the same way.

Detecting and Preventing Fraud

Learning how to read and understand a void cheque can help you prevent fraud. By recognizing where your sensitive information is placed on a cheque, you can take steps to protect it. Notify your bank immediately if you suspect your account information has been compromised. Understanding void cheques is also a defense against fraud, as you'll be able to tell if an account number or routing number has been tampered with.