How To Fill Cheque

Writing a cheque can be a daunting task, especially for those who are new to banking or have never had to write one before. However, with the right guidance, filling out a cheque can be a straightforward process. In this article, we will provide a comprehensive guide on how to fill a cheque, covering the basics, a step-by-step guide, and best practices for secure and accurate cheque filling. We will start by understanding the basics of cheque filling, including the essential components of a cheque and the importance of accuracy. By grasping these fundamentals, you will be well-equipped to move on to the next step, which is filling out the cheque itself. With this knowledge, you will be able to confidently and correctly fill out a cheque, ensuring a smooth transaction. So, let's begin by understanding the basics of cheque filling.

Understanding the Basics of Cheque Filling

When it comes to managing personal finances, understanding the basics of cheque filling is an essential skill that can help individuals avoid errors and ensure smooth transactions. A cheque is a widely accepted payment method, and filling it out correctly is crucial to prevent any discrepancies or delays. To master the art of cheque filling, it's vital to start with the fundamentals. This includes knowing the cheque format, understanding the importance of date, and familiarizing oneself with cheque components. By grasping these essential concepts, individuals can confidently fill out cheques and avoid any potential issues. In this article, we will delve into the world of cheque filling, starting with the basics of the cheque format, which is the foundation of accurate and efficient cheque filling.

Knowing the Cheque Format

A cheque is a written order that instructs a bank to pay a specific amount of money from one person's account to another. To ensure that the cheque is processed correctly, it's essential to know the cheque format. A standard cheque typically consists of several key components, including the date, payee's name, amount in both numbers and words, and the signature of the account holder. The date is usually written in the top right-hand corner, and it's crucial to use the correct date format, which is typically day/month/year. The payee's name is written next to the word "Pay" or "Pay to the order of," and it's essential to spell the name correctly to avoid any errors. The amount in numbers is written in the box on the right-hand side, and it should match the amount written in words on the line below. The amount in words is written out in full, and it's essential to use the correct spelling and punctuation. Finally, the signature of the account holder is written in the bottom right-hand corner, and it's essential to use the same signature that is on file with the bank. By understanding the cheque format, individuals can ensure that their cheques are filled out correctly, reducing the risk of errors or delays in processing.

Understanding the Importance of Date

Understanding the importance of the date on a cheque is crucial when it comes to filling out a cheque correctly. The date is a critical component of a cheque, as it determines when the cheque can be cashed and when the funds will be deducted from the account. The date should be written in the top right-hand corner of the cheque, and it should be the date when the cheque is being written, not the date when it is intended to be cashed. This is important because it allows the bank to verify the cheque and ensure that it is valid. If the date is incorrect or missing, the bank may not honour the cheque, which could result in delays or even bounced cheques. Furthermore, the date also helps to prevent cheques from being cashed prematurely or after they have expired. For instance, if a cheque is dated for a future date, it cannot be cashed until that date has arrived. Similarly, if a cheque is dated for a past date, it may be considered stale and not honoured by the bank. Therefore, it is essential to write the correct date on the cheque to avoid any potential issues or complications. By understanding the importance of the date on a cheque, individuals can ensure that their cheques are filled out correctly and that their transactions are processed smoothly.

Familiarizing with Cheque Components

A cheque is a financial instrument that allows you to transfer funds from your account to another person's account. To fill out a cheque correctly, it's essential to familiarize yourself with its various components. A standard cheque typically consists of several key elements, including the date, payee's name, amount in numbers, amount in words, and signature. The date section is usually located at the top right corner of the cheque and is where you write the date you're filling out the cheque. The payee's name is written on the line that says "Pay to the order of," and it's crucial to spell the name correctly to avoid any errors. The amount in numbers is written in the box on the right side of the cheque, and it should match the amount in words written on the line below. The amount in words is written out in full, using words like "dollars" and "cents" to specify the exact amount. Finally, your signature is required in the bottom right corner of the cheque, and it's essential to sign your name as it appears on your bank account to validate the cheque. Understanding these components and how to fill them out correctly is vital to ensure that your cheque is processed smoothly and efficiently.

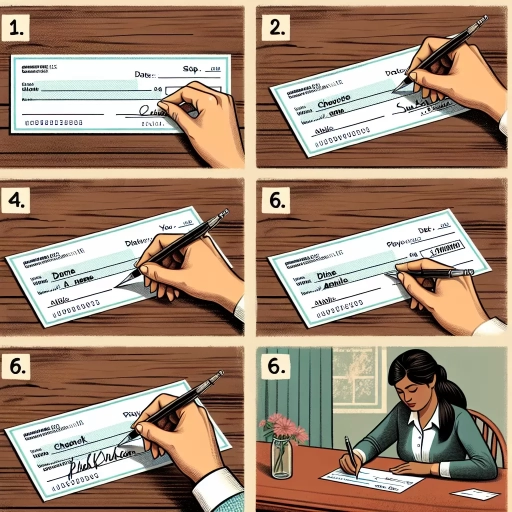

Step-by-Step Guide to Filling a Cheque

Filling a cheque correctly is a crucial step in ensuring that your transaction is processed smoothly and efficiently. A cheque is a financial instrument that allows you to transfer funds from your account to another person's account, and it is essential to fill it out accurately to avoid any errors or discrepancies. In this article, we will provide a step-by-step guide on how to fill a cheque correctly, covering essential aspects such as writing the date correctly, specifying the payee's name, and entering the amount in figures and words. By following these simple steps, you can ensure that your cheque is filled out accurately and processed without any issues. To start, let's begin with the first step, which is writing the date correctly.

Writing the Date Correctly

When writing the date on a cheque, it is essential to do so correctly to avoid any confusion or potential issues with the transaction. The date should be written in the top right-hand corner of the cheque, and it should be the current date or a future date when you want the cheque to be cashed. It is crucial to use the correct format, which is typically day/month/year (e.g., 12/02/2023). Using the correct format ensures that the bank can easily read and process the cheque. Additionally, it is recommended to use a pen, preferably black or blue ink, to write the date, as pencil marks can be easily erased or altered. It is also important to note that post-dating a cheque, which means writing a future date, can be useful in certain situations, such as when you want to ensure that the cheque is not cashed until a specific date. However, it is essential to be aware that post-dating a cheque does not guarantee that the cheque will not be cashed earlier, as the bank may still process it if the recipient presents it before the specified date. Therefore, it is crucial to communicate clearly with the recipient about the intended date of the cheque. By following these guidelines, you can ensure that the date on your cheque is written correctly and avoid any potential issues with the transaction.

Specifying the Payee's Name

When specifying the payee's name on a cheque, it is essential to ensure that the name is accurate and complete to avoid any potential issues with the payment. The payee's name should be written clearly and legibly in the space provided on the cheque, usually on the line that says "Pay to the order of." The name should be spelled correctly, and any abbreviations or initials should be used consistently. For example, if the payee's name is John Smith, it should be written as "John Smith" and not "J. Smith" or "John S." If the payee is a business or organization, the full name of the business should be used, including any suffixes such as "Inc." or "Ltd." It is also important to note that the payee's name should match the name on the account that the cheque is being deposited into. If the names do not match, the bank may reject the cheque, and the payment will not be processed. Therefore, it is crucial to double-check the payee's name before filling out the cheque to ensure that the payment is processed correctly and efficiently.

Entering the Amount in Figures and Words

When filling out a cheque, it is essential to enter the amount in both figures and words to avoid any confusion or discrepancies. The amount in figures should be written in the box provided on the right-hand side of the cheque, using numbers and a decimal point. For example, if the amount is $100.50, it should be written as "100.50" in the box. On the other hand, the amount in words should be written on the line provided below the date, using words and not numbers. Using the same example, the amount in words would be written as "One Hundred Dollars and 50/100". It is crucial to ensure that the amounts in both figures and words match exactly, as any discrepancy can lead to the cheque being rejected or delayed. Additionally, it is recommended to use a pen and not a pencil to fill out the cheque, as pencil marks can be easily erased or altered. By following these simple steps, you can ensure that your cheque is filled out correctly and processed smoothly.

Best Practices for Secure and Accurate Cheque Filling

When it comes to filling out cheques, accuracy and security are paramount to prevent errors, fraud, and financial losses. To ensure that your cheques are processed correctly and safely, it's essential to follow best practices for secure and accurate cheque filling. Three key aspects to focus on are using permanent ink and avoiding erasures, verifying the payee's details, and signing the cheque legibly and authentically. By adopting these habits, you can significantly reduce the risk of cheque fraud and errors. In this article, we will delve into each of these critical aspects, starting with the importance of using permanent ink and avoiding erasures, which is crucial in preventing alterations and ensuring the integrity of the cheque.

Using Permanent Ink and Avoiding Erasures

When filling out a cheque, it's essential to use permanent ink to ensure that the details cannot be altered or erased. This is a critical security measure to prevent cheque fraud and unauthorized transactions. Permanent ink, such as that found in ballpoint pens, is recommended because it is difficult to erase or alter without leaving visible signs of tampering. On the other hand, erasable pens or pencils should be avoided as they can be easily manipulated, allowing fraudsters to change the payee's name, amount, or other crucial details. Furthermore, using permanent ink helps to maintain the integrity of the cheque, ensuring that the transaction is processed accurately and securely. By taking this simple precaution, individuals can significantly reduce the risk of cheque fraud and protect their financial assets. Therefore, it is crucial to always use permanent ink when filling out a cheque to ensure the security and accuracy of the transaction.

Verifying the Payee's Details

Verifying the payee's details is a crucial step in the cheque filling process. It ensures that the payment is made to the intended recipient, reducing the risk of errors and potential fraud. To verify the payee's details, start by checking the payee's name and address on the cheque against the information provided by the payee or on any supporting documents, such as invoices or receipts. Make sure to spell the payee's name correctly and include any necessary titles, such as "Mr." or "Ms." Next, verify the payee's account details, including the account number and bank branch. This information can usually be found on the payee's bank statement or on a voided cheque. If you're unsure about any of the payee's details, it's best to contact them directly to confirm. Additionally, be cautious of any payee details that seem suspicious or inconsistent, as this could be a sign of fraudulent activity. By taking the time to verify the payee's details, you can help ensure that your cheque is filled out accurately and securely, reducing the risk of errors and potential financial losses.

Signing the Cheque Legibly and Authentically

Signing the cheque legibly and authentically is a crucial step in the cheque filling process. A clear and genuine signature is essential to prevent cheque fraud and ensure that the cheque is honoured by the bank. To sign the cheque legibly, use a pen with permanent ink, such as a ballpoint or rollerball pen, and sign your name in the same way you signed your cheque account application form. Avoid using pencils, gel pens, or markers, as they can be easily erased or altered. Make sure to sign your name clearly and concisely, without any scribbles or flourishes that could be misinterpreted. It's also important to sign the cheque in the same location on the cheque, usually on the bottom right-hand corner, to maintain consistency and make it easier for the bank to verify your signature. Additionally, never sign a blank cheque, as this can be used by someone else to fill in the details and cash the cheque. Always ensure that the date, payee's name, and amount are filled in before signing the cheque. By signing the cheque legibly and authentically, you can help prevent cheque fraud and ensure that your transactions are secure and accurate.