How To Find Notice Of Assessment Cra

Here is the introduction paragraph: Receiving a Notice of Assessment (NOA) from the Canada Revenue Agency (CRA) is a crucial step in the tax filing process. The NOA is a document that outlines the amount of taxes owed or refunded to an individual or business. However, many taxpayers struggle to find their NOA, which can lead to delays in receiving refunds or making payments. In this article, we will explore the ways to obtain a Notice of Assessment, common issues that may arise, and provide a comprehensive understanding of what the NOA entails. To begin, it's essential to understand the basics of a Notice of Assessment, including what information it contains and how it's used by the CRA. By grasping this fundamental knowledge, taxpayers can better navigate the tax filing process and avoid potential pitfalls. Let's start by understanding what a Notice of Assessment is and how it's used by the CRA.

Understanding Notice of Assessment (NOA)

The Canada Revenue Agency (CRA) plays a crucial role in ensuring that taxpayers comply with tax laws and regulations. One of the key documents that the CRA issues to taxpayers is the Notice of Assessment (NOA). The NOA is a critical document that provides taxpayers with information about their tax return, including any changes or adjustments made by the CRA. Understanding the NOA is essential for taxpayers to ensure that they are in compliance with tax laws and to avoid any potential penalties or interest. In this article, we will explore what a Notice of Assessment (NOA) is, why it is important for taxpayers, and how the CRA issues a NOA. By understanding these key aspects of the NOA, taxpayers can better navigate the tax system and ensure that they are meeting their tax obligations. So, let's start by exploring what a Notice of Assessment (NOA) is.

What is a Notice of Assessment (NOA)?

A Notice of Assessment (NOA) is a document issued by the Canada Revenue Agency (CRA) after reviewing an individual's or business's tax return. The NOA outlines the amount of taxes owed or the refund due to the taxpayer, as well as any changes or adjustments made to the original tax return. The NOA is typically sent to taxpayers within a few weeks of filing their tax return and serves as a confirmation of the CRA's assessment of their tax liability. The NOA will also indicate if there are any outstanding balances or if the taxpayer is eligible for a refund. In some cases, the NOA may also include additional information, such as the amount of Canada Pension Plan (CPP) contributions or Employment Insurance (EI) premiums paid. Taxpayers should carefully review their NOA to ensure its accuracy and contact the CRA if they have any questions or concerns.

Why is a NOA important for taxpayers?

A Notice of Assessment (NOA) is a crucial document for taxpayers as it serves as a confirmation of the Canada Revenue Agency's (CRA) assessment of their tax return. The NOA is typically issued after the CRA has processed a taxpayer's tax return and verified the information provided. It outlines the amount of taxes owed or the refund due to the taxpayer, as well as any changes or adjustments made to the original return. The NOA is important for taxpayers because it provides a clear understanding of their tax obligations and any outstanding balances. It also serves as a record of the taxpayer's compliance with tax laws and regulations. Furthermore, the NOA is often required by financial institutions and other organizations to verify a taxpayer's income and tax status, making it an essential document for various financial transactions. Additionally, the NOA can be used to support claims for benefits and credits, such as the Canada Child Benefit or the GST/HST credit. Overall, the NOA plays a vital role in ensuring taxpayers are aware of their tax obligations and can plan accordingly, making it an important document for taxpayers to review and understand.

How does the CRA issue a NOA?

The Canada Revenue Agency (CRA) issues a Notice of Assessment (NOA) after reviewing an individual's or business's tax return. The NOA is a document that summarizes the CRA's assessment of the taxpayer's tax return, including any changes or adjustments made to the original return. To issue a NOA, the CRA follows a standard process. First, the taxpayer submits their tax return, either electronically or by mail. The CRA then reviews the return to ensure it is complete and accurate. If the return is incomplete or contains errors, the CRA may request additional information or documentation from the taxpayer. Once the return is deemed complete and accurate, the CRA processes the return and calculates the taxpayer's tax liability. The CRA then generates a NOA, which is mailed to the taxpayer or made available online through the CRA's My Account portal. The NOA typically includes information such as the taxpayer's total income, deductions, and credits, as well as any taxes owed or refunds due. In some cases, the CRA may also include additional information, such as a request for payment or a notice of a tax audit. Overall, the CRA's process for issuing a NOA is designed to ensure that taxpayers are aware of their tax obligations and can take steps to resolve any issues or discrepancies with their tax return.

Ways to Obtain a Notice of Assessment

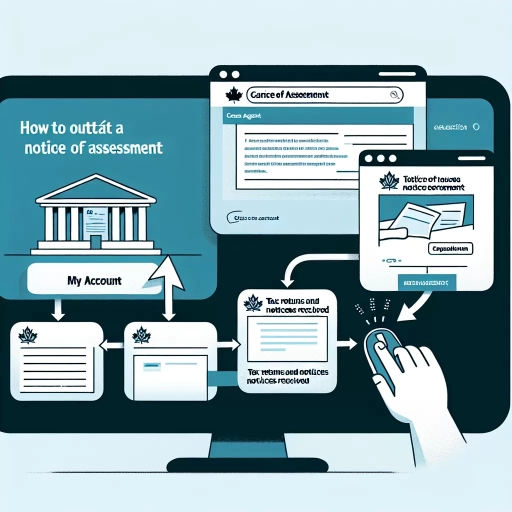

Receiving a Notice of Assessment (NOA) is a crucial step in the tax filing process, as it confirms the Canada Revenue Agency's (CRA) assessment of your tax return. The NOA provides important information, such as your tax refund or balance owing, and is required for various financial transactions. Fortunately, obtaining a NOA is a relatively straightforward process, and there are several ways to do so. You can access your NOA online through My Account on the CRA website, by phone through the CRA's automated service, or by mail through a written request to the CRA. In this article, we will explore these methods in more detail, starting with the most convenient option: accessing your NOA online through My Account on the CRA website.

Online through My Account on the CRA website

You can also obtain your Notice of Assessment online through My Account on the CRA website. To do this, you will need to register for a CRA My Account, which is a secure online portal that allows you to access your tax information and manage your tax affairs. Once you have registered, you can log in to your account and navigate to the "Tax Return" section, where you will find a link to view your Notice of Assessment. You can also use the "Express NOA" service, which allows you to view your Notice of Assessment immediately after filing your tax return. This service is available for individuals who have filed their tax return electronically and have a valid CRA My Account. Additionally, you can also use the CRA's mobile app, which allows you to view your Notice of Assessment on your mobile device. The online service is available 21 hours a day, 7 days a week, and is a convenient way to access your Notice of Assessment from the comfort of your own home.

By phone through the CRA's automated service

You can obtain your Notice of Assessment by phone through the CRA's automated service. This service is available 24/7 and can be accessed by calling 1-800-959-8281. To use this service, you will need to have your social insurance number, date of birth, and the amount of income tax you paid for the year you are inquiring about. Once you have provided this information, the automated system will provide you with your Notice of Assessment information, including your net income, taxable income, and any balance owing or refund. This service is a convenient way to obtain your Notice of Assessment, especially if you need the information quickly or are unable to access the CRA's online services.

By mail through a written request to the CRA

To obtain a Notice of Assessment by mail, individuals can submit a written request to the Canada Revenue Agency (CRA). This method is ideal for those who prefer a physical copy of their assessment or do not have access to online services. To initiate the process, taxpayers should start by gathering the required information, including their social insurance number, the tax year for which they are requesting the assessment, and their current mailing address. Next, they should write a clear and concise letter to the CRA, specifying their request for a Notice of Assessment and providing the necessary details. The letter should be signed and dated, and it is recommended to keep a copy for personal records. Once the request is prepared, it can be mailed to the CRA at the address specified on their website or on the tax return. The CRA will process the request and mail the Notice of Assessment to the taxpayer's address on file. It is essential to note that this method may take longer than online requests, typically 2-4 weeks, depending on the volume of requests and mail delivery times. Therefore, taxpayers should plan accordingly and allow sufficient time to receive their Notice of Assessment by mail.

Common Issues and Solutions

The Notice of Assessment (NOA) is a crucial document that the Canada Revenue Agency (CRA) sends to taxpayers after processing their tax returns. It outlines the amount of taxes owed or the refund due to the taxpayer. However, sometimes issues may arise with the NOA, causing inconvenience and stress for taxpayers. In this article, we will discuss common issues and solutions related to the NOA, including what to do if you haven't received your NOA, how to correct errors on your NOA, and what to do if you disagree with your NOA. If you're experiencing difficulties with your NOA, don't worry, we've got you covered. Let's start by addressing the first common issue: what to do if you haven't received your NOA.

What to do if you haven't received your NOA

If you haven't received your Notice of Assessment (NOA) from the Canada Revenue Agency (CRA), there are several steps you can take to resolve the issue. First, check your online account through the CRA's My Account service or the MyCRA mobile app to see if your NOA is available digitally. If it's not available online, you can contact the CRA directly by calling their individual tax enquiries line at 1-800-959-8281. Be prepared to provide your social insurance number, date of birth, and the tax year you're inquiring about. The CRA may be able to provide you with a copy of your NOA over the phone or mail one to you. Alternatively, you can also request a copy of your NOA by mail by filling out Form RC151, Request for a Notice of Assessment, and sending it to the CRA. If you're concerned about a delay in receiving your NOA, you can also check the CRA's website for any service disruptions or maintenance that may be affecting mail delivery. Additionally, if you've recently moved, ensure that the CRA has your updated address on file to prevent any delays in receiving your NOA. By following these steps, you should be able to obtain a copy of your NOA and resolve any issues related to its delivery.

How to correct errors on your NOA

Here is the paragraphy: If you notice any errors on your NOA, it's essential to correct them as soon as possible to avoid any potential issues with your tax return or benefits. To correct errors on your NOA, start by reviewing the document carefully and identifying the incorrect information. Next, gather any supporting documentation that proves the correct information, such as receipts, invoices, or bank statements. You can then contact the CRA by phone or mail to request corrections. When contacting the CRA, be prepared to provide your social insurance number, the year of the NOA, and a clear explanation of the error. You can also use the CRA's online services, such as My Account, to request corrections. If you're unable to resolve the issue over the phone or online, you may need to submit a formal request in writing, including the supporting documentation. The CRA will review your request and make the necessary corrections to your NOA. It's essential to keep a record of your communication with the CRA, including the date, time, and details of the conversation or correspondence. This will help you track the progress of your request and ensure that the errors are corrected accurately. By following these steps, you can ensure that your NOA is accurate and up-to-date, which is crucial for your tax return and benefits.

What to do if you disagree with your NOA

Here is the paragraphy: If you disagree with your Notice of Assessment (NOA), there are steps you can take to address the issue. First, review your NOA carefully to identify the specific error or discrepancy. Check your tax return and supporting documents to ensure that the information is accurate. If you find an error, you can contact the Canada Revenue Agency (CRA) to request a correction. You can do this by phone, mail, or through the CRA's online portal, My Account. Be prepared to provide documentation to support your claim. If the issue is more complex, you may want to consider filing a formal objection. This involves submitting a written notice to the CRA, outlining the reasons for your disagreement and providing supporting evidence. The CRA will review your objection and may request additional information. If your objection is denied, you can appeal to the Tax Court of Canada. It's essential to act quickly, as there are time limits for filing objections and appeals. Additionally, consider seeking the advice of a tax professional or accountant to help navigate the process and ensure that your rights are protected.