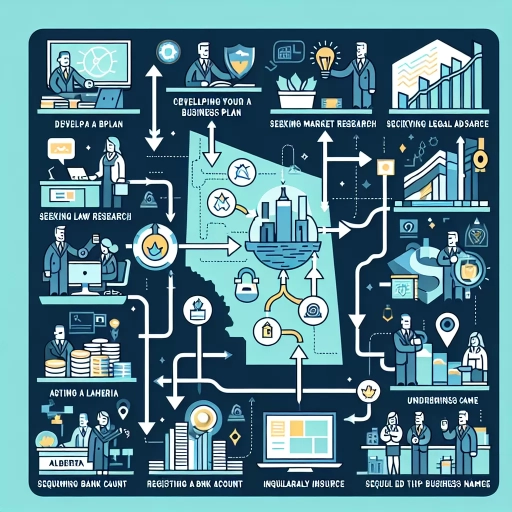

How To Start A Business In Alberta

Understanding the Alberta Business Landscape

Grasping the Market Economy

Alberta has made a name for itself as one of the best provinces in Canada to start a business. This is due to its rich resources, diverse economy, and supportive government policies. As an entrepreneur, understanding the overall market economy is key to developing a successful business venture. It should be noted that Alberta operates within a free-market system where businesses compete for customers. Therefore, having a clear understanding of how this system works would give any startup an essential grounding.

Establishing your Niche

Finding your niche in Alberta's business landscape is another crucial component. The province offers numerous opportunities in various sectors such as energy, agriculture, and information technology, among others. Identifying a unique business idea within these sectors could be a significant step towards creating a successful enterprise. Niche businesses typically deal with specialized aspects of larger industries, and they are often less competitive, making it easier for startups to establish a strong foothold.

Complying with Alberta's Business Regulations

Finally, complying with Alberta's business regulations is a must for any business. These regulations cover a broad range of subjects including business registration, licensing, tax compliance, environmental laws, and more. Adherence to these laws is not just about avoiding penalties—it signifies a company's commitment to responsible business practices which, in turn, boosts public trust and potentially drives more business your way. It cannot be overemphasized: understanding Alberta's business landscape is central to starting a successful business.

Creating a Business Plan

Components of a Strong Business Plan

A strong business plan is critical to getting your business off the ground. It serves as a guide to running your business and it is essential when securing funding from investors or applying for business loans from banks. There are key components a business plan must have such as executive summary, company description, target market analysis, competitive analysis, organizational structure, product line or services description, marketing and sales strategy, and financial projections.

Writing a Compelling Executive Summary

The executive summary is arguably one of the most important parts of a business plan. It provides an overview of your business idea and outlines your plans for realizing it. It is typically about two pages long and should be clear, concise, and compelling enough to persuade potential investors, partners, or other stakeholders. A compelling executive summary is essentially your business plan's sales pitch—it should capture attention and spark interest in your venture.

Formulating a Concrete Marketing and Sales Strategy

Today's business environment is marked by fierce competition, and as such, formulating a concrete marketing and sales strategy is vital. This section of your business plan is your game plan for attracting and retaining customers. It outlines your strategies for advertising and promotion, as well as for sales. Equally important is detailing your understanding of your target audience: Who are they? What motivates them to buy? This knowledge is crucial for crafting a marketing and sales strategy that works.

Registering the Business

Choosing a Suitable Business Structure

Choosing a suitable business structure for your startup has implications for how much you pay in taxes, the paperwork your business is required to do, the personal liability you face, and your ability to raise money. The right business structure for your venture in Alberta could be a sole proprietorship, partnership, or corporation. Each has its own advantages and disadvantages that should be carefully evaluated in light of your business plans and objectives.

Understanding the Business Registration Process

Simplicity characterizes Alberta's business registration process—a factor that appeals to many prospective business owners. The steps usually involve choosing a business name, performing a NUANS report to ensure the name is unique, and then filling certain paperwork, including the registration form. Knowledge of these steps beforehand could save you some crucial time and resources during actual registration.

Staying Compliant with Tax and License Requirements

In Alberta, just like in any other jurisdiction, staying compliant with tax and license requirements is critical. This requires understanding the various taxes your business may be subject to—such as corporate tax, GST, and payroll taxes—and knowing when and how to file them. Besides, depending on the nature of your business, you may need to obtain one or more licenses or permits. Such compliance is not only mandatory—it also contributes to a business's goodwill and reputation. Therefore, investing in acquiring this knowledge is invariably a smart move for any aspiring business owner.