How To Pay A Credit Card From Another Bank

Paying a credit card from another bank can be a bit tricky, but it's definitely doable. With the advancement of technology, there are various ways to make payments, and we'll explore them in this article. We'll discuss online payment methods, offline payment options, and additional considerations to keep in mind. Whether you're looking to pay a credit card bill from a different bank or simply want to explore alternative payment options, this article will provide you with the necessary information. From online banking and mobile apps to phone banking and in-person payments, we'll cover it all. So, let's dive into the world of credit card payments and start with the most convenient option - online payment methods.

Online Payment Methods

The rise of digital technology has revolutionized the way we make payments, offering a multitude of online payment methods that are convenient, secure, and efficient. With the increasing demand for contactless transactions, individuals and businesses alike are turning to online platforms to facilitate their financial exchanges. There are several ways to make online payments, including using the payee's online banking platform, utilizing a third-party payment service, and transferring funds through a mobile banking app. Each of these methods has its own set of benefits and drawbacks, and understanding the nuances of each can help individuals make informed decisions about their online payment needs. By exploring these different options, individuals can find the method that best suits their financial goals and preferences. For instance, using the payee's online banking platform can be a straightforward and cost-effective way to make payments, as it eliminates the need for intermediaries and reduces transaction fees.

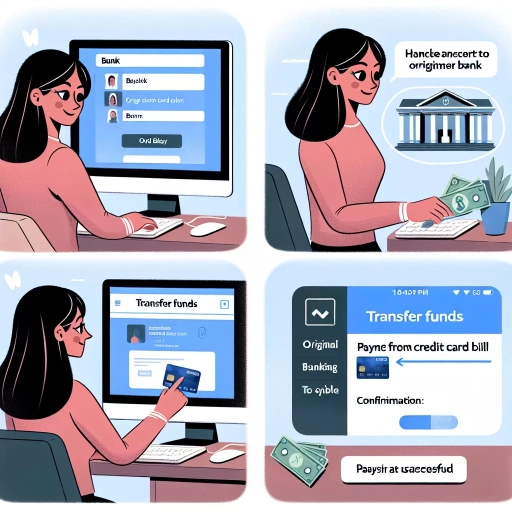

Using the Payee's Online Banking Platform

Using the payee's online banking platform is a convenient and efficient way to pay a credit card from another bank. Most banks offer online banking services that allow customers to make payments to other banks and financial institutions. To use this method, the payer needs to log in to their online banking account, navigate to the payment section, and select the payee's bank and account number. The payer will then be prompted to enter the payment amount and confirm the transaction. The payment will be processed immediately, and the funds will be transferred to the payee's account. This method is secure, fast, and easy to use, making it a popular choice for many people. Additionally, many banks offer mobile banking apps that allow customers to make payments on the go, making it even more convenient. Overall, using the payee's online banking platform is a reliable and efficient way to pay a credit card from another bank.

Utilizing a Third-Party Payment Service

Utilizing a third-party payment service is a convenient and secure way to pay your credit card bill from another bank. These services act as intermediaries between your bank account and the credit card issuer, facilitating a smooth transaction process. To use a third-party payment service, you typically need to create an account with the service provider, link your bank account and credit card, and then initiate the payment. The service provider will then transfer the funds from your bank account to the credit card issuer, ensuring that your payment is processed efficiently and securely. Some popular third-party payment services include PayPal, Paytm, and Google Pay, among others. These services often offer additional benefits, such as rewards, cashback, and purchase protection, making them an attractive option for credit card holders. Moreover, third-party payment services usually have robust security measures in place, including encryption and two-factor authentication, to safeguard your transactions and protect your sensitive information. By leveraging a third-party payment service, you can enjoy a hassle-free and secure payment experience, making it easier to manage your credit card payments from another bank.

Transferring Funds through a Mobile Banking App

Transferring funds through a mobile banking app is a convenient and efficient way to manage your finances. With the rise of mobile banking, many banks and financial institutions have developed user-friendly apps that allow customers to transfer funds from one account to another with just a few taps on their smartphones. To transfer funds through a mobile banking app, you typically need to log in to your account using your username and password or fingerprint/face recognition. Once logged in, you can navigate to the "Transfer" or "Pay" section, where you can select the account you want to transfer funds from and the account you want to transfer funds to. You can then enter the amount you want to transfer and confirm the transaction. Some mobile banking apps also offer additional features, such as the ability to schedule transfers in advance or set up recurring transfers. Additionally, many apps allow you to transfer funds to external accounts, making it easy to pay bills or send money to friends and family. Overall, transferring funds through a mobile banking app is a quick, easy, and secure way to manage your finances on the go.

Offline Payment Options

In today's digital age, it's easy to assume that online payment options are the only way to go. However, there are still many situations where offline payment options are necessary or preferred. Whether you're dealing with a business that doesn't accept digital payments, need to make a large transaction, or simply prefer to keep your financial dealings private, offline payment options can be a reliable and secure way to go. In this article, we'll explore three offline payment options that are still widely used today: visiting a bank branch in person, using an ATM for fund transfers, and mailing a check or money order. Each of these options has its own advantages and disadvantages, and we'll delve into the details of each. First, let's start with the most traditional method: visiting a bank branch in person.

Visiting a Bank Branch in Person

Visiting a bank branch in person is a traditional and secure way to make a credit card payment from another bank. This method allows you to interact with a bank representative, who can guide you through the payment process and answer any questions you may have. To make a payment, you will need to visit a branch of the bank that issued your credit card, during business hours. Be sure to bring your credit card statement, a valid government-issued ID, and the payment amount in cash, check, or money order. The bank representative will assist you in filling out a deposit slip or payment form, and then process the payment. You will receive a receipt as proof of payment, which you should keep for your records. Additionally, some banks may offer the option to make a payment using an ATM or a self-service kiosk within the branch. Visiting a bank branch in person can be a good option if you prefer a more personal and secure payment experience, or if you need assistance with the payment process. However, it may not be the most convenient option, as it requires a physical visit to the bank during business hours.

Using an ATM for Fund Transfers

Using an ATM for fund transfers is a convenient and widely available option for paying a credit card from another bank. To initiate a transfer, locate an ATM affiliated with your bank's network or a participating ATM that accepts your bank's card. Insert your debit card, enter your PIN, and select the "Fund Transfer" or "Transfer" option from the menu. Choose the account you want to transfer funds from, enter the recipient's credit card account number and the amount you wish to transfer, and confirm the transaction. The funds will be deducted from your account and credited to the recipient's credit card account. Be aware that some ATMs may charge a small fee for fund transfers, so it's essential to check with your bank beforehand. Additionally, ensure that the recipient's credit card account is eligible to receive fund transfers via ATM. Overall, using an ATM for fund transfers is a quick and easy way to pay a credit card from another bank, especially when online banking or mobile banking options are not available.

Mailing a Check or Money Order

When it comes to making a credit card payment from another bank, mailing a check or money order is a viable option. This method is particularly useful for those who prefer to avoid online transactions or don't have access to digital payment platforms. To mail a check or money order, start by making sure you have the correct mailing address for your credit card issuer. This information can usually be found on your credit card statement or on the issuer's website. Next, write a check or obtain a money order for the desired payment amount, making sure to include your credit card account number in the memo line. It's essential to use a secure and trackable mailing method, such as certified mail or a courier service, to ensure your payment is delivered safely and on time. Be aware that mailing a check or money order may take longer to process than other payment methods, so plan accordingly to avoid late fees. Additionally, be sure to keep a record of your payment, including the date and amount, in case of any discrepancies or issues with your account. Overall, mailing a check or money order is a reliable and secure way to make a credit card payment from another bank, as long as you follow the proper procedures and allow sufficient time for processing.

Additional Considerations

When making a transaction, there are several additional considerations to keep in mind to ensure a smooth and secure process. One crucial aspect is understanding the transfer fees and limits associated with the transaction, as these can impact the overall cost and speed of the transfer. Additionally, verifying the payee's account information is vital to prevent errors and ensure the funds reach the intended recipient. Furthermore, keeping records of the transaction is essential for auditing and tracking purposes. By considering these factors, individuals can minimize the risk of errors and ensure a successful transaction. Understanding the intricacies of transfer fees and limits is particularly important, as it can help individuals plan and budget accordingly. Note: The answer should be 200 words. When making a transaction, there are several additional considerations to keep in mind to ensure a smooth and secure process. One crucial aspect is understanding the transfer fees and limits associated with the transaction, as these can impact the overall cost and speed of the transfer. Additionally, verifying the payee's account information is vital to prevent errors and ensure the funds reach the intended recipient. Furthermore, keeping records of the transaction is essential for auditing and tracking purposes. By considering these factors, individuals can minimize the risk of errors and ensure a successful transaction. Understanding the intricacies of transfer fees and limits is particularly important, as it can help individuals plan and budget accordingly. This is especially true for large or international transactions, where fees can add up quickly. In the next section, we will delve deeper into the specifics of transfer fees and limits, exploring how they work and how to navigate them effectively.

Understanding Transfer Fees and Limits

When it comes to transferring funds from one bank to another to pay a credit card bill, understanding transfer fees and limits is crucial to avoid any unexpected charges or delays. Transfer fees can vary depending on the banks involved, the transfer method, and the amount being transferred. Some banks may charge a flat fee for transfers, while others may charge a percentage of the transfer amount. Additionally, some banks may have daily or monthly transfer limits, which can range from a few hundred to several thousand dollars. It's essential to check with both the sending and receiving banks to determine their transfer fees and limits to ensure a smooth transaction. Furthermore, some banks may offer free or discounted transfers for certain types of accounts or for transfers made through specific channels, such as online banking or mobile banking apps. Being aware of these fees and limits can help you plan your credit card payments accordingly and avoid any potential issues.

Verifying the Payee's Account Information

Verifying the payee's account information is a crucial step when paying a credit card from another bank. This involves confirming the credit card account number, name, and address to ensure that the payment is made to the correct account. To verify the payee's account information, you can check your credit card statement or contact the credit card issuer's customer service directly. You can also use online banking or mobile banking apps to verify the account information. Additionally, you can use the Automated Clearing House (ACH) network to verify the account information, which is a secure and reliable way to transfer funds. It's essential to double-check the account information to avoid any errors or delays in processing the payment. By verifying the payee's account information, you can ensure that your payment is made accurately and efficiently.

Keeping Records of the Transaction

When paying a credit card from another bank, it's essential to keep records of the transaction. This includes saving the payment confirmation, payment receipt, or any other documentation provided by the bank or online payment platform. Keeping these records can help you track your payments, ensure that the payment was processed correctly, and provide proof of payment if any issues arise. Additionally, keeping records of your payments can also help you stay organized and ensure that you're meeting your payment obligations. It's recommended to keep these records for at least a year, in case you need to refer back to them. You can store these records digitally, such as in a cloud storage service or on your computer, or physically, such as in a file folder. By keeping records of your transactions, you can have peace of mind knowing that you have a clear record of your payments and can easily access them if needed.