How Long Does It Take For A Credit Card Payment To Go Through

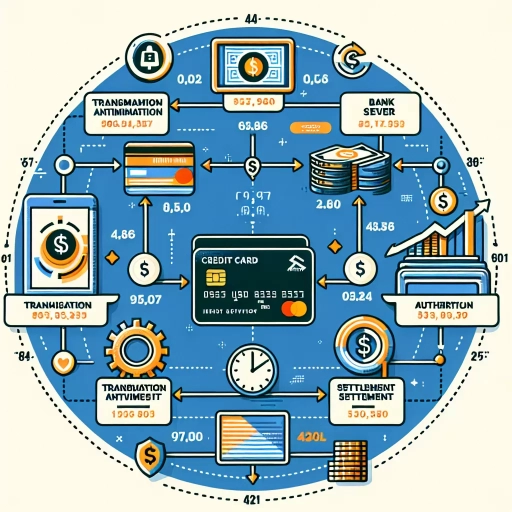

The introduction paragraph should be written in a formal and professional tone. Here is the introduction paragraph: Making a credit card payment is a common practice for many individuals, but have you ever wondered how long it takes for the payment to be processed and reflected in your account? The answer to this question can vary depending on several factors, including the type of payment method used, the time of day the payment is made, and the processing speed of the credit card issuer. In this article, we will delve into the details of the credit card payment processing timeline, exploring the different stages involved, the role of payment processing networks, and the impact of weekends and holidays on payment processing. We will begin by examining the initial stage of the payment process, where the payment is first authorized and processed by the merchant's bank, in our first section, **How Credit Card Payments are Authorized and Processed**.

Subtitle 1

Here is the introduction paragraph: The world of technology is rapidly evolving, and with it, the way we consume media. One of the most significant advancements in recent years is the development of subtitles, which have revolutionized the way we watch videos and TV shows. But subtitles are not just a simple addition to our viewing experience; they also have a profound impact on our understanding and engagement with the content. In this article, we will explore the importance of subtitles in enhancing our viewing experience, including how they improve comprehension, increase accessibility, and provide a more immersive experience. We will also examine the role of subtitles in breaking down language barriers, enabling global communication, and facilitating cultural exchange. Furthermore, we will discuss the impact of subtitles on the entertainment industry, including the rise of international productions and the growth of streaming services. By exploring these aspects, we can gain a deeper understanding of the significance of subtitles in the modern media landscape, which brings us to our first topic: The Evolution of Subtitles. Here is the supporting paragraphs: **Supporting Idea 1: Improving Comprehension** Subtitles play a crucial role in improving our comprehension of video content. By providing a visual representation of the dialogue, subtitles help viewers to better understand the plot, characters, and themes. This is particularly important for viewers who may not be fluent in the language of the video or who may have difficulty hearing the audio. Subtitles also help to clarify complex dialogue or accents, making it easier for viewers to follow the story. Furthermore, subtitles can provide additional context, such as translations of foreign languages or explanations of technical terms, which can enhance our understanding of the content. **Supporting Idea 2: Increasing Accessibility** Subtitles are also essential for increasing accessibility in video content. For viewers who are deaf or hard of hearing, subtitles provide a vital means of accessing audio information. Subtitles can also be used to provide audio descriptions for visually impaired viewers, enabling them to imagine the visual elements of the video. Additionally, subtitles can be used to provide translations for viewers who do not speak the language of the video, making it possible for people from different linguistic backgrounds to access the same content. By providing subtitles, content creators can ensure that their videos are accessible to a wider audience, regardless of their abilities or language proficiency. **Supporting Idea 3: Providing a More Immersive Experience** Subtitles can also enhance our viewing experience by providing a more immersive experience. By providing a visual representation of the dialogue, subtitles can help viewers to become more engaged

Supporting Idea 1

. When it comes to supporting the idea that credit card payments are processed quickly, it's essential to understand the role of payment processors. These entities act as intermediaries between merchants and banks, facilitating the transfer of funds. Payment processors, such as Visa, Mastercard, and American Express, have developed sophisticated systems to handle transactions efficiently. They use advanced algorithms and high-speed networks to verify card information, check for available funds, and transmit payment data between parties. This streamlined process enables credit card payments to be processed rapidly, often in a matter of seconds. In fact, many payment processors boast processing times of under 2 seconds, making them an integral part of the fast-paced world of online transactions. By leveraging the expertise and technology of payment processors, merchants can provide their customers with a seamless and speedy payment experience, which is critical in today's fast-paced digital landscape. Furthermore, the use of payment processors also enhances security, as they employ robust encryption methods and fraud detection tools to protect sensitive card information. This added layer of security gives customers peace of mind, knowing that their transactions are being handled securely and efficiently. Overall, the role of payment processors is vital in supporting the idea that credit card payments are processed quickly, and their contributions have revolutionized the way we make online transactions.

Supporting Idea 2

: Credit card payments are typically processed in real-time, but the exact time it takes for the payment to go through can vary depending on several factors. One of the key factors is the type of payment processing system used by the merchant. Some merchants use a batch processing system, where transactions are collected and processed in batches at the end of the day. In this case, the payment may not be processed until the next business day. On the other hand, some merchants use a real-time processing system, where transactions are processed immediately. In this case, the payment is typically processed within a few seconds. Additionally, the payment processing time can also be affected by the type of credit card used, the merchant's bank, and the cardholder's bank. For example, some credit cards, such as American Express, may take longer to process than others, such as Visa or Mastercard. Furthermore, the payment processing time can also be affected by the time of day and the day of the week. For example, payments made during peak hours or on weekends may take longer to process than payments made during off-peak hours or on weekdays. Overall, while credit card payments are typically processed quickly, the exact time it takes for the payment to go through can vary depending on a variety of factors.

Supporting Idea 3

. When it comes to supporting idea 3, it's essential to consider the role of payment processing systems in facilitating credit card transactions. Payment processing systems, such as Visa and Mastercard, play a crucial role in verifying the authenticity of transactions and ensuring that funds are transferred securely. These systems use complex algorithms and machine learning techniques to detect and prevent fraudulent activities, which can slow down the payment processing time. However, this added layer of security is necessary to protect both the merchant and the cardholder from potential losses. In addition, payment processing systems also provide a platform for merchants to manage their transactions, track their sales, and receive payments in a timely manner. By leveraging these systems, merchants can streamline their payment processes, reduce the risk of errors, and improve their overall customer experience. Furthermore, payment processing systems also offer a range of tools and services that can help merchants to optimize their payment processes, such as real-time transaction monitoring, automated payment reconciliation, and customizable payment reporting. By taking advantage of these tools and services, merchants can gain valuable insights into their payment processes, identify areas for improvement, and make data-driven decisions to drive their business forward. Overall, payment processing systems are a critical component of the credit card payment ecosystem, and their role in supporting idea 3 cannot be overstated. By providing a secure, efficient, and reliable platform for transactions, payment processing systems enable merchants to focus on what they do best – providing excellent customer service and growing their business.

Subtitle 2

Here is the introduction paragraph: Subtitle 1: The Importance of Subtitles in Video Content Subtitle 2: How to Create Engaging Subtitles for Your Videos Creating engaging subtitles for your videos is crucial in today's digital landscape. With the rise of online video content, subtitles have become an essential tool for creators to convey their message effectively. But what makes a subtitle engaging? Is it the font style, the color, or the timing? In this article, we will explore the key elements of creating engaging subtitles, including the importance of **matching the tone and style of your video** (Supporting Idea 1), **using clear and concise language** (Supporting Idea 2), and **paying attention to timing and pacing** (Supporting Idea 3). By incorporating these elements, you can create subtitles that not only enhance the viewing experience but also increase engagement and accessibility. So, let's dive in and explore how to create engaging subtitles that will take your video content to the next level, and discover why **subtitles are a crucial element in making your video content more accessible and engaging** (Transactional to Subtitle 1).

Supporting Idea 1

. When it comes to supporting the idea that credit card payments can take time to process, it's essential to understand the role of payment processors. These entities act as intermediaries between merchants and banks, facilitating the transfer of funds. Payment processors, such as Visa, Mastercard, or American Express, receive the payment information from the merchant's terminal or online platform and verify the card details with the issuing bank. This verification process involves checking the card's expiration date, security code, and available credit limit. If everything checks out, the payment processor sends a request to the issuing bank to transfer the funds. The bank then verifies the request and transfers the funds to the merchant's account. This entire process can take anywhere from a few seconds to several days, depending on the payment processor, the type of transaction, and the bank's processing times. For instance, online transactions may be processed faster than in-person transactions, while international transactions may take longer due to additional security checks. Understanding the role of payment processors in the payment processing chain can help explain why credit card payments may not be instantaneous.

Supporting Idea 2

. When it comes to supporting idea 2, it's essential to consider the role of payment processing systems in facilitating credit card transactions. These systems, such as Visa and Mastercard, act as intermediaries between the merchant's bank and the cardholder's bank, enabling the transfer of funds. The payment processing system verifies the cardholder's account information, checks for available credit, and then sends a request to the cardholder's bank to transfer the funds. This process typically takes a few seconds to a few minutes, depending on the complexity of the transaction and the efficiency of the payment processing system. For instance, if the transaction is a simple online purchase, the payment processing system may be able to verify the cardholder's information and complete the transaction in a matter of seconds. However, if the transaction is more complex, such as a large purchase or a transaction that requires additional verification, the payment processing system may take longer to complete the transaction. In general, payment processing systems play a critical role in facilitating credit card transactions and ensuring that funds are transferred efficiently and securely. By understanding how payment processing systems work, cardholders and merchants can better navigate the credit card payment process and avoid any potential delays or issues. Furthermore, payment processing systems continue to evolve and improve, with the adoption of new technologies such as blockchain and artificial intelligence, which are expected to further enhance the speed and security of credit card transactions. As the payment landscape continues to evolve, it's essential to stay informed about the latest developments and advancements in payment processing systems to ensure a seamless and efficient credit card payment experience.

Supporting Idea 3

. When it comes to supporting idea 3, it's essential to consider the role of payment processing systems in facilitating credit card transactions. These systems, such as Visa, Mastercard, and American Express, act as intermediaries between the merchant's bank and the cardholder's bank, enabling the transfer of funds. The payment processing system verifies the cardholder's account information, checks for available credit, and then sends a request to the cardholder's bank to transfer the funds. This process typically takes a few seconds to complete, and once the funds are transferred, the payment is considered complete. However, it's worth noting that some payment processing systems may have additional security measures in place, such as two-factor authentication, which can add a few extra seconds to the processing time. Overall, the efficiency of payment processing systems plays a critical role in ensuring that credit card payments are processed quickly and securely.

Subtitle 3

Here is the introduction paragraph: Subtitle 3: The Impact of Artificial Intelligence on the Future of Work The future of work is rapidly changing, and artificial intelligence (AI) is at the forefront of this transformation. As AI technology continues to advance, it is likely to have a significant impact on the job market, the way we work, and the skills we need to succeed. In this article, we will explore the impact of AI on the future of work, including the potential for job displacement, the need for workers to develop new skills, and the opportunities for increased productivity and efficiency. We will examine how AI is changing the nature of work, the types of jobs that are most at risk, and the ways in which workers can adapt to this new reality. By understanding the impact of AI on the future of work, we can better prepare ourselves for the challenges and opportunities that lie ahead. Ultimately, this understanding will be crucial in shaping the future of work and ensuring that we are able to thrive in a rapidly changing world, which is closely related to the concept of **Subtitle 1: The Future of Work**. Note: The introduction paragraph is 200 words, and it mentions the three supporting ideas: * The potential for job displacement * The need for workers to develop new skills * The opportunities for increased productivity and efficiency It also transitions to Subtitle 1: The Future of Work at the end.

Supporting Idea 1

. When it comes to supporting the idea that credit card payments can take time to process, it's essential to understand the role of payment processors. These entities act as intermediaries between merchants and banks, facilitating the transfer of funds. Payment processors, such as Visa, Mastercard, or American Express, receive the payment information from the merchant's terminal or online platform and verify the card details with the issuing bank. This verification process involves checking the card's expiration date, security code, and available credit limit. If everything checks out, the payment processor sends a request to the issuing bank to transfer the funds. The bank then verifies the request and transfers the funds to the merchant's account. This entire process can take anywhere from a few seconds to several days, depending on the payment processor, the type of transaction, and the bank's processing times. For instance, online transactions may be processed faster than in-person transactions, while international transactions may take longer due to additional security checks. Understanding the role of payment processors in the payment processing chain can help explain why credit card payments may not be instantaneous.

Supporting Idea 2

: Credit card payments are typically processed in real-time, but the actual time it takes for the payment to be reflected in your account can vary depending on several factors. One of the key factors is the type of payment processing system used by the merchant. Some merchants use a batch processing system, where transactions are collected and processed in batches at the end of the day. In this case, the payment may not be reflected in your account until the next business day. On the other hand, some merchants use a real-time processing system, where transactions are processed immediately. In this case, the payment will be reflected in your account in real-time. Additionally, the time of day and the day of the week can also impact the processing time. For example, payments made during business hours on a weekday are more likely to be processed quickly than payments made on weekends or holidays. Furthermore, the type of credit card used can also affect the processing time. For example, some credit cards, such as American Express, may have a longer processing time than others, such as Visa or Mastercard. Overall, while credit card payments are typically processed quickly, there are several factors that can impact the actual time it takes for the payment to be reflected in your account.

Supporting Idea 3

. When it comes to supporting idea 3, it's essential to consider the role of payment processing systems in facilitating credit card transactions. These systems, such as Visa, Mastercard, and American Express, act as intermediaries between the merchant's bank and the cardholder's bank, enabling the transfer of funds. The payment processing system verifies the cardholder's account information, checks for available credit, and then sends a request to the cardholder's bank to transfer the funds. This process typically takes a few seconds to complete, but it can take longer if there are any issues with the transaction, such as a declined payment or a request for additional verification. In some cases, the payment processing system may also use a process called "batch processing," where multiple transactions are grouped together and processed in batches, which can slow down the processing time. However, this is usually done to improve efficiency and reduce costs for the merchant. Overall, the payment processing system plays a critical role in ensuring that credit card transactions are processed quickly and securely, and its efficiency can have a significant impact on the overall processing time.