How Can I Get My Notice Of Assessment

Here is the introduction paragraph: Receiving your Notice of Assessment (NOA) is a crucial step in the tax filing process. The NOA is a document issued by the Canada Revenue Agency (CRA) that summarizes your tax return and provides important information about your tax account. But have you ever wondered how to get your hands on this essential document? In this article, we will explore the ways to obtain a Notice of Assessment, troubleshoot common issues that may arise, and delve into the details of what the NOA entails. By understanding the Notice of Assessment, you'll be better equipped to navigate the tax system and make informed decisions about your financial situation. So, let's start by understanding what the Notice of Assessment is and why it's so important.

Understanding the Notice of Assessment

The Notice of Assessment is a crucial document that plays a significant role in the tax filing process. It is a document issued by the tax authority to taxpayers after they have filed their tax returns, and it provides a detailed breakdown of their tax liability. Understanding the Notice of Assessment is essential for taxpayers to ensure they are meeting their tax obligations and to avoid any potential penalties or fines. In this article, we will delve into the world of the Notice of Assessment, exploring what it is, why it is important, and what information it includes. By the end of this article, taxpayers will have a comprehensive understanding of the Notice of Assessment and be able to navigate the tax filing process with confidence. So, let's start by answering the most basic question: What is a Notice of Assessment?

What is a Notice of Assessment?

A Notice of Assessment (NOA) is a document issued by the Canada Revenue Agency (CRA) after reviewing an individual's or business's tax return. The NOA outlines the amount of taxes owed or the amount of refund due, as well as any changes or adjustments made to the original tax return. It also provides information on the taxpayer's RRSP deduction limit, Home Buyers' Plan (HBP) repayment, and any other relevant tax-related details. The NOA is typically mailed to the taxpayer within a few weeks of filing their tax return, and it is essential to review it carefully to ensure accuracy and understand any changes or implications for future tax years.

Why is a Notice of Assessment Important?

A Notice of Assessment (NOA) is a crucial document issued by the Canada Revenue Agency (CRA) after reviewing an individual's or business's tax return. It is essential to understand the significance of a NOA, as it plays a vital role in the tax filing process. A NOA is important because it confirms the amount of taxes owed or refunded, and it also serves as a receipt for the tax return filed. The NOA outlines the total income, deductions, and credits claimed, as well as any adjustments made by the CRA. This information is vital for individuals and businesses to ensure they have accurately reported their income and claimed the correct deductions and credits. Furthermore, a NOA is necessary for applying for government benefits, such as the Canada Child Benefit or the GST/HST credit, as it provides proof of income. Additionally, a NOA is required when applying for a mortgage or loan, as lenders use it to verify an individual's or business's income and creditworthiness. In the event of an audit or dispute, a NOA serves as a record of the original tax return and any subsequent adjustments. Overall, a Notice of Assessment is a critical document that provides a summary of an individual's or business's tax situation, and it is essential to carefully review and understand its contents to ensure accuracy and avoid any potential issues.

What Information is Included in a Notice of Assessment?

A Notice of Assessment (NOA) is a document issued by the Canada Revenue Agency (CRA) after reviewing an individual's or business's tax return. The NOA provides a summary of the tax return and any changes made by the CRA. It includes information such as the taxpayer's name, address, and social insurance number, as well as the tax year and type of return filed. The NOA also outlines the total income, deductions, and credits claimed, and the resulting net income or loss. Additionally, it shows the amount of taxes owed or the refund due, including any interest or penalties. The NOA may also include information about any carryover amounts, such as unused RRSP contributions or capital losses, and any amounts owing for other taxes, such as GST/HST or provincial taxes. Furthermore, the NOA may provide information about any tax credits or benefits, such as the Canada Child Benefit or the GST/HST credit. Overall, the NOA provides a comprehensive summary of an individual's or business's tax situation and is an important document for record-keeping and tax planning purposes.

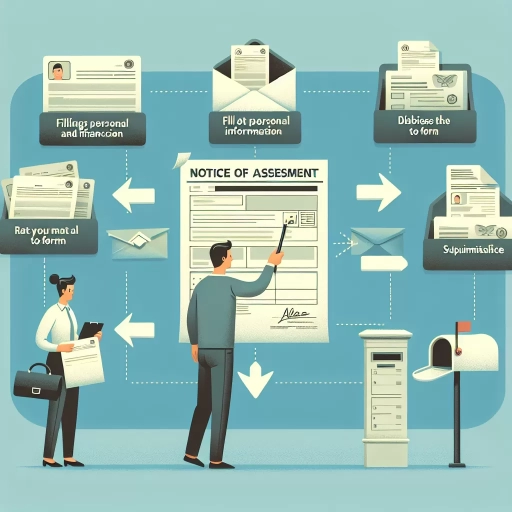

Ways to Obtain a Notice of Assessment

Obtaining a Notice of Assessment is a crucial step in managing your tax obligations in Canada. The Canada Revenue Agency (CRA) provides several convenient ways to access this essential document. You can obtain a Notice of Assessment online through the CRA website, request it by phone, or visit a CRA service counter in person. Each method offers a unique set of benefits and requirements. For instance, online access provides instant availability, while requesting by phone allows for direct communication with a CRA representative. On the other hand, visiting a service counter in person offers a more personalized experience. In this article, we will explore these methods in detail, starting with the most convenient and widely used option: online access through the CRA website.

Online Access through the CRA Website

The Canada Revenue Agency (CRA) provides an efficient and convenient way to access your Notice of Assessment (NOA) through their official website. By registering for a CRA My Account, you can easily view and print your NOA online. To access your NOA, simply log in to your account, navigate to the "Tax Return" section, and select the tax year for which you want to view your NOA. Your NOA will be displayed on the screen, and you can print or save it for your records. Additionally, you can also use the CRA's Auto-fill my return service, which allows you to automatically fill in parts of your tax return with information from your NOA. This service is available through certified tax software, making it easier to complete your tax return accurately and efficiently. Furthermore, the CRA website also provides a secure and reliable way to access other tax-related documents, such as your tax return, tax slips, and benefit information. By accessing your NOA online through the CRA website, you can save time, reduce paperwork, and stay organized with your tax information.

Requesting a Notice of Assessment by Phone

To request a Notice of Assessment by phone, you can contact the Canada Revenue Agency (CRA) at 1-800-959-8281 for individual tax inquiries or 1-800-959-5525 for business tax inquiries. When you call, be prepared to provide your social insurance number, date of birth, and the tax year for which you are requesting the Notice of Assessment. The CRA representative will verify your identity and then provide you with the information you need. You can also ask the representative to mail a copy of your Notice of Assessment to you. Please note that the CRA's phone lines are available from 9:00 a.m. to 5:00 p.m. local time, Monday to Friday, except for holidays. Additionally, be aware that the CRA may experience high call volumes during peak tax season, which may result in longer wait times. It's recommended to call early in the morning or later in the evening to avoid busy periods. By requesting a Notice of Assessment by phone, you can quickly and easily obtain the information you need to complete your tax return or address any tax-related issues.

Visiting a CRA Service Counter in Person

Visiting a CRA Service Counter in Person is a convenient way to obtain a Notice of Assessment. The Canada Revenue Agency (CRA) has service counters located throughout the country, where taxpayers can receive assistance with their tax-related inquiries and obtain a copy of their Notice of Assessment. To visit a CRA Service Counter, taxpayers can find their nearest location by using the CRA's online office locator tool or by calling the CRA's general inquiries line. Once at the service counter, taxpayers will need to provide identification and proof of address to verify their identity. The CRA representative will then assist with printing a copy of the Notice of Assessment, which can be provided on the spot. This method is ideal for those who require immediate assistance or prefer face-to-face interaction. Additionally, CRA Service Counters often offer extended hours of operation, making it easier for taxpayers to visit at a time that suits their schedule. By visiting a CRA Service Counter in Person, taxpayers can quickly and easily obtain their Notice of Assessment, allowing them to access the information they need to complete their tax return or address any tax-related issues.

Troubleshooting Common Issues with Notice of Assessment

Receiving a Notice of Assessment (NOA) from the Canada Revenue Agency (CRA) is a crucial step in the tax filing process. However, issues can arise, causing frustration and uncertainty. If you're experiencing problems with your NOA, don't worry – you're not alone. In this article, we'll explore common issues and provide guidance on how to troubleshoot them. We'll cover what to do if you haven't received your NOA, how to correct errors on your NOA, and understanding the impact of a reassessed NOA. If you're currently waiting for your NOA and it's taking longer than expected, let's start by addressing the first common issue: what to do if you haven't received your Notice of Assessment.

What to Do if You Haven't Received Your Notice of Assessment

If you haven't received your Notice of Assessment (NOA) after filing your tax return, there are several steps you can take to resolve the issue. First, wait for at least 2-3 weeks after the Canada Revenue Agency (CRA) has processed your return, as it may take some time for the NOA to be mailed out. If you still haven't received it, you can contact the CRA directly to inquire about the status of your NOA. You can reach them by phone at 1-800-959-8281 or through their online services, such as My Account or the CRA Mobile App. When you contact the CRA, have your social insurance number and tax return information ready to verify your identity and locate your account. The CRA may be able to provide you with a replacement NOA or guide you through the process of obtaining one. Additionally, you can also check your My Account online or the CRA Mobile App to see if your NOA is available digitally. If you're unable to access your NOA through these channels, you can request a reprint of your NOA, which will be mailed to you within 10 business days. It's essential to note that if you're waiting for your NOA to confirm your eligibility for government benefits or to file other tax-related documents, you may want to consider contacting the relevant authorities to inform them of the delay and ask about possible alternatives or extensions.

How to Correct Errors on Your Notice of Assessment

If you've received your Notice of Assessment (NOA) and noticed errors, don't panic. The Canada Revenue Agency (CRA) provides a straightforward process to correct mistakes. To start, review your NOA carefully and identify the errors. Check for discrepancies in your name, address, social insurance number, income, deductions, and credits. Next, gather supporting documents to substantiate the corrections, such as pay stubs, receipts, or bank statements. You can then contact the CRA by phone or mail to request corrections. When calling, have your NOA and supporting documents ready to provide the necessary information. If mailing, include a clear explanation of the errors and attach the supporting documents. The CRA will review your request and make the necessary corrections. If the errors result in a change to your tax refund or balance owing, the CRA will issue a revised NOA. In some cases, you may need to file an amended tax return, which can be done online or by mail. The CRA will guide you through this process if necessary. It's essential to address errors promptly to avoid any potential delays or penalties. By following these steps, you can ensure your NOA is accurate and up-to-date, providing a clear picture of your tax situation.

Understanding the Impact of a Reassessed Notice of Assessment

Here is the paragraphy: Understanding the Impact of a Reassessed Notice of Assessment A reassessed Notice of Assessment (NOA) can have a significant impact on your tax situation, and it's essential to understand the implications. When the Canada Revenue Agency (CRA) reassesses your tax return, it means they have made changes to your original assessment, which can result in a higher or lower tax bill. If you receive a reassessed NOA, review it carefully to ensure you understand the changes made and the reasons behind them. You may need to pay additional taxes, interest, or penalties, or you may be eligible for a refund. It's crucial to address any discrepancies or errors promptly to avoid further complications. If you disagree with the reassessment, you can file a notice of objection with the CRA, which will review your case and make a decision. In some cases, a reassessed NOA may also affect your eligibility for government benefits, such as the Canada Child Benefit or the Goods and Services Tax (GST) credit. Therefore, it's vital to understand the impact of a reassessed NOA on your overall tax situation and take necessary steps to resolve any issues that may arise.