How To Incorporate In Ontario

Understanding the Basics of Incorporation in Ontario

The Concept of Incorporation

Before diving into the procedures of incorporating a business in Ontario, it is crucial to understand the concept of incorporation itself. Incorporation is a legal process that involves the formation of a new corporation, wherein a company is officially recognized as an entity separate from its owners. It involves numerous legal and financial benefits, including limited liability, easier access to capital, heightened credibility, and perpetual existence. In Ontario, the process is streamlined and easy to navigate provided you adhere to specific requirements and steps.

Benefits of Incorporating in Ontario

Ontario, Canada’s most populous province, is a haven for entrepreneurs and businesses. It offers a conducive environment for businesses to thrive, courtesy of numerous factors, including abundant natural resources, a diverse workforce, and robust infrastructure. More importantly, Ontario has a business-friendly legal environment. By incorporating your business in Ontario, you get to enjoy various benefits. These include enhanced business credibility, easier access to loans and investment capital, and limited liability, which protects your personal assets from business debts. Furthermore, corporations enjoy tax advantages that are not typically available to sole proprietorships and partnerships.

Demystifying the Legal Requirements

Incorporating a business in Ontario means adhering to certain legal obligations. Understanding these legal requirements is paramount in ensuring a smooth incorporation process. Some of these include selecting a unique business name, filing the necessary documents, having a registered address, and appointing directors, among others. It is important to remember that meeting these legal obligations ensures your business operates within the law, thereby avoiding any potential conflicts or liabilities in the future.

Detailed Guide to Incorporation in Ontario

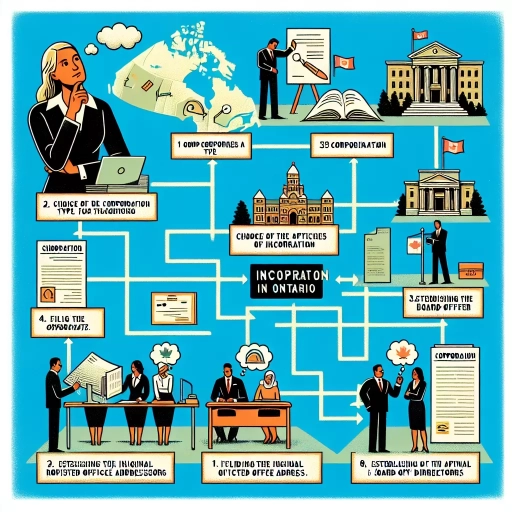

Selecting a Unique Business name

Choosing the right name for your business is a critical decision when incorporating in Ontario. Your business name should be unique, meaningful, and representative of the services or products you offer. Moreover, it should comply with the Business Names Act, mustn't be identical to an existing corporate name, and must end with a legal element such as "Inc," "Limited," or "Corp." It is advisable to conduct a NUANS search to ensure your selected name is unique and does not infringe on existing trademarks.

Filing Articles of Incorporation

The next step is filing the Articles of Incorporation with the Ontario Ministry of Government and Consumer Services. This document outlines critical details about your business, such as its name, registered office address, number and types of shares it’s authorized to issue, and the number of directors. It acts as a constitution for your corporation and forms the legal basis for its existence.

Appointing Directors and Officers

In Ontario, it’s mandatory for businesses to appoint a minimum of one director for privately-held corporations and at least three directors for publicly held ones. Directors can be Canadian residents or non-residents but must be at least 18 years old. They are responsible for managing and supervising the affairs of the corporation. The officers of the corporation, on the other hand, are assigned specific tasks and responsibilities. They can be the directors or simply employees, and their role is pivotal in ensuring smooth company operations.

Maintaining Your Ontario Corporation

Maintaining Corporate Records

As an incorporated entity in Ontario, you are required to maintain certain records. These include the Articles of Incorporation, bylaws, minutes of meetings, register of directors, officers and shareholders, and accounting records, among others. Effective record keeping is not only a legal requirement but also a vital tool for day-to-day management, decision-making, and future planning.

Filing Annual Returns

Ontario corporations are also required to file Annual Returns. These reports provide updated information about the corporation, such as the current directors and their addresses, and changes in share structure, if any. This accountability measure ensures corporations in Ontario operate under high standards of transparency and professionalism.

Benefitting from Legal and Tax Advice

Once your corporation is up and running, you might need to regularly engage with legal and tax advisors to ensure your corporation remains in compliance with the evolving laws and tax obligations. This conservative approach can help your corporation in Ontario mitigate disputes, avoid heavy penalties, and maximize tax benefits.