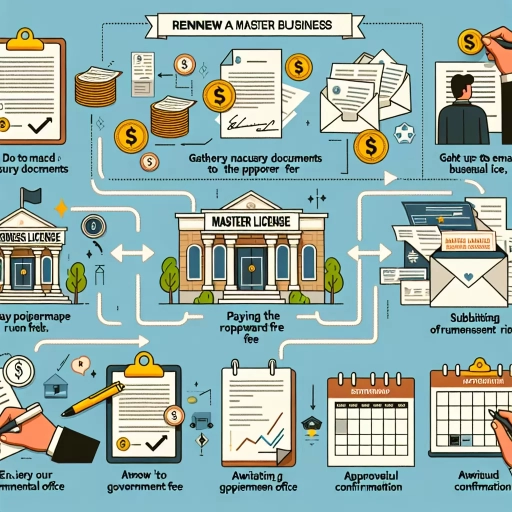

How To Renew Master Business License

Renewing a master business license is a crucial step for businesses to maintain their legal status and continue operating smoothly. To ensure a seamless renewal process, it's essential to understand the requirements and procedures involved. In this article, we will guide you through the necessary steps to renew your master business license, starting with understanding the renewal process itself. We will also cover the essential documents and information you need to gather, as well as the submission process for your renewal application. By the end of this article, you will be well-equipped to navigate the master business license renewal process with confidence. So, let's begin by understanding the master business license renewal process.

Understanding the Master Business License Renewal Process

Here is the introduction paragraph: Renewing a master business license is a crucial step for businesses to maintain their legal status and avoid any potential penalties. However, the process can be complex and time-consuming, especially for those who are new to the business world. In this article, we will break down the master business license renewal process and provide valuable insights to help businesses navigate this process smoothly. We will start by explaining what a master business license is and why it is important, followed by discussing who needs to renew their master business license, and finally, highlighting the consequences of not renewing your master business license. By understanding these key aspects, businesses can ensure they are in compliance with the law and avoid any unnecessary complications. So, let's start by understanding what a master business license is and why it is important.

What is a Master Business License and Why is it Important?

A Master Business License is a mandatory license required for businesses operating in the state of Washington, USA. It is a registration that allows businesses to operate legally and is issued by the Washington State Department of Licensing. The license is important because it verifies that a business has met the necessary requirements to operate in the state, including registering with the Secretary of State, obtaining any necessary local licenses, and paying the required fees. Having a Master Business License is crucial for businesses as it allows them to open bank accounts, obtain credit, and enter into contracts. Additionally, it provides a level of credibility and legitimacy to the business, which can be beneficial when dealing with customers, suppliers, and partners. Furthermore, the license is required for tax purposes, and businesses that fail to obtain or renew their Master Business License may face penalties and fines. Overall, a Master Business License is a critical component of doing business in Washington state, and businesses must ensure they obtain and maintain it to operate legally and successfully.

Who Needs to Renew Their Master Business License?

Businesses that need to renew their Master Business License include those that have an active license and are required to file annual reports with the state. This typically includes corporations, limited liability companies (LLCs), limited partnerships (LPs), and limited liability partnerships (LLPs). Additionally, businesses that have made changes to their structure, ownership, or name may need to renew their license to reflect these updates. Sole proprietorships and general partnerships may not need to renew their license, but they may still need to file annual reports or other paperwork with the state. It's essential for businesses to check with their state's licensing authority to determine their specific renewal requirements.

Consequences of Not Renewing Your Master Business License

Renewing your Master Business License is a crucial step in maintaining your business's legitimacy and compliance with state regulations. Failing to do so can have severe consequences, including fines, penalties, and even business closure. If you don't renew your license, you may be subject to late fees and interest charges, which can quickly add up and become a significant financial burden. Moreover, an expired license can lead to the suspension or revocation of your business's ability to operate, resulting in lost revenue and damage to your reputation. Additionally, you may be required to pay back taxes and fees, and in some cases, you may even face legal action. In extreme cases, failure to renew your Master Business License can lead to the dissolution of your business, resulting in the loss of your livelihood and investment. It is essential to prioritize the renewal of your Master Business License to avoid these consequences and ensure the continued success and growth of your business.

Gathering Required Documents and Information

When it comes to gathering required documents and information for your business, it's essential to be thorough and meticulous. This process is crucial for various purposes, such as loan applications, tax compliance, and business registration. To ensure you have everything in order, you'll need to collect and organize several key documents and pieces of information. This includes business registration documents and certificates, financial statements and tax returns, and updated business information and contact details. By having these documents and information readily available, you'll be able to navigate the complexities of business operations with ease. In this article, we'll delve into the specifics of each of these requirements, starting with the importance of business registration documents and certificates.

Business Registration Documents and Certificates

When renewing a Master Business License, it's essential to gather all the necessary business registration documents and certificates. These documents serve as proof of your business's legitimacy and compliance with regulatory requirements. Typically, you'll need to provide your business registration certificate, which is issued by the state or local government when you initially registered your business. This certificate confirms your business name, structure, and ownership. Additionally, you may need to provide other documents, such as your articles of incorporation, articles of organization, or a fictitious business name statement, depending on your business type and location. You may also need to provide certificates of good standing, which verify that your business is up-to-date on all state and local taxes and fees. Furthermore, if your business has undergone any changes, such as a name change or change in ownership, you'll need to provide documentation of these changes, such as amended articles of incorporation or a certificate of amendment. Having all these documents in order will ensure a smooth renewal process and help you avoid any potential delays or penalties.

Financial Statements and Tax Returns

Financial statements and tax returns are crucial documents required for renewing a master business license. These documents provide a comprehensive overview of a company's financial performance and position, enabling the licensing authority to assess its creditworthiness and compliance with tax laws. A financial statement typically includes a balance sheet, income statement, and cash flow statement, which collectively provide insights into a company's assets, liabilities, revenues, expenses, and cash flows. Tax returns, on the other hand, demonstrate a company's adherence to tax laws and regulations, showcasing its tax obligations, payments, and any refunds or liabilities. By reviewing these documents, the licensing authority can verify a company's financial stability, tax compliance, and overall business health, thereby ensuring that it meets the necessary requirements for a master business license renewal. Furthermore, financial statements and tax returns can also help identify any potential risks or issues that may impact a company's ability to operate, allowing the licensing authority to take proactive measures to mitigate these risks. Overall, the submission of accurate and up-to-date financial statements and tax returns is essential for a successful master business license renewal application.

Updated Business Information and Contact Details

When renewing a Master Business License, it is essential to ensure that your business information and contact details are up-to-date and accurate. This includes verifying your business name, address, and contact information, such as phone numbers and email addresses. You should also confirm that your business structure, ownership, and management details are current and reflect any changes that may have occurred since your last license renewal. Additionally, you may need to provide updated information about your business activities, products, or services, as well as any changes to your business location or operations. It is crucial to review and update your business information and contact details carefully, as any errors or inaccuracies can lead to delays or even rejection of your license renewal application. By taking the time to verify and update your business information, you can ensure a smooth and efficient license renewal process.

Submitting Your Master Business License Renewal Application

Renewing your Master Business License is a crucial step in maintaining your business's compliance with state regulations. To ensure a smooth renewal process, it's essential to understand the different submission options available to you. In this article, we'll guide you through the process of submitting your Master Business License renewal application, covering the online application portal and required fees, mail or in-person submission options, and how to track your application status and follow up. By the end of this article, you'll be equipped with the knowledge to successfully submit your renewal application. Let's start by exploring the online application portal and required fees, which offer a convenient and efficient way to renew your Master Business License.

Online Application Portal and Required Fees

The online application portal is a convenient and efficient way to renew your Master Business License. To access the portal, you will need to create an account or log in to your existing account. Once you have logged in, you will be prompted to select the type of license you are renewing and provide the required information. The online application portal will guide you through the process, ensuring that you provide all the necessary documentation and information. The required fees for renewing a Master Business License vary depending on the type of business and the location. The fees typically include a license fee, a late fee (if applicable), and a payment processing fee. The license fee ranges from $20 to $100, depending on the type of business. The late fee is typically $25, but it may be higher if you are renewing your license more than 30 days after the expiration date. The payment processing fee is usually around 2.5% of the total payment. It's essential to note that the fees are non-refundable, so it's crucial to ensure that you have all the required information and documentation before submitting your application. Additionally, you may need to pay for any outstanding taxes or penalties before your license can be renewed. The online application portal will provide you with a detailed breakdown of the fees and any additional costs associated with renewing your Master Business License.

Mail or In-Person Submission Options

When it comes to submitting your Master Business License renewal application, you have two convenient options: mail or in-person submission. If you prefer to submit your application by mail, you can send it to the Business Licensing Service (BLS) at the address provided on the application form. Make sure to use a trackable mail service, such as USPS, UPS, or FedEx, to ensure that your application is delivered safely and efficiently. It's also a good idea to keep a copy of your application and supporting documents for your records. On the other hand, if you prefer a more personal touch, you can submit your application in person at a BLS office location. This option allows you to interact with a licensing representative who can answer any questions you may have and provide guidance on the application process. Additionally, submitting your application in person can help ensure that it is complete and accurate, reducing the risk of delays or rejection. Regardless of which option you choose, be sure to follow the instructions carefully and include all required documentation to avoid any issues with your renewal application. By choosing the submission method that works best for you, you can ensure a smooth and efficient renewal process for your Master Business License.

Tracking Your Application Status and Follow-up

After submitting your Master Business License renewal application, it's essential to track the status of your application and follow up as needed. You can usually check the status of your application online through the state's business licensing website or by contacting the licensing authority directly. If you submitted your application online, you may be able to log in to your account to view the status. If you submitted a paper application, you may need to contact the licensing authority to inquire about the status. It's a good idea to follow up on your application if you haven't received a response or update within a few weeks. You can contact the licensing authority via phone or email to inquire about the status of your application. Be prepared to provide your business name, license number, and other identifying information to facilitate the lookup. If there are any issues or deficiencies with your application, the licensing authority will typically contact you to request additional information or clarification. Be sure to respond promptly to any requests to avoid delays in the processing of your application. By tracking the status of your application and following up as needed, you can help ensure that your Master Business License is renewed in a timely manner and avoid any potential penalties or fines for non-compliance.