How To Get A Void Check

A void check is a crucial document required for various financial transactions, including setting up direct deposit, automatic bill payments, and verifying account information. To obtain a void check, individuals can follow a few simple steps. First, it's essential to understand the purpose of a void check and how it's used in financial transactions. This knowledge will help individuals appreciate the importance of having a void check and how it can facilitate smooth financial operations. Once the purpose is understood, individuals can proceed to obtain a void check from their bank, either by visiting a branch in person, contacting customer service, or using online banking services. Alternatively, individuals can also explore other methods for getting a void check, such as using a check printing software or requesting a void check from their employer. By understanding the purpose of a void check and exploring the available options, individuals can easily obtain this essential document and complete their financial transactions efficiently. Understanding the purpose of a void check is the first step in this process, and it's essential to grasp this concept before proceeding further.

Understanding the Purpose of a Void Check

A void check is a crucial document in various financial transactions, serving as a safeguard against unauthorized access to one's bank account. Understanding the purpose of a void check is essential for individuals and businesses alike, as it can help prevent financial losses and protect sensitive information. In this article, we will delve into the world of void checks, exploring what they are and why they are needed, common situations where they are required, and the consequences of not having one when needed. By the end of this article, readers will have a comprehensive understanding of the importance of void checks and how they can be used to protect their financial interests. So, let's start by understanding what a void check is and why it is needed.

What is a Void Check and Why is it Needed

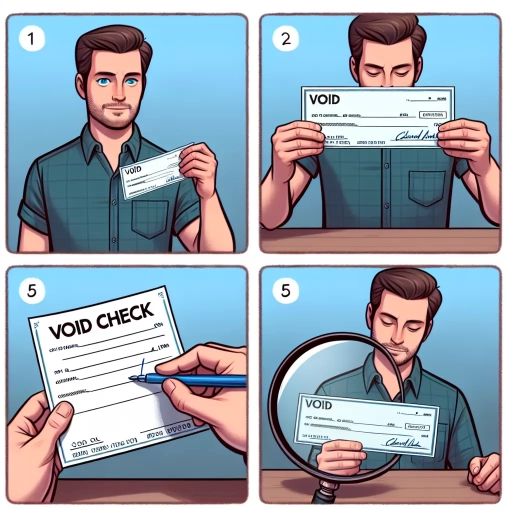

A void check is a check that has been intentionally marked as "void" to prevent it from being used as a valid payment method. This is typically done by writing "VOID" in large letters across the front of the check, making it clear that the check is not intended to be cashed or deposited. A void check is often needed when setting up direct deposit, automatic payments, or electronic fund transfers, as it provides a way to verify the account holder's information and ensure that the funds are being transferred to the correct account. By providing a void check, the account holder is giving permission for the payor to access their account and make deposits or withdrawals. This helps to prevent errors and ensures that the funds are being transferred securely and accurately. In some cases, a void check may also be required to set up a new account or to update existing account information. Overall, a void check is an important tool for verifying account information and ensuring the secure transfer of funds.

Common Situations Where a Void Check is Required

A void check is often required in various common situations to verify account information, prevent unauthorized transactions, and ensure secure payment processing. One of the most common situations where a void check is required is when setting up direct deposit for payroll, government benefits, or tax refunds. In this case, a void check is used to confirm the account holder's identity and account details, ensuring that the funds are deposited into the correct account. Another situation where a void check is necessary is when setting up automatic bill payments or electronic fund transfers. This helps to verify the account information and prevent any errors or misdirected payments. Additionally, a void check may be required when opening a new bank account or applying for a loan, as it serves as proof of account ownership and helps to prevent identity theft. Furthermore, some businesses may request a void check as part of their payment processing setup, such as when setting up a merchant account or online payment gateway. In all these situations, a void check provides a secure and reliable way to verify account information and prevent any potential errors or fraudulent activities.

Consequences of Not Having a Void Check When Needed

Not having a void check when needed can have several consequences, including delayed or rejected direct deposit setup, missed paychecks, and potential financial penalties. Without a void check, employers or financial institutions may not be able to verify the account information, leading to errors or rejections. This can result in delayed payment processing, causing inconvenience and financial hardship for individuals who rely on timely payments. Furthermore, some employers or financial institutions may charge fees for incorrect or incomplete account information, adding to the financial burden. In some cases, not having a void check can also lead to identity theft or account fraud, as sensitive account information may be compromised during the verification process. Additionally, not having a void check can make it difficult to set up automatic bill payments, leading to late fees and negative credit reporting. Overall, not having a void check when needed can lead to a range of negative consequences, emphasizing the importance of having one readily available.

Obtaining a Void Check from Your Bank

Obtaining a void check from your bank is a relatively straightforward process that can be completed in a few different ways. If you need a void check for setting up direct deposit, verifying your account information, or for any other purpose, you can request one from your bank. There are typically three ways to obtain a void check: by requesting one from your bank teller, through online banking, or by understanding your bank's specific policies and requirements for issuing void checks. In this article, we will explore each of these methods in more detail. To start, let's take a look at how to request a void check from your bank teller.

Requesting a Void Check from Your Bank Teller

When requesting a void check from your bank teller, it's essential to be clear and concise about your needs. Start by approaching the bank teller and explaining that you need a void check for a specific purpose, such as setting up direct deposit or verifying your account information. Be prepared to provide your account number and identification to verify your account ownership. The bank teller will then print a check with the word "VOID" written across it, making it unusable for any financial transactions. This check will contain your account and routing numbers, which are necessary for the intended purpose. It's crucial to ensure that the check is indeed voided, as an active check could lead to unintended transactions. Once you receive the void check, review it carefully to confirm that it meets your requirements. If everything is in order, you can use the void check to complete the necessary paperwork or provide it to the relevant party. Throughout the process, the bank teller should be able to guide you and answer any questions you may have, ensuring a smooth and efficient experience.

Getting a Void Check Through Online Banking

To obtain a void check through online banking, you can follow these steps. First, log in to your online banking account using your credentials. Once you're logged in, navigate to the "Account Services" or "Account Management" section. Look for the "Order Checks" or "Check Services" option and click on it. Some banks may have a "Void Check" or "Stop Payment" option directly available. If you can't find it, you can contact your bank's customer support for assistance. They will guide you through the process or provide you with a void check. Alternatively, you can also use your bank's mobile app to request a void check. Simply log in to the app, go to the "Account Services" section, and look for the "Void Check" or "Stop Payment" option. Fill out the required information, and your bank will provide you with a void check. In some cases, your bank may require you to confirm your identity or provide additional information to process your request. Once you've submitted your request, your bank will typically provide you with a void check within a few business days. You can then use this void check to set up direct deposit or make other financial transactions.

Bank Policies and Requirements for Issuing Void Checks

When it comes to issuing void checks, banks have specific policies and requirements in place to ensure the security and integrity of the checking account. Typically, banks require the account holder to request a void check in person or over the phone, and some may also offer online request options. To obtain a void check, the account holder must provide identification and verify their account information to confirm their identity and account ownership. The bank may also require the account holder to sign a request form or provide a written authorization to issue the void check. Additionally, some banks may have specific requirements for the type of account, such as a business account, or the account balance, such as a minimum balance requirement. Furthermore, banks may also have policies in place for the number of void checks that can be issued within a certain timeframe, and may charge a fee for excessive requests. It's essential to check with your bank to understand their specific policies and requirements for issuing void checks, as these can vary from bank to bank. By following the bank's policies and requirements, account holders can ensure a smooth and secure process for obtaining a void check.

Alternative Methods for Getting a Void Check

When it comes to obtaining a void check, there are several alternative methods that can be employed. A void check is a check that has the word "VOID" written across it, indicating that it cannot be used for payment. This type of check is often required by employers, banks, and other financial institutions to set up direct deposit, verify account information, and process payroll. Fortunately, individuals do not necessarily need to rely on traditional methods of obtaining a void check. Instead, they can explore alternative methods such as creating a void check from a regular check, using a check printing software to generate a void check, or requesting a void check from their employer or payroll department. By understanding these alternative methods, individuals can save time and effort in obtaining a void check. For those who have a regular check on hand, creating a void check from it is a simple and convenient option.

Creating a Void Check from a Regular Check

Creating a void check from a regular check is a simple process that can be done at home. To start, take a regular check and write "VOID" in large letters across the front of the check, making sure to cover the entire check. This will render the check unusable for any financial transactions. You can use a pen or a marker to write "VOID" on the check, but make sure the ink is permanent and won't smudge or fade easily. It's also a good idea to write "VOID" on the back of the check as well, to further ensure that it can't be used. Once you've written "VOID" on the check, it's ready to use as a sample check for setting up direct deposit or other financial transactions. Keep in mind that a voided check is only valid for a short period of time, usually 6-12 months, so be sure to check with your bank or financial institution for their specific policies on voided checks.

Using a Check Printing Software to Generate a Void Check

Using a check printing software is a convenient and efficient way to generate a void check. This method is particularly useful for businesses or individuals who need to provide a void check for direct deposit or other financial purposes. Check printing software allows users to create and print their own checks, including void checks, using their computer and printer. To generate a void check using this method, simply open the software, select the "void" option, and enter the relevant information, such as the check number, date, and payee name. The software will then print a void check with the word "VOID" clearly marked across the front. This method is quick, easy, and eliminates the need to physically go to the bank or wait for a void check to be mailed. Additionally, check printing software often includes security features, such as encryption and password protection, to ensure that sensitive financial information is protected. Overall, using a check printing software is a reliable and efficient way to generate a void check, making it a great alternative to traditional methods.

Requesting a Void Check from Your Employer or Payroll Department

Requesting a void check from your employer or payroll department is a straightforward process that can be completed with a simple phone call or email. Start by contacting your HR representative or payroll department and explain that you need a void check for direct deposit or other financial purposes. They may ask for your employee ID or other identifying information to verify your request. Once verified, they will typically generate a void check and mail it to you or make it available for pickup. In some cases, they may also be able to provide a digital copy of the void check, which can be emailed to you. Be sure to confirm with your employer or payroll department what their specific process is for requesting a void check, as it may vary. Additionally, if you are no longer employed with the company, you may need to provide additional documentation or follow a different process to obtain a void check.