How To Cancel E Transfer Scotiabank

Understanding How E-Transfer Works At Scotiabank

The Definition and Purpose of Scotiabank's E-transfer

When talking about Scotiabank, one cannot belittle the importance of its e-transfer system. The service has been protagonists in providing customers the ability to send money easily through electronic means. Its mechanism allows easy transfer to recipients even if they don't bank with Scotiabank, this makes the service incredibly versatile and important. The system works by sending an email or an SMS to the recipient once money has been transferred to them. They can deposit the payment to their account with the use of a unique security question and answer, that was set up by the sender.

Understanding the Different Features of E-transfer

Understanding the functionalities of e-transfer is an integral step when intending to cancel transactions. To begin with, the service allows users to send money to anyone with an email address or mobile phone, and a bank account in Canada. Another prominent feature is its simplicity; to make a transfer, all you need to do is log-on to Scotiabank's online or mobile banking. Indeed, the system is not only user-friendly, but it also assures a secure sending of your money. The system's security is manifested by the encryption it uses, and the security question and answer the sender sets for the recipient. In terms of availability, as long as you have online or mobile banking, you can send money anytime and anywhere.

Examining Common Scenarios for Canceling E-transfers

Various reasons and scenarios may push a user to resort to cancelling an e-transfer. A common scenario is accidentally sending money to the wrong recipient. This could occur due to a typo in the email address or selecting the wrong recipient if you have several in your list. Another situation is when the recipient has difficulties answering the security question. A delay in the recipient's action can also push the sender to cancel the transfer. Scotiabank's system allows you to see if the recipient has deposited the money, hence you can decide to cancel the transaction if it is too long.

Steps to Cancel E-Transfer ScotiaBank

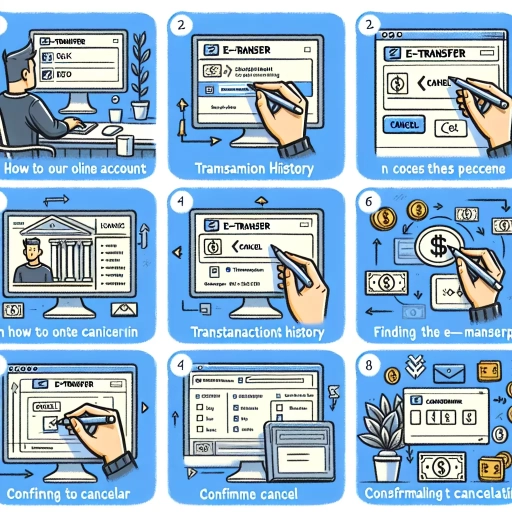

Navigating Through ScotiaBank's Website or Application

Both the Scotiabank's website and mobile banking app have user-friendly interfaces. To cancel an e-transfer, you'll first need to log in to your online or mobile banking and find the list of your e-transfers. Once you've located it, you'll see all of your active e-transfers and you can select the one that you want to cancel. Make sure you select the correct one, as this step may lead to cancellation of other e-transfers.

Canceling the E-transfer

After identifying the transfer you want to cancel, go on and click or tap on the "cancel" button. A prompt asking for confirmation will appear on the screen. Ensure to thoroughly read it before confirming, as this implies that you are sure of the cancellation. Understand that the cancellation isn't always guaranteed, as it depends on whether or not the recipient has already deposited the money into their account.

After Canceling E-transfer

Once you've cancelled an e-transfer, the money will be credited back to your account almost immediately. Remember to plan how to resend the money in case the recipient still needs it. However, the ease of use of the service means this shouldn't be a problem. If there was an error in the address or phone number, revise it thoroughly before sending it. The recipient also has an option to contact you in case they can't answer the security question, which allows you to give them a hint without revealing the answer.

Important Tips on ScotiaBank E-transfer Cancellation

Considerations For Canceling An E-transfer

When cancelling your e-transfer, keep in mind that it's only possible if the recipient has not already deposited the money. As the sender, it is your responsibility to ensure the information is correct before sending any e-transfer to avoid cancellation. Always double-check the recipient's email or mobile number. The system also allows senders to add a note or memo to the recipient, this should be properly utilized to avoid future confusions.

ScotiaBank's Fees For Canceling An E-transfer

ScotiaBank typically does not charge any fees for canceling e-transfers. However, the bank does retain the right to introduce such fees at its discretion. It's therefore advisable to always check for any possible fees when looking to cancel any transfer. Contact the bank directly in case such fees exist as this ensures you would not get more charges than you expected.

Importance of Communication in Canceling E-transfer

Effective communication between the sender and the recipient is important when canceling the e-transfer. Whenever a sender needs to cancel the transfer, it is crucial to inform the recipient beforehand, if possible. This will decrease the chance of misunderstandings, especially if the recipient is waiting for the money.