How To Send Money From Canada To Pakistan

Understanding the Basics of International Money Transfers

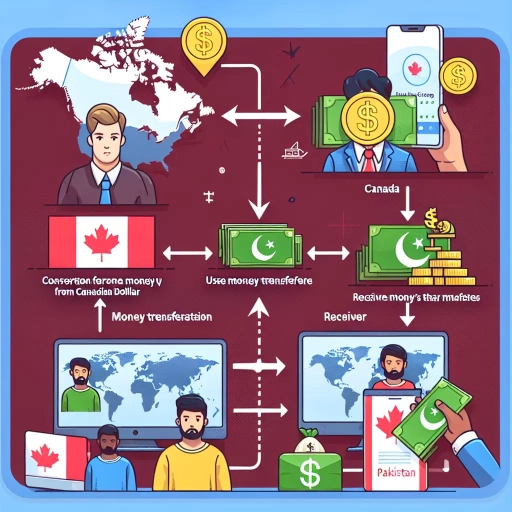

Exploring the Process

The process of sending money from Canada to Pakistan may seem daunting at first due to the international boundaries that need to be crossed. However, there are numerous well-established services and methods available today that have simplified the process significantly. These include banks, money transfer operators like Western Union or MoneyGram, and online services like TransferWise or PayPal. The key lies in understanding the specific process each service follows, including their fees, exchange rates, and transfer durations. This knowledge will enable you to make an informed decision about the best method to use based on your unique requirements.

Transaction Fees and Exchange Rates

Transaction fees and exchange rates play a vital role in international money transfers. They directly affect the amount of money the recipient will receive. Therefore, before choosing a method, it is crucial to compare the charges and rates offered by different services. Some services charge a flat fee, while others charge a percentage of the amount being sent. Similarly, some services offer competitive exchange rates while others add a significant margin. A good service ultimately offers a favorable balance of low fees and competitive rates.

Avoiding Common Pitfalls

Due to the myriad of services available, individuals may face confusion and end up falling prey to common pitfalls such as hidden fees, unfavorable exchange rates, and lengthy transfer durations. Therefore, it is important to clearly understand the terms and conditions of your chosen service. Avoid services that lack transparency in their pricing structure or have a history of delayed transfers. Furthermore, always keep receipts or record of the transaction as proof of the transfer.

Selecting and Using the Best Money Transfer Services

Finding Reliable Service Providers

Finding a reliable money transfer service is crucial for a smooth, quick, and cost-effective transfer. Reliable service providers prioritize transparency, efficiency, and offer competitive rates. They also keep their customers updated about the status of their transfer and provide customer service for any queries or issues. Further, customer reviews and ratings also serve as indicators of a service provider's reliability and quality of service. The most reliable services have been in the industry for a while and have a strong reputation.

Using Online Services

Online services have become a popular choice for international money transfers due to their ease of use, cost-effectiveness, and speed. Services like TransferWise and PayPal allow you to send money directly to the recipient's bank account or to an email address. However, both sender and recipient usually need to have an account with the service. The transfer can be initiated from the comfort of your home or office and is usually completed within 1-2 business days.

Traditional Bank Transfers

Traditional bank transfers can be a good option for large amounts due to their security measures. However, they are not known for speed and are often more expensive due to high transaction fees and poor exchange rates. Further, both the sender and receiver need to have a bank account. Therefore, this method is suitable for regular, large-scale transfers where the transaction safety outweighs the cost and time considerations.

Regulations and Guidelines for Money Transfers to Pakistan

Understanding Regulatory Framework

While sending money to Pakistan from Canada, it's essential to understand the regulatory framework under which these international transactions operate. Both countries have specific rules and requirements for inbound and outbound international money transfers. For instance, the Government of Pakistan requires documentation for any transactions above a certain threshold. Understanding these regulations will ensure that you remain compliant with the rules and avoid unnecessary delays or complications during the transfer.

Pakistani Banking System

The banking system in Pakistan may be slightly different from what you're familiar with in Canada. Therefore, it is important to learn about the recipient's banking context to ensure a smooth transaction. This includes details like bank working hours, account types, and procedures for receiving international transfers. It can also be beneficial to check if the receiver's bank has a partnership with your Canadian bank or transfer service, as this might speed up the transfer process and even reduce costs.

Tax Implications of Money Transfers

When sending significant amounts of money, it's crucial to be aware of the potential tax implications in both Canada and Pakistan. In some cases, these transfers could be subject to taxes, especially if they are regular or large amounts. Consulting with a tax advisor or doing thorough online research on the rules and regulations around this topic can save you from unexpected tax liabilities in the future.