How To Fill A Cheque

Wading through the sea of financial transactions, a method stands resilient amidst digital disruptions - the humble cheque. Serving as the bridge between physical and digital financial transactions, cheques offer a level of financial control and non-immediacy that electronic forms may not provide. This article seeks to simplify and elucidate the method behind filling out a cheque correctly. Beginning with understanding the basic components of a cheque, we'll guide you meticulously through each section, ensuring you never miss a step. Subsequently, we'll detail a comprehensive step-by-step guide on how to fill out a cheque precisely and avoid common mistakes. A focused understanding of these aspects can significantly minimize errors, ensuring your cheque transactions remain seamless and efficient. Strap in as we navigate the world of financial scrip, transitioning into the first section: understanding the basics of a cheque.

Wading through the sea of financial transactions, a method stands resilient amidst digital disruptions - the humble cheque. Serving as the bridge between physical and digital financial transactions, cheques offer a level of financial control and non-immediacy that electronic forms may not provide. This article seeks to simplify and elucidate the method behind filling out a cheque correctly. Beginning with understanding the basic components of a cheque, we'll guide you meticulously through each section, ensuring you never miss a step. Subsequently, we'll detail a comprehensive step-by-step guide on how to fill out a cheque precisely and avoid common mistakes. A focused understanding of these aspects can significantly minimize errors, ensuring your cheque transactions remain seamless and efficient. Strap in as we navigate the world of financial scrip, transitioning into the first section: understanding the basics of a cheque.Understanding the Basics of a Cheque

In today's digital age, traditional forms of payment like cheques may seem outdated. However, they still play a pivotal role in our financial systems. In this comprehensive article, we will examine the basics of a cheque - a tool frequently employed for monetary transactions. In the pursuit to demystify this financial instrument, we'll delve into three crucial areas. Firstly, we will familiarize ourselves with the definition and core purpose of a cheque, expounding on how it functions as an effective means of payment. Secondly, we'll break down a cheque into its major components, providing an in-depth explanation of each element, and demonstrating how they act in combination to fulfill a cheque's purpose. Lastly, to ensure absolute comprehension, we shall browse through a glossary of common terms associated with cheques, terminologies that may seem foreign, but are essential in fully grasping the concept. Armed with this knowledge, cheques no longer will be an enigma to you. Our first step would be to delve into the definition and purpose of a cheque, a fascinating journey towards financial literacy.

1. The Definition and Purpose of a Cheque

A cheque, as a fundamental medium of financial exchange, fulfills multiple essential functions in our contemporary economic framework. It is a written document issued by an account holder, also referred to as the drawer, directing a bank to pay a specific sum of money to the entity or person mentioned in the document, known as the payee. Contrary to the immediacy of cash transactions, cheques involve a process where money is transacted, not physically, but from one account to another when the cheque is cleared. Its role extends beyond being a simple payment tool: it upholds the values of trust, responsibility, and accountability in financial transactions. A key purpose of a cheque is to enable secure and efficient monetary exchanges with a physical document acting as proof of transaction, thus providing a clear trail for record-keeping and accountability. It allows payments without the requirement for physical cash transactions, fostering convenience, especially for large sums. Further exemplifying flexibility and security, cheques are often preferred in situations involving distant transactions, guaranteeing that the funds reach the intended recipient. Understanding these elements reinforces our perception of a cheque's value in facilitating a responsible, transparent financial process, hence guiding us to fill a cheque properly.

2. The Major Components of a Cheque

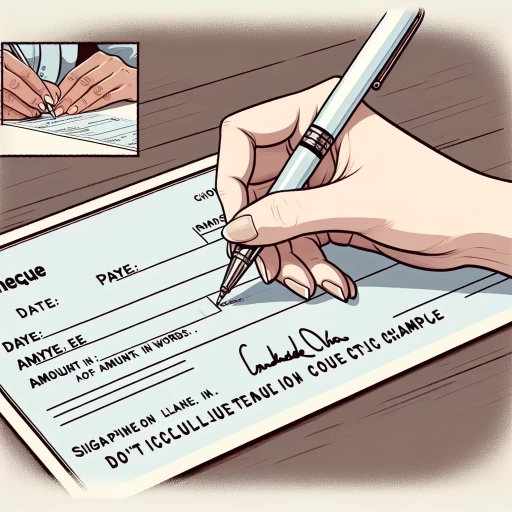

When writing a cheque, understanding the major components is a sine qua non to avoid making costly mistakes that might lead to the invalidation of your cheque or falling prey to cheque fraud. The first component is the drawer's information that includes the name, address, and account number of the person writing the cheque. This is printed on the top-left corner or sometimes in the middle of the cheque leaf. The second component is the Payee's line, where you write the name of the person or firm to whom the cheque is issued. This should be as mentioned in their bank account to prevent rejection due to mismatch. Next comes the date line where the drawer puts the date when the cheque is written. It is crucial as it delineates the period within which the cheque should be cashed or it becomes stale. The fourth component is the amount box and the amount line. These are arguably the most critical aspects of a cheque. The amount box has the amount written in figures while the amount line has it in words. Both should match for the bank to honor the cheque. Overwriting is illegal and may lead to the cheque not being accepted. The Memo line, although not mandatory, is another major component. It is a reminder of why the cheque was written, be it for groceries, rent, or a car payment. This can help both parties keep track of their finances. The final component is the signature line which is placed at the lower right corner of the cheque. Here, the drawer signs, thereby authorizing the bank to pay the written amount to the payee. It is vital that the signature matches the one that the bank has on file, or the cheque may get rejected. Understanding each of these components will ensure smooth transactions and avoid any potential hassles, misunderstandings or financial losses. Missteps in cheque handling could leave one’s account vulnerable, lead to bank penalties, or worse — legal trouble. Hence, possessing a clear understanding of the major components of a cheque is absolutely indispensable.

3. Common Terms Associated with Cheques

In simpler terms, getting down to the basics of a cheque, a few common terms are constantly associated with cheques and are vital in understanding how to properly fill one. Firstly, we have the "Drawer." This refers to the person or entity who writes the cheque. In essence, it is the account holder who provides clear instructions to their bank to pay a specific amount to a certain individual or organization. The second term, "Drawee," is the bank or financial institution where the cheque writer has an account. The drawee holds the responsibility of validating the cheque and subsequently processing the payment from the drawer's account to the payee's account. Lastly, we have the "Payee," the individual, or entity to whom the cheque is being made out. The payee is the intended recipient of the financial sum stipulated on the cheque. They receive the payment either through direct deposit into their account or by cashing the cheque at the relevant bank. Understanding these three main terms associated with cheques is crucial as they form the base of cheque transactions. By acquainting ourselves with these terms, it expounds on the roles each party plays seamlessly in the transaction process. It's evident that while cheques are seen as traditional financial tools, they remain an integral, trusted component within our dynamic financial ecosystem, with processes guided by exacting terms and parameters.

Step-by-step Guide on Filling Out a Cheque Correctly

Understanding the correct way to fill out a cheque is an essential life skill. In this digital age, many are accustomed to online transactions, yet cheques remain a widely accepted form of payment, conveying a sense of authority and formality. This step-by-step guide will demystify the process and provide you with confidence the next time you have to fill out one. We will focus on three key elements: 1) Writing the payee's name correctly, an imperative step that ensures your funds reach the intended recipient; 2) Specifying the correct amount, a critical aspect to preventing unauthorized funds withdrawal; and 3) Completing the date, the signature, and the memo section, vital identifiers that authenticate your cheque. Let's begin with the first step: correctly writing the payee’s name, a task that might seem simple, but demands precision to avoid potential complications.

1. How to Write the Payee’s Name

While a check may seem like an antiquated form of payment in the age of digital banking and online transactions, it's essential to know how to fill it out correctly. In this regard, correctly writing the payee's name on a check is a crucial step that can make a considerable difference in successfully completing the transaction. This step ensures that only the designated recipient can cash or deposit the check, thereby promoting the utmost security. When filling out the 'Pay to the Order of' line on a check, be meticulous in correctly spelling out the first and last name, or the title of the organization you intend your payment to reach. Whether it's to an individual or a business entity, make sure to write clearly and legibly, to avoid any confusion or potential typos that may lead to a delay in processing the check or worse, a possible fraud. Get the proper name information from the recipient beforehand if unsure about the correct spelling. For business transactions, it's always recommended to use the full, registered name of the company rather than abbreviations. If you make an error, avoid strikethroughs or cover-ups as banks may reject checks that have been altered. Writing a check is not merely scribbling numbers and names; it is a legal document that mandates precision and vigilance. Making sure the payee's name is written correctly minimizes fraud risk and assures a seamless transaction. Be armed with accurate information and write legibly in a flowing but readable hand. It's recommended to use a pen with permanent ink, preferably black or blue, to make it tamper evident and flood resistant. Different banks or countries might have subtle variations in their handling or preferred protocol with checks, and it's always worth investing time to familiarize yourself with them to avoid making mistakes. By adopting this structured, careful approach, you will ensure the security of your transactions and develop a reliable, concrete record of all your payments. This strategic, diligent process contributes significantly towards maintaining your financial health and transparency. Now that we've articulated how to write the payee's name on a check, remember that this is just one step in the process of correctly filling out a check. But as small as this step may seem, its significance is undeniable. Just like the smooth running of a well-oiled machine depends on all its parts functioning correctly, every step in the process of filling out a check plays a fundamental role in the successful completion of a transaction. Keep following our guide to master each step and become adept at filling out checks correctly.

2. Specifying the Correct Amount

Writing a cheque is as much an art as it is a science, and second only in importance to writing the payee's name, is declaring the right amount. Specifying the correct amount on a cheque, while evident to some, can indeed be a challenging and complex process that requires precision. Any error in specifying the amount can lead to a waste of time, potential financial losses, or even fraudulent activities. This step is crucial as it tells the bank how much money you intend to transfer from your account to the payee's. So, how exactly do you specify the correct amount on a cheque? First, you need to fill the space next to the dollar sign with the amount you are paying. The amount needs to be precise, remember to include the dollars and cents, even if the cents amount to zero. Additionally, do not round up your figures or use estimates. For instance, if the amount intended to pay is two thousand one hundred and fifty dollars, it should be explicitly written as $2,150.00 and not as $2,150 or 2150 without the dollar sign or any other variations thereof. To the right of the “Pay to the Order of” line, write out the same amount in words rather than figures. For example, for $2,150.00, write "two thousand one hundred and fifty dollars only". If there are cents involved, it is essential to include them in writing too. For $2,150.50, pen down "two thousand one hundred fifty and 50/100". Remember, if your written figure and worded amount do not match, banks will honor the written out amount in words as it is a legal representation of the payable sum on a cheque. One key tip is to be neat, clear, and precise when filling out this area. Stray marks could be misinterpreted as additional digits, leading to potential confusion. Also, start writing as far left as possible to prevent anyone from adding extra numbers. Understanding these nuances of specifying the correct amount on a cheque is an invaluable skill. By following the guidelines and procedures detailed above, you'll be able to avoid unnecessary financial confusion or losses, ensuring your cheques are honored by the concerned parties without issues.

3. Filling the Date, Signature, and Memo Section

Common mistakes and How to Avoid Them when Filling a Cheque

In the era of digital transactions, the art of cheque writing may seem obsolete, but it remains a critical financial tool in many businesses and personal transactions. However, this traditional form of payment comes with a unique set of challenges that can potentially cause significant financial missteps. Particularly, cheque writers must be cautious of three common mistakes: lapses in writing the payee's name correctly, errors in writing the cheque amount, and incorrectly signing and dating the cheque. Despite their seeming simplicity, these errors can result in unwanted complications, including misplaced funds or even fraudulent activities. Thankfully, with a few precautionary measures and keen attention to detail, these mishaps can be avoided entirely. As we delve into the intricacies of these typical errors, our first focal point will be the all-important payee's name – a small component of the cheque with an outsized impact on its validity.

1. Lapses in Writing the Payee's Name Correctly

Lapses in Writing the Payee's Name Correctly One common mistake that many individuals inadvertently make when filling out a cheque is inaccurately writing the payee's name. This seemingly minor error can have significant consequences. It's not just about misspelling a name, but also about any discrepancies between a preferred name and a legal name. For instance, writing 'Mike' instead of 'Michael' or 'Jenny' instead of 'Jennifer' on a cheque can lead to difficulties in cashing or depositing it since banks are particularly stringent about matters of legality and authenticity. The slightest deviation from the registered name can cause unnecessary hassles for both the payer and the payee. Such administrative complications can easily be avoided by double-checking and confirming the correct and full legal name of the payee before filling the cheque. In scenarios where you are unsure or confused, it's always better to ask the payee, search their name online if they have a public profile, or revisit related paperwork where their name could be mentioned. In the fast-paced digital world where we often rely on nicknames or abbreviated names, it's crucial to revisit old-fashioned accuracy and adherence to legal particulars, especially when it comes to financial transactions. These stringent checks on the identification of the payee act as buffers against potential fraud while ensuring timely, seamless transactions. Similarly, from the payee's perspective, it's equally crucial to register their legal names accurately with their banks and other financial institutions to prevent such hiccups in monetary exchanges. Miscommunication, hurry or neglect in such critical matters can give rise to frustrating roadblocks that can easily be avoided with thorough prudence. Furthermore, it's advisable to fill out the cheque in a clear and legible handwriting. If the writing is too unclear or scruffy, the bank can refuse to honour it. To this end, taking extra time to write neatly can save both you and your payee a significant amount of trouble. In closing, paying attention to such seemingly small details carries a huge weight in ensuring a smooth, error-free transaction.

2. Errors in Writing the Cheque Amount

Writing a cheque may seem like a basic task, but it's easy to make mistakes if you're not careful—and one major common mistake pertains to the cheque amount. There are typically two areas on a cheque where the amount is written, and it's crucial to fill out both accurately. Failing to do so could potentially lead to a number of mishaps, from your cheque being rejected to your bank charging you unnecessary fees due to inaccuracies. Firstly, the numeral box is where you write the cheque amount in numbers, e.g., £100.00. This needs to be precise, with no room for interpretation. Errors often occur when the figures are not written clearly - an involuntarily added dash or scribble could be misconstrued as an extra digit. Therefore, it's important to write the numbers as distinctly as possible to avoid any ambiguity. For lofty amounts with multiple zeroes, consider underlining the zeros to stress their significance. Secondly, the amount line is where you write out the same amount—in words this time. This prevents anyone from adding extra digits to the numbers in the numeral box. For example, if you write 'one hundred' instead of '100', it is much harder to alter. Normal pitfalls in this section usually involve spelling errors, confusing the bank and making the cheque void. So, how can you avoid such mistakes? Always take your time when filling out a cheque; this is not a task to rush. Be specific with your digits and your words. For large amounts, it's a good idea to double- or triple-check your figures and words to ensure they align perfectly. Use clear, legible handwriting and fill in any spaces you don't need with a simple line to prevent unauthorized alterations. Finally, always ensure that the written amount and numeric amount correspond with each other. If the cheque amount expressed in words differs from the amount expressed in numbers, the bank will act on what's written in words – that’s a rule as per the Negotiable Instruments Act. Effective and accurate cheque-writing is a crucial skill, ensuring not just the legality of your transactions but also the timeliness and efficiency of your financial dealings. So, take your time, double-check everything, and make sure you're filling out your cheques correctly to keep your financial house in order.