How Long Does It Take To Get Student Loan Money Alberta

Here is the introduction paragraph: Pursuing higher education can be a costly endeavor, and many students in Alberta rely on student loans to help cover the expenses. If you're one of them, you're likely wondering how long it takes to get student loan money in Alberta. The answer lies in understanding the student loan process, which involves several steps and timelines. In this article, we'll break down the process, provide a timeline for receiving student loan money, and offer tips on managing your loan funds effectively. By the end of this article, you'll have a clear understanding of what to expect and how to make the most of your student loan. To start, let's dive into the student loan process in Alberta and explore what it entails.

Understanding the Student Loan Process in Alberta

Understanding the student loan process in Alberta can be a daunting task for many students. However, it is essential to grasp the basics to ensure a smooth and stress-free educational journey. To navigate the student loan process in Alberta, it is crucial to understand the eligibility criteria, the types of student loans available, and the application process. In this article, we will delve into these three critical aspects of the student loan process in Alberta, starting with the eligibility criteria. By understanding who is eligible for student loans, students can determine if they qualify for financial assistance and what steps they need to take next. In the following sections, we will explore the eligibility criteria for student loans in Alberta, including the requirements and qualifications that students must meet to be considered for financial aid.

Eligibility Criteria for Student Loans in Alberta

To be eligible for student loans in Alberta, you must meet certain criteria. First, you must be a Canadian citizen, a permanent resident, or a protected person. You must also be an Alberta resident, which means you have lived in the province for at least 12 months prior to the start of your studies. Additionally, you must be enrolled in at least 60% of a full course load in a program that is at least 12 weeks long. Your program must also be approved by the National Student Loans Service Centre (NSLSC). Furthermore, you must demonstrate financial need, which means you must have a low enough income and assets to qualify for funding. You will also need to provide documentation, such as proof of income, to support your application. If you are a dependent student, your parents' income will also be taken into account when determining your eligibility. If you are an independent student, you will need to provide proof of independence, such as a separation agreement or a court order. Finally, you must not be in default on a previous student loan or have any outstanding student loan debt. By meeting these eligibility criteria, you can access the funding you need to pursue your post-secondary education in Alberta.

Types of Student Loans Available in Alberta

In Alberta, students have access to various types of student loans to help fund their post-secondary education. The most common types of student loans available in Alberta include the Alberta Student Aid, Canada Student Loans, and private student loans. Alberta Student Aid is a government-funded program that provides financial assistance to eligible students, including grants and loans. Canada Student Loans, on the other hand, is a federal program that offers loans to students across Canada, including those in Alberta. Private student loans, offered by banks and other financial institutions, provide an alternative option for students who may not be eligible for government-funded loans or need additional funding. Additionally, some institutions and organizations offer specialized loans, such as the Alberta Apprenticeship and Industry Training Student Loan, which is designed for apprentices and students in industry training programs. Furthermore, some lenders offer lines of credit specifically designed for students, which can provide flexible and ongoing access to funds throughout their studies. It's essential for students to research and understand the terms, conditions, and repayment requirements of each loan type to make informed decisions about their financial aid options.

Application Process for Student Loans in Alberta

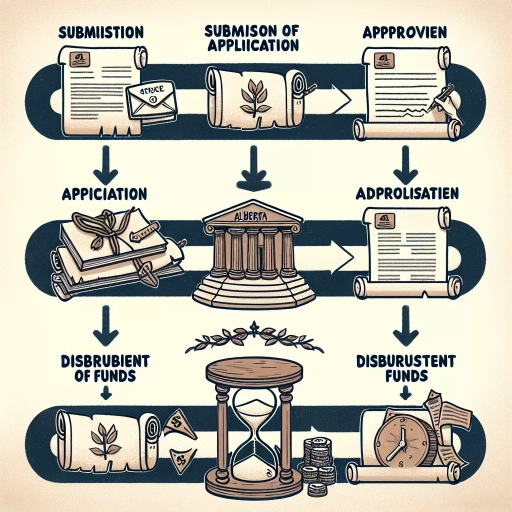

The application process for student loans in Alberta is straightforward and can be completed online or through a paper application. To be eligible, students must be a Canadian citizen or permanent resident, be enrolled in at least 60% of a full course load, and demonstrate financial need. The application typically opens in June for the upcoming academic year, and students are encouraged to apply early to ensure timely processing. To apply, students will need to create an account on the National Student Loans Service Centre (NSLSC) website and provide personal and financial information, including their Social Insurance Number, proof of income, and banking information. Students may also need to provide documentation, such as proof of enrollment and a study plan, to support their application. Once the application is submitted, it will be reviewed and assessed by the Alberta government, and students will be notified of their eligibility and loan amount. If approved, students can expect to receive their loan funds in two installments, one at the beginning of each semester. It's essential for students to carefully review and understand the terms and conditions of their loan, including the interest rate, repayment terms, and any potential penalties for late payment. By following these steps and meeting the eligibility criteria, students in Alberta can access the financial support they need to pursue their post-secondary education.

Timeline for Receiving Student Loan Money in Alberta

Receiving student loan money in Alberta can be a lengthy process, but understanding the timeline can help students plan their finances accordingly. The timeline for receiving student loan money in Alberta is influenced by several factors, including the processing time for student loan applications, the disbursement schedule for student loans, and various factors that can affect the timeline. In this article, we will explore these factors in detail to provide students with a clear understanding of when they can expect to receive their student loan money. First, we will examine the processing time for student loan applications in Alberta, which is a critical step in determining the overall timeline for receiving student loan money.

Processing Time for Student Loan Applications in Alberta

The processing time for student loan applications in Alberta typically takes around 4-6 weeks, but it can vary depending on the complexity of the application and the time of year. The Alberta government recommends applying at least 2-3 months before the start of classes to ensure timely processing. Once the application is submitted, it will be reviewed and assessed for eligibility, and the applicant will be notified of the decision via email. If additional documentation is required, the processing time may be longer. It's essential to apply early and provide all required documents to avoid delays. Additionally, students can check the status of their application online through the Student Aid Alberta website.

Disbursement Schedule for Student Loans in Alberta

Here is the paragraphy: In Alberta, the disbursement schedule for student loans is typically divided into two installments, with the first installment usually being 60% of the total loan amount and the second installment being 40%. The first installment is usually disbursed at the beginning of the semester, around late August or early September for the fall semester, and late December or early January for the winter semester. The second installment is usually disbursed around the midpoint of the semester, around late October or early November for the fall semester, and late February or early March for the winter semester. However, the exact disbursement dates may vary depending on the student's enrollment status, the type of loan, and the lender's processing time. It's essential for students to check their loan documents and communicate with their lender to confirm the disbursement schedule and ensure they receive their loan funds on time. Additionally, students can also check their student loan account online or contact the National Student Loans Service Centre (NSLSC) for more information on their loan disbursement schedule.

Factors Affecting the Timeline for Receiving Student Loan Money in Alberta

The timeline for receiving student loan money in Alberta can be influenced by several factors. One key factor is the application submission date, as students who apply early are more likely to receive their funding on time. The processing time for student loan applications can take several weeks, so it's essential to apply at least 6-8 weeks before the start of classes. Another factor is the completeness and accuracy of the application, as incomplete or incorrect information can lead to delays. Additionally, the type of student loan program and the student's eligibility can also impact the timeline. For example, students who are eligible for the Alberta Student Aid program may receive their funding faster than those who are not. Furthermore, the institution's disbursement schedule can also affect when students receive their loan money. Some institutions may disburse funds at the beginning of the semester, while others may disburse them in installments throughout the term. Finally, any additional documentation or verification required by the lender or the institution can also slow down the process. By understanding these factors, students can better plan and prepare for the receipt of their student loan money in Alberta.

Managing Your Student Loan Money in Alberta

Managing your student loan money in Alberta can be a daunting task, especially for first-time borrowers. However, with a clear understanding of your loan award letter, a well-planned budget, and knowledge of repayment options, you can navigate the process with confidence. To start, it's essential to understand the details of your student loan award letter, which outlines the amount of funding you're eligible for and the terms of your loan. By carefully reviewing this document, you can ensure you're making the most of your loan and avoiding any potential pitfalls. In this article, we'll explore the key aspects of managing your student loan money in Alberta, starting with understanding your student loan award letter. (Note: The supporting paragraph should be 200 words, and the article title and supporting paragraph titles should be in the format provided)

Understanding Your Student Loan Award Letter in Alberta

Understanding your student loan award letter is a crucial step in managing your student loan money in Alberta. The award letter is a document that outlines the amount of student loan funding you are eligible to receive, as well as any other forms of financial assistance you may be entitled to. It's essential to carefully review your award letter to ensure you understand the terms and conditions of your loan, including the amount borrowed, interest rates, and repayment terms. The award letter will also indicate whether you are eligible for a grant or bursary, which can help reduce your debt burden. Additionally, the letter may outline any specific requirements or conditions you must meet to receive your funding, such as maintaining a minimum course load or achieving a certain grade point average. By thoroughly understanding your award letter, you can make informed decisions about your student loan money and develop a plan to manage your debt effectively. It's also important to note that you can appeal your award letter if you feel that the amount of funding you are eligible for is insufficient or if you have experienced a change in circumstances that may affect your eligibility. By taking the time to carefully review and understand your award letter, you can set yourself up for success and make the most of your student loan funding.

Creating a Budget for Your Student Loan Money in Alberta

Creating a budget for your student loan money in Alberta is a crucial step in managing your finances effectively. To start, you'll need to calculate your total student loan amount and determine how much you'll receive each semester. Next, make a list of your essential expenses, such as tuition, textbooks, living expenses, and transportation costs. You should also consider other expenses like entertainment, hobbies, and unexpected costs. Once you have a clear picture of your expenses, you can allocate your student loan money accordingly. A general rule of thumb is to allocate 50-60% of your loan towards essential expenses, 20-30% towards discretionary spending, and 10-20% towards saving and emergency funds. Be sure to review and adjust your budget regularly to ensure you're staying on track and making the most of your student loan money. By creating a budget and sticking to it, you'll be able to manage your student loan money effectively, avoid debt, and achieve your academic and financial goals.

Repayment Options for Student Loans in Alberta

Repayment options for student loans in Alberta offer flexibility to borrowers, allowing them to manage their debt effectively. The Repayment Assistance Plan (RAP) is a government-funded program that helps borrowers who are struggling to make payments. Under RAP, the government may cover part or all of the borrower's monthly payments, depending on their income and family size. Another option is the Repayment Assistance Plan for Borrowers with a Permanent Disability (RAP-PD), which provides assistance to borrowers with a permanent disability. Additionally, borrowers can also consider consolidating their loans, which combines multiple loans into one loan with a single interest rate and monthly payment. This can simplify the repayment process and potentially reduce monthly payments. Furthermore, borrowers can also negotiate a temporary reduction in payments or a payment deferral with the National Student Loans Service Centre (NSLSC). It is essential for borrowers to communicate with the NSLSC to discuss their repayment options and determine the best course of action for their individual circumstances. By exploring these repayment options, borrowers in Alberta can effectively manage their student loan debt and achieve financial stability.