How Long Does It Take For An Etransfer To Go Through

Understanding eTransfer and Its Functioning

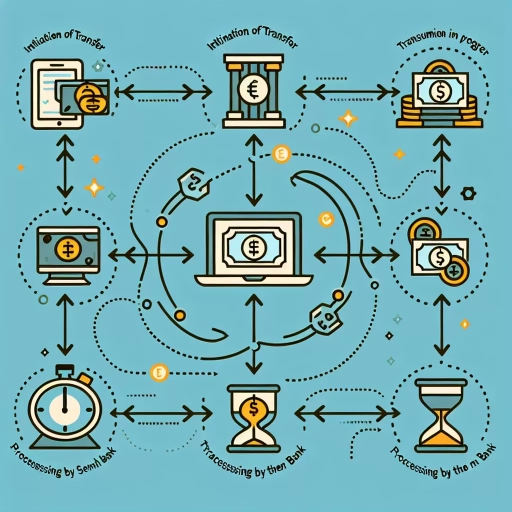

The Mechanism of eTransfer

An e-transfer, also known as electronic transfer, is a convenient, safe, and reliable way of sending and receiving money between different bank accounts via email or mobile phone. The primary step in executing eTransfer is having the sender and receiver's email addresses or mobile phone numbers. You can initiate the eTransfer process through your bank's online banking or mobile banking app. This process bypasses the need for physical checks and cash, making money transfers smoother and faster.

While most eTransfers are completed within minutes, the duration can vary for numerous reasons. The sender’s bank, the recipient’s bank, Internet connectivity, and security checks are all factors that can influence how long an eTransfer takes. It is crucial to note that while many enjoy the convenience of eTransfers, understanding the intricate details of its workings is beneficial in planning and managing finances effectively.

The Process of eTransfer

Once an eTransfer is set up, the sending bank ends an email or text notification to the recipient. This notification contains a secure link, leading the recipient to a secure web page. Here, the recipient must answer a pre-arranged security question correctly to access the funds. On successful validation, the funds are immediately transferred from the sender’s account to the recipient's account.

However, it may take anywhere from a few minutes to several hours, depending on the banks involved and their processing procedures. There might also be instances where the transfer is held for additional security review, further delaying the transfer. However, rest assured that the security of everyone's funds is a top priority in every bank's eTransfer protocol.

Factors affecting eTransfer Speed

The transfer speed of eTransfers can be influenced by several factors. One significant factor is the banks involved in the transaction. Different banks may have different policies and processing times, and transfers between accounts in the same bank may be faster than transfers between different banks.

Another factor is the time of transfer initiation. eTransfers initiated during business hours are often processed quicker than those initiated after business hours or during weekends or public holidays. Internet connectivity plays an essential role: poor connectivity can lead to delays in transaction notifications. Lastly, security efforts by banks to thwart money-laundering activities and other frauds might slow the transfer time in certain cases, but they go a long way in ensuring the safety of end users.

Practical Advice for Faster eTransfers

Effective Communication with Recipients

To ensure eTransfers get processed as quickly as possible, effective communication between sender and recipient is necessary. The sender should inform the recipient of the transfer details, including the answer to the security question, promptly. Moreover, the recipient should also ensure they check their email or mobile alerts regularly to know when the transfer has been initiated.

Some financial institutions provide updates on the transfer status, and keeping an eye on these updates can help both sides know the transaction's progress. The faster the recipient correctly responds to the safety question upon receipt of transaction notification, the faster the transaction will be completed.

Planning Ahead

Another way to ensure faster eTransfers is by planning the transfers in advance, especially if they are large amounts or if they involve transfers between different banks. The initiation time should ideally be within business hours, reducing the chance of a transfer falling into the ‘pending’ or ‘processing’ stage for too long.

One should also be aware of their bank's eTransfer policies, including any daily or monthly limits on transfers. If these limits are exceeded, the transfer may be delayed or even declined.

Utilizing InstantTransfer Features

Some banks offer features like Instant Transfer, reducing the waiting time. This feature can transfer funds instantly from one account to another, irrespective of the bank. However, Instant Transfer is usually available for a fee, so it's a choice between paying extra for speed or waiting for standard transfers.

Understanding these features and using them judiciously can ensure that eTransfers remain a quick, safe, and reliable method of monetary transfer several people rely upon every day.

Factors influencing eTransfer Delays

Bank Policies and Security Checks

Different banks or financial institutions may have slightly different policies for eTransfers, affecting the time it takes for a transfer to go through. This is especially true when making international eTransfers. Some banks may also hold the transfer for a period for security checks, particularly for larger amounts or unfamiliar recipients.

To understand what might be causing delays in eTransfer transactions, one needs to get accustomed to their bank's policies. These are usually outlined on the bank's website or can be obtained by contacting the bank's customer service.

Holidays and Off-Business Hours

Banks and financial institutions usually process transfers only during their business hours. Therefore, if an eTransfer request is submitted over a weekend, on public holidays, or after the bank's working hours, the transfer process may be delayed. This is why it is recommended to initiate eTransfers during regular business hours or even beforehand.

Even a bank's systems need downtime for maintenance and upgrades. These mostly occur during off-business hours, causing further delays in processing transactions.

Miscommunication or Errors

Errors in the email address or mobile number provided, or errors in the security answer can delay the eTransfer process. If the recipient fails to answer the security question correctly within a set number of attempts, the transfer will typically be returned to the sender. Miscommunication between the sender and the receiver can slow down the transaction process.

Always double-check the recipient's contact details and ensure they know the correct answer to the security question before initiating an eTransfer. This avoids unnecessary delays and helps ensure your eTransfer is as smooth and fast as possible.