How To Read A Canadian Cheque

Here is the introduction paragraph: Reading a Canadian cheque can seem like a daunting task, especially for those who are new to handling financial transactions. However, with a little practice and knowledge, you can become proficient in deciphering the various components of a cheque. To start, it's essential to understand the different parts of a Canadian cheque, including the date, payee, and amount fields. Once you're familiar with these components, you can move on to deciphering the numerical and written amounts, which can sometimes be tricky. Additionally, verifying the cheque's authenticity and validity is crucial to ensure that the transaction is legitimate. In this article, we'll break down the process of reading a Canadian cheque, starting with the basics of understanding the components of a Canadian cheque.

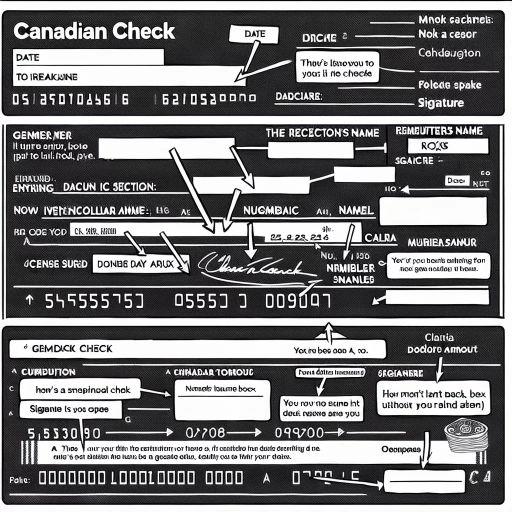

Understanding the Components of a Canadian Cheque

Understanding the components of a Canadian cheque is crucial for individuals and businesses to ensure secure and efficient financial transactions. A Canadian cheque typically consists of several key elements that verify the authenticity and legitimacy of the transaction. To begin with, it is essential to identify the date and cheque number, which serve as a unique identifier for the transaction. Additionally, locating the payee and dollar amount is vital to ensure that the correct recipient receives the correct amount. Furthermore, recognizing the signature and bank information is necessary to verify the account holder's identity and the financial institution's details. By understanding these components, individuals and businesses can confidently navigate the process of writing, depositing, and verifying cheques. In this article, we will delve into the specifics of each component, starting with identifying the date and cheque number.

Identifying the Date and Cheque Number

When it comes to reading a Canadian cheque, identifying the date and cheque number is crucial. The date is usually located in the top right-hand corner of the cheque and is written in the format of day, month, and year. This date indicates when the cheque was written and is important for determining its validity. The cheque number, on the other hand, is a unique identifier assigned to each cheque and is usually located in the top right-hand corner as well, often in a box or preceded by the "#" symbol. The cheque number helps to prevent cheque fraud and ensures that the cheque is processed correctly. By identifying the date and cheque number, you can verify the cheque's authenticity and ensure that it is processed in a timely manner.

Locating the Payee and Dollar Amount

When it comes to reading a Canadian cheque, two crucial pieces of information to locate are the payee and the dollar amount. The payee is the individual or business to whom the cheque is being written, and their name is typically printed on the line that says "Pay to the order of." This line is usually located in the centre of the cheque, below the date. The payee's name should be spelled correctly, and it's essential to ensure that the name matches the one on the account or identification provided. The dollar amount, on the other hand, is the amount of money being transferred from the account holder's account to the payee's account. There are two places to look for the dollar amount: the numeric amount in the box on the right-hand side of the cheque, and the written amount in words on the line below the payee's name. Both amounts should match, and it's crucial to verify that the numeric amount corresponds to the written amount to avoid any discrepancies. By locating the payee and dollar amount, you can ensure that the cheque is being written correctly and that the funds are being transferred to the intended recipient.

Recognizing the Signature and Bank Information

When it comes to reading a Canadian cheque, recognizing the signature and bank information is crucial. The signature section, located at the bottom right corner of the cheque, is where the account holder signs their name to authorize the transaction. The signature must match the one on file with the bank to ensure the cheque is valid. The bank information, on the other hand, is located at the top right corner of the cheque and includes the bank's name, transit number, and institution number. The transit number, also known as the branch number, identifies the specific bank branch where the account is held, while the institution number identifies the bank itself. The account number, located at the bottom of the cheque, is the unique identifier for the account holder's account. By verifying the signature and bank information, you can ensure that the cheque is legitimate and that the funds will be withdrawn from the correct account.

Deciphering the Numerical and Written Amounts

When it comes to deciphering the numerical and written amounts on a cheque, accuracy is crucial to avoid any discrepancies or misunderstandings. To ensure that the transaction is processed correctly, it is essential to understand how to read and interpret both the numerical and written amounts on a cheque. This involves reading the numerical amount in the dollar box, interpreting the written amount on the cheque line, and verifying the consistency between the two amounts. By following these steps, individuals can ensure that their financial transactions are accurate and secure. In this article, we will explore each of these steps in detail, starting with the first step: reading the numerical amount in the dollar box.

Reading the Numerical Amount in the Dollar Box

When reading the numerical amount in the dollar box, it is essential to understand the format and conventions used. The dollar box, also known as the numerical amount box, is the rectangular box located on the right-hand side of the cheque, usually with a dollar sign ($) preceding it. The numerical amount is written in this box using digits, and it represents the amount of money being paid. To read the numerical amount, start by looking at the dollar sign, which indicates that the amount is in Canadian dollars. Next, read the digits in the box, which represent the amount in dollars and cents. For example, if the box contains the number "100.50", it means the cheque is for one hundred dollars and fifty cents. It is crucial to note that the numerical amount in the dollar box should match the written amount on the cheque, which is usually written in words on the line below the date. If the amounts do not match, the cheque may be considered invalid or fraudulent. Therefore, it is vital to carefully read and verify the numerical amount in the dollar box to ensure accuracy and avoid any potential issues.

Interpreting the Written Amount on the Cheque Line

When interpreting the written amount on the cheque line, it is essential to pay attention to the words and numbers used. The written amount is usually located on the line below the date and is written in both numbers and words. The words should match the numerical amount, and any discrepancies should be investigated. The written amount is typically written in a specific format, with the dollar amount written first, followed by the cents. For example, if the numerical amount is $100.50, the written amount would be "One Hundred Dollars and 50/100." The cents are usually written as a fraction of 100, with the numerator representing the cents and the denominator being 100. It is crucial to ensure that the written amount matches the numerical amount to avoid any errors or discrepancies. Additionally, the written amount should be checked for any alterations or corrections, as these can be indicative of cheque tampering. By carefully interpreting the written amount on the cheque line, individuals can ensure that the cheque is legitimate and accurate.

Verifying the Consistency between Numerical and Written Amounts

Verifying the consistency between numerical and written amounts is a crucial step in ensuring the accuracy of a Canadian cheque. To do this, compare the numerical amount in the box located at the right-hand side of the cheque to the written amount on the line below. The numerical amount should match the written amount exactly, with no discrepancies or differences. If the amounts do not match, the cheque may be considered invalid or fraudulent. For example, if the numerical amount is $100.00, the written amount should also be "One Hundred Dollars" or "100.00 Dollars". Any inconsistencies between the two amounts should raise a red flag, and the cheque should not be accepted or processed. By verifying the consistency between numerical and written amounts, individuals and businesses can protect themselves from potential financial losses and ensure that transactions are conducted securely and efficiently.

Verifying the Cheque's Authenticity and Validity

Verifying the authenticity and validity of a cheque is a crucial step in ensuring a smooth and secure transaction. With the rise of cheque fraud, it's essential to take extra precautions to confirm the legitimacy of a cheque before depositing or cashing it. To do this, one must check for security features and watermarks, confirm the cheque's expiration date and status, and inspect the cheque for alterations or tampering. By taking these steps, individuals and businesses can protect themselves from potential financial losses and ensure that their transactions are secure. One of the first steps in verifying a cheque's authenticity is to check for security features and watermarks.

Checking for Security Features and Watermarks

When verifying the authenticity and validity of a Canadian cheque, it's essential to check for security features and watermarks. Hold the cheque up to a light source to examine the paper for a watermark, which is a translucent pattern woven into the paper. The watermark should feature a repeating pattern of the words "Canada" or "Canadian" in both English and French. Additionally, look for a security thread that glows pink when held under ultraviolet (UV) light. This thread is embedded in the paper and is difficult to reproduce. Check the cheque for raised printing, such as the numerals in the top right corner, which should be raised and feel embossed. Also, examine the cheque for microprinting, which is tiny text that is difficult to read with the naked eye. The microprinted text should be clear and legible when magnified. Furthermore, check the cheque for a foil strip, which is a thin strip of metallic foil that is embedded in the paper. The foil strip should be difficult to remove and should feature a repeating pattern of maple leaves or other Canadian symbols. By checking for these security features and watermarks, you can increase the chances of detecting a counterfeit cheque and ensure that the cheque is authentic and valid.

Confirming the Cheque's Expiration Date and Status

Before depositing or cashing a cheque, it's essential to confirm its expiration date and status to avoid any potential issues. In Canada, cheques typically have a six-month validity period from the date of issuance, after which they become stale-dated. To verify the expiration date, check the date written on the top right-hand corner of the cheque, which is usually the date the cheque was written. If the date is more than six months old, the cheque may be stale-dated and not valid for deposit or cashing. Additionally, you can contact the bank or financial institution that issued the cheque to confirm its status and ensure it hasn't been cancelled or stopped. You can also use the bank's online services or mobile app to verify the cheque's status. By confirming the cheque's expiration date and status, you can ensure a smooth and hassle-free transaction.

Inspecting the Cheque for Alterations or Tampering

Inspecting the cheque for alterations or tampering is a crucial step in verifying its authenticity and validity. When examining the cheque, look for any signs of alteration, such as changes to the payee's name, the amount in words or numbers, or the date. Check if the handwriting or printing appears inconsistent or if there are any erasures, corrections, or whiteout marks. Also, verify that the cheque number, account number, and routing number are correct and match the information on the cheque. Additionally, inspect the cheque for any signs of tampering, such as tears, holes, or cuts, which could indicate that the cheque has been altered or manipulated. Furthermore, check the cheque's security features, such as watermarks, holograms, or microprinting, to ensure they are intact and have not been compromised. By carefully inspecting the cheque for alterations or tampering, you can help prevent cheque fraud and ensure that the cheque is legitimate and valid.