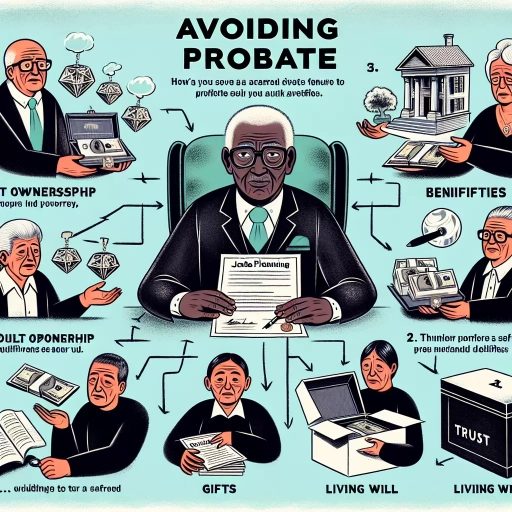

How To Avoid Probate

Here is the introduction paragraph: Probate can be a lengthy, costly, and emotionally draining process for families and loved ones after a person's passing. It involves the court's supervision of the distribution of the deceased's assets, which can lead to public disclosure of personal financial information, high legal fees, and potential conflicts among beneficiaries. Fortunately, there are ways to avoid probate and ensure a smoother transition of assets. By implementing effective estate planning strategies, utilizing alternative property ownership methods, and minimizing probate through strategic asset management, individuals can protect their loved ones from the complexities and expenses associated with probate. In this article, we will explore these approaches in more detail, starting with the importance of avoiding probate through estate planning.

Avoiding Probate through Estate Planning

Probate is a lengthy and costly process that can be avoided through effective estate planning. One of the primary goals of estate planning is to ensure that your assets are distributed according to your wishes after you pass away, without the need for probate. There are several strategies that can help you achieve this goal, including creating a living trust, establishing joint ownership, and naming beneficiaries. By implementing these strategies, you can ensure that your loved ones avoid the hassle and expense of probate, and that your assets are transferred to them quickly and efficiently. For instance, creating a living trust allows you to transfer ownership of your assets to the trust, which can then be managed and distributed by a trustee according to your instructions, thereby avoiding probate. Note: The above paragraph is the introduction paragraph of the article, and the 3 supporting paragraphs are Creating a Living Trust, Establishing Joint Ownership, Naming Beneficiaries. Here is a 200 words supporting paragraph for Creating a Living Trust: Creating a living trust is a popular estate planning strategy that allows you to avoid probate and ensure that your assets are distributed according to your wishes. A living trust is a legal document that allows you to transfer ownership of your assets to the trust, which can then be managed and distributed by a trustee according to your instructions. By creating a living trust, you can avoid the costs and delays associated with probate, and ensure that your loved ones receive their inheritance quickly and efficiently. In addition, a living trust can also provide tax benefits and protection for your assets. For example, a living trust can help to minimize estate taxes, and can also provide protection for your assets in the event of a lawsuit or creditor claim. Furthermore, a living trust can be amended or revoked at any time, giving you flexibility and control over your estate plan. Overall, creating a living trust is a powerful tool for avoiding probate and ensuring that your assets are distributed according to your wishes.

Creating a Living Trust

A living trust, also known as a revocable living trust, is a popular estate planning tool that allows individuals to manage and distribute their assets during their lifetime and after their death, while avoiding probate. To create a living trust, you'll need to follow these steps: start by gathering all relevant information about your assets, including real estate, bank accounts, investments, and personal property. Next, choose a trustee, who will be responsible for managing the trust and carrying out your wishes. You can name yourself as the trustee, or appoint a trusted family member, friend, or professional. Then, prepare the trust document, which should include the name of the trust, the trustee's powers and responsibilities, and the beneficiaries who will receive the assets. You'll also need to transfer ownership of your assets to the trust, which may involve re-titling property, changing account names, and updating beneficiary designations. Once the trust is established, you can make changes to it at any time, as long as you're mentally competent. After your death, the trustee will distribute the assets according to your instructions, without the need for probate. By creating a living trust, you can ensure that your assets are distributed quickly and efficiently, while minimizing the risk of disputes and court involvement. Additionally, a living trust can provide tax benefits, protect your assets from creditors, and ensure that your wishes are carried out, even if you become incapacitated. Overall, a living trust is a powerful tool for avoiding probate and achieving your estate planning goals.

Establishing Joint Ownership

Here is the paragraphy: Establishing joint ownership is a popular strategy for avoiding probate, as it allows two or more individuals to own property together, with the surviving owner(s) automatically inheriting the property upon the death of the other owner(s). This can be achieved through various means, such as joint tenancy, community property, or tenancy by the entirety. Joint tenancy, for example, allows two or more individuals to own a property together, with each owner having an undivided interest in the property. When one owner dies, their share of the property automatically passes to the surviving owner(s), bypassing probate. Community property, on the other hand, is a form of joint ownership that is only available to married couples in certain states, where all property acquired during the marriage is considered jointly owned. Tenancy by the entirety is a type of joint ownership that is also only available to married couples, where the property is considered a single, undivided unit that cannot be divided or sold without the consent of both spouses. By establishing joint ownership, individuals can avoid probate and ensure that their property passes to their loved ones quickly and efficiently. However, it's essential to note that joint ownership can have tax implications and may not be suitable for all individuals, particularly those with complex family dynamics or significant assets. It's crucial to consult with an attorney or financial advisor to determine the best approach for your specific situation.

Naming Beneficiaries

Naming beneficiaries is a crucial aspect of estate planning that allows individuals to transfer assets directly to their loved ones, bypassing the probate process. By designating beneficiaries, individuals can ensure that their assets are distributed according to their wishes, without the need for court intervention. Beneficiaries can be named for various types of assets, including life insurance policies, retirement accounts, and annuities. When naming beneficiaries, it is essential to consider the tax implications and potential consequences of each choice. For instance, naming a minor as a beneficiary may require the appointment of a guardian or trustee to manage the assets until the minor reaches adulthood. Similarly, naming a beneficiary with special needs may require the creation of a special needs trust to ensure that the assets do not disqualify the beneficiary from receiving government benefits. It is also important to review and update beneficiary designations periodically to ensure that they remain consistent with the individual's current wishes and circumstances. By naming beneficiaries, individuals can avoid probate, reduce estate taxes, and ensure that their assets are distributed efficiently and effectively. Ultimately, naming beneficiaries is a simple yet powerful estate planning tool that can provide peace of mind and financial security for individuals and their loved ones.

Using Alternative Property Ownership Methods

When it comes to owning property, many people are familiar with traditional methods such as sole ownership or joint tenancy. However, there are alternative property ownership methods that can provide more flexibility and benefits, especially in certain situations. Three such methods are Co-Ownership with Right of Survivorship, Transfer-on-Death Deeds, and Community Property with Right of Survivorship. These alternative methods can help individuals avoid probate, reduce taxes, and ensure that their property is transferred to their loved ones according to their wishes. For instance, Co-Ownership with Right of Survivorship allows multiple owners to share property while ensuring that the surviving owners inherit the property automatically upon the death of one of the co-owners. This method can be particularly useful for family members or business partners who want to maintain control and ownership of the property without the need for probate. By understanding these alternative property ownership methods, individuals can make informed decisions about how to manage their property and achieve their goals. Let's take a closer look at Co-Ownership with Right of Survivorship and how it can be a valuable option for property owners.

Co-Ownership with Right of Survivorship

Co-ownership with right of survivorship is a type of property ownership that allows multiple individuals to own a property together, with the right of survivorship ensuring that the remaining owners automatically inherit the deceased owner's share of the property. This type of ownership is often used by married couples, family members, or business partners who want to avoid probate and ensure that their property passes to their loved ones without the need for a will or probate proceedings. When a co-owner with right of survivorship passes away, their share of the property is automatically transferred to the remaining co-owners, bypassing probate and minimizing the risk of disputes or challenges to the ownership. This type of ownership can be established through a joint tenancy or a tenancy by the entirety, and can be used for a variety of assets, including real estate, bank accounts, and investments. One of the key benefits of co-ownership with right of survivorship is that it provides a seamless transfer of ownership, allowing the remaining co-owners to continue managing and using the property without interruption. Additionally, this type of ownership can help to minimize estate taxes and other costs associated with probate, making it a popular choice for individuals looking to avoid probate and ensure that their assets are passed on to their loved ones in a timely and efficient manner.

Transfer-on-Death Deeds

Here is the answer: A transfer-on-death (TOD) deed, also known as a beneficiary deed, is a type of deed that allows a property owner to transfer their property to a beneficiary upon their death without the need for probate. This type of deed is recognized in many states and is a popular alternative to traditional probate methods. With a TOD deed, the property owner retains full control over the property during their lifetime and can sell, mortgage, or gift the property as they see fit. The beneficiary has no rights to the property until the owner's death, at which point the property automatically transfers to the beneficiary without the need for probate. This can be a cost-effective and efficient way to transfer property, as it avoids the time and expense associated with probate. Additionally, a TOD deed can be revoked or changed at any time by the property owner, providing flexibility and control. It's essential to note that TOD deeds are subject to state-specific laws and regulations, so it's crucial to consult with an attorney to ensure that the deed is properly executed and meets the requirements of the state in which the property is located. Overall, a transfer-on-death deed can be a valuable tool for individuals looking to avoid probate and ensure a smooth transfer of property to their loved ones.

Community Property with Right of Survivorship

Community property with right of survivorship is a type of property ownership that allows married couples to own property together, with the surviving spouse automatically inheriting the deceased spouse's share of the property upon their passing. This type of ownership is recognized in some states, including Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. When a married couple owns property as community property with right of survivorship, they both have equal ownership and control of the property during their lifetimes. Upon the death of one spouse, the surviving spouse automatically inherits the deceased spouse's share of the property, without the need for probate. This means that the property can be transferred to the surviving spouse quickly and efficiently, without the need for court involvement. Community property with right of survivorship can be used for a variety of assets, including real estate, bank accounts, and investments. It is an attractive option for married couples who want to ensure that their property is transferred to their spouse upon their death, while also avoiding the costs and delays associated with probate. However, it's worth noting that community property with right of survivorship may not be suitable for all couples, particularly those with complex family situations or significant assets. It's always recommended to consult with an attorney or financial advisor to determine the best property ownership method for your specific situation.

Minimizing Probate through Strategic Asset Management

Minimizing probate through strategic asset management is a crucial aspect of estate planning. Probate can be a lengthy and costly process, tying up assets and causing unnecessary stress for loved ones. By implementing a few key strategies, individuals can significantly reduce the likelihood of their assets being subject to probate. Three effective methods for minimizing probate include converting assets to non-probate assets, using payable-on-death accounts, and transferring assets to a trust. By understanding and utilizing these techniques, individuals can ensure that their assets are distributed according to their wishes, while also minimizing the burden of probate on their loved ones. One of the most effective ways to minimize probate is by converting assets to non-probate assets, which can be achieved by re-titling assets in a way that avoids probate.

Converting Assets to Non-Probate Assets

Converting assets to non-probate assets is a strategic approach to minimize the probate process. Non-probate assets are those that pass directly to beneficiaries outside of the probate court, avoiding the lengthy and costly process. One way to convert assets to non-probate assets is by creating a living trust, also known as a revocable trust. This type of trust allows individuals to transfer ownership of assets, such as real estate, bank accounts, and investments, into the trust, which is then managed by a trustee. Upon the individual's passing, the assets in the trust are distributed to beneficiaries according to the trust's terms, bypassing probate. Another method is to use beneficiary designations, such as payable-on-death (POD) or transfer-on-death (TOD) designations, for assets like bank accounts, retirement accounts, and life insurance policies. These designations allow individuals to name beneficiaries who will receive the assets directly, without the need for probate. Joint ownership with right of survivorship is another way to convert assets to non-probate assets. When two or more individuals own an asset jointly, such as a bank account or real estate, the surviving owner(s) automatically inherit the asset upon the passing of the other owner(s), avoiding probate. Additionally, converting assets to non-probate assets can be achieved through the use of annuities and life insurance policies. By naming beneficiaries for these policies, individuals can ensure that the proceeds are distributed directly to the beneficiaries, bypassing probate. It is essential to note that converting assets to non-probate assets requires careful planning and consideration of individual circumstances. Consulting with an attorney or financial advisor can help individuals determine the best approach for their specific situation and ensure that their assets are distributed according to their wishes. By converting assets to non-probate assets, individuals can minimize the probate process, reduce costs, and ensure a smoother transition of their assets to their loved ones.

Using Payable-on-Death Accounts

Using payable-on-death (POD) accounts is a simple and effective way to minimize probate. A POD account allows you to name a beneficiary who will receive the account's assets upon your passing, bypassing probate entirely. This type of account can be used for various assets, including bank accounts, certificates of deposit, and even brokerage accounts. By designating a POD beneficiary, you ensure that the account's assets are transferred directly to the beneficiary, without the need for probate. This not only saves time and money but also provides peace of mind, knowing that your loved ones will receive the assets quickly and efficiently. Additionally, POD accounts are generally easy to set up and require minimal paperwork, making them a convenient option for those looking to avoid probate. It's essential to review and update your POD accounts regularly to ensure that the beneficiary information is accurate and reflects your current wishes. By incorporating POD accounts into your estate plan, you can minimize the risk of probate and ensure a smoother transition of your assets to your loved ones.

Transferring Assets to a Trust

Here is the paragraphy: Transferring assets to a trust is a strategic approach to minimizing probate. By placing assets in a trust, individuals can ensure that their property is distributed according to their wishes, while avoiding the lengthy and costly probate process. A trust is a legal entity that holds assets on behalf of beneficiaries, allowing the grantor to maintain control over the assets during their lifetime. To transfer assets to a trust, individuals can retitle assets in the name of the trust, such as real estate, bank accounts, and investments. They can also use beneficiary designations, such as payable-on-death (POD) accounts or transfer-on-death (TOD) deeds, to transfer assets to the trust upon their passing. Additionally, individuals can use a pour-over will to transfer any remaining assets to the trust after their death. By transferring assets to a trust, individuals can avoid probate, reduce estate taxes, and ensure that their assets are distributed according to their wishes. Furthermore, trusts can provide asset protection, creditor protection, and tax benefits, making them an attractive option for individuals looking to minimize probate and protect their assets.