How Long Does An Insurance Company Have To Investigate A Claim In Canada

Understanding The Basics Of Insurance Claim Investigations In Canada

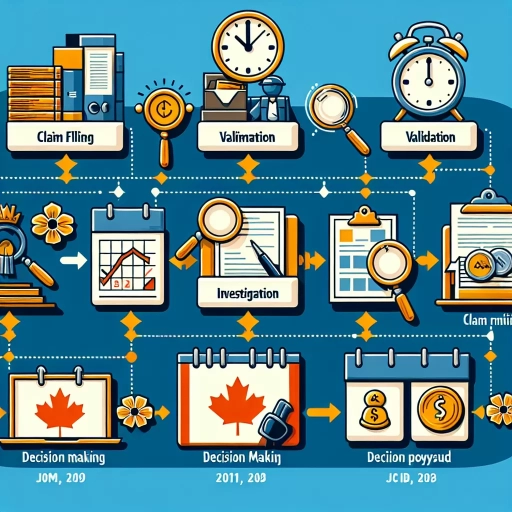

The Process Of Insurance Claim Investigations

Whenever an insurance claim is filed in Canada, an insurance company initiates a process known as an investigation to validate the authenticity of the claim. This is a critical and necessary step, designed to prevent insurance fraud, which can potentially elevate the cost of insurance premiums for all policyholders. From a policyholder's perspective, this step can be disturbing and time-consuming. However, it is essential to remember that the insurance company is simply fulfilling its due diligence to ensure that all claims are legitimate before they are paid out. This process includes review of relevant documents, eyewitness interviews, as well as background checks.

The Role Of An Insurance Adjuster

An insurance adjuster plays a crucial role in the claim investigation process. This individual is usually employed by the insurance company to scrutinize the details of your claim. The adjuster’s role involves gathering information about your claim, which often includes taking photographs, recording statements, as well as talking to witnesses. It is the adjuster's responsibility to ensure that all the facts of the case are aligned with the claim before recommending the insurance company to pay the claim. Therefore, the process could take a bit of time, depending on the complexity of the case.

Legal Time Frames For Insurance Claim Investigations

According to Canada's insurance regulations, insurance companies generally have a legal timeframe within which they should complete the claim investigation. Nevertheless, this timeline is not one-size-fits-all and varies depending on factors such as the province, the complexity of the case, the type of claim or the insurance company's existing backlog of cases. It is always advisable for policyholders to directly consult with their respective insurance providers about the expected time frame for their claim processing to avoid frustrations.

Factors Affecting the Duration of Insurance Claim Investigations in Canada

Type and Complexity of The Claim

The nature and complexity of the claim are significant determinants of how long the investigation will take. For instance, minor car accident claims may take a few days to investigate. On the other hand, complex claims like home insurance claims due to a house fire, where arson is suspected, might take several weeks or even months to conclude due to the higher levels of scrutiny required.

Level of Cooperation

A significant factor that impacts the duration of investigations is the level of cooperation demonstrated by the claimants. Providing all the necessary documents promptly and responding to questions honestly and quickly will speed up the investigation. Any delay from the claimant’s end may extend the time taken for the insurance company to investigate the claim.

Legal Mandates

The time taken by insurance companies to investigate a claim are also dictated by regional or provincial laws. These legal mandates often specify the maximum duration within which an insurance claim must be addressed, failure to which the insurance company might face penalties. Thus, while insurance companies have a responsibility towards abiding by these deadlines, policyholders too should acquaint themselves with these rules to ensure that their rights are not violated.

How To Expedite The Insurance Claim Investigation Process

Submit Comprehensive and Accurate Information

In order to facilitate a smooth and quick investigation, policyholders should strive to submit comprehensive and accurate information from the onset. This means providing all required documents, details, and being honest about the incident. By doing so, you eliminate the need for the adjuster to spend additional time on fact verification thus leading to a faster investigation process.

Follow Up Regularly

Although an insurance company has the obligation to investigate your claim promptly, sometimes following up can speed up the process. Regularly checking in with the insurance company or adjuster ensures that your claim is on their radar and avoids undue delays.

Enlist The Services of A Lawyer

In cases where the investigation seems to be taking longer than it should, enlisting the services of an insurance lawyer may be a wise decision. Lawyers specializing in insurance claims understand the legal terrain and could be instrumental in ensuring insurance companies uphold their legal obligation to timely investigate your claim.