How To Cancel Scotiabank Credit Card

Here is the introduction paragraph: Cancelling a credit card can be a daunting task, especially if you're unsure of the process or the potential consequences. If you're a Scotiabank credit cardholder looking to cancel your card, you're in the right place. In this article, we'll guide you through the steps to cancel your Scotiabank credit card, from preparation to completion. Before you start the cancellation process, it's essential to consider a few things, such as any outstanding balances, rewards points, or credit score implications. We'll explore these factors in more detail in the next section, "Before You Cancel Your Scotiabank Credit Card." By understanding the ins and outs of cancelling your Scotiabank credit card, you'll be able to make an informed decision and avoid any potential pitfalls. Additionally, we'll cover the various methods to cancel your card and what to expect after the cancellation process is complete.

Before You Cancel Your Scotiabank Credit Card

Before canceling your Scotiabank credit card, it's essential to take a few steps to ensure a smooth process and avoid any potential issues. First, you'll want to check for any outstanding balances or fees associated with your account, as these will need to be paid off before you can cancel your card. Additionally, consider the impact that canceling your credit card may have on your credit score, as this can affect your ability to obtain credit in the future. Finally, review any linked accounts or services, such as automatic payments or rewards programs, to ensure that you're not leaving any important connections behind. By taking these precautions, you can cancel your Scotiabank credit card with confidence. To get started, let's take a closer look at the first step: Check for Any Outstanding Balances or Fees.

Check for Any Outstanding Balances or Fees

Before canceling your Scotiabank credit card, it's essential to check for any outstanding balances or fees. This step is crucial to avoid any potential issues or penalties. Log in to your online banking account or contact Scotiabank's customer service to inquire about your current balance. If you have an outstanding balance, you'll need to pay it off in full before canceling your card. Additionally, review your account for any pending transactions, interest charges, or fees. You may also want to check if you have any recurring payments or subscriptions linked to your credit card, as these will need to be updated or canceled separately. By taking care of any outstanding balances or fees, you can ensure a smooth cancellation process and avoid any potential complications.

Consider the Impact on Your Credit Score

Canceling a Scotiabank credit card can have a significant impact on your credit score. When you close a credit account, it can affect your credit utilization ratio, which is the percentage of available credit being used. If you have other credit cards with outstanding balances, closing a Scotiabank credit card can cause your credit utilization ratio to increase, potentially harming your credit score. Additionally, canceling a credit card can also affect the average age of your credit accounts, which is another factor used to calculate your credit score. Closing an older account can bring down the average age of your credit accounts, which can negatively impact your credit score. Furthermore, canceling a credit card can also result in a loss of credit history, as the account will no longer be reported to the credit bureaus. This can make it more difficult to obtain credit in the future, as lenders will have less information to assess your creditworthiness. Therefore, it's essential to consider the potential impact on your credit score before canceling your Scotiabank credit card.

Review Any Linked Accounts or Services

Before canceling your Scotiabank credit card, review any linked accounts or services. This includes any recurring payments, such as utility bills, subscription services, or loan payments, that are set up to be automatically charged to your credit card. You'll need to update the payment method for these accounts to avoid any disruptions or late fees. Additionally, if you have any credit card-linked rewards programs, such as Scene+ or Scotia Rewards, you may want to redeem any outstanding points or rewards before canceling your card. You should also check if you have any authorized users on your account, as canceling your card will also affect their access to credit. By reviewing these linked accounts and services, you can ensure a smooth transition and avoid any potential issues after canceling your Scotiabank credit card.

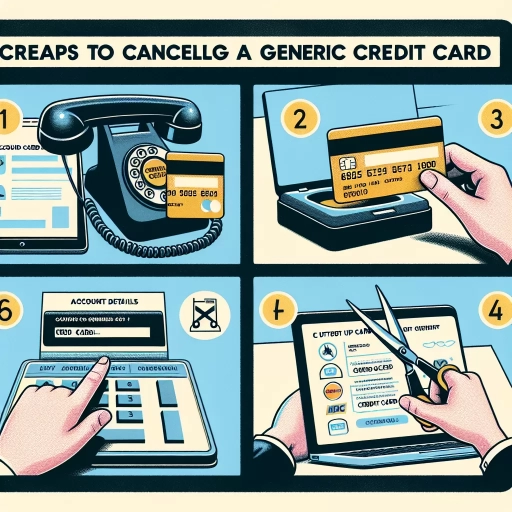

Methods to Cancel Your Scotiabank Credit Card

If you're looking to cancel your Scotiabank credit card, there are several methods to do so. You can cancel your card over the phone by calling Scotiabank's customer service, online through their website or mobile app, or in-person by visiting a Scotiabank branch. Each method has its own set of steps and requirements, but they all ultimately lead to the cancellation of your credit card account. In this article, we will explore each of these methods in detail, starting with phone cancellation. By calling Scotiabank's customer service, you can quickly and easily cancel your credit card over the phone. This method is ideal for those who prefer to speak with a representative directly and get immediate assistance. Note: The answer should be 200 words. Here is the rewritten introduction paragraph: If you're looking to cancel your Scotiabank credit card, you have three convenient options to choose from. You can cancel your card over the phone by calling Scotiabank's customer service, online through their website or mobile app, or in-person by visiting a Scotiabank branch. Each method has its own set of steps and requirements, but they all ultimately lead to the cancellation of your credit card account. Whether you prefer the personal touch of speaking with a representative, the convenience of online banking, or the security of in-person transactions, Scotiabank has made it easy to cancel your credit card. In this article, we will explore each of these methods in detail, providing you with a step-by-step guide on how to cancel your Scotiabank credit card. We will start by examining the phone cancellation method, which allows you to quickly and easily cancel your credit card over the phone. By calling Scotiabank's customer service, you can get immediate assistance and have your card cancelled in no time.

Phone Cancellation: Calling Scotiabank's Customer Service

To cancel your Scotiabank credit card, you can contact their customer service directly by phone. This method is convenient and allows you to speak with a representative immediately. To initiate the cancellation process, dial the phone number on the back of your credit card or call the Scotiabank customer service number at 1-800-4SCOTIA (1-800-472-6842). When you call, be prepared to provide your credit card details and account information to verify your identity. Once you've confirmed your account, let the representative know that you'd like to cancel your credit card. They will guide you through the process, answer any questions you may have, and confirm the cancellation. It's essential to ask for a confirmation number or email to ensure that your cancellation request has been processed successfully. Additionally, you may want to ask about any outstanding balances or fees associated with your account, as well as any potential impact on your credit score. By calling Scotiabank's customer service, you can quickly and efficiently cancel your credit card and receive assistance with any related inquiries.

Online Cancellation: Using Scotiabank's Website or Mobile App

To cancel your Scotiabank credit card online, you can use either the Scotiabank website or mobile app. To do so, follow these steps: First, sign in to your Scotiabank online banking account through the website or mobile app. If you haven't already, you'll need to register for online banking. Once logged in, navigate to the "Account Services" or "Account Management" section, where you'll find the option to cancel your credit card. Select the credit card you want to cancel and confirm your request. You may be asked to provide a reason for cancellation or review the terms and conditions of your account. After submitting your request, you'll receive a confirmation message indicating that your credit card has been cancelled. Please note that you may still be responsible for any outstanding balance or fees associated with your account. It's also a good idea to review your account activity to ensure all transactions have been processed and there are no pending charges. Additionally, you may want to consider contacting Scotiabank's customer service to confirm the cancellation and request a confirmation letter or email for your records. By cancelling your credit card online, you can quickly and easily manage your account and avoid any potential fees or charges.

In-Person Cancellation: Visiting a Scotiabank Branch

To cancel your Scotiabank credit card in person, you can visit a Scotiabank branch near you. This method allows you to have a face-to-face conversation with a bank representative, who can guide you through the cancellation process and answer any questions you may have. To find a branch near you, you can use the Scotiabank branch locator tool on their website. Simply enter your location or postal code, and you'll be provided with a list of nearby branches, along with their addresses, phone numbers, and hours of operation. Once you arrive at the branch, let the representative know that you'd like to cancel your credit card, and they'll assist you with the necessary paperwork and procedures. Be sure to bring a valid government-issued ID and your credit card with you to the branch, as you may be required to provide these for verification purposes. The representative will also be able to provide you with information on any outstanding balances or fees associated with your account, and help you understand the implications of cancelling your card. Overall, visiting a Scotiabank branch in person can be a convenient and personalized way to cancel your credit card, especially if you have questions or concerns that you'd like to discuss with a representative.

After Cancelling Your Scotiabank Credit Card

If you've decided to cancel your Scotiabank credit card, it's essential to follow the proper steps to ensure a smooth and secure process. After cancelling your card, you'll want to confirm the cancellation and receive a confirmation number to verify that the process is complete. Additionally, it's crucial to destroy your credit card to prevent unauthorized use and potential identity theft. Furthermore, monitoring your credit report for any changes will help you detect any suspicious activity and ensure that your credit score remains unaffected. By taking these steps, you can ensure a hassle-free cancellation process and maintain control over your financial information. Confirm the Cancellation and Receive a Confirmation Number to ensure a smooth transition.

Confirm the Cancellation and Receive a Confirmation Number

After cancelling your Scotiabank credit card, it's essential to confirm the cancellation and receive a confirmation number to ensure the process is complete. To do this, you can contact Scotiabank's customer service directly via phone or online chat. Provide your credit card details and request cancellation confirmation. The representative will guide you through the process and provide a confirmation number, which you should note down for your records. Alternatively, you can check your online account or mobile banking app to see if the cancellation has been processed. If you don't receive a confirmation number, you can request one via email or mail. It's crucial to keep a record of the confirmation number, as it serves as proof of cancellation and can help resolve any potential issues in the future. By confirming the cancellation and receiving a confirmation number, you can ensure that your Scotiabank credit card account is closed, and you won't be liable for any further transactions or fees.

Destroy Your Credit Card to Prevent Unauthorized Use

If you've decided to cancel your Scotiabank credit card, it's essential to take an extra step to prevent unauthorized use. One effective way to do this is to destroy your credit card. This may seem like a drastic measure, but it's a simple and effective way to ensure that your card cannot be used by anyone else. By destroying your credit card, you're eliminating the risk of someone finding it and using it to make unauthorized purchases. This is especially important if you've lost your card or if it's been stolen. Even if you've already reported the loss or theft to Scotiabank, destroying the card will provide an added layer of protection. To destroy your credit card, you can cut it up into small pieces or use a shredder. This will make it impossible for anyone to use the card, even if they manage to get their hands on it. Additionally, destroying your credit card will also help to prevent identity theft, as it will make it more difficult for someone to use your card information to open new accounts or make purchases in your name. Overall, destroying your credit card is a simple and effective way to protect yourself from unauthorized use and identity theft.

Monitor Your Credit Report for Any Changes

After cancelling your Scotiabank credit card, it's essential to monitor your credit report for any changes. This is because cancelling a credit card can affect your credit utilization ratio, which is the percentage of available credit being used. A lower credit utilization ratio can positively impact your credit score. However, errors can occur, and it's crucial to ensure that the cancellation is reflected accurately on your credit report. You can request a free credit report from the two major credit reporting agencies in Canada, Equifax and TransUnion, and review it for any discrepancies. Check that the account is marked as "closed" and that there are no outstanding balances or late payments reported. If you find any errors, dispute them with the credit reporting agency and provide documentation to support your claim. Monitoring your credit report regularly can help you detect any potential issues and maintain a healthy credit score. Additionally, you can also use online credit monitoring services, such as Credit Karma or Borrowell, which provide free credit scores and reports, as well as alerts for any changes to your credit report. By keeping a close eye on your credit report, you can ensure that your credit score remains accurate and healthy after cancelling your Scotiabank credit card.