How To Get A Gst Number

Understanding GST and Its Importance

The Definition and Objective of GST

The Goods and Services Tax, often referred to as GST, is a value-added tax that is levied on almost all goods and services marketed for domestic consumption. It was implemented to replace several indirect taxes, enabling the provision of a single taxation system. The goal of GST is to achieve a uniform standard of indirect taxes throughout the nation, thereby making India one single unified market.

Why Do You Need a GST Number?

Sellers need a GST number for a variety of reasons. Primarily, having a GST number is a legal requirement for businesses with a turnover of more than 20 lakh INR in a financial year. This tax registration allows you to legally charge your customers GST, contributing to the overall tax revenue of the country. Additionally, having a GST number can lend your business credibility, making it more attractive to potential clients. It's also obligatory if you plan on claiming GST credits for taxes paid on your business purchases.

Benefits of GST Implementation

The implementation of GST presents numerous advantages. Among these benefits is the streamlining and simplification of indirect tax structures, which were previously time-consuming and complicated. The GST also reduces the cost of compliance and administration for businesses, fostering a business-friendly environment. Moreover, it provides better regulation and accountability, resulting in reduced corruption. Lastly, the GST promotes competitiveness by eliminating cascading tax effects, enabling businesses to have a level playing field, regardless of their size or scale.

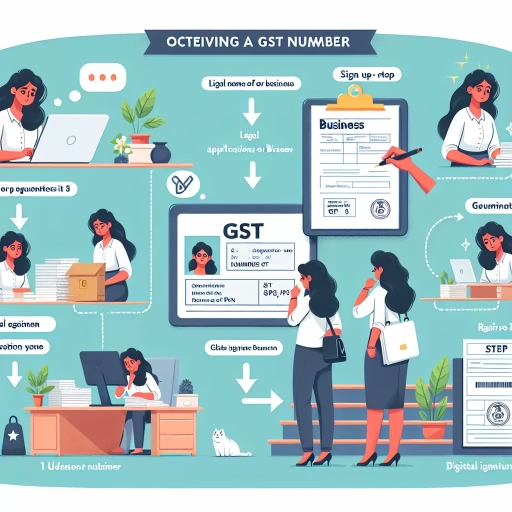

Steps to Obtain a GST Number

Prepare the Necessary Documents

Prior to registering for a GST number, it is crucial to gather all necessary documents. These documents vary depending on the business nature and include proofs of business, PAN card of the business, and personal details like photographs and proof of appointment of authorised signatory. You should also prepare financial information such as details of the bank account.

Navigating the GST Portal

Obtaining a GST number involves applying online via the GST portal. Understanding how to properly navigate the portal will be instrumental in your registration process. On the portal, you will be asked to fill out various forms, submit the necessary documentation, and validate yourself as a business owner. Be prepared to be patient and meticulous in this process to avoid any errors or delays.

Carefully Comply with All Legal Requirements

The GST registration process requires full legal compliance. This involves being completely honest in your application, providing accurate and up-to-date information, and ensuring all your operations are legal and above board. Non-compliance can lead to a range of penalties, including sizable fines and even jail time in severe cases.

Maximizing the Benefits of Your GST Registration

Access to Tax Credits

Once you have your GST number, you will be able to claim Input Tax Credit (ITC). This means that the taxes you paid on your business purchases can be deducted from your tax liability, potentially resulting in significant savings. To maximise these benefits, it is essential to keep track of all your business-related purchases and ensure you have legitimate invoices for all of them.

Expanding Your Business

Having a GST number enables you to expand your business across state lines. This is because GST is a centralised tax, so no extra taxes are required for interstate transactions. This not only simplifies your tax processes but also opens up a much larger market for your products or services.

Possibility of Government Tenders

Finally, smaller businesses with a GST number have a better chance of securing government tenders. Government bodies often require companies to have a GST registration to be considered for their tenders, so having a GST number significantly increases your opportunities for growth and expansion.