How To Get A Copy Of Vacant Home Tax Declaration Online

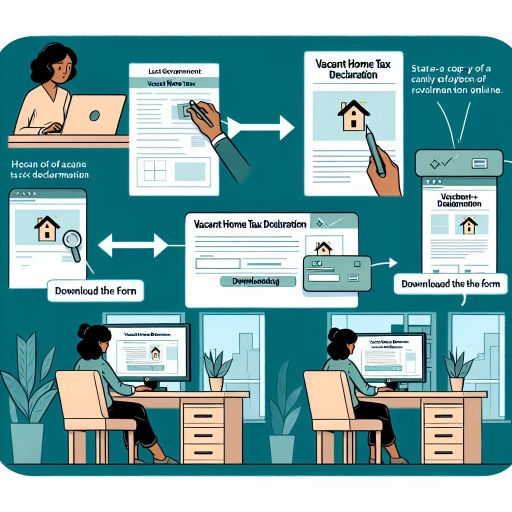

In an era of increased digitalization, obtaining crucial documents like a vacant home tax declaration has been transformed into a simple and efficient process. This article offers meticulous insight into how to obtain a copy of a vacant home tax declaration online, so you can avoid unnecessary stress and effort associated with traditional bureaucratic paperwork. We'll walk you through three important steps: gathering your required information, locating the correct online portal, and finally, accessing and filling out the form. Whether you're tackling this task out of necessity or are simply considering the purchase of a vacant property, understanding this process can potentially save you from future tax-related headaches. Now, let's dive into the first step of this procedure, which is the key to streamlining your vacant home tax declaration process: gathering the necessary information.

In an era of increased digitalization, obtaining crucial documents like a vacant home tax declaration has been transformed into a simple and efficient process. This article offers meticulous insight into how to obtain a copy of a vacant home tax declaration online, so you can avoid unnecessary stress and effort associated with traditional bureaucratic paperwork. We'll walk you through three important steps: gathering your required information, locating the correct online portal, and finally, accessing and filling out the form. Whether you're tackling this task out of necessity or are simply considering the purchase of a vacant property, understanding this process can potentially save you from future tax-related headaches. Now, let's dive into the first step of this procedure, which is the key to streamlining your vacant home tax declaration process: gathering the necessary information.Step 1: Gather Required Information

Property Management begins with a strategic assemblage of crucial information. Every venture into property management serves as a journey of essential discovery that can influence the eventual success or failure of your venture. This foundational and thoroughly focused method initiates with three pivotal steps: identifying the property, collecting vital property details, and determining the relevant tax authority. Initially, identifying the property under consideration is the basis of everything else. This involves ascertaining the physical location and other rudimentary information of the property. Moving one step further, intense exploration to collect property details follows suit. You should delve into intricate aspects like property measurements, layout, condition, history, zoning, and other unique features. Lastly, determining the tax authority helps you delineate tax obligations and possibly, any underlying advantages that you could leverage. Each step runs intrinsically into the other, interlocking to form a consummate knowledge base required for effective property management. We begin with the initial phase: identifying the property.

1.1 Identify the Property

1.1 Identify the Property

The first crucial step to retrieve a vacant home's tax declaration online is pinpointing the exact identity of the property in question. This pivotal stage encompasses more than just knowing the street address of the vacant property as it involves gathering a comprehensive set of information that outlines the distinctive aspects of the property, providing an accurate identity that aids in quick and efficient identification within an online database. Primarily, you may begin with the simple details such as the property's street address, city, and zip code. Subsequently, delve into more intricate information like the Property Identification Number (PIN), if available, which is unique to every property and can be found on tax bills or mortgage documents. Another key aspect is the legal description of the property, usually recorded within the property title, highlighting the boundaries or coordinates of the land on which the house is situated. Properties also have associated tax parcel numbers, assigned by the county tax assessor, crucial for tracking tax payments. Moreover, if accessible, include details such as the year the house was built, the size of the property measured in square footage, and the current zoning status (residential, commercial, etc.) as these can also provide additional layers of identification. Familiarity with these minute details, from its location to its legal description, helps in distinguishing the property from others, ensuring the accuracy and efficiency of your search within an online records database. Accurate identification of a property also eliminates any potential confusion or errors that can lead to misinformation or delayed processing. This livelihood on detailed information extends the significance of this step within the broader process of obtaining a copy of a vacant home tax declaration online. Remember, identifying the property is only the beginning, but its necessity cannot be overstressed as it is the bedrock step that sets the tone for the following phases of the process.1.2 Collect Property Details

As part of your endeavor to obtain a copy of a vacant home tax declaration online, it is essential to collect all pertinent property details, which is step 1.2 in the process - Gather all Required Information. The comprehensive collection of property details acts as a cornerstone to the online acquisition of a vacant home tax declaration, expediting the venture and ensuring its success. It is important to note that property details will vary based on the specific property and location, but there are certain key pieces of information that you will invariably need. Start with fundamental information such as the official property address, property identification number or parcel number. This data is typically available on previous tax bills, mortgage papers, or other official correspondence associated with the property. You’ll also need the name(s) of the homeowner(s) or property owner(s). This is crucial because tax declarations are often registered in the owner's name. If the property is owned by an entity, such as a corporation or a trust, you'll need the name of that entity. In the case where the property has passed through several hands, gather details of all former owners, if possible. In some jurisdictions, it may be necessary to provide additional information, like the legal description of the property, which includes lot number, block number, tract number, and other legal identifiers. This information can often be found in the deed or title report of the property. You may also need to provide specifications of the property, like the total square footage, the number of bedrooms and bathrooms, year of construction, and any other significant architectural details or improvements. This kind of detailed information will help you accurately identify the property and ensure the correct vacant home tax declaration is obtained. Remember, this is a comprehensive, meticulous process, and accuracy is paramount for successful completion. Any inaccuracies or missing information may delay or derail the entire process. Consider taking the help of a real estate professional or tax expert if you are unsure about any aspect of this step. Thus, collecting property details efficiently is crucial and forms a fundamental part of the process of obtaining a vacant home tax declaration online.

1.3 Determine the Tax Authority

In the process of obtaining a copy of a vacant home tax declaration online, step 1.3 requires determining your tax authority. It is crucial to identify the correct tax authority because they manage property tax assessments, payments, and tax declaration documents. In the United States, for example, the tax authority may be a town clerk, a county treasurer, a tax collector, or a municipal assessor. It varies depending on state and local laws. To ensure that you are dealing with the right authority, it's advisable to conduct some detailed online research. Start by reviewing your property tax bills or annual tax documents if you have access to them as these often contain the name and contact information of your tax authority. Alternatively, you can look up your local government's website where there should be a section dedicated to property taxes. Look for departments named 'Assessor’s Office', 'Tax Collector’s Office', or 'Treasurer’s Office'. These are common names for tax administering bodies. Some states may also have multiple tax authorities, such as school districts or special-purpose districts, which impose taxes separate from the regular property tax. In such cases, check who specifically handles vacant home tax declarations. In some instances, it might be a different department or level of government. You could also try searching for the term 'property tax' or 'vacant property tax' with your location to discover the most relevant results. Don’t underestimate the value of making a phone call. Reach out to your city, county, or state’s administrative offices for guidance. They are equipped to provide you with the correct tax authority contact information and can guide you to the right place. In conclusion, identifying the right tax authority forms a pivotal part of the process in obtaining a vacant home tax declaration. This step ensures that your requests are directed to the right jurisdiction for action. It underscores the importance of gathering the required information in the initial stages before proceeding with any specific requests. By assuring this, you ensure a smooth process when obtaining a copy of vacant home tax declarations online.

Step 2: Find the Online Portal

Finding the online portal for any service or transaction can be quite a daunting task. It requires careful consideration and attention to detail. The second step to a successful online tax filing is tracing the exact, official web portal. This is vital as the web is filled with pseudo-websites keen on stealing your information and resources. The next sections explain the process in three easy to follow steps. Firstly, you should be well versed in how to effectively search for the official website being mindful of imitation websites. Secondly, you must be careful to check for online tax declaration platforms. These platforms are your primary avenues of filing your tax declaration. Not all are created equal so an understanding of their credibility is vital. Lastly, you must ascertain the security and legitimacy of the website. Cybersecurity is paramount in online transactions. Failing to ensure website security could lead to severe consequences. Therefore, firstly, we shall delve into how you can competently search and locate the official website.

2.1 Search for the Official Website

2.1 Search for the Official Website

To begin the process of obtaining a copy of your vacant home tax declaration online, you will first need to search for the official website/platform of the local tax authority or municipal corporation. As the official site, it will present an authorized view of your tax obligations and provide you with reliable and comprehensive resources. Key information about vacant home taxes, filing deadlines, requisites, and other pertinent details are typically presented on these platforms. It's certain that the website is secure and legal, which means your confidential information will remain safe and sound throughout the process. Starting the search, it's essential to use credible search engines like Google or Bing to avoid potential scams or unofficial sites that may aim to mislead you. Type in the correct combination of keywords such as 'vacant home tax declaration' along with the name of your city or council. From the displayed search results, identify the official website which is usually characterized by a domain ending in '.gov' or '.org'. These suffixes give a hallmark of a valid governmental website. Beware of 'phishing' sites that may appear legitimate but could be designed for data theft. The homepage of the official website commonly provides a structured and user-friendly layout. It typically embraces links to various services, ordinances, guidelines, and tax-related forms. While navigating, if you experience any difficulties in finding the appropriate section for vacant home tax declarations, utilize the ‘search’ function, which typically located at the top of the homepage. By using relevant keywords, it can guide you directly to the desired page. Furthermore, ensure your browser is updated to the latest version to prevent security risks and allow for a seamless browsing experience. It is recommended to have a stable internet connection to avoid interruption during the process. As you'd expect with any digital transaction, your individual privacy is paramount. So, before proceeding with any online transactions or data entry, make sure to read the privacy policy of the website. In summary, the search for the official website is a critical first step towards obtaining a copy of your vacant home tax declaration online. This step not only guides you to the right source but also ensures the safety of your data and provides efficient transactional experience. Remember, while the information provided on the website is designed to be comprehensive and user-friendly, you should always feel free to contact customer service if ever in doubt about the process. They are there to assist you and make your online tax declaration as straightforward as possible.2.2 Check for Online Tax Declaration Platforms

The subsection 2.2 on the topic 'Check for Online Tax Declaration Platforms' is an integral aspect of Step 2: 'Find the Online Portal,' in the article titled 'How to Get a Copy of Vacant Home Tax Declaration OnlineBedrock'. Proper execution of this step ensures seamless navigation through the virtual tax realm. In an era where digital prevalence has revolutionized the way we perform daily tasks, various tax authorities across the world have integrated online platforms to facilitate easy tax declarations. Securing a copy of your vacant home tax declaration is now as simple as a click away. The bedrock of this process lies in identifying and utilizing the correct online tax declaration platform. It is the pivotal point that helps in navigating the digital tax ecosystem. The user-friendly platforms are designed, keeping in mind the need for easy navigation, even for those not technologically versed. Detailed instructions, help buttons, and FAQs are just a click away, ensuring a smooth experience in going about your tax declaration. With most jurisdictions having their specific tax portals, ensure you are visiting the legitimate site for your area. This can be verified by looking at the website's domain, which usually ends with '.gov' signifying its authenticity. These platforms are equipped with multifaceted features. Not only do they allow you to declare your taxes but also provide access to previous tax documents, status of your payments, deadlines, and even tax law updates. Some platforms also offer the accommodation of different languages, making it a universal tool for tax declarations. Safety is paramount. These sites offer high-level security for your personal and fiscal data. They are guarded by advanced security measures, including encryption and firewalls, and often necessitate two-factor authentication to further safeguard your data. Your information traverses the digital realm securely without running the risk of falling into the wrong hands. Lastly, online tax declaration platforms are not merely limited to computer access. With the advent of mobile technology, many tax authorities have also developed mobile applications. Thus, granting you the liberty to declare your taxes anytime, anywhere, at your convenience. However, one must be cautious while doing so. Ensure that you are using a secure internet connection and avoid unsecured public Wi-Fi to prevent any potential data theft. Finding and utilizing the right online tax declaration platform is the key to making your vacant home tax declaration process simple, secure, and convenient. It ensures you stay in line with your fiscal duties while avoiding long queues at the tax office. Enjoy the process of easy tax declaration from the comfort of your home, without compromising on security and accuracy.

2.3 Verify the Website's Security and Legitimacy

After locating the online portal that provides access to the records regarding vacant home tax declarations, Step 2.3 is to verify the website's security and legitimacy. It's a critical step that should never be bypassed, just as the security of personal and financial information is equally essential. Data breaches are a regular occurrence in today's digital world with grave consequences, making it a mandatory task for every user to verify the authenticity of every website before providing sensitive information. Check for an SSL (Secure Sockets Layer) Certificate to determine if the site is safe. This is usually marked by showing 'https://' instead of 'http://' before the web address. A padlock icon next to the URL also signifies that the website is safe. The SSL Certificate encrypts data that flow between your web browser and the website, keeping your sensitive information secure. Website authority and reputation also play an important role in establishing its legitimacy. To ascertain a website’s authenticity, analyze its design, content, and usability. Frauds and scams typically have poorly-designed pages with several grammatical errors and low-quality images. Furthermore, examine if the website has transparent contact information and check the genuineness of its social media presence. Also, check for the website's privacy policy. A legitimate website will clearly articulate their policies regarding the collection, use, and disclosure of personal information. Websites without a privacy policy or those with vague policies should be approached cautiously. Furthermore, remember that official portals for such declarations usually end with '.gov' or similar official domain titles. Any other domain could signify a potential threat. Reviews and ratings from other users on platforms like Trustpilot or Google can also provide insights into a website's reliability. Also, it's always advisable to use trusted Internet networks when accessing these sites. Avoid using public WIFI to protect your data from being intercepted by cybercriminals. So, before pursuing any vacancy home tax declaration online, prioritize your safety. Make sure the website you're navigating is secure and legitimate, then proceed with gaining access to the records. Internet security is more than a step in a process; it's a requirement and a responsibility. Stay informed and take the necessary precautions. Remember, when it comes to online safety, vigilance plays a crucial role.

Step 3: Access and Fill Out the Form

The third step in filing your vacant home tax requires careful attention as it involves accessing and accurately filling out the Vacant Home Tax Declaration Form. This crucial stage is composed of three essential sub-steps that should be duly followed to ensure a successful process. The first sub-step, 3.1 details how to correctly locate the Vacant Home Tax Declaration Form. The second sub-step, 3.2 focuses on accurately and completely filling out the form, to avoid any inaccuracies that could lead to potential issues down the road. Finally, sub-step 3.3 emphasizes the importance of reviewing your entries and effectively submitting the form. Each sub-step is critical to a seamless process and provides detailed guidance on every single stage – from locating the form, ensuring accurate data input, to effectively reviewing and submitting your entries. Now, let's delve deeper into the first critical stage- locating the Vacant Home Tax Declaration Form.

3.1 Locate the Vacant Home Tax Declaration Form

To locate the Vacant Home Tax Declaration Form, you'll need to navigate to the specific web portal of your local government or taxation agency. This webpage is typically nested under sections concerning property taxes, housing, or local codes. Utilizing the search bar – if present – and entering 'Vacant Home Tax Declaration Form' can also streamline the process. Before you start filling out the Vacant Home Tax Declaration Form, it is crucial to bring together all necessary information. Therefore, gather your property and personal tax records. The form typically requires tax-related data about you as the property owner and specific details about the property itself. Your full legal name, contact information, and social security number are among personal details usually required. As per the property information, you may need to provide the property's exact location, dimensions, property use specifics, and whether utility services are being used. Filling out the Vacant Home Tax Declaration Form is an easy process once you've prepared all the necessary information. Depending on your locality, this form may be accessible online or provided as a downloadable PDF document. If it's the former, you can efficiently fill out the requested fields in a couple of minutes. If it's a PDF, you'll need to download it, print it out, complete it manually, then scan and return it either by mail or as an email attachment. Bear in mind to read each section thoroughly, input accurate responses, and double-check everything before submission. Finally, remember that failure to timely submit a Vacant Home Tax Declaration Form may result in fines. Certain localities even implicate property liens for persistent non-compliance. These laws are put in place to address housing shortages, thus encouraging property owners to either rent out their vacant properties or place them back on the market. Therefore, it is vital not only to find and complete the Vacant Home Tax Declaration Form but also to submit it on time. In conclusion, locating the Vacant Home Tax Declaration Form online constitutes a crucial step towards adhering to property tax regulations within your area. Be aware of all the necessary supporting documents needed, fill out the form meticulously, and ensure prompt submission to avoid penalties. Communities thrive when all property owners fulfill their civic duties, contributing to vibrant, populated neighborhoods as opposed to vacant ones.

3.2 Fill Out the Form Accurately and Completely

Acquiring a copy of an online vacant home tax declaration should be third step of the online application process. In the 3.2 section, 'Fill Out the Form Accurately and Completely,' it's significantly critical to pay careful attention to ensuring that all information provided matches the official records. Missteps here may lead to processing delays or even rejection of the request. Initially, one needs to recognize the different components of the form. The typical form fields include the property identification number, taxpayer details, property facts, tax records, and verification details. The property identification number is especially critical because it links your application to the specific vacant property you're interested in. Consequently, to avoid errors, it's better to double-check this number with the official property records. The form also necessitates accurate taxpayer details. One should provide the full taxpayer’s name as registered with the tax authority. Some forms demand more details such as social security numbers or taxpayer identification numbers. It's essential to ascertain that the information provided matches with the tax records linked to the respective vacant property. Following this, the form may require information about the vacant property itself. One should accurately fill in the full address, ownership details, and other specifics such as the date of vacancy, square footage, and market value. Obtain this data from official records to ensure its accuracy. Another necessary part of the form is the tax records section, typically asking for the years for which one wants property tax details. Since some tax authorities provide a yearly summary of unpaid taxes, one might need to specify the year to discover any existing tax liens against the vacant property. Finally, the form will usually end with a verification section where you must affirm that all the information provided is correct to the best of your knowledge. Be careful at this point because the provision of false information can have legal consequences. However, if you've carefully filled out all the form sections, this should be straightforward. Properly completing the form is fundamental to the online application process. The tax authority needs correct and complete information to locate the specific vacant property and provide accurate tax declaration details. Therefore, one should not rush through this process. Instead, take enough time to fill out the form accurately and completely. This step is an essential component in your efforts to obtain a copy of the vacant home tax declaration.

3.3 Review and Submit the Form

Once you've accessed and filled out the vacant home tax declaration form, the next crucial step is to thoroughly review and submit it. It's a vital part of 'Step 3: Access and Fill Out the Form.' Carefully checking and revising the information included in the form ensures validation. As errors or inaccuracies are potentially detrimental, possibly leading to processing delays or outright disapproval, meticulous evaluation becomes paramount. Review the data entered in the form, including property locations, the length of vacancy, reasons for vacancy, etc. Remember, truthful and accurate information bolsters the chances of successful submission. Submission of the form follows the evaluation process. Make sure to know the submission guidelines properly to avoid any complications. Typically, online forms like these can often be submitted with the click of a button. However, it's essential to double-check if the form submission requires additional steps, like identity verification, property verification, or digital signatures. Sometimes, a failure to complete these steps can lead to your application being dismissed or returned, causing unnecessary delays. Each portion of the form should be checked for clarity, accuracy, and completeness. The reviewing process may seem arduous and time-consuming, yet its importance can not be overstated. Reviewing and submitting the form is not just about going through the data and clicking submit; it's a careful process that requires attentive focus. The review process should include validating personal information, contact details, the subject property's details and the reason for its vacancy, the duration it has been vacant, and any additional information that may be required as per jurisdiction, like tax-related documents, homeowner association documents, or photographic evidence. The idea is to ensure that you have correctly filled in every necessary field without leaving anything vague or unanswered. It's also recommended to save a copy of your completed form before submitting it. This step is essential for future reference and to ensure you have proof of the information submitted. It also helps if you need to follow up on your application and reference specific details reported in your application. In conclusion, reviewing and submitting your tax declaration form for vacant homes is undoubtedly a significant step that requires careful attention to detail. Proper execution of this step not only increases the likelihood of your form being accepted but also significantly saves your time and hassle through the process. The online platform provides a seamless way to complete this process, contributing to efficient and effective property management. The three-point-step of accessing, filling out, and reviewing & submitting the form becomes your guide to a hassle-free vacant home tax declaration.