How To Find Line 15000 On Tax Return

Here is the introduction paragraph: When it comes to filing taxes, navigating the complex tax return form can be overwhelming, especially for those who are new to the process. One of the most common questions taxpayers have is how to find line 15000 on their tax return. To answer this question, it's essential to understand the tax return form, navigate to the correct section, and be aware of common challenges that may arise. In this article, we will break down the process into three key steps: understanding the tax return form, navigating to line 15000, and overcoming common challenges. By the end of this article, you will have a clear understanding of how to find line 15000 on your tax return. First, let's start by understanding the tax return form.

Understanding the Tax Return Form

The tax return form can be a daunting document, especially for those who are new to filing taxes. However, understanding the layout and components of the form is crucial for accurate and efficient tax filing. To navigate the tax return form with confidence, it's essential to locate the main sections, identify the different schedules and forms, and recognize the importance of line numbers. By breaking down the form into these key components, individuals can better comprehend the information required and ensure they are taking advantage of all eligible deductions and credits. In this article, we will explore these critical aspects of the tax return form, starting with the main sections that provide the foundation for the entire document. By understanding the layout of the main sections, individuals can begin to build a solid foundation for their tax filing process. Locating the Main Sections of the Tax Return is the first step in mastering the tax return form.

Locating the Main Sections of the Tax Return

The main sections of the tax return form are crucial to understanding and completing the document accurately. The first section is the Identification section, which includes the taxpayer's name, address, date of birth, and social insurance number. This section is usually located at the top of the first page of the tax return. The next section is the Filing Status section, which determines the taxpayer's marital status and number of dependents. This section is typically found on the first page as well. The Income section is where the taxpayer reports their employment income, self-employment income, and other sources of income. This section is usually divided into several subsections, such as T4 slips, T4A slips, and self-employment income. The Income section is typically located on the first and second pages of the tax return. The Deductions section is where the taxpayer claims their deductions, such as RRSP contributions, charitable donations, and medical expenses. This section is usually located on the second and third pages of the tax return. The Credits section is where the taxpayer claims their tax credits, such as the basic personal amount, spousal amount, and child fitness tax credit. This section is usually located on the third and fourth pages of the tax return. Finally, the Payment and Refund section is where the taxpayer reports their total tax payable, total credits, and net amount owing or refund. This section is usually located on the last page of the tax return. By locating these main sections, taxpayers can ensure they complete their tax return accurately and efficiently.

Identifying the Different Schedules and Forms

When it comes to navigating the complexities of tax returns, understanding the different schedules and forms is crucial. The Canada Revenue Agency (CRA) provides various schedules and forms to help individuals and businesses report their income, claim deductions, and calculate their tax liability. One of the most common schedules is the T1 General, which is used to report personal income, deductions, and credits. This schedule is typically used by individuals who have employment income, investment income, or self-employment income. Another important schedule is the T4, which is used to report employment income, such as salaries, wages, and tips. The T4A schedule is used to report other income, such as scholarships, fellowships, and research grants. For businesses, the T2125 Statement of Business or Professional Activities is used to report business income and expenses. The T776 Statement of Real Estate Rentals is used to report rental income and expenses. The T1135 Foreign Asset Verification Statement is used to report foreign assets and income. Understanding which schedules and forms to use is essential to ensure accurate reporting and to avoid penalties. It's also important to note that some schedules and forms may be required to be filed electronically, while others may be filed on paper. By familiarizing yourself with the different schedules and forms, you can ensure a smooth and stress-free tax filing experience.

Recognizing the Importance of Line Numbers

Here is the paragraphy: Recognizing the importance of line numbers is crucial when navigating the tax return form. Each line number corresponds to a specific section or field that requires information, and understanding their significance can help individuals accurately complete their tax return. Line numbers serve as a reference point, allowing taxpayers to quickly identify the information required for each section. For instance, line 15000 is a critical section that requires individuals to report their total income from all sources. By recognizing the importance of line numbers, taxpayers can ensure they provide accurate information, avoid errors, and minimize the risk of audits or penalties. Furthermore, line numbers help taxpayers to organize their information, making it easier to review and verify their tax return. By paying attention to line numbers, individuals can ensure they meet the necessary requirements and take advantage of available tax credits and deductions. Ultimately, recognizing the importance of line numbers is essential for a smooth and stress-free tax filing experience.

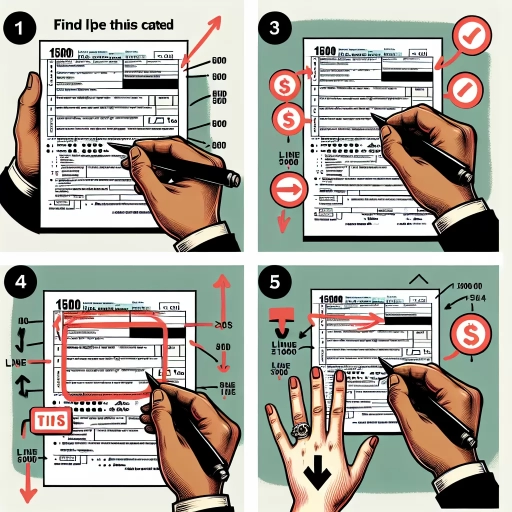

Navigating to Line 15000

Navigating to Line 15000 in a lengthy document or form can be a daunting task, especially when time is of the essence. To efficiently find this specific line, it's crucial to employ effective navigation strategies. Three key methods can significantly reduce the time spent searching: utilizing the table of contents or index, searching for keywords related to the content around Line 15000, and following the sequential order of the form. By understanding how to apply these techniques, individuals can streamline their navigation process. For those looking to quickly locate Line 15000, starting with the most direct method—using the table of contents or index—can often yield the fastest results. This approach allows users to bypass unnecessary sections and directly access the desired part of the document, making it an indispensable skill for efficient navigation.

Using the Table of Contents or Index

When navigating to Line 15000 on your tax return, using the Table of Contents or Index can be a huge time-saver. The Table of Contents is usually located at the beginning of the tax return form, and it provides a list of all the sections and lines, including Line 15000. By referring to the Table of Contents, you can quickly identify the page number where Line 15000 is located. On the other hand, the Index is typically found at the back of the tax return form, and it provides an alphabetical list of keywords and phrases, including "Line 15000". By looking up "Line 15000" in the Index, you can find the corresponding page number and section where it is located. Both the Table of Contents and Index are designed to help you quickly locate specific lines and sections on your tax return, saving you time and effort. By using these tools, you can efficiently navigate to Line 15000 and complete your tax return with ease.

Searching for Keywords Related to Line 15000

When searching for keywords related to Line 15000, it's essential to use specific and relevant terms to get accurate results. Some of the keywords you can use include "Line 15000 tax return," "Line 15000 tax form," "Line 15000 tax deduction," and "Line 15000 tax credit." You can also use phrases like "what is Line 15000 on tax return," "how to find Line 15000 on tax form," and "Line 15000 tax return instructions." Additionally, you can use keywords related to the specific tax form you are using, such as "Form 1040 Line 15000" or "Form 1040A Line 15000." By using these keywords, you can quickly find the information you need to accurately complete Line 15000 on your tax return.

Following the Sequential Order of the Form

When navigating to Line 15000 on your tax return, it's essential to follow the sequential order of the form to ensure accuracy and avoid errors. The sequential order refers to the numerical order in which the lines and sections are presented on the tax return form. By following this order, you can systematically work through the form, completing each section and line in the correct sequence. This approach helps prevent mistakes, such as omitting required information or incorrectly calculating totals. To follow the sequential order, start at the beginning of the form and work your way down, completing each line and section in numerical order. For example, if you're completing Form 1040, you would start with Line 1, "Filing Status," and then proceed to Line 2, "Name and Address," and so on. As you complete each line, make sure to follow the instructions provided and enter the required information accurately. By following the sequential order of the form, you can ensure that your tax return is accurate, complete, and submitted correctly, ultimately helping you to avoid delays or issues with your tax refund.

Common Challenges and Solutions

When it comes to navigating the complexities of tax preparation, individuals often encounter a multitude of challenges that can hinder their progress and cause undue stress. One of the most common issues is dealing with missing or incorrect line numbers, which can lead to errors and delays in the filing process. Additionally, handling complex tax situations and schedules can be overwhelming, especially for those who are not familiar with the intricacies of tax law. Furthermore, knowing when to seek help from tax professionals or resources is crucial in ensuring that one's tax return is accurate and complete. In this article, we will delve into these common challenges and provide practical solutions to help individuals overcome them. First, we will explore the issue of dealing with missing or incorrect line numbers and provide tips on how to resolve this problem efficiently.

Dealing with Missing or Incorrect Line Numbers

Dealing with missing or incorrect line numbers on your tax return can be frustrating and time-consuming. If you're unable to find a specific line number, such as line 15000, it's essential to remain calm and methodically troubleshoot the issue. First, double-check your tax return form to ensure you're looking at the correct section. Verify that you're using the correct tax year and form type, as line numbers can vary between forms and years. If you're still unable to locate the line number, try searching for keywords related to the line number, such as "total income" or "tax credits." You can also use the table of contents or index to navigate to the relevant section. If the issue persists, consider consulting the tax authority's website or contacting their support hotline for guidance. Additionally, if you're using tax preparation software, check for any updates or patches that may resolve the issue. By taking a systematic approach, you can efficiently resolve the problem and complete your tax return accurately.

Handling Complex Tax Situations and Schedules

Handling complex tax situations and schedules can be a daunting task, especially for individuals who are not familiar with tax laws and regulations. One of the most common complex tax situations is dealing with multiple sources of income, such as self-employment income, rental income, and investment income. In such cases, taxpayers need to complete multiple schedules, including Schedule C for business income, Schedule E for rental income, and Schedule D for capital gains and losses. Additionally, taxpayers may need to complete Form 4562 for depreciation and amortization, and Form 8829 for home office deductions. To handle these complex tax situations, taxpayers can seek the help of a tax professional or use tax preparation software that can guide them through the process. It's also essential to keep accurate records and documentation, including receipts, invoices, and bank statements, to support tax deductions and credits. By staying organized and seeking help when needed, taxpayers can navigate complex tax situations and schedules with confidence.

Seeking Help from Tax Professionals or Resources

Seeking help from tax professionals or resources is a viable option for individuals who are struggling to find line 15000 on their tax return. Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), have extensive knowledge and experience in tax preparation and can provide personalized guidance. They can help individuals navigate the tax return, identify the correct line 15000, and ensure that all necessary information is accurately reported. Additionally, tax professionals can offer advice on how to minimize tax liabilities and maximize refunds. For those who prefer to prepare their own taxes, there are numerous online resources available, including tax software and websites. These resources often provide step-by-step instructions, tutorials, and FAQs to help individuals find line 15000 and complete their tax return accurately. The Canada Revenue Agency (CRA) website is also a valuable resource, offering detailed information on tax returns, including instructions on how to find specific lines, such as line 15000. Furthermore, the CRA offers a free tax preparation software, NETFILE, which can help individuals prepare and submit their tax return electronically. By seeking help from tax professionals or utilizing online resources, individuals can ensure that their tax return is accurate and complete, reducing the risk of errors or delays in processing their refund.