How To Fill Out A Cheque In Canada

In an increasingly digital world, the art of writing a cheque may seem like a forgotten skill. However, there are still many situations in Canada where knowing how to properly fill out a cheque is essential. Whether you're paying rent, settling a bill, or making a charitable donation, understanding the correct way to write a cheque can help you avoid financial mishaps and ensure your payments are processed smoothly. This article will guide you through the process of filling out a cheque in Canada, covering three crucial aspects: understanding the parts of a Canadian cheque, providing a step-by-step guide to properly filling out a cheque, and highlighting common mistakes to avoid. By mastering these elements, you'll gain confidence in your cheque-writing abilities and prevent potential issues with your financial transactions. Let's begin by exploring the various components of a Canadian cheque, which will serve as the foundation for correctly completing this important financial document.

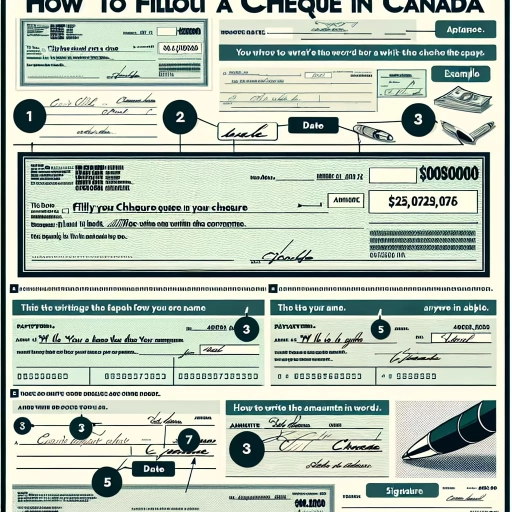

Understanding the Parts of a Canadian Cheque

In an increasingly digital world, the humble cheque still plays a significant role in many financial transactions, particularly in Canada. While electronic payments are on the rise, understanding the components of a Canadian cheque remains essential for both personal and business finances. This article delves into the intricate details of a Canadian cheque, unraveling its various elements to provide a comprehensive guide for both novice and experienced users. We'll explore three key aspects of cheque anatomy: first, we'll identify and explain the crucial elements such as the date line, payee line, and amount boxes, which form the core of any cheque transaction. Next, we'll locate and discuss the significance of the signature line and memo field, two components that add security and context to your payment. Finally, we'll recognize the importance of the MICR line and cheque number, often overlooked but vital for processing and tracking purposes. By the end of this article, you'll have a thorough understanding of the parts of a Canadian cheque, empowering you to navigate this traditional yet enduring form of payment with confidence and clarity.

Identifying the date line, payee line, and amount boxes

Identifying the date line, payee line, and amount boxes is a crucial step in correctly filling out a Canadian cheque. These elements are essential for ensuring that your payment is processed accurately and efficiently. Let's explore each of these components in detail to help you navigate the cheque-writing process with confidence. The date line is typically located in the upper right corner of the cheque. It's where you'll write the current date or a future date if you're postdating the cheque. In Canada, the preferred date format is DD/MM/YYYY (day/month/year). For example, July 1, 2023, would be written as 01/07/2023. It's important to note that while postdating a cheque is allowed, it doesn't guarantee that the recipient won't attempt to cash it before the specified date. Always communicate clearly with the payee if you're postdating a cheque. The payee line is usually found near the center of the cheque, often preceded by the words "Pay to the order of" or simply "Pay to." This is where you'll write the name of the person or organization you're paying. It's crucial to write the payee's name accurately and legibly to avoid any confusion or potential issues when the cheque is being processed. If you're unsure about the exact name to use, especially for businesses or organizations, it's best to double-check with the recipient to ensure you have the correct information. The amount boxes on a Canadian cheque consist of two parts: the numerical amount box and the written amount line. The numerical amount box is typically located on the right side of the cheque and is where you'll write the payment amount in numbers. It's important to write the amount clearly and to start writing from the left side of the box to prevent any potential alterations. The written amount line is usually found below the payee line and is where you'll spell out the payment amount in words. This serves as a backup to the numerical amount and helps prevent fraud or misinterpretation. When writing out the amount, be sure to start at the far left of the line and draw a line through any unused space to prevent additions. For cents, you can write them as a fraction over 100 (e.g., "Twenty-five dollars and 50/100"). By correctly identifying and filling out these key components of a Canadian cheque, you'll ensure that your payment is processed smoothly and accurately. Taking the time to double-check these elements before signing your cheque can help prevent errors and potential financial complications down the line.

Locating the signature line and memo field

When filling out a cheque in Canada, locating the signature line and memo field is crucial for ensuring the cheque's validity and providing additional information about the payment. These two elements play distinct roles in the cheque-writing process and are typically found in specific areas of the document. The signature line is one of the most critical components of a cheque, as it serves as the official authorization for the bank to release funds from your account. Usually located in the bottom right corner of the cheque, the signature line is where you, as the account holder, must sign your name exactly as it appears on your bank records. This signature acts as a legal confirmation that you authorize the payment and agree to the amount stated on the cheque. It's important to note that a cheque without a valid signature will be rejected by the bank, so take care to sign clearly and consistently. Some cheques may have multiple signature lines, which is common for joint accounts or business accounts that require more than one authorized signatory. In such cases, all required signatures must be present for the cheque to be valid. It's crucial to familiarize yourself with your specific account requirements to ensure proper authorization. The memo field, on the other hand, is typically located in the lower left corner of the cheque. This optional field allows you to include a brief note or reference about the purpose of the payment. While not mandatory, filling out the memo field can be incredibly helpful for both you and the recipient in keeping track of the payment's purpose. Common uses for the memo field include writing invoice numbers, account references, or simple descriptions like "rent payment" or "birthday gift." Utilizing the memo field effectively can assist you in managing your finances and reconciling your bank statements. It provides a quick reference for the nature of each payment, making it easier to track expenses and maintain accurate financial records. For the recipient, the memo field can help them properly allocate the payment and apply it to the correct account or invoice. It's worth noting that some modern cheques may have slight variations in the layout, but the signature line and memo field are standard features you can expect to find on virtually all Canadian cheques. As electronic banking becomes more prevalent, these elements remain crucial for those occasions when a paper cheque is necessary or preferred. By understanding the location and purpose of the signature line and memo field, you can ensure that your cheques are properly completed, legally valid, and provide clear information about each transaction. This knowledge is an essential part of mastering the art of writing cheques in Canada and maintaining organized financial records.

Recognizing the importance of the MICR line and cheque number

Recognizing the importance of the MICR line and cheque number is crucial for anyone handling cheques in Canada. The Magnetic Ink Character Recognition (MICR) line and cheque number are essential components that ensure the smooth processing and tracking of cheques within the banking system. The MICR line, located at the bottom of the cheque, is a series of numbers and symbols printed in special magnetic ink. This line contains vital information that allows for quick and accurate automated processing of cheques. It typically includes the cheque number, bank transit number, and account number. The magnetic ink enables high-speed cheque sorting machines to read this information efficiently, reducing processing time and minimizing errors. The cheque number, usually found in the top right corner of the cheque and repeated in the MICR line, serves as a unique identifier for each cheque within an account. This number helps both the account holder and the bank to track individual cheques and maintain accurate records. It's particularly useful when reconciling bank statements or investigating any discrepancies in transactions. Understanding the significance of these elements can help cheque users in several ways. For instance, when ordering new cheques, ensuring that the MICR line and cheque numbers are correct is crucial. Any errors in this information can lead to processing delays or rejected cheques. Additionally, being aware of the cheque number sequence can help in detecting potential fraud or unauthorized use of cheques. For businesses and individuals who frequently write cheques, paying attention to the cheque number can aid in maintaining organized financial records. It allows for easy reference when tracking payments or following up on transactions. Some people even use the cheque number as a reference when communicating with payees about specific payments. It's worth noting that while the use of cheques has declined with the rise of electronic payment methods, they remain an important part of the Canadian financial system, especially for certain types of transactions. As such, familiarity with all parts of a cheque, including the MICR line and cheque number, remains relevant for many Canadians. In the digital age, the information contained in the MICR line is also used in electronic cheque processing systems. When cheques are deposited via mobile banking apps or ATMs, the MICR data is captured and used to process the transaction, demonstrating the enduring importance of this feature even as banking technologies evolve. By recognizing the importance of the MICR line and cheque number, Canadians can ensure more efficient processing of their cheques, maintain better financial records, and contribute to the overall smooth operation of the cheque-based payment system in Canada.

Step-by-Step Guide to Properly Filling Out a Canadian Cheque

In an increasingly digital world, the art of writing a cheque may seem like a fading skill. However, there are still many situations where knowing how to properly fill out a Canadian cheque is essential. Whether you're paying rent, settling a bill, or gifting money to a loved one, understanding the correct process ensures your payment is processed smoothly and securely. This comprehensive guide will walk you through the step-by-step procedure of completing a Canadian cheque accurately and confidently. We'll cover three crucial aspects: writing the date and payee information correctly, entering the amount in both words and numbers with precision, and signing the cheque while adding optional memo details. By mastering these key elements, you'll be equipped to handle any cheque-writing situation with ease. Moreover, this knowledge will help you avoid common mistakes that could lead to payment delays or rejections. Before we delve into the specifics of filling out a cheque, it's important to familiarize yourself with the various parts of a Canadian cheque. Understanding the layout and purpose of each section will provide a solid foundation for the step-by-step instructions that follow.

Writing the date and payee information correctly

Writing the date and payee information correctly on a Canadian cheque is crucial to ensure that your payment is processed accurately and efficiently. When filling out the date, it's important to use the correct format, which in Canada is typically day/month/year (e.g., 15/04/2023 for April 15, 2023). However, it's also acceptable to write out the date in full, such as "April 15, 2023." Whichever format you choose, make sure it's clear and legible to avoid any confusion or potential delays in processing. The payee line is where you indicate who will receive the funds from the cheque. This could be an individual's name, a company name, or an organization. When writing the payee information, it's essential to use the full, legal name of the recipient. Avoid using nicknames or abbreviations, as this may cause issues when the cheque is being deposited or cashed. If you're unsure about the exact name to use, it's best to verify with the recipient beforehand. In some cases, you may need to make the cheque payable to multiple parties. This can be done by writing "and" between the names (e.g., "John Smith and Jane Doe") if both parties must endorse the cheque, or by using "or" (e.g., "John Smith or Jane Doe") if either party can cash it individually. For added security, you can draw a line after the payee's name to prevent any unauthorized additions. It's also important to consider special instructions when writing the payee information. For instance, if you're paying a company, you may need to include an account number or invoice number. In such cases, you can write this information after the payee's name, separated by a comma or on the memo line at the bottom of the cheque. When writing both the date and payee information, always use permanent ink to prevent tampering. Blue or black ink is preferred, as these colors are easily readable and scan well. Avoid using pencil or erasable ink, as these can be altered easily. Lastly, double-check your writing to ensure that both the date and payee information are correct, clear, and free of any errors or smudges. Taking a moment to review this information can save you from potential headaches down the line, such as returned cheques or incorrect payments. By following these guidelines, you'll ensure that your Canadian cheque is filled out properly, facilitating a smooth and hassle-free transaction for both you and the recipient.

Entering the amount in words and numbers accurately

Entering the amount in words and numbers accurately is a crucial step in filling out a Canadian cheque, as it serves as a safeguard against fraud and ensures that the intended payment is processed correctly. This step requires precision and attention to detail, as any discrepancies between the numerical and written amounts can lead to complications or even rejection of the cheque. When writing the amount in words, start at the far left of the designated line to prevent any unauthorized additions. Spell out the dollar amount clearly and legibly, followed by the word "and," then state the cents as a fraction over 100. For example, if the amount is $1,234.56, you would write "One thousand two hundred thirty-four and 56/100." It's important to capitalize the first letter of the first word and use hyphens appropriately for compound numbers. If there are no cents, write "and 00/100" to indicate zero cents. For added security, draw a line from the end of the written amount to the end of the designated space. This prevents anyone from altering the amount by adding extra words. Some people prefer to write "DOLLARS" at the end of the line as an additional precaution. When entering the numerical amount in the designated box, write it clearly and close to the dollar sign to prevent tampering. Use a decimal point to separate dollars and cents, and include zeros for even dollar amounts (e.g., $100.00). Ensure that the numbers are legible and properly aligned within the box. It's crucial to double-check that the written and numerical amounts match exactly. Banks typically honor the written amount if there's a discrepancy, but such inconsistencies can lead to processing delays or rejection of the cheque. Take your time with this step to avoid errors that could cause inconvenience to both you and the payee. Remember that accuracy in this step not only ensures smooth processing of the payment but also protects you from potential fraud. Properly written amounts make it difficult for anyone to alter the cheque without detection. Additionally, clear and accurate amounts help maintain a proper record of your financial transactions, which is invaluable for personal bookkeeping and potential tax purposes. By mastering this step, you demonstrate financial responsibility and attention to detail, skills that are highly valued in personal and professional contexts alike. Take pride in filling out your cheques accurately, as it reflects your commitment to financial integrity and responsible money management.

Signing the cheque and adding optional memo details

Signing the cheque and adding optional memo details

The final step in completing your Canadian cheque is perhaps the most crucial: signing the cheque and adding any optional memo details. This process not only validates the cheque but also provides an opportunity to include additional information for record-keeping purposes. When it comes to signing the cheque, it's essential to use the same signature you have on file with your bank. This signature should be placed on the line at the bottom right corner of the cheque, typically labeled "Signature" or left blank. Your signature serves as your authorization for the bank to transfer the specified funds from your account to the payee. It's important to note that unsigned cheques are invalid and will be rejected by the bank, so always double-check that you've signed before handing over or mailing the cheque. For added security, it's advisable to sign your cheque only after you've filled out all other necessary information. This precaution prevents anyone from altering the cheque's details after you've signed it. If you make a mistake while filling out the cheque, it's best to void it and start over with a new one rather than making corrections that could raise suspicions about the cheque's authenticity. Many Canadian cheques also include a memo line, usually located in the bottom left corner. While this field is optional, it can be incredibly useful for both you and the recipient. The memo line allows you to add a brief note about the purpose of the payment, which can be helpful for your personal record-keeping or for the payee's accounting purposes. Common uses for the memo line include noting an invoice number, specifying the purpose of the payment (e.g., "June Rent," "Car Repair"), or adding a personal message (e.g., "Happy Birthday"). If you're writing a cheque for a business transaction, including relevant details in the memo line can help ensure that the payment is correctly applied to your account. For personal payments, the memo can serve as a reminder of the occasion or reason for the gift. However, be mindful that the information in the memo line is visible to anyone handling the cheque, so avoid including sensitive or private information. Some banks also offer the option to add your phone number or other contact information on the cheque. While not necessary, this can be helpful if there are any issues with processing the cheque and the bank or recipient needs to reach you quickly. By carefully signing your cheque and thoughtfully utilizing the memo line, you not only complete the cheque-writing process but also enhance the clarity and usefulness of this financial document for all parties involved. This attention to detail helps ensure smooth processing of your payment and maintains accurate financial records for both you and the recipient.Common Mistakes to Avoid When Writing a Cheque in Canada

In today's digital age, writing a cheque may seem like a declining practice, yet it remains a crucial skill for many Canadians. Whether you're paying rent, settling a bill, or gifting money, knowing how to properly write a cheque is essential to ensure your financial transactions are processed smoothly and securely. However, even seasoned cheque writers can fall prey to common mistakes that may lead to rejected payments, financial discrepancies, or even fraud. This article aims to shed light on the most frequent errors made when writing cheques in Canada and provide valuable insights to help you avoid them. We'll explore three key areas: preventing errors in spelling and numerical entries, ensuring proper use of abbreviations and symbols, and understanding the implications of post-dated and stale-dated cheques. By mastering these aspects, you'll be better equipped to handle cheque-based transactions with confidence and precision. Before delving into these common pitfalls, it's important to first understand the basic components of a Canadian cheque, as this knowledge forms the foundation for error-free cheque writing.

Preventing errors in spelling and numerical entries

Preventing errors in spelling and numerical entries is crucial when writing a cheque in Canada, as even minor mistakes can lead to significant complications and potential financial issues. One of the most common errors occurs when writing the recipient's name or the payment amount, which can result in the cheque being rejected or processed incorrectly. To avoid such pitfalls, it's essential to double-check all information before finalizing the cheque. When writing the recipient's name, take extra care to spell it correctly and legibly. Verify the spelling with the payee or any official documents you may have. If you're unsure about the correct spelling, it's always better to ask for clarification rather than risk writing an invalid cheque. For business payees, ensure you use the full, legal company name rather than abbreviations or trade names. Numerical entries require particular attention, as discrepancies between the written and numerical amounts can cause confusion and potential rejection of the cheque. Always start writing the numerical amount at the far left of the designated box to prevent anyone from altering the amount by adding extra digits. Use a clear, consistent handwriting style and avoid leaving large gaps between numbers. When writing out the amount in words, begin as close to the left edge of the line as possible and draw a line through any unused space to prevent alterations. Be sure to spell out the dollars and use a fraction for cents (e.g., "One hundred fifty-two and 50/100"). If you make a mistake, it's best to void the cheque and start over rather than attempting to correct it, as crossed-out or altered cheques may be viewed with suspicion by financial institutions. To further reduce the risk of errors, consider using a pen with permanent ink that cannot be easily erased or altered. Blue or black ink is generally preferred, as these colors are easily distinguishable on most cheque paper and reproduce well when scanned or photocopied. Implementing a personal double-check system can also be beneficial. After completing the cheque, take a moment to review all the information carefully, paying close attention to the spelling of names, the accuracy of dates, and the consistency between written and numerical amounts. If possible, have someone else review the cheque for added assurance. By taking these precautions and maintaining a high level of attention to detail, you can significantly reduce the likelihood of errors in spelling and numerical entries on your cheques. This diligence not only ensures smoother financial transactions but also helps protect you from potential fraud or misunderstandings related to your payments.

Ensuring proper use of abbreviations and symbols

Ensuring proper use of abbreviations and symbols is crucial when writing a cheque in Canada to avoid confusion and potential security issues. One common mistake that many people make is using inappropriate abbreviations or symbols, which can lead to misinterpretation or even rejection of the cheque by financial institutions. When writing the date on a cheque, it's essential to use the correct format and avoid ambiguous abbreviations. In Canada, the preferred date format is DD/MM/YYYY or Month DD, YYYY. Using numerical representations for months (e.g., 01 for January) is acceptable, but it's important to be consistent and clear. Avoid using shorthand like "Jan" or "Feb" as these can be misinterpreted, especially if the cheque is processed in different regions or countries. Another area where proper use of abbreviations and symbols is critical is in writing the amount in words. It's crucial to spell out the full amount without using any abbreviations or symbols. For example, write "One hundred and fifty dollars" instead of "One hundred & fifty dollars" or "100 fifty dollars." Using ampersands (&) or numerals within the written amount can create confusion and potentially lead to alterations. When it comes to writing the numerical amount, use the dollar sign ($) correctly and place it immediately before the first digit without any spaces. Ensure that you fill in all empty spaces with a horizontal line to prevent unauthorized additions. For cents, use a decimal point followed by two digits, even if the amount is a whole number (e.g., $100.00). It's also important to avoid using any symbols or abbreviations in the payee line. Write out the full name of the individual or organization to whom the cheque is payable. Using initials or abbreviated company names can lead to issues with cashing or depositing the cheque. In the memo line, while it's acceptable to use common abbreviations related to the purpose of the payment (e.g., "Inv." for invoice), it's best to write out the full words to ensure clarity. This helps both you and the recipient keep accurate records of the transaction. When signing the cheque, use your full signature as it appears on your bank records. Avoid using initials or abbreviated versions of your name, as this can raise red flags with financial institutions and potentially lead to the cheque being rejected. Lastly, be cautious about using any additional symbols or markings on the cheque that are not standard. Extra symbols or notations can be misinterpreted as alterations or attempts to modify the cheque, potentially causing issues with processing or acceptance. By being mindful of these guidelines and avoiding the improper use of abbreviations and symbols, you can ensure that your cheques are clear, professional, and less likely to encounter problems when being processed or cashed. This attention to detail helps maintain the integrity of your financial transactions and promotes smooth, error-free banking experiences.

Understanding the implications of post-dated cheques and stale-dated cheques

Understanding the implications of post-dated cheques and stale-dated cheques is crucial for anyone using cheques in Canada. These two types of cheques can have significant consequences if not handled properly, and being aware of their implications can help you avoid potential financial and legal issues. Post-dated cheques are those written with a future date, typically used when the payer wants to delay the payment until a specific date. While it's legal to write post-dated cheques in Canada, it's important to understand their limitations and risks. Banks are not obligated to honor the future date on a post-dated cheque, and they may process it before the specified date if it's deposited early. This can lead to unexpected withdrawals from your account and potential overdraft fees. To protect yourself, clearly communicate with the recipient about when the cheque should be deposited and consider placing a stop payment order with your bank if necessary. On the other hand, stale-dated cheques are those that have become too old to be cashed. In Canada, cheques are typically considered stale-dated six months after the date written on them, although this can vary depending on the specific bank or financial institution. Attempting to deposit a stale-dated cheque can result in it being returned unpaid, potentially causing inconvenience and fees for both the payer and the payee. To avoid issues with stale-dated cheques, it's best to cash or deposit cheques promptly and to review your account regularly for any outstanding cheques. When writing cheques, it's essential to be mindful of these potential pitfalls. Avoid post-dating cheques unless absolutely necessary, and if you do, make sure to keep track of when they're due to be cashed. Similarly, if you receive a cheque, deposit it as soon as possible to prevent it from becoming stale-dated. If you find yourself holding onto an old cheque, contact the issuer to request a replacement before attempting to deposit it. It's also worth noting that with the increasing prevalence of electronic payment methods, many businesses and individuals are moving away from cheques altogether. Consider exploring alternative payment options like e-transfers, online bill payments, or direct deposits to minimize the risks associated with post-dated and stale-dated cheques. By staying informed about these issues and adopting best practices when dealing with cheques, you can better manage your finances and avoid common mistakes that could lead to unnecessary complications or expenses.