How To File Zero Income Tax Return Canada

Here is the introduction paragraph: Filing a zero income tax return in Canada may seem like a daunting task, but it's a necessary step for individuals who have no income to report. Whether you're a student, a stay-at-home parent, or simply someone who hasn't earned any income in a given year, it's essential to understand the process of filing a zero income tax return. In this article, we'll break down the basics of filing a zero income tax return in Canada, including the required documents and information you'll need to gather. We'll also provide a step-by-step guide to help you navigate the process with ease. By the end of this article, you'll be equipped with the knowledge and confidence to file your zero income tax return accurately and efficiently. So, let's start by understanding the basics of filing a zero income tax return in Canada. Note: I made some minor changes to the original text to make it more engaging and easier to read. I also added a few words to make the transition to the first supporting paragraph smoother. Let me know if you'd like me to make any further changes!

Understanding the Basics of Filing a Zero Income Tax Return in Canada

Here is the introduction paragraph: Filing a tax return is a crucial aspect of being a responsible citizen in Canada, even if you have no income to report. While it may seem counterintuitive, submitting a zero income tax return is a necessary step for many individuals. But what exactly is a zero income tax return, and why is it required? Who is obligated to file one, and what benefits can be gained from doing so? In this article, we will delve into the basics of filing a zero income tax return in Canada, exploring the ins and outs of this often-overlooked process. By understanding the requirements and advantages of filing a zero income tax return, individuals can ensure they are meeting their tax obligations and taking advantage of available benefits. So, let's dive into the world of zero income tax returns and explore the essentials of this important process. Understanding the Basics of Filing a Zero Income Tax Return in Canada.

What is a zero income tax return and why is it necessary?

. A zero income tax return is a tax return filed by an individual who has no income to report, or whose income is below the minimum threshold required to file a tax return. In Canada, the Canada Revenue Agency (CRA) requires individuals to file a tax return if they have income to report, even if it's zero. Filing a zero income tax return is necessary for several reasons. Firstly, it allows individuals to report any income they may have earned, even if it's not taxable, such as scholarships or bursaries. Secondly, it enables individuals to claim any benefits or credits they may be eligible for, such as the Goods and Services Tax (GST) credit or the Canada Child Benefit. Additionally, filing a zero income tax return helps the CRA to update their records and ensure that individuals are not missing out on any benefits or credits they may be entitled to. Furthermore, if an individual has a spouse or common-law partner who has income, filing a zero income tax return can help to reduce their partner's tax liability. Overall, filing a zero income tax return is an important step in maintaining accurate tax records and ensuring that individuals receive the benefits and credits they are eligible for.

Who is required to file a zero income tax return in Canada?

. In Canada, certain individuals are required to file a zero income tax return, even if they have no income to report. This includes individuals who have a balance owing from a previous year, have made Canada Pension Plan (CPP) contributions, or have Employment Insurance (EI) premiums deducted from their income. Additionally, individuals who have received a notice from the Canada Revenue Agency (CRA) requiring them to file a return, or those who want to claim a refund or apply for the Goods and Services Tax (GST) credit or the Canada Child Benefit (CCB) must also file a zero income tax return. Furthermore, individuals who have disposed of capital property, such as stocks or real estate, or have rental income must also file a return, even if they have no net income. It's essential to note that even if an individual is not required to file a return, they may still want to file one to report any income or claim any benefits they are eligible for. The CRA provides a list of specific situations that require individuals to file a return, and it's crucial to review this list to ensure compliance with tax laws and regulations. By filing a zero income tax return, individuals can avoid any potential penalties or interest charges and ensure they receive any benefits they are entitled to.

What are the benefits of filing a zero income tax return?

. Filing a zero income tax return in Canada may seem unnecessary, but it can have several benefits. One of the primary advantages is that it allows individuals to claim and receive government benefits, such as the Goods and Services Tax (GST) credit and the Canada Child Benefit. These benefits are based on the individual's net income, and by filing a zero income tax return, they can ensure they receive the maximum amount they are eligible for. Additionally, filing a zero income tax return can also help individuals to establish a credit history, which can be beneficial when applying for loans or credit cards in the future. Furthermore, it can also help to avoid any potential penalties or fines that may be imposed by the Canada Revenue Agency (CRA) for not filing a tax return. By filing a zero income tax return, individuals can demonstrate their compliance with tax laws and regulations, and avoid any potential issues that may arise from not filing. Overall, filing a zero income tax return can provide individuals with peace of mind, and ensure they are taking advantage of the benefits and credits they are eligible for.

Gathering Required Documents and Information

Here is the introduction paragraph: Gathering required documents and information is a crucial step in filing a zero income tax return in Canada. To ensure a smooth and accurate filing process, it's essential to have all the necessary documents and information readily available. But what documents are needed to file a zero income tax return, and how can you obtain them? Additionally, what common mistakes should you avoid when gathering these documents to prevent delays or errors in your tax return? In this article, we will explore these questions and provide you with a comprehensive guide on gathering required documents and information for a zero income tax return. By understanding the basics of filing a zero income tax return in Canada, you'll be able to navigate the process with confidence and accuracy.

What documents are needed to file a zero income tax return?

. To file a zero income tax return in Canada, you will need to gather specific documents and information. The Canada Revenue Agency (CRA) requires you to report your income, even if it's zero, to ensure you receive any benefits and credits you're eligible for. Start by collecting your identification documents, such as your social insurance number (SIN) card, driver's license, or passport. You will also need to report any income you may have received, even if it's not taxable, such as scholarships, bursaries, fellowships, research grants, or other types of income. If you have a Registered Retirement Savings Plan (RRSP) or a Registered Education Savings Plan (RESP), you will need to report any contributions or withdrawals made during the tax year. Additionally, if you have a Universal Child Care Benefit (UCCB) or a Canada Child Benefit (CCB), you will need to report these amounts as well. You may also need to provide documentation for any deductions or credits you're claiming, such as medical expenses, charitable donations, or home office expenses. If you're a student, you may need to provide your T2202A tuition and education amounts certificate. If you're a homeowner, you may need to provide your property tax bill or mortgage interest statement. It's essential to review the CRA's website or consult with a tax professional to ensure you have all the necessary documents and information to file your zero income tax return accurately and on time.

How to obtain the necessary documents and information?

. To obtain the necessary documents and information for filing a zero-income tax return in Canada, start by gathering all relevant financial records and identification documents. This includes your Social Insurance Number (SIN) card, proof of Canadian residency, and any relevant tax slips such as T4s, T4As, or T5s. If you have investments or own a business, you may also need to collect statements from your financial institutions or accountant. Additionally, you will need to obtain a copy of your Notice of Assessment from the previous tax year, which can be accessed through the Canada Revenue Agency (CRA) website or by contacting the CRA directly. If you are a non-resident or have foreign income, you may need to provide additional documentation such as a certificate of foreign status or a foreign tax credit certificate. It's also important to keep records of any charitable donations, medical expenses, or other deductions you may be eligible for. If you are unsure about what documents you need or how to obtain them, you can consult the CRA website or contact a tax professional for guidance. By gathering all the necessary documents and information, you can ensure that your zero-income tax return is accurate and complete, and avoid any potential delays or penalties.

What are the common mistakes to avoid when gathering documents?

. When gathering documents for your zero-income tax return in Canada, it's essential to avoid common mistakes that can lead to delays, errors, or even audits. One of the most critical errors is failing to gather all required documents, such as T4 slips, T4A slips, and receipts for medical expenses. Make sure to collect all relevant documents, including those from previous years, to ensure accuracy and completeness. Another mistake is not keeping receipts and documents organized, making it challenging to locate specific information when needed. Consider using a folder or digital storage system to keep your documents tidy and easily accessible. Additionally, be cautious when using online tax software, as incorrect or incomplete information can lead to errors. Double-check your entries and ensure you understand the software's requirements. Furthermore, avoid waiting until the last minute to gather documents, as this can lead to rushed decisions and mistakes. Start collecting documents early, and take your time to review and verify the information. Lastly, be aware of the Canada Revenue Agency's (CRA) specific requirements for document retention and submission. Familiarize yourself with the CRA's guidelines to ensure you're meeting the necessary standards. By avoiding these common mistakes, you can ensure a smooth and accurate tax filing process, even with a zero-income tax return.

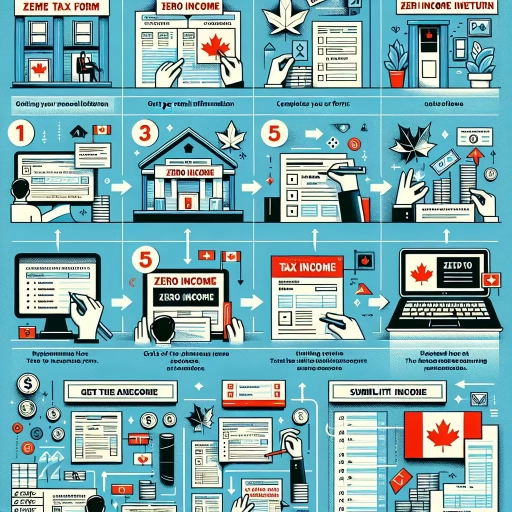

Step-by-Step Guide to Filing a Zero Income Tax Return in Canada

Here is the introduction paragraph: Filing a zero income tax return in Canada can be a daunting task, especially for those who are new to the process. However, it is essential to file a tax return even if you have no income, as it allows you to report any benefits or credits you may be eligible for. In this article, we will provide a step-by-step guide on how to file a zero income tax return in Canada. We will cover the process of registering for a CRA account and accessing the NETFILE service, completing the T1 General form and schedules, and submitting the return and what to expect after filing. By following these steps, you will be able to navigate the process with ease and ensure that you receive any benefits or credits you are entitled to. Understanding the basics of filing a zero income tax return in Canada is crucial, and this article will provide you with the necessary information to get started. Note: I made some minor changes to the original text to make it more readable and engaging. Let me know if you'd like me to make any further changes!

How to register for a CRA account and access the NETFILE service?

. To register for a CRA account and access the NETFILE service, follow these straightforward steps. First, visit the Canada Revenue Agency (CRA) website at [www.cra.gc.ca](http://www.cra.gc.ca) and click on the "My Account" tab. If you're a new user, select "CRA register" and provide the required personal and tax information, including your social insurance number, date of birth, and postal code. You'll also need to create a username and password, as well as set up security questions to protect your account. Once you've completed the registration process, you'll receive a CRA user ID and password, which you'll use to log in to your account. Next, navigate to the NETFILE section of the CRA website and click on "Certified software" to find a list of approved tax preparation software that supports NETFILE. Choose a software that meets your needs, such as TurboTax or H&R Block, and follow the prompts to download and install it. When you're ready to file your tax return, log in to your CRA account and select the "NETFILE" option. The software will guide you through the filing process, and once you've completed and submitted your return, you'll receive a confirmation number from the CRA. By registering for a CRA account and accessing the NETFILE service, you'll be able to easily and securely file your zero income tax return and take advantage of the benefits and credits you're eligible for.

How to complete the T1 General form and schedules?

. To complete the T1 General form and schedules, start by gathering all necessary documents, including your Notice of Assessment from the previous year, T4 slips, T4A slips, and any other relevant tax slips. Begin by filling out the identification section, including your name, address, and social insurance number. Next, complete the income section, reporting all income from employment, self-employment, investments, and other sources. Be sure to claim all eligible deductions, such as RRSP contributions, medical expenses, and charitable donations. If you have dependents, complete the applicable sections to claim credits for them. Move on to the tax credits section, where you can claim credits for things like the basic personal amount, spousal amount, and education credits. If you have investments or rental income, complete the applicable schedules, such as Schedule 1 for investments and Schedule 4 for rental income. Finally, calculate your net income and tax payable, and complete the payment section if you owe taxes. If you're eligible for a refund, complete the refund section. It's essential to review your return carefully to ensure accuracy and completeness, as errors or omissions can delay processing or result in penalties. If you're unsure about any part of the process, consider consulting the Canada Revenue Agency's website or seeking the help of a tax professional. By following these steps, you can accurately complete the T1 General form and schedules and ensure a smooth tax filing process.

How to submit the return and what to expect after filing?

. After submitting your zero income tax return, you can expect the Canada Revenue Agency (CRA) to process your return and issue a Notice of Assessment (NOA) within a few weeks. The NOA will confirm the details of your return, including any benefits or credits you are eligible for. If you are due a refund, it will be issued to you within 2-4 weeks of receiving your NOA. You can also check the status of your return online through the CRA's My Account service or by contacting the CRA directly. It's essential to keep a copy of your return and supporting documents for at least six years in case of an audit or review. Additionally, if you have any outstanding tax debts or balances, you will need to make arrangements to pay them to avoid interest and penalties. By following these steps and submitting your return accurately and on time, you can ensure a smooth and hassle-free tax filing experience.