How To Send Money From Usa To Canada

Understanding Money Transfer Basics

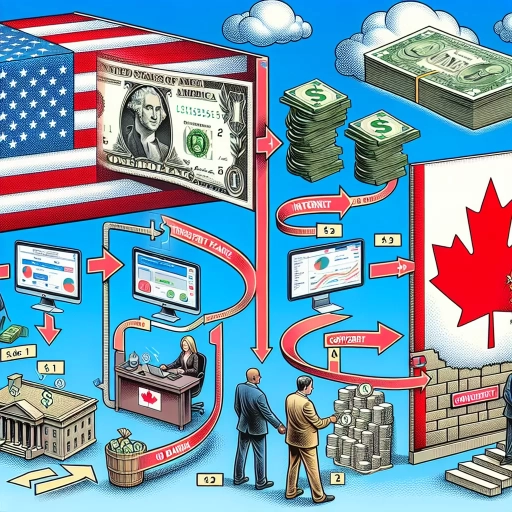

The significance of cross-border transactions

Living in the digital age has revolutionized the way we handle financial transactions, especially those that cross international borders. The continuous evolution of technology and international trade has prompted a rise in demand for efficient, secure, and fast ways to send money from USA to Canada. Whether it's for personal or business reasons, understanding how to navigate these processes is essential. According to a report by the World Bank, cross-border transactions have rapidly increased over the last years, pointing to the interest of consumers and businesses in international transfer solutions.

The legal framework behind money transfers

Transmitting money internationally involves several jurisdictions and their respective laws and the underpinning international financial protocols that ensure these transactions are secure, reliable, and efficient. In both the USA and Canada, there are strict regulations by financial regulatory bodies, such as the Financial Crimes Enforcement Network (FinCEN) in the USA and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), which oversee these transactions to prevent money laundering and other financial crimes. Understanding this legal framework is of high importance to ensure the compliance of these transactions with the local and international law.

The role of exchange rates and transaction fees

When sending money from the USA to Canada, it's important to consider the current exchange rates as they can greatly affect the amount the recipient eventually gets. Factors that affect these rates include; current market conditions, the economic status of the countries involved, and the inflation rate among others. Transaction fees are another significant factor to consider. Different money transfer services apply different fees on transactions, and it’s important to compare these to ensure you're not losing much of your money to these fees.

Selecting the Best Money Transfer Service

Comparing available money transfer services

In the quest to find the most suitable service to send money from the USA to Canada, it’s important to consider various service providers and their offerings. Key factors to consider when comparing these services include the transfer speed, customer service, safety, and reputation among others. Some renowned money transfer services that operate between the USA and Canada include Western Union, PayPal, TransferWise, among others. A detailed review of each service will provide a good starting point in making an informed decision.

Assessing online reviews and ratings

Online reviews and ratings provide real users’ experiences with different service providers. They provide honest insights into how these services work and the possible challenges users might encounter when using the services. These reviews can be found on the service provider's website or third-party review sites. They are important in assessing the provider’s reliability and overall service quality. However, one should use a discerning eye as some reviews can be biased or manipulated.

Identifying the most cost-effective option

Sometimes the most advertised options are not necessarily the most cost-effective. Costs associated with sending money internationally can include transaction fees and foreign exchange margins. Some service providers may also have hidden charges that aren’t disclosed upfront. Therefore, it’s crucial to understand all the costs associated with a transfer before making a final decision. Services that offer low-cost transactions and favourable exchange rates may offer the best value for money.

Making The Money Transfer

Signing up for your chosen service

Once you've chosen the best money transfer service that meets your needs, the first step to making a transfer is usually to sign up for the service. This is usually a simple process that involves providing your personal information such as full names, address, and contact information. Depending on the service, you may also be required to verify your identity using a government-issued identification.

Initiating the money transfer

To initiate a money transfer, you will typically need to enter the recipient's details, such as their name, account details, and contact information. Next, you will need to enter the amount you want to transfer and select the funding source (usually a bank account or credit card). Once you've entered all the necessary details, you can confirm and send your transfer. Most services offer the ability to track your transfer online.

Securing the transaction

Fraud and scams are common in money transfers. Therefore, it's important to ensure that the transfer is secure. Some of the things to consider include; using a secure network when initiating the transfer, non-disclosure of your personal, financial and transaction details, confirming the identity of the recipient, and using reputable money transfer services. Following the recommended security measures will help avoid potential risks associated with sending money internationally.