How Long Does A Etransfer Take

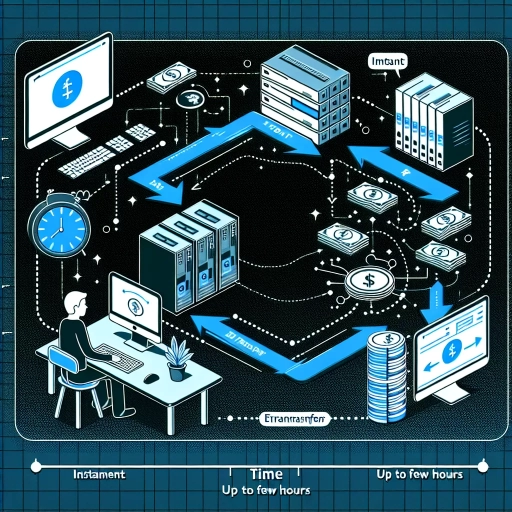

In the digital landscape of transactions, the speed and efficiency of financial transfers have taken on a critical role. As e-transfers or electronic funds transfers have become increasingly commonplace, a question often posed by users is - "How long does an e-transfer take?". In this comprehensive article, we strive to answer that pressing query and delve into the essential aspects related to e-transfer timings. First, we will explore "Understanding Etransfer Processing Times", giving you an in-depth view of how long it generally takes and what factors come into play during the process. Then, we take a deeper dive into the "Factors Influencing Etransfer Speed" that are often not in control of the users but significantly affect the speed. Lastly, through "Real-World Examples and Case Studies", we will provide tangible instances to illuminate the reality of e-transfer timelines. So, without further ado, let's kick off with an insight into Etransfer Processing Times and set the groundwork for gaining a holistic understanding of this crucial financial tool.

In the digital landscape of transactions, the speed and efficiency of financial transfers have taken on a critical role. As e-transfers or electronic funds transfers have become increasingly commonplace, a question often posed by users is - "How long does an e-transfer take?". In this comprehensive article, we strive to answer that pressing query and delve into the essential aspects related to e-transfer timings. First, we will explore "Understanding Etransfer Processing Times", giving you an in-depth view of how long it generally takes and what factors come into play during the process. Then, we take a deeper dive into the "Factors Influencing Etransfer Speed" that are often not in control of the users but significantly affect the speed. Lastly, through "Real-World Examples and Case Studies", we will provide tangible instances to illuminate the reality of e-transfer timelines. So, without further ado, let's kick off with an insight into Etransfer Processing Times and set the groundwork for gaining a holistic understanding of this crucial financial tool.Understanding Etransfer Processing Times

Understanding the intricacies of eTransfers, particularly the variables influencing processing times, isn't necessarily straightforward. With a multitude of factors at play, it's crucial to dig deeper to truly comprehend the process. To help shed light on this subject, this article will explore three key aspects that govern eTransfer processing times. Firstly, we'll delve into the various factors that can affect eTransfer speed, exploring how elements such as the sender-receiver relationship, bank's transaction limits, and day of transaction can directly impact transfer time. Next, we'll discuss the role of bank processing times and their inherent delays. Sometimes, these delays are due to checks on the bank's end to prevent fraud and ensure transaction security. Finally, we'll look at technical issues and system maintenance times, which are unavoidable elements that can skip a beat in your eTransfer's rhythm. With a focus on these areas, you'll better understand what underpins the ‘processing’ in eTransfer processing times. By knowing what to expect, you can better navigate and plan around these factors. Let’s begin by examining the multitude of factors that can affect the speed of your eTransfer.

Factors Affecting Etransfer Speed

Etransfer speed is significantly influenced by various factors that intertwine in sometimes complex ways. The most prominent among these factors include the processing policies of participating banks and financial institutions, the overall network traffic, the geographical location of sender and receiver, as well as security checks. Firstly, each bank or financial institution has a unique set of processing rules that applies to etransfers, which can significantly affect the transaction speed. Some banks are extremely expedient, making funds available within minutes, while others may need anywhere from a few hours to a full business day. These policies depend largely on the institution's technological capacity, security protocols, and operational framework. Therefore, it is beneficial to be familiar with your bank's specific policies for a smoother and faster transaction process. Another factor that significantly impacts etransfer speed is the volume of overall network traffic at any given time. Like any other digital process, etransfers go through a network that can become congested due to high activity. For instance, paydays and bank holidays tend to witness high traffic, potentially causing delays. In such cases, transferring money early in the morning or late at night when network traffic is likely to be lower can potentially speed up transaction times. The geographical locations of both the sender and the receiver also play a pivotal role in determining the etransfer speed. Domestic etransfers are typically faster as they traverse relatively short distances, while international transfers could take longer due to the multiple stages of processing involved across various international banking systems. In this context, it's noteworthy that some banks or financial institutions establish faster networks with certain countries, simplifying and accelerating the transfer process to these locations. Lastly, the speed of etransfers can be impacted by security checks that banks and financial institutions conduct to prevent illicit activities such as money laundering and fraud. High-value transfers are particularly subject to stricter scrutiny, which can sometimes lead to longer processing times. The sender's and receiver's accounts are also likely to face thorough checks if any suspicious activity is detected, thereby adding to the transaction time. Taking these factors into account can significantly help anticipate the potential duration of an etransfer, thereby facilitating a smoother and more efficient transaction process. However, it is also critical to remember that etransfer times are essentially reliant on variables that are often beyond the command of the sender or receiver, hence, some degree of patience and flexibility becomes necessary when conducting such transactions.

Bank Processing Times and Delays

Bank Processing Times and Delays are an integral aspect that determines the overall duration of an e-transfer. Every banking firm or financial institution operates under different protocols, business hours, and various system capabilities. Consequently, the exact time needed to process an eTransfer largely relies on where and when it is being sent. Processing times for banks can range from immediate transfers to transactions that take a few business days. This fluctuation stems from the factor that systems employed by these institutions don't run ceaselessly. They usually operate within specific ‘business hours,’ which can exclude weekends or public holidays, the times the general populace would presume transacting might be fastest. Banks often batch process transactions together meaning, instead of processing them instantly, they gather a group of transactions and process them at the same time to optimize their system resources, which can invariably delay the transfer time. Furthermore, the transfer speed can also depend on whether the transaction is happening within the same bank or different banks. Interbank transactions typically take longer due to the need for communication and verification between two separate banking systems. It is equally significant to examine the role of potential delays that can cause an eTransfer to be delayed significantly. Delays in bank processing times can occur due to numerous reasons, such as system maintenance, updates or malfunctions, or heightened security checks invoked by abnormal or unusually large transactions. These security checks are crucial to prevent fraudulent activities but can increase the waiting period for transfers’ clearance. Another form of delay can emerge on the receiver's side. This happens if the recipient does not accept the transaction timely. The recipient's bank might also have its system processing times — resulting in additional delays even after the sender's bank has processed the transaction. The banks strive to process transfers as quickly as possible to provide seamless service. However, the intricate process of securing, verifying, and recording transactions to ensure they are error-free and legitimate mandates careful time. Therefore, understanding these bank processing times and potential delays can equip bank customers with realistic expectations about eTransfer durations while boosting their confidence in the banking system's credibility and efficiency.

Technical Issues and System Maintenance

Financial Technology's speed, efficiency, and extensive availability have reshaped the banking and financial sector to make it more user-friendly and accessible. However, it also has its fair share of complexities and intricacies. Often, eTransfer processing timelines are expected to be instant, but certain factors can potentially delay these transactions. A key concern that can affect eTransfer processing times is technical issues and system maintenance. Primarily, these tend to revolve around downtime, software bugs, server overload, or network connectivity glitches. Consequently, any one of these complications can greatly increase processing times or even halt transactions temporarily. For instance, your service provider's servers may be undergoing scheduled maintenance or have a sudden network issue that can postpone eTransfer completion times. Although these scenarios can be rather tedious, they are necessary to ensure both the safety and efficiency of the overall system operation, thereby protecting your resources. In the digital age, dealing with software bugs and system errors is an inconvenient yet vital aspect of maintaining a safe and effective eTransfer environment. A bug in the system may cause transfers to be delayed, and sometimes, even cancelled. It is an unanticipated variable that often goes unnoticed until revealed by its adverse impacts, thus making it a silent disrupter of seamless processing times. Adding to this, as the volume of users performing eTransfers surges, especially during peak transaction hours, servers may be overwhelmed, causing undue delays. This overload is particularly common during business hours, public holidays, or festive seasons when users attempt to make numerous transactions simultaneously. Lastly, network connectivity, often taken for granted, is a critical factor that could impact eTransfer processing times. This factor becomes particularly relevant in scenarios where connectivity issues on the sender's or receiver's end can hold up the transaction process. In conclusion, understanding the effects of technical issues and system maintenance can significantly add to your understanding of eTransfer processing times. Therefore, while instant eTransfers are often the norm, some unavoidable contingencies could potentially delay your transactions. Knowledge of these factors is beneficial as it allows you to predict possible delays and plan accordingly, ensuring your financial activities function smoothly despite these occasional setbacks.

Factors Influencing Etransfer Speed

The concept of Etransfer has revolutionized the financial industry, offering unparalleled convenience by enabling instant money transactions between different banks and financial institutions. However, the speed at which these transactions are completed can vary considerably based on several influencing factors. This includes the Time of Day and Day of Week, Transaction Amount and Frequency, and individual Sender and Recipient Bank Details. The time at which a transaction is initiated can have a substantial impact on the speed of its completion. Banks and financial institutions typically have business hours during which they efficiently process transactions. Likewise, the volume of transactions - as governed by the amount of money being transferred and the frequency of such transaction - can influence the speed of Etransfers. Last but not least, specific bank details of both the sender and recipient are also contributing factors. Keeping this in mind, let’s delve deeper into how the Time of Day and Day of Week impact the Etransfer speed. The significance of these timing factors often go unnoticed, yet they play a critical role in determining the speed of transaction processing.

Time of Day and Day of Week

Billions of Etransfers are executed globally on a daily basis. Interestingly, the time of the day and the day of the week can significantly impact the Etransfer speed — one of many factors in the equation of digital transaction processing. It is remarkable how a seemingly trivial element can play an essential part in the time it takes an Etransfer to reach its destination. During peak business hours, there is a significant surge in online transactions that can result in slower processing times. The high traffic on banking networks, especially between 9AM – 5PM on weekdays, can delay transaction processing times. Consequently, there is a distinct possibility that an Etransfer may take a longer time to complete if sent during these peak hours. In contrast, during non-peak hours — usually late in the evening and early morning — banks often experience a decline in their online traffic, potentially making Etransfer processes faster due to the reduced stress on their network infrastructures. Furthermore, weekends and holidays also impact the speed of Etransfers. Most traditional banks do not typically process transactions on non-business days. Modern online and digital banking services offer 24/7 services, yet bear in mind they can still experience slower processing times during weekends and holidays. This is mainly due to the fact that their transaction-processing partners, such as other banks and financial institutions, may not operate fully on these days. Additionally, global time differences can add a complicated layer to the Etransfer processing time. Banks and other financial institutions follow the business hours of their specific time zones, which affects when they process transactions. Hence, an Etransfer sent across different time zones can take longer to process, especially in cases where the Etransfer sent near the end of the business day in one time zone might not be processed until the start of the next business day in the receiving time zone. In effect, the time of day and the day of the week in which the Etransfer is executed influences the speed of its processing and its arrival to the intended recipient. Understanding these factors can help navigate and plan necessary Etransfers with full awareness of potential timeframes and delays. While the digital financial world continues to advance and improve, these aspects remain a crucial part of the conversation surrounding Etransfer speed. It is a fascinating intersection of time, technology, and finance, showing us how interconnected and interdependent these elements are in our modern world.

Transaction Amount and Frequency

One of the critical factors influencing e-transfer speed is the transaction amount and frequency. When it comes to the transaction amount, most banks and financial institutions have daily transfer limits instituted as a security measure. While some institutions may allow larger transfer amounts, these typically take a little longer to process for security and verification purposes. Consequently, if you're making a high-value transfer, you're likely in for a longer wait time. This ensures both the sender and receiver's safety and reduces the risk of fraud or wrong transfers. High-frequency transactions could also potentially signal a security alert, leading to further delays. Suppose you're conducting multiple transactions within a short span regularly. In that case, it might be considered suspicious activity by the financial institution's security systems, thus slowing down the process further. Your overall banking behavior may also play a role in this. For instance, if you've just opened an account and are already making high-value, high-frequency transactions, the institution might put in extra scrutiny, extending the transaction time. But it's not always a matter of security. Institution policies, system capabilities, and even interbank relationships play a part in this. Some banks may have stricter rules and less capacity to process high-frequency transactions, while others operating on more advanced systems might handle this faster. The relationship between the sending and receiving banks can also influence the speed. For instance, if they are a part of the same banking network or have a good working relationship, transactions could be processed faster. Overall, while the transaction amount and frequency are just two factors influencing e-transfer speeds, they can significantly impact this aspect. It’s worth being mindful about how much you’re transferring and how often to ensure efficient processing. Consulting with your specific banking institution for its policies and limitations could also better prepare you for how long the e-transfer might take.

Sender and Recipient Bank Details

The accuracy of sender and recipient bank details is a crucial factor that directly influences the speed of an e-transfer. Detailed information is essential as it forms the basis for hassle-free online transactions. For instance, every transaction involves elements such as the sender's account number, bank routing number, name, and the same details about the recipient. The information exchange between the sender's and recipient's bank is how funds get processed and sent securely from one end to another. Any inaccuracies in this information may result in delays of transfer or even transaction failure. A common instance of this can be mistyping the recipient's account number or using an incorrect bank routing number. Such discrepancies can derail the transaction process, forcing the funds to bounce back to the sender's account, hence elongating the total time taken for the transaction. The bank systems are designed for security, so if they find any misalignment or discrepancy in the transaction details, the transaction is halted or reversed to prevent potential fraud or malicious activity. This security measure, while safeguarding users' funds, can inadvertently lead to delays if the sender doesn't enter the details correctly. Therefore, the correctness of the sender’s and recipient’s bank details plays a pivotal role in the speedy process of e-transfers. Moreover, different banks may have varying processing times based on their technology efficiency, transfer policies, and banking hours. There might be a further delay if the sender and recipient bank are situated in different geographical locations or if they are international banks. Such details are pivotal as transactions across borders or between banks with different operating systems might take longer to reconcile and process. Furthermore, factors such as weekends, public holidays, cut-off timings, and bank's working hours can also affect the transaction speed. Banks typically have a specific cut-off time each day for processing transactions. If a transaction is initiated after this time, it will likely get processed on the next working day, thus slowing down the entire process. In conclusion, the accuracy in the sender and recipient bank details, adherence to bank policies, and correct understanding of bank specific mechanisms can greatly influence the speed of e-transfers. Thus, it behooves customers to ensure correctness on these fronts to enjoy a seamless and speedy e-transfer service.

Real-World Examples and Case Studies

As the modern world continues to benefit from advances in digital technology, one such boon is the evolution of Etransfers within the realms of online banking and finance. This innovative form of money transfer fosters convenience, time-efficiency, and a broad global reach. However, to grasp its full impact, one must delve into real-world examples and case studies. This article furnishes a comprehensive view of Etransfers in the real-life context by employing three main support areas. Firstly, it contrasts Fast and Slow Etransfers, shedding light on the influencing factors and differentiating traits. Secondly, it uncovers a multitude of Success Stories and Lessons Learned from institutions and individuals who have paved the way for Etransfer improvements. Lastly, it explores Common Etransfer Issues and Solutions, offering a balanced narrative that highlights both the challenges and the strategized solutions within the Etransfer realm. Progressing forth, we commence our exploration with a comparative study of Fast and Slow Etransfers, and their implications on users and broader financial ecosystems.

Fast and Slow Etransfers Compared

Today's digital economy necessitates rapid monetary exchanges; hence the increasing reliance on e-transfers. The speed at which these transfers are effected can significantly influence business operations, personal transactions, and even macroeconomic factors. Comparing fast and slow e-transfers sheds light on their impacts and plausible applications. Fast e-transfers, as implied, are immediate or near-immediate, often taking a matter of seconds or minutes to complete. These have gained significant traction in recent years owing to their convenience and efficacy in an increasingly fast-paced world. With such transfers, businesses can seamless pay and receive payments, enhancing their liquidity management. Notably, it has been imperative in facilitating international trade, characterized by time-sensitive transactions. For instance, a US-based fashion retailer handling 'just-in-time' inventory management can promptly pay an Italian leather supplier through instant e-transfers, thus maintaining the supply chain's integrity. On the personal front, individuals use fast e-transfers for instant peer-to-peer money transfers, negating the need for cash or checks. In 2020, Zelle, a US-based digital payments network, registered a 62% growth in their fast peer-to-peer transactions, underlining their vital role in a digitized society. Slow e-transfers, on the other hand, typically take a few hours to a couple of days to process. While seemingly counterproductive amongst the speedy alternatives, slow e-transfers have their unique applications, mainly due to their cost-effectiveness. Particularly for large-volume transfers, businesses and individuals often prefer slow e-transfers due to lower processing fees. An example of slow e-transfer application is by non-profit organizations. When these organizations receive large donations from overseas, they generally prefer to use slower e-transfer methods to avoid massive charges on fast e-transfers. The Bill & Melinda Gates Foundation, for instance, frequently employ slow e-transfers when receiving or disbursing large funds. Overall, the choice between fast and slow e-transfers is subjective, depending on the urgency, volume, and cost implications. With an increasing global shift towards digitization, it's plausible that more efficient, cost-effective, and rapid e-transfer options might emerge, further transforming the financial landscape.

Success Stories and Lessons Learned

Success stories and lessons learned often thrive at the heart of real-world examples and case studies. These narratives not only inspire, but they also offer practical lessons, shareable methods, and substantive experiences for individuals and organizations navigating similar paths. One profound success story is the evolution of online transactions, particularly eTransfers. Consider a decade ago: online banking was still gaining ground. Today, it's a bulwark of global finance systems with processes such as eTransfers for sending and receiving money becoming a standard. One notable case study here is Interac Corp's eTransfer system, a Canadian-based service which has revolutionized money transfer in the country. The system overcame early challenges linked to data safety and slow processing times, to become a fast, secure, and preferred money transfer method for millions, taking approximately 30 minutes to an hour at most times. This wasn't just luck; it was a triumph of innovation, learning, and adapting. The initial slow eTransfer speeds were a major obstacle. Customers found the 24 to 48 hours transfer time inconvenient, pushing the company to optimize their processes for efficiency. They harnessed technological advancements, specifically cloud-based technologies and robust end-to-end encryption to ensure safe, swift deliveries. The successful reduction of eTransfer times dramatically boosted their market acceptance. However, with success came new lessons. One major issue was handling peak volume times. Instances of transfers taking longer than an hour arose during these periods, leading to customer dissatisfaction. Interac approached this from an infrastructural upgrade perspective, learning from other high-volume, real-time service platforms. They invested in more server capacity and advanced load-balancing techniques to handle volume peaks, further slimming down their transfer times. In summary, Interac's eTransfer service exemplifies how success is often married to challenges, mistakes, and continuous learning. Late Steve Jobs, Apple's co-founder, once said, "Remembering that you are going to die is the best way I know to avoid the trap of thinking you have something to lose. You are already naked. There is no reason not to follow your heart." This quote, in many ways, speaks to the essence of lessons learned from success stories. Success is never a straight line, it is a series of peaks and valleys, and the key to sustained growth and accomplishment lies in learning from the downturns and applying those lessons to future challenges.

Common Etransfer Issues and Solutions

Etransfer is a powerful and convenient tool for sending money electronically. However, the technology is not without its own set of issues. Users often encounter common etransfer problems such as failed transactions, delays, and security concerns. Let's delve into possible solutions for such issues. Failed transactions lead the list of common etransfer issues. This usually happens due to incorrect recipient information or a problem on the recipient's end. Double-checking the recipient's email or mobile information before initiating the transfer can help reduce the chances of a failed transaction. Additionally, since etransfers rely heavily on internet activity and server functionality, a weak internet connection or server downtime could lead to transaction failures or significant delays. Ensuring a strong internet connection and executing transactions during non-peak hours can help mitigate these problems. Delays are another frustrating issue with etransfers. The expectation is instant or near-instant money transfer, but various factors can cause delays; they range from technical glitches, the recipient's bank processing times, or even security measures in place to protect users against fraud. Most financial institutions state in their disclosure that it may take up to 30 minutes or more for the transaction to take effect. However, a delay beyond 24 hours is generally not common. If the delay persists, contacting customer support can expedite the resolution process. Security concerns constitute a significant etransfer issue as well. Despite multiple security layers, like encryption and security questions, etransfers can still fall into the wrong hands, especially through phishing attacks. To add an extra layer of security, users are advised to create challenging security questions that only the authorized recipient can answer. Users should also avoid sharing security question answers via email or text, as these mediums can be easily intercepted by cybercriminals. A notable real-world case study was presented by Royal Bank of Canada (RBC) in 2020. They documented a delay in their etransfer service due to an unprecedented surge in digital banking amidst the COVID-19 pandemic. As per RBC, the delay was resolved by increasing their server capacity. The bank also introduced additional security measures to avoid fraudulent transactions. Furthermore, a 2018 case from TD Bank highlights the security risk in etransfers. A customer lost $3,000 through an etransfer phishing scam, revealing the vulnerabilities of current security protocols. The solution, as recommended by experts, was to use a two-factor authentication method to ensure even greater security in transactions. In conclusion, common etransfer issues require users to take precautionary measures such as double checking recipient data, ensuring good internet connectivity, setting strong security questions, and seeking help from customer care when necessary. Banks and other financial institutions, on the other hand, must continually bolster their systems to better manage processing loads and implement advanced security measures to safeguard transactions.