How Does E Transfer Work

In the digital age, the way we handle currency has profoundly changed. One of these breakthroughs is the electronic money transfer, commonly known as e-transfer, a pivotal tool that has revolutionized the process of money exchange. This article serves as a comprehensive guide about the e-transfer system, equipping you with the knowledge to safely utilize this powerful fiscal tool. The text will firstly present you with an in-depth understanding of electronic money transfer and how this digital system works. Subsequently, we'll journey through the actual steps needed to make an e-transfer, helping you become adept at this crucial digital financial system. Towards the end, we will delve into the security measures associated with e-transfers, a key element because, in our online world, information protection is paramount. Upon finishing this article, you'll be well-armed with the necessary information about e-transfers. Therefore, without further ado, buckle up as we embark on our first exploration into understanding electronic money transfers.

In the digital age, the way we handle currency has profoundly changed. One of these breakthroughs is the electronic money transfer, commonly known as e-transfer, a pivotal tool that has revolutionized the process of money exchange. This article serves as a comprehensive guide about the e-transfer system, equipping you with the knowledge to safely utilize this powerful fiscal tool. The text will firstly present you with an in-depth understanding of electronic money transfer and how this digital system works. Subsequently, we'll journey through the actual steps needed to make an e-transfer, helping you become adept at this crucial digital financial system. Towards the end, we will delve into the security measures associated with e-transfers, a key element because, in our online world, information protection is paramount. Upon finishing this article, you'll be well-armed with the necessary information about e-transfers. Therefore, without further ado, buckle up as we embark on our first exploration into understanding electronic money transfers.Understanding Electronic Money Transfer

It's impossible to deny the evolution of financial transactions in today's digital age. The modern world has transformed this previously time-consuming process into a near-immediate one by facilitating Electronic Money Transfer. This article aims to unravel the concept and intricate workings of e-transfers, focus on the multitude of benefits that e-transfers bring to users, and shed light on the most prevalent e-transfer services accessible to users around the globe. The seemingly complex practice of electronic money transfer has undeniably revolutionized financial management and transactions, promoting simplicity, security, and speed. By understanding these concepts, we embrace the future of financial transactions. Come along as we dissect the fascinating world of e-transfers, delving first into the concept and working process of these digital tools, setting the stage for an enlightening exploration of this financial innovation.

Concept and Working Process of E-Transfers

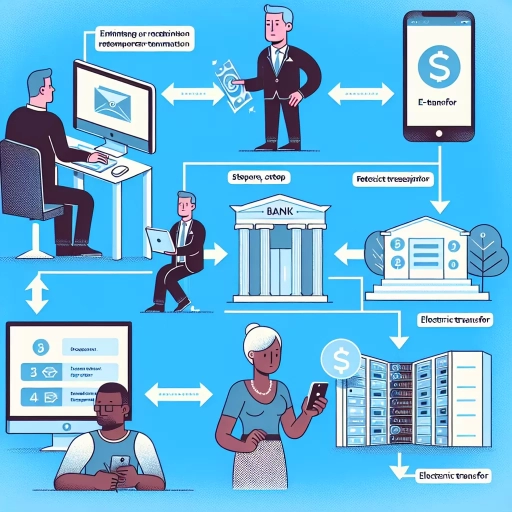

E-transfers, or Electronic Money Transfers, operate as sophisticated, high-speed technologies, powering the flow of funds across today's digital landscape. They serve a major role in the globalized economy, knitting together businesses, individuals, and entities into an interconnected web of financial transactions. Initiated through an electronic request, the sender first authorizes the e-transfer by providing the necessary credentials to access the funds, typically from a bank account. Following this authorization, the intended amount is deducted from the sender's account. The next phase relies heavily on the Automated Clearing House (ACH) network – a secure, centralized system that manages the bulk of electronic transactions. The ACH accepts the sender's request, adding it to a batch of similar orders. Several times a day, these batches are processed, and the transfers are executed. The recipient's bank receives a notification, stating the incoming transfer and the details of the sender. The recipient's account is then credited with the transferred amount, completing the process. E-transfers typically take one to two business days, accounting for verification and fraud prevention steps. What makes e-transfers particularly compelling is the potential for efficiency and convenience. Traditional manual transfers can be time-consuming, requiring paperwork and physical presence. E-transfers, on the other hand, provide a swift, paperless transaction experience, which is accessible anywhere with internet connectivity. However, it’s crucial to remember that this speed and accessibility do come with a need for robust security measures. Most institutions utilize encryption and two-step verification among other advanced security protocols to ensure funds are transferred safely. Wrapping up, e-transfers embody a powerful blend of convenience, speed, and security, facilitating faster, smoother transactions. As we continue to digitalize, understanding and leveraging this financial process become extremely beneficial, shaping the next era of our global financial system. Technologies such as e-transfers are undoubtedly paving the way for a seamless, interconnected economic horizon.

Benefits of Using E-Transfers

E-transfers revolutionize how transactions are done, offering numerous benefits to both individuals and businesses. To start, convenience is a huge plus. Unlike traditional wire transfers that require physical visits to financial institutions, e-transfers can be performed on a smartphone or computer anytime, anywhere. This accessibility has made financial transactions more flexible, particularly for those in remote areas or who cannot spare the time for a bank visit. Efficiency is another important factor. E-transfers are usually processed within minutes or a few hours, significantly quicker than with traditional checks or bank transfers, which can take a few days. Moreover, there's no geographical limit; you can send money across town or the world at a similar pace. Security is enhanced with e-transfers, with multiple layers of encryption technology ensuring that transactions are secure, minimizing the risk of fraud. In addition, e-transfers reduce the necessity for cash handling, a physical security risk. E-transfers also support the quest for financial inclusion, particularly for the unbanked and the underbanked population. It provides them access to services they would otherwise be excluded from due to the lack of a traditional banking infrastructure. E-transfers come with simpler tracking and auditing processes. Digital record-keeping provides easy access to transaction histories, aiding in budgeting, auditing, and dispute resolution. Last, the cost-effectiveness of e-transfers is deemed beneficial for businesses due to the decrease in overhead cost. It minimizes paper checks, physical money handling, or mailing costs - all contributing to a reduction in operational costs. In conclusion, using e-transfers deliver unparalleled benefits such as convenience, efficiency, security, financial inclusion, simplified auditing, and significant cost savings. It simplifies and revolutionizes the way we handle money, truly mirroring the digital age that we live in. The rise of e-transfers reinforces the trends of digitalization and electronic money, leading to a future where cashless transactions could become the norm.

Common E-Transfer Services Globally

Common E-Transfer Services Globally When it comes to electronic money transfers, a number of globally recognized platforms have proven reliable, quick, and easy to use. One of the most popular is PayPal, with over 360 million active users worldwide. This service provides speedy transactions between different currencies, making it a top choice for international businesses and freelancers. Another widely used platform is Western Union, an established player in the industry that allows for money transfers to over 200 countries and territories around the world. The emergence of digitization has also seen rising popularity in newer platforms like TransferWise, a platform celebrated for its transparency about the real mid-market exchange rates and low fees. Alipay, a product of the tech giant Alibaba Group, dominates the Asian market, facilitating seamless e-transfers both within and outside China. Other giants in this domain include Paytm, an Indian based platform, and Venmo, popular among American millennials for its social-friendly interface. These e-transfer services also ensure the highest level of security using multiple layers of advanced encryptions, thereby keeping user's financial data safe from cyber threats. With the evolution of technology, conducting financial transactions using these common e-transfer services has not only become efficient but also boundaryless, bringing the world closer together. These services have transformed the way we perceive and handle money, making distance an obsolete factor in financial transactions. Understanding these global electronic money transfer platforms aids in demystifying how e-transfer works, contributing to a more inclusive and technologically advanced global economy.

Steps to Make an E-Transfer

In today's digital world, carrying out financial transactions like an E-Transfer is practically second nature. This article aims to guide you seamlessly through the process of making an E-Transfer. It breaks down the steps into three focused stages, namely, 'Initiating an E-Transfer: Requirements and Instructions', 'Sending the E-Transfer: Verification and Authorization Procedures', and finally 'Receiving an E-Transfer: Steps and Guidelines'. Each section is designed to elucidate generous insights into the particular stage of E-Transfer, ensuring that you finally gain a comprehensive understanding from its initiation to final acceptance. As we delve into the method, let's begin by focusing on the first crucial step in conducting an E-transfer, which is its initiation. Understanding the requirements and instructions is vital to ensure a smooth and effective transaction. Stay tuned and enjoy this informative ride.

Initiating an E-Transfer: Requirements and Instructions

Initiating an E-transfer involves a process that is quite straightforward, but it requires some key prerequisites and careful execution. To begin an e-transfer, you typically need three vital things. First, an internet or mobile banking facility. This could be an app on your smartphone, or a desktop-based type like the official website of a bank. Second, you must have the email address or mobile number of the recipient to whom you intend to send the money. The third is a secured network connection to prevent any fraudulent activities during the process. Once these primary requirements are in place, the process unfolds in a few simple steps. The first step involves logging into your online banking application, where you will often find an option labeled "E-Transfer" or something similar. This is where your transfer journey begins. Upon clicking, an area should open asking you to input recipient details such as their email or mobile number. It's paramount to ensure that these details are accurate to avoid sending funds to an unintended recipient, an issue that might be hard to undo. The next step involves designating the amount you wish to transfer. Most banking systems offer users a selection of their account balances, from which they can choose the one they want to subtract the transfer amount from. After specifying the amount, most systems will request a question and answer for security purposes. It helps verify the recipient since they will be prompted to provide the correct answer to receive the money you sent. It's is best to choose a question to which only your intended recipient can know the answer. Also, don't forget to inform them about the question and answer you set in advance. The final step is clicking 'Send' or 'Submit' based on what your specific banking application says. Many people may perceive initiating an E-Transfer as a complex process. However, by carefully adhering to the instructions provided and ensuring all requirements are met, it can be a seamless process. This popularity of this digital transaction method lies in its simplistic yet highly secure way of moving money conveniently. By understanding these steps, anyone can successfully conduct e-transfers, shifting their banking activities into the rapidly progressing digital landscape.

Sending the E-Transfer: Verification and Authorization Procedures

Sending an E-Transfer: Verification and Authorization Procedures As a progressive move towards digital financial transactions, Electronic Transfer (E-Transfer) has revolutionized the way we manage our routine financial activities, simplifying them, and accounting for flexibility and ease. However, the success and efficiency of an E-Transfer lie within its crucial process steps, most notably the Verification and Authorization Procedures. This process is the foundational backbone of any E-Transfer, ensuring that it remains secure, swift, and straightforward. It commences with the sender initiating the E-Transfer through their online banking system or application. The sender is then prompted to enter the email address or mobile number of the intended recipient. What follows is a critical phase: verification, where the sender needs to authenticate the transaction by inputting their unique, pre-set security question and answer. The security question acts as an additional layer of protection, ensuring that the transaction only proceeds if the recipient accurately answers it. This step also plays an essential role in deterring unauthorized or mistaken transactions, acting as a built-in fraud alert system. Verification safeguards the funds and legitimizes the recipient. Next comes the authorization procedure. This is an automated process that is taken care of by the bank. Upon successful verification, the bank authorizes the transfer using a network like INTERAC in Canada. This network sends a notification to the recipient about the pending E-Transfer. Once the recipient successfully provides the correct answer to the security question, the transfer is authorized, and the amount is deducted from the sender's account and credited to the recipient's account. This sequence of verification and authorization processes ensures a secure, smooth, and auditable transaction trail. With the surge in digital banking and cyber threats, these protocols provide a safety net, reducing risks associated with electronic transactions. By understanding these procedural nuances, users can confidently leverage the convenience and efficiency of E-Transfers. This crucial knowledge empowers users to securely manage their financial transactions digitally and positions them to take full advantage of this innovative banking solution.

Receiving an E-Transfer: Steps and Guidelines

When receiving an e-transfer, the process is often simple and quick, offering an efficient way to obtain funds directly into one's bank account with just a few clicks. However, the steps and guidelines vary slightly depending on the financial institution and the platform used. Firstly, to receive an e-transfer, you should have a valid email address or a mobile number where the sender can forward the funds. Once the e-transfer is initiated, you will receive a notification either by email or text message, depending on the medium provided to the sender. This notification contains a secure link which you should click on, leading you to a secure, encrypted site where you are requested to choose your bank from a list of participating financial institutions. After selecting your bank, you should log into your online or mobile banking account. It's crucial to ensure your web browser is up-to-date and secure to prevent potential phishing threats or cyber-attacks. Once logged in, you would be directed to a page where you are required to answer a security question. This question is predetermined by the sender, who should also provide the answer separately as part of the e-transfer protocol to keep the transaction secure. The security question adds an extra layer of protection, ensuring that only the intended recipient can access the funds. Upon correctly answering the security question, you may choose the account into which you wish to deposit the funds. Be aware that some banks may take up to 30 minutes to reflect the new balance, although in many cases, the update is instantaneous. In conclusion, receiving an e-transfer offers a seamless, secure and highly efficient means of handling cash transactions from one bank to another. Understanding the steps and guidelines can make the process smoother and worry-free, enabling the recipient to access their funds swiftly and safely. Hence, utilising e-transfers can dramatically simplify personal finances, enabling modern consumers to manage their money digitally with enhanced convenience and security.

Security Measures for E-Tranfers

Digital transactions have dramatically reshaped the way we conduct business, facilitating instant payments across borders. Yet, as the digital economy grows, so too does the need for robust security measures for e-transfers. In this article, we seek to delve into the intricacies of ensuring the safety of digital transactions, analyzing the various risks one might encounter, the features ensuring safe e-transfers and, ultimately, best practices in safeguarding these transactions. Our first point of focus is cybersecurity, an often underestimated terrain in the world of e-transfers. Understanding these risks is the first stride towards effective mitigation. As we shift our focus onto the fundamental features ensuring safe e-transfers, we will discover how these measures buffer against potential threats. Finally, we'll explore tried-and-true best practices that users can utilize to amplify their digital transaction safety. Imminent and increasingly sophisticated cybersecurity risks in e-transfers underline the pressing need for these security measures, a topic we will delve into next.

Cybersecurity Risks in E-Transfers

Digital transactions have grown exponentially, making e-transfers a target for cybercriminals. Cybersecurity risks in electronic monetary transactions have become a concern demanding immediate attention. The crux of these risks lies in the potential for unauthorized access, data breaches, malware attacks, and phishing schemes. In the digital realm, e-transfers are like a double-edged sword. On one hand, they provide unparalleled convenience for transacting around the globe and conducting businesses across borders. However, on the other hand, they expose users to multifarious cybersecurity risks, making their hard-earned money vulnerable to malicious cybercriminals. Data breaches are one of the most alarming cybersecurity risks involved with e-transfers. These breaches can involve unauthorized access to sensitive personal information and banking details, leading to significant financial losses and damage to personal reputation. The transfer of money online leads to the generation of data that cybercriminals can infiltrate, manipulate, and exploit. The advent of malware attacks accentuates risks linked with e-transfers. These rogue software programs can infiltrate your computer systems, gaining unauthorized access to confidential data and causing extensive damage. It can involve not only financial loss but also the compromising of sensitive personal data. Now, phishing schemes in e-transfers are quite prevalent as well. During a typical phishing scheme, cybercriminals disguise themselves as trustworthy institutions to obtain sensitive data. This is crucial as the hunter becomes the hunted – the ones seeking security unknowingly hand over their significant credentials to cyber plunderers. In short, while enjoying the convenience of e-transfers, we must be cognizant of the cybersecurity risks. Notably, focusing on security measures like strong passwords, encrypted connections, multi-factor authentication, and staying vigilant about suspicious activities can significantly decrease these cyber threats. By taking these precautions, we can embrace the efficiency of e-transfers while safeguarding ourselves from the lurking cyber predators.

Features Ensuring Safe E-Transfers

Features Ensuring Safe E-Transfers As an essential component of secure online transactions, features ensuring safe e-transfers are integral in preserving the integrity and guaranteeing the safety of financial exchanges over the internet. First and foremost, encryption is a crucial component of secure e-transfers. It is a process that converts the sender's data into codes to prevent unauthorized access. The recipient, who has a unique key, can only decipher these codes, making it nearly impossible for cybercriminals to intercept and decode the information. Secondly, multi-factor authentication (MFA) elevates the standard username and password protocol by requiring a second or even third verification method. The extra steps could involve a security question, a fingerprint scan, a unique passcode sent via text, or a face ID confirmation. This multi-layered defense system drastically reduces the risk of account breaches and illegitimate transactions. Thirdly, anti-virus and anti-malware software are fundamental in safeguarding online e-transfers. They proactively protect computers and mobile devices from malware, spywares and viruses potent of stealing financial and personal information. Consistently updating these software ensures the optimal defense against thriving cyber threats. Furthermore, secure e-transfers often incorporate a time-out feature, automatically logging the user out after a specific period of stagnancy. This preventive measure is remarkably potent in instances where users might forget to log out from a public computer, or when the device gets stolen while still logged in. Lastly, most secure e-transfers utilize Secure Socket Layer (SSL) protocols for secure communications over computer networks. SSL certificates validate the identity of a business and encrypt the information transmitted, boosting customer's confidence and securing transactions. Regardless of these features, it's important to remember user diligence plays an equally significant role. Regular monitoring of account activities, enabling security alerts, cautious sharing of account information, and use of strong, unique passwords are among practices that greatly enhance e-transfer security. With these robust safety measures in place, e-transfers can prove to be a secure, efficient, and convenient method of money transfer in our increasingly digital-oriented financial landscape.

Best Practices for Safeguarding E-Transfers

Effective safeguarding of e-transfers is indispensable in ensuring top-notch safety during a transaction. One of the best practices for securing e-transfers encompasses setting up strong, difficult-to-decipher security questions and answers. This serves as the first line of defense against unauthorized access. The use of complex, unique, and unpredictable passwords, encompassing a blend of upper and lowercase letters, numbers, and special characters, can bolster this defense further. Multi-factor authentication provides yet another security layer for e-transfers, necessitating the end user to provide multiple evidentiary elements to prove their identity. This typically includes something they know (like a password), something they possess (like a verification code instrumental in confirming one's identity when controlling access), and something unarguably intrinsic to them (like biometrics). Moreover, regular monitoring of account activity is pivotal for early detection of fraudulent activities. Users are recommended to set up alerts for suspicious transactions, instigating immediate investigation and prompt necessary actions. Advanced software solutions that guard against malware and other cyber threats also contribute to safeguarding e-transfers. They achieve this by safeguarding one's device from malicious software that may compromise sensitive financial information. Furthermore, encryption is a bulwark against potential security breaches. It uses complex algorithms to encode data, rendering it inaccessible to unauthorized users. A secure, encrypted connection is instrumental when making e-transfers, as it ensures that data being transmitted is only decipherable by legitimate entities, hence ensuring safer transactions. Lastly, user awareness plays an integral role in the safeguarding of e-transfers. Even with stringent measures in place, security is erodible if users are unsuspecting victims of fraudulent schemes such as phishing. Thus, users should be made aware of potential threats and steps to circumvent them for a safer online transaction environment. In conclusion, the broad range of security measures for e-transfers balances between user convenience and transactional risk. By leveraging the best practices mentioned above, it is possible to mitigate and manage a majority of the potential threats, thereby leading the way toward secure and hassle-free e-transfers.