How Much Will My Insurance Go Up With An At-fault Accident Ontario

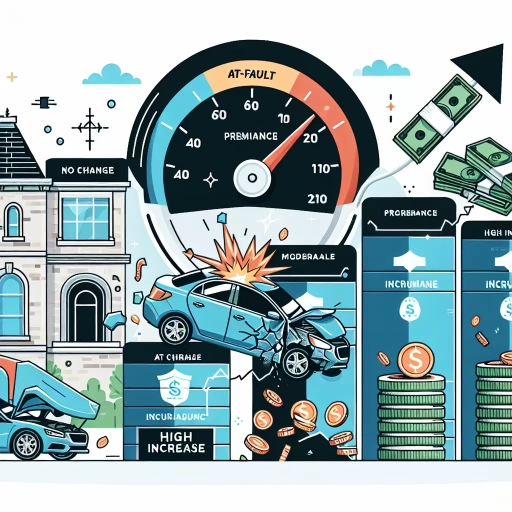

Here is the introduction paragraph: Being involved in an at-fault accident in Ontario can have significant consequences on your insurance rates. The increase in premiums can be substantial, leaving many drivers wondering how much their insurance will go up. The impact of an at-fault accident on insurance rates in Ontario is influenced by various factors, including the severity of the accident, the driver's history, and the insurance company's policies. To better understand the potential rate increase, it's essential to delve into the specifics of how an at-fault accident affects insurance rates in Ontario. In this article, we'll explore the factors that contribute to the magnitude of the rate increase, discuss ways to navigate the consequences, and provide guidance on mitigating the rate hike. By understanding the impact of an at-fault accident on insurance rates in Ontario, drivers can make informed decisions about their coverage and take steps to minimize the financial burden. Understanding the Impact of an At-Fault Accident on Insurance Rates in Ontario is crucial to grasp the full extent of the consequences, and we will start by exploring this topic in the next section.

Understanding the Impact of an At-Fault Accident on Insurance Rates in Ontario

Here is the introduction paragraph: In Ontario, being involved in an at-fault accident can have significant consequences on your insurance rates. The impact of such an accident can be substantial, leading to increased premiums and potentially even policy cancellations. But how do insurance companies calculate rates after an accident, and what factors influence the increase in insurance rates? Furthermore, how do the Fault Determination Rules in Ontario play a role in determining the impact of an at-fault accident on insurance rates? Understanding the answers to these questions is crucial for drivers in Ontario who want to navigate the complex world of insurance rates after an accident. In this article, we will delve into the world of insurance rates and explore the impact of an at-fault accident on insurance rates in Ontario, providing you with the knowledge you need to make informed decisions about your insurance coverage.

1. How Insurance Companies Calculate Rates After an Accident

. Insurance companies in Ontario use a complex algorithm to calculate rates after an accident, taking into account various factors to determine the level of risk associated with insuring a particular driver. The primary factor considered is the severity of the accident, with more severe accidents resulting in higher rate increases. The company will also assess the driver's level of fault, with 100% fault resulting in the highest rate increase. Additionally, the driver's claims history, driving record, and credit score are also taken into account. The insurance company will also consider the driver's age, experience, and vehicle type, as well as the location and type of accident. Furthermore, the company will use data analytics and industry trends to determine the likelihood of future accidents and adjust rates accordingly. The rate increase will also depend on the insurance company's rating system, with some companies using a more aggressive rating system than others. Overall, the calculation of rates after an accident is a complex process that takes into account a wide range of factors to determine the level of risk associated with insuring a particular driver.

2. Factors That Influence the Increase in Insurance Rates

. Several factors contribute to the increase in insurance rates following an at-fault accident in Ontario. One significant factor is the severity of the accident. If the accident resulted in significant damage or injuries, the insurance company may view the driver as a higher risk and increase their premiums accordingly. Additionally, the number of claims filed and the total cost of the claims can also impact the rate increase. If the driver has a history of filing multiple claims, the insurance company may consider them a higher risk and increase their rates. Furthermore, the driver's driving record and history of accidents can also play a role in determining the rate increase. If the driver has a clean driving record with no previous accidents, the rate increase may be lower compared to a driver with a history of accidents. The insurance company's rating system and the driver's insurance score can also influence the rate increase. In Ontario, insurance companies use a rating system to determine premiums, and a driver's insurance score is based on their driving record, credit score, and other factors. A lower insurance score can result in higher premiums. Lastly, the insurance company's overall claims experience and the regulatory environment in Ontario can also impact the rate increase. If the insurance company has experienced a high number of claims in a particular area, they may increase rates to account for the increased risk. Similarly, changes in regulations or laws can also impact insurance rates. Understanding these factors can help drivers anticipate the potential impact of an at-fault accident on their insurance rates in Ontario.

3. The Role of the Fault Determination Rules in Ontario

. In Ontario, the Fault Determination Rules play a crucial role in determining the at-fault party in an accident, which in turn affects insurance rates. These rules, established by the Insurance Act, provide a framework for insurers to assess fault in accidents involving two or more vehicles. The rules consider various factors, including the actions of each driver, the circumstances of the accident, and the applicable laws and regulations. When an accident occurs, insurers use these rules to assign a percentage of fault to each party involved, which can range from 0% to 100%. The at-fault party's insurance rates will likely increase, while the not-at-fault party's rates may remain unaffected or even decrease. The Fault Determination Rules also consider the concept of "shared fault," where both parties are partially responsible for the accident. In such cases, the percentage of fault assigned to each party will impact their respective insurance rates. For instance, if one party is deemed 70% at fault and the other 30%, the former's rates will increase more significantly than the latter's. Understanding the Fault Determination Rules is essential for Ontario drivers, as it can help them navigate the complex process of determining fault and its subsequent impact on their insurance rates. By familiarizing themselves with these rules, drivers can better anticipate the potential consequences of an at-fault accident and take steps to mitigate the effects on their insurance premiums.

Factors That Affect the Magnitude of the Insurance Rate Increase

Here is the introduction paragraph: When it comes to car insurance, one of the most significant concerns for drivers is the potential for rate increases following an at-fault accident. The magnitude of the insurance rate increase can vary greatly depending on several key factors. Three crucial elements that play a significant role in determining the extent of the rate hike are the severity of the accident and the extent of damage, the driver's history and previous claims, and the type of vehicle and its value. Understanding how these factors interact and impact insurance rates is essential for drivers in Ontario who want to minimize the financial consequences of an at-fault accident. By examining these factors in more detail, drivers can gain a better understanding of the potential rate increase and take steps to mitigate its effects. This knowledge can also help drivers make informed decisions about their insurance coverage and take proactive measures to reduce their premiums. Ultimately, understanding the impact of an at-fault accident on insurance rates in Ontario is crucial for drivers who want to navigate the complex world of car insurance with confidence.

1. Severity of the Accident and the Extent of Damage

. Here is the paragraphy: The severity of the accident and the extent of damage play a significant role in determining the magnitude of the insurance rate increase. If the accident resulted in minor damage, such as a small scratch or dent, the insurance rate increase may be relatively small. However, if the accident resulted in significant damage, such as a totaled vehicle or injuries, the insurance rate increase can be substantial. In Ontario, insurance companies use a system called the "Fault Determination Rules" to determine the degree of fault in an accident. If you are found to be 100% at fault, your insurance rates will likely increase more than if you are found to be partially at fault. Additionally, if the accident resulted in injuries or fatalities, the insurance rate increase can be even more severe. In some cases, the insurance company may even cancel your policy or refuse to renew it. Furthermore, if you have a history of accidents or claims, the insurance rate increase can be even more significant. It's essential to note that the severity of the accident and the extent of damage are just two of the many factors that insurance companies consider when determining the magnitude of the insurance rate increase. Other factors, such as your driving record, credit score, and vehicle type, can also play a role in determining the extent of the rate increase.

2. Driver's History and Previous Claims

. A driver's history and previous claims play a significant role in determining the magnitude of the insurance rate increase following an at-fault accident in Ontario. Insurance companies view drivers with a history of accidents or claims as higher risks, as they are more likely to be involved in future accidents. As a result, drivers with a clean driving record and no previous claims will typically experience a lower rate increase compared to those with a history of accidents or claims. The severity of the accident, the number of claims made, and the amount of damages paid out will also be taken into account when determining the rate increase. For example, a driver who has been involved in multiple accidents or has made several claims in the past may face a higher rate increase than a driver who has been involved in a single accident with minimal damages. Additionally, drivers who have been convicted of traffic offenses, such as speeding or reckless driving, may also face higher rate increases. Insurance companies use a complex algorithm to assess the level of risk posed by a driver, and a driver's history and previous claims are key factors in this assessment. By understanding how a driver's history and previous claims impact insurance rates, drivers can take steps to mitigate the effects of an at-fault accident and work towards maintaining a clean driving record.

3. Type of Vehicle and Its Value

. The type of vehicle you drive can significantly impact the magnitude of the insurance rate increase after an at-fault accident in Ontario. Generally, vehicles with higher values or those that are more expensive to repair or replace tend to have higher insurance rates. For instance, if you drive a luxury vehicle, such as a Mercedes-Benz or a BMW, you can expect a more substantial rate increase compared to driving a more modest vehicle, like a Toyota or a Honda. This is because luxury vehicles often come with higher repair costs, which insurers factor into their rate calculations. Additionally, vehicles with advanced safety features or high-performance capabilities may also be more expensive to insure, as they can be more costly to repair or replace in the event of an accident. On the other hand, driving a vehicle with a lower value or one that is less expensive to repair or replace may result in a smaller rate increase. For example, if you drive an older vehicle with a lower market value, your insurance rate increase may be less severe compared to driving a newer, more expensive vehicle. Ultimately, the type of vehicle you drive is just one of the many factors that insurers consider when determining your insurance rates, and it's essential to shop around and compare rates from different insurers to find the best coverage for your needs and budget.

Navigating the Consequences and Finding Ways to Mitigate the Rate Increase

Here is the introduction paragraph: Navigating the consequences of a rate increase can be a daunting task, especially when it comes to car insurance. A rate increase can be triggered by various factors, including an at-fault accident, traffic tickets, or changes in your personal circumstances. When faced with a rate increase, it's essential to understand the insurance company's policy and the reasons behind the increase. This knowledge will enable you to explore options for reducing the rate increase, such as taking a defensive driving course or installing safety features in your vehicle. Additionally, shopping around for alternative insurance providers can help you find a better rate. By understanding the insurance company's rate increase policy, exploring options for reduction, and shopping around, you can mitigate the impact of a rate increase and find a more affordable insurance solution. This is particularly important in Ontario, where the consequences of an at-fault accident on insurance rates can be severe, as we discussed in our previous article, Understanding the Impact of an At-Fault Accident on Insurance Rates in Ontario.

1. Understanding the Insurance Company's Rate Increase Policy

. Here is the paragraphy: Understanding the Insurance Company's Rate Increase Policy When an at-fault accident occurs in Ontario, the insurance company will typically increase the policyholder's premium. The rate increase policy varies from one insurance company to another, but most companies follow a similar framework. The insurance company will assess the severity of the accident, the policyholder's driving record, and the number of claims filed in the past. Based on this assessment, the company will assign a surcharge to the policyholder's premium. The surcharge is usually a percentage of the original premium and can range from 10% to 50% or more, depending on the circumstances. For example, if the policyholder's original premium was $1,000 per year, a 20% surcharge would increase the premium to $1,200 per year. It's essential to review the insurance company's rate increase policy to understand how the surcharge will be applied and for how long. Some insurance companies may offer a "step-back" system, where the surcharge decreases over time if the policyholder maintains a clean driving record. Understanding the rate increase policy can help policyholders navigate the consequences of an at-fault accident and find ways to mitigate the rate increase.

2. Exploring Options for Reducing the Rate Increase

. Here is the paragraphy: If you're facing a rate increase after an at-fault accident in Ontario, there are several options you can explore to reduce the rate hike. One option is to take a defensive driving course, which can demonstrate to your insurer that you're committed to safe driving practices and may lead to a lower premium. Another option is to install a dashcam or other safety devices in your vehicle, which can provide evidence in the event of another accident and potentially reduce your rates. You may also want to consider shopping around for insurance quotes from other providers, as some insurers may offer more competitive rates than others. Additionally, if you have a good driving record prior to the accident, you may be able to negotiate with your insurer to reduce the rate increase. It's also worth noting that some insurers offer accident forgiveness programs, which can help to mitigate the impact of an at-fault accident on your rates. By exploring these options, you may be able to reduce the rate increase and make your insurance more affordable.

3. Shopping Around for Alternative Insurance Providers

. Here is the paragraphy: Shopping around for alternative insurance providers is a crucial step in mitigating the rate increase after an at-fault accident in Ontario. It's essential to compare rates from different insurance companies to find the best option for your situation. Some insurance providers may offer more competitive rates than others, even with an at-fault accident on your record. Additionally, some companies may specialize in providing insurance to high-risk drivers, which could result in lower premiums. When shopping around, make sure to provide the same information to each insurance provider to ensure accurate comparisons. It's also important to consider other factors beyond just the premium rate, such as the level of coverage, deductible, and customer service. By exploring alternative insurance providers, you may be able to find a more affordable option that meets your needs and helps to minimize the financial impact of the rate increase.