How To Transfer Child Tax Benefit To Other Parent

Understanding Child Tax Benefit and Its Transferability

The Importance of Child Tax Benefit

The Child Tax Benefit is a financial assistance instituted by the government to assist families in raising their kids. It serves as a substantial financial relief for families grappling with economic struggles. The stipend helps meet children's needs, including housing, food, clothing, health care, and education requirements. Consequently, the benefit considerably ameliorates the economic stress on families, especially those in the lower-income strata, making lives a lot more manageable for them.

Understanding the Transferability of Child Tax Benefit

Theoretically, the child tax benefit is disbursed to the primary caregiver – generally, the mother. However, particular circumstances may necessitate transferring this benefit to the other parent or a third party, such as when the primary caregiver is unable to fulfill their responsibilities due to health, work, or personal reasons. Such transferability is possible but needs to adhere to specific requisite procedures set forth by the relevant authorities. Therefore, understanding these protocols is pivotal to ensure a smooth and legal transition.

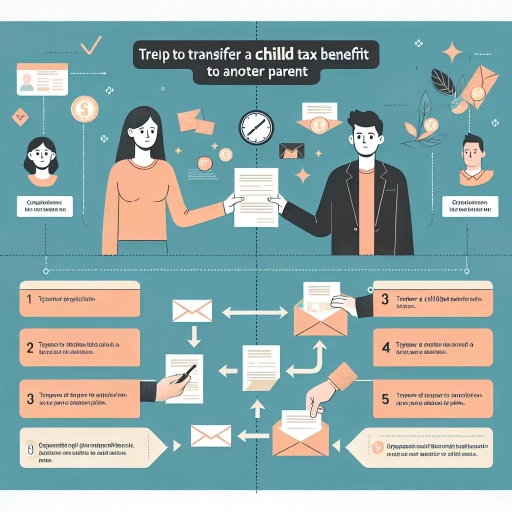

The Process of Transferring the Child Tax Benefit

The procedure for transferring the child tax benefit is fairly straightforward but demands the complete cooperation of both parties involved. This process includes formal request submission for the transfer, documentation furnishing proving the recipient's legitimacy, and validation of the exiting recipient’s relinquishment of the benefit. The transfer doesn't occur instantaneously and might take some time since all documents and circumstances are meticulously vetted for the child’s best interest.

Steps in Transferring Child Tax Benefit

Submitting a Formal Request

The first step in transferring the child tax benefit to another party is submitting a formal request. Standard procedures require the prospective recipient to fill out a form indicating their full name, address, social security number, relationship to the child, among other essential details. Equally important, they should state valid reasons for the transfer. For instance, their taking over as the primary caregiver plays a huge role in swaying the decision-making. This step ensures that the concerned authorities identify the correct beneficiary and kick-start the transfer process.

Substantiation of Recipients Legitimacy

After the formal request is made, the potential recipient is expected to provide supporting documents testifying their relationship with the child. These documents would traditionally include a birth certificate, adoption papers, or court order documents defining custody rights. Depending upon varying regulations, additional documents might be required like proof of residence and proof of providing economic support to the child. The criticality of this step can't be overstressed since it guarantees unequivocally that the recipient rightfully qualifies for the benefit.

Relinquishment by Existing Recipient

In most cases, the existing recipient must issue written consent for the transfer of the benefit. This consent should provide the necessary details – names, address, relationship to the child, reason for relinquishment, etc. In fact, the extant recipient might need to attend an interview or meeting to attest to their relinquishment. This step is to ensure that the transfer process is consensual, ethical, and is indeed in the best interest of the child.

Repercussions of the Child Tax Benefit Transfer

Impact on the New Beneficiary

The person to whom the tax benefit is transferred eventually assumes the role of the primary caregiver. This implies taking on the responsibilities and obligations previously held by the original recipient. In essence, they commit to use the benefit for the child's welfare, including meeting nutritional requirements, providing accommodation, covering education expenses, or healthcare costs, to name a few. Consequentially, they become answerable for any misuse of the benefit.

Impact on the Previous Recipient

Post-transfer, the previous recipient of the child tax benefit relinquishes not only the benefit but also their role as the primary caregiver. They consequently lose the legal rights associated with this status. However, it's crucial to understand that this doesn't absolve them from their responsibilities towards the child as a parental figure, which might include visitation rights, emotional support, etc., depending on the personal circumstances and legal arrangements.

Impact on the Child

Primarily, the child tax benefit is designed for the well-being and growth of the child. Thus, any transfer should fundamentally be made keeping in view the best interests of the child. If the transfer brings about positive changes in the child’s life, offering them a better living environment, better provision of needs, or better parental care, it can be tremendously beneficial, ensuring their healthy, happy, and holistic upbringing. However, it’s vital that during and post the transfer, the child's comfort and emotional well-being are given precedence over everything else.