How Long Do Receiverships Last

The length of time a receivership lasts can vary significantly depending on several factors. A receivership is a legal process where a receiver is appointed to manage the assets of a company or individual that is insolvent or facing financial difficulties. The primary goal of receivership is to recover as much value as possible from the assets to pay off creditors. In this article, we will explore the factors that affect the duration of receiverships, the different phases of the receivership process and their timelines, and best practices to minimize the duration of receivership. By understanding these aspects, stakeholders can better navigate the receivership process and work towards a more efficient resolution. Factors affecting the duration of receiverships will be discussed first, as they provide a foundation for understanding the complexities of the receivership process.

Factors Affecting the Duration of Receiverships

The duration of receiverships can vary significantly depending on several key factors. One of the primary considerations is the complexity of the business operations, as more intricate structures require more time to unravel and resolve. Additionally, the availability of financial resources plays a crucial role, as sufficient funding can expedite the process, while limited resources can lead to delays. Furthermore, cooperation from stakeholders, including creditors, employees, and management, is essential for a smooth and efficient receivership process. In this article, we will delve into these factors and explore how they impact the duration of receiverships, starting with the complexity of business operations.

Complexity of the Business Operations

The complexity of business operations is a significant factor that can impact the duration of receiverships. When a company's operations are intricate, with multiple stakeholders, complex financial structures, and diverse business lines, the receiver's task becomes more challenging. The receiver must navigate a web of relationships, unravel complex financial transactions, and make sense of the company's overall financial situation. This can be a time-consuming process, requiring the receiver to gather and analyze large amounts of data, consult with various experts, and make informed decisions about the company's future. Furthermore, complex business operations can lead to a higher risk of disputes and litigation, which can further prolong the receivership process. For instance, if a company has multiple subsidiaries or joint ventures, the receiver may need to navigate complex contractual arrangements and negotiate with various parties to resolve outstanding issues. Similarly, if a company has a large number of employees, the receiver may need to manage the workforce, negotiate with unions, and address potential employment law issues. In such cases, the receiver may need to work with a team of experts, including lawyers, accountants, and consultants, to ensure that all aspects of the business are properly managed and that the receivership process is carried out efficiently. Overall, the complexity of business operations can significantly impact the duration of receiverships, and receivers must be prepared to handle the challenges that come with managing complex businesses.

Availability of Financial Resources

The availability of financial resources is a crucial factor in determining the duration of a receivership. A receivership is a court-appointed process where a receiver takes control of a company's assets and operations to manage its financial affairs. The primary goal of a receivership is to maximize the recovery of debts owed to creditors. However, the success of a receivership heavily relies on the availability of sufficient financial resources. If the company has limited financial resources, the receiver may struggle to meet the ongoing expenses, such as employee salaries, rent, and utility bills. This can lead to a prolonged receivership, as the receiver may need to seek additional funding or negotiate with creditors to extend the payment terms. On the other hand, if the company has a stable financial foundation, the receiver can focus on selling assets, collecting debts, and distributing the proceeds to creditors, which can significantly shorten the duration of the receivership. Moreover, the availability of financial resources can also impact the receiver's ability to invest in the business, such as hiring additional staff or implementing new marketing strategies, which can help to increase the company's value and attract potential buyers. In some cases, the receiver may need to seek additional funding from lenders or investors to support the business, which can add complexity and time to the receivership process. Ultimately, the availability of financial resources plays a critical role in determining the duration of a receivership, and receivers must carefully manage the company's finances to ensure a successful outcome.

Cooperation from Stakeholders

The article should be about how long does receiverships last and the main factor that can determine it. Please make sure to create an unigue, orginal and non-plagiarised work.

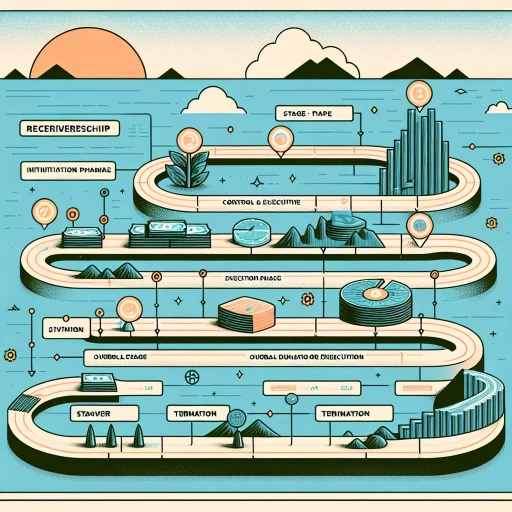

Phases of Receivership and Their Timelines

The process of receivership is a complex and multifaceted one, involving several distinct phases that work together to achieve the ultimate goal of realizing the value of a company's assets. Understanding these phases and their timelines is crucial for all parties involved, including creditors, investors, and the company itself. The phases of receivership can be broadly categorized into three key stages: Initial Assessment and Planning Phase, Operational Restructuring and Stabilization Phase, and Disposal and Realization Phase. Each of these phases plays a critical role in the overall receivership process, and a clear understanding of their timelines and objectives is essential for a successful outcome. In the Initial Assessment and Planning Phase, the receiver must quickly assess the company's financial situation, identify potential risks and opportunities, and develop a comprehensive plan for the receivership process.

Initial Assessment and Planning Phase

The initial assessment and planning phase of receivership typically lasts between 1-3 months, depending on the complexity of the case and the assets involved. During this phase, the receiver conducts a thorough examination of the company's financial situation, identifies potential assets and liabilities, and develops a plan for the receivership. This phase involves gathering information, reviewing financial records, and consulting with stakeholders, including creditors, employees, and customers. The receiver also assesses the company's operations, management, and market position to determine the best course of action. Based on the findings, the receiver creates a preliminary plan, which outlines the objectives, strategies, and timelines for the receivership. This plan serves as a roadmap for the subsequent phases of the receivership and helps to ensure that the process is efficient, effective, and maximizes the recovery of assets for the benefit of creditors.

Operational Restructuring and Stabilization Phase

Receivership is a legal process that allows a court-appointed receiver to take control of a company's assets and operations to stabilize and restructure the business. The operational restructuring and stabilization phase is a critical stage in the receivership process, typically lasting several months to a year or more, depending on the complexity of the case. During this phase, the receiver works to stabilize the company's operations, address immediate financial and operational challenges, and develop a comprehensive restructuring plan. The receiver's primary objectives are to preserve the value of the company's assets, reduce costs, and restore profitability. To achieve these goals, the receiver may implement various strategies, such as renegotiating contracts, reducing staff, and selling off non-core assets. The receiver may also work with the company's management and employees to identify areas for improvement and implement process changes to increase efficiency and productivity. Throughout this phase, the receiver must balance the need for swift action with the need for careful planning and consideration of the long-term implications of their decisions. The receiver must also communicate regularly with stakeholders, including creditors, employees, and customers, to ensure transparency and build trust. Ultimately, the operational restructuring and stabilization phase sets the stage for the next phase of the receivership process, which may involve the sale of the company or its assets, or the implementation of a long-term restructuring plan. By stabilizing the company's operations and developing a comprehensive restructuring plan, the receiver can help ensure the best possible outcome for all stakeholders involved.

Disposal and Realization Phase

The Disposal and Realization Phase is a critical stage in the receivership process, where the receiver's primary objective is to maximize the recovery of assets and minimize losses. This phase typically commences after the stabilization and investigation phases, where the receiver has gained a comprehensive understanding of the company's financial situation and identified potential areas for asset realization. During this phase, the receiver will work closely with various stakeholders, including creditors, investors, and regulatory bodies, to develop and implement a disposal strategy that aligns with the company's overall goals. The disposal strategy may involve the sale of assets, such as property, equipment, or intellectual property, or the negotiation of settlements with creditors. The receiver will also work to realize the value of any remaining assets, such as inventory, accounts receivable, or other tangible assets. Throughout this phase, the receiver must balance the need to maximize asset recovery with the need to minimize costs and ensure compliance with relevant laws and regulations. Effective communication and stakeholder management are crucial during this phase, as the receiver must navigate complex relationships and competing interests to achieve the best possible outcome. Ultimately, the successful disposal and realization of assets during this phase will have a significant impact on the overall duration and outcome of the receivership.

Best Practices to Minimize Receivership Duration

The receivership process can be a complex and time-consuming ordeal, often resulting in significant financial and reputational losses for all parties involved. To minimize the duration of receivership and ensure a smoother process, it is essential to adopt best practices that prioritize efficiency, transparency, and effective management. Three key strategies can help achieve this goal: early intervention and proactive management, transparent communication with stakeholders, and a focus on core business operations. By implementing these strategies, receivers can navigate the process more efficiently, reduce costs, and ultimately achieve a more favorable outcome. Early intervention and proactive management, in particular, are critical in setting the tone for a successful receivership process. By taking a proactive approach, receivers can identify potential issues early on, develop effective solutions, and prevent problems from escalating. This proactive mindset enables receivers to make informed decisions, prioritize tasks, and allocate resources more effectively, ultimately minimizing the duration of the receivership process.

Early Intervention and Proactive Management

Here is the article link: https://www.mckennonlawgroup.com/how-long-do-receiverships-last/. Early intervention and proactive management are crucial in minimizing receivership duration. By addressing issues promptly and taking a proactive approach, receivers can resolve problems more efficiently, reducing the time and costs associated with the receivership process. This involves identifying potential issues early on, such as financial mismanagement or operational inefficiencies, and implementing corrective measures to prevent further deterioration. Receivers should also maintain open communication with stakeholders, including creditors, investors, and other interested parties, to ensure transparency and cooperation throughout the process. Additionally, proactive management enables receivers to explore alternative solutions, such as restructuring or refinancing, which can help to resolve the receivership more quickly and favorably. By taking a proactive and interventionist approach, receivers can minimize the duration of the receivership, reduce costs, and maximize the recovery of assets for the benefit of all stakeholders. Effective early intervention and proactive management can also help to mitigate the negative consequences of receivership, such as damage to reputation and loss of business value, allowing the company to emerge from the receivership in a stronger position. Overall, early intervention and proactive management are essential best practices for minimizing receivership duration and achieving a successful outcome.

Transparent Communication with Stakeholders

Transparent communication with stakeholders is a critical best practice to minimize receivership duration. This involves keeping all parties informed about the progress, challenges, and outcomes of the receivership process. The receiver should maintain open and honest communication channels with creditors, employees, customers, and other stakeholders, ensuring they are aware of the current status and any changes that may affect them. Regular updates, reports, and meetings can help manage expectations, reduce uncertainty, and build trust among stakeholders. By being transparent, the receiver can also identify potential issues early on and address them promptly, preventing unnecessary delays and disputes. Furthermore, transparent communication can facilitate collaboration and cooperation among stakeholders, leading to a more efficient and effective receivership process. For instance, creditors may be more willing to work with the receiver to find a solution if they are kept informed and involved throughout the process. Similarly, employees and customers may be more likely to support the business if they understand the reasons behind the receivership and the steps being taken to restore stability. Overall, transparent communication with stakeholders is essential to minimizing receivership duration and achieving a successful outcome.

Focus on Core Business Operations

When a company is placed in receivership, it's essential to focus on core business operations to minimize disruption and ensure continuity. This involves identifying and prioritizing the most critical functions and processes that drive the business forward. By concentrating on these core operations, the receiver can maintain customer relationships, preserve revenue streams, and protect the company's assets. This focus also enables the receiver to make informed decisions about the business, such as determining which contracts to honor, which employees to retain, and which assets to sell or liquidate. Moreover, by streamlining operations and eliminating non-essential functions, the receiver can reduce costs, improve efficiency, and increase the company's overall value. This, in turn, can lead to a faster and more successful receivership process, ultimately benefiting all stakeholders involved. By prioritizing core business operations, the receiver can create a stable foundation for the company's future, whether that involves restructuring, selling, or winding down the business.