How To Get My Notice Of Assessment

When it comes to managing your personal finances and staying on top of your tax obligations, understanding and obtaining your Notice of Assessment is crucial. This important document, issued by the Canada Revenue Agency (CRA) after processing your tax return, provides a comprehensive summary of your tax situation for the year. Whether you need it for loan applications, government benefits, or simply for your own records, knowing how to access your Notice of Assessment is essential. This article will guide you through the process, covering three key aspects: understanding what the Notice of Assessment entails, exploring various methods to obtain it, and addressing potential troubleshooting issues and special situations you may encounter. By familiarizing yourself with these elements, you'll be better equipped to navigate the Canadian tax system and maintain accurate financial records. Let's begin by delving into the details of what exactly a Notice of Assessment is and why it's so important for Canadian taxpayers.

Understanding the Notice of Assessment

Understanding your tax obligations is crucial for maintaining financial health and staying compliant with the law. One essential document in this process is the Notice of Assessment, a key piece of correspondence from tax authorities that often leaves many individuals puzzled. This article aims to demystify the Notice of Assessment, providing you with a comprehensive guide to its significance and contents. We'll explore what exactly a Notice of Assessment is and why it's important for taxpayers, delving into its role in the tax system and its implications for your financial planning. Next, we'll break down the key information contained within this document, helping you navigate its sometimes complex layout and terminology. Finally, we'll clarify the differences between a Notice of Assessment and your tax return, two documents that are often confused but serve distinct purposes in the tax process. By the end of this article, you'll have a solid understanding of the Notice of Assessment, empowering you to better manage your tax affairs and make informed financial decisions.

What is a Notice of Assessment and its importance

A Notice of Assessment (NOA) is a crucial document issued by the Canada Revenue Agency (CRA) after processing your income tax return. This official statement provides a comprehensive summary of your tax situation for a specific tax year, including your taxable income, tax credits, deductions, and the amount of tax you owe or the refund you're entitled to receive. The NOA serves as more than just a receipt for your tax filing; it's a vital record that plays a significant role in various financial and administrative aspects of your life. The importance of the Notice of Assessment cannot be overstated. Firstly, it confirms that the CRA has received and processed your tax return, giving you peace of mind that your filing obligations have been met. Moreover, the NOA acts as a final calculation of your tax liability, which may differ from your initial estimates due to adjustments made by the CRA. This document is essential for verifying the accuracy of your tax return and understanding any changes made by the tax authorities. Beyond its tax-related functions, the Notice of Assessment holds significance in many other areas. For instance, it's often required when applying for loans, mortgages, or other financial products, as it serves as proof of income and tax compliance. Government agencies and programs, such as social assistance or immigration services, may also request your NOA to assess your eligibility for certain benefits or services. Additionally, the NOA provides valuable information for future tax planning. It outlines your RRSP contribution limit for the following year, which is crucial for maximizing your retirement savings and tax deductions. The document also indicates any carry-forward amounts for items like capital losses or unused tuition credits, which can be applied to reduce your tax liability in subsequent years. For small business owners and self-employed individuals, the Notice of Assessment is particularly important. It confirms your reported business income and expenses, which can be essential for securing business loans, leases, or partnerships. Furthermore, it helps in tracking your tax installment payments and planning for future tax obligations. It's worth noting that the NOA also serves as a starting point for any potential disputes with the CRA. If you disagree with the assessment, you have a limited time frame to file an objection, making it crucial to review your NOA promptly and thoroughly upon receipt. In essence, the Notice of Assessment is a multifaceted document that goes beyond mere tax reporting. It's a key financial record that impacts various aspects of your financial life, from personal planning to business operations. Understanding its content and importance is crucial for maintaining good financial health and ensuring compliance with tax regulations.

Key information contained in the Notice of Assessment

A Notice of Assessment (NOA) is a crucial document issued by the Canada Revenue Agency (CRA) after processing your tax return. It contains key information that every taxpayer should carefully review and understand. The NOA provides a comprehensive summary of your tax situation for the specific tax year, including your total income, deductions, credits, and the final amount of tax you owe or the refund you're entitled to receive. One of the most important pieces of information on your NOA is your taxable income. This figure represents your total income minus all eligible deductions and is used to calculate your tax liability. The NOA also displays your total non-refundable tax credits, which directly reduce the amount of tax you owe. These credits may include items such as the basic personal amount, age amount, and various other credits you've claimed on your tax return. The NOA clearly states whether you have a balance owing or if you're entitled to a refund. If you owe money, it will specify the amount due and the payment deadline. Conversely, if you're receiving a refund, the document will indicate the amount and how it will be issued (e.g., direct deposit or mailed cheque). It's crucial to pay attention to these details to avoid late payment penalties or delays in receiving your refund. Another vital piece of information on your NOA is your RRSP deduction limit for the following year. This amount represents the maximum contribution you can make to your Registered Retirement Savings Plan (RRSP) and deduct from your income in the next tax year. The NOA also shows your available contribution room, which includes any unused contribution room from previous years. The CRA uses the NOA to communicate any changes or adjustments made to your tax return. If the CRA has modified any of the information you provided, these changes will be clearly outlined in the document. It's essential to review these adjustments carefully and contact the CRA if you disagree with any modifications. Your NOA also includes important account information, such as your social insurance number (SIN) and tax center address. Additionally, it provides details about your Home Buyers' Plan (HBP) or Lifelong Learning Plan (LLP) repayments if applicable, as well as any carry-forward amounts for things like capital losses or tuition credits. Lastly, the NOA contains information about how to dispute the assessment if you believe there are errors. It outlines the process for filing an objection and provides the deadline for doing so, typically within 90 days of the date on the notice. Understanding this information is crucial if you need to challenge any aspect of your assessment. By thoroughly examining the key information in your Notice of Assessment, you can gain a clear picture of your tax situation, ensure the accuracy of your return, and make informed decisions about your financial planning for the upcoming year.

Differences between Notice of Assessment and tax return

Understanding the differences between a Notice of Assessment and a tax return is crucial for taxpayers to navigate the complex world of taxation effectively. While both documents are integral to the tax filing process, they serve distinct purposes and contain different information. A tax return is a form that taxpayers complete and submit to the tax authority, typically on an annual basis. This document reports income, expenses, deductions, and credits for the previous tax year. It's essentially a self-assessment of one's tax situation, where the taxpayer calculates their tax liability or refund based on the information provided. Tax returns can be complex, often requiring careful consideration of various financial aspects and adherence to current tax laws and regulations. On the other hand, a Notice of Assessment is a document issued by the tax authority after reviewing the submitted tax return. This notice serves as an official response to the taxpayer's filed return, confirming or adjusting the self-assessed figures. The Notice of Assessment outlines the tax authority's calculation of the taxpayer's income, deductions, credits, and ultimately, the amount of tax owed or refunded. It also includes important information such as the taxpayer's account balance and any changes made to the original tax return. One key difference lies in the timing of these documents. A tax return is prepared and submitted by the taxpayer before the annual filing deadline, while the Notice of Assessment is issued by the tax authority after processing the return, usually within a few weeks or months after submission. Another crucial distinction is the level of authority each document carries. While a tax return represents the taxpayer's declaration of their financial situation, the Notice of Assessment is an official government document that holds legal weight. It serves as the final determination of a taxpayer's obligations for the given tax year, unless contested through formal channels. The Notice of Assessment also provides additional information not found in a tax return, such as the taxpayer's RRSP (Registered Retirement Savings Plan) contribution limit for the following year, carry-forward amounts for certain credits or losses, and any penalties or interest charged on unpaid taxes. Understanding these differences is essential for taxpayers to effectively manage their tax affairs. The Notice of Assessment should be carefully reviewed and compared with the originally filed tax return to ensure accuracy and identify any discrepancies. If disagreements arise, taxpayers have the right to dispute the assessment within a specified timeframe, making it crucial to pay close attention to the details provided in this document. In summary, while a tax return is a taxpayer-prepared document submitted to report financial information, the Notice of Assessment is the government's official response and determination of the taxpayer's obligations. Both play vital roles in the tax process, but serve different purposes in ensuring accurate and fair taxation.

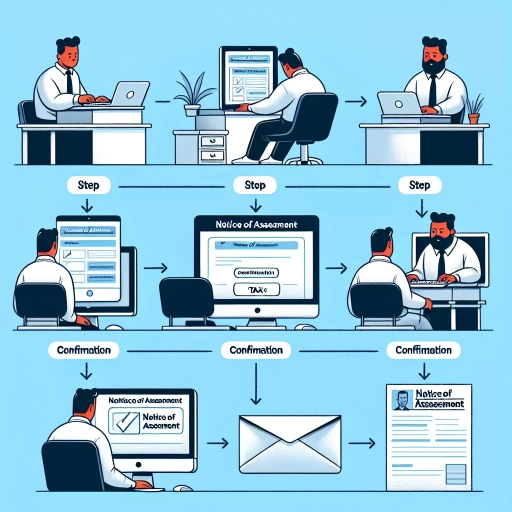

Methods to Obtain Your Notice of Assessment

The Notice of Assessment is a crucial document issued by the Canada Revenue Agency (CRA) that summarizes your tax return and provides important information about your tax situation. Whether you're applying for a mortgage, seeking financial assistance, or simply want to review your tax status, knowing how to obtain your Notice of Assessment is essential. This article explores three effective methods to access this vital document: utilizing the CRA My Account online platform, requesting a copy directly from the CRA via phone or mail, and leveraging tax preparation software. Each method offers unique advantages, catering to different preferences and technological comfort levels. By understanding these options, you can choose the most convenient way to retrieve your Notice of Assessment and stay informed about your tax affairs. As we delve into these methods, it's important to note that regardless of how you obtain it, understanding the contents of your Notice of Assessment is equally crucial. This document contains valuable information about your tax position, including any refunds or balances owing, as well as details about your RRSP contribution limit and other important tax-related data. Let's explore these methods in detail and set the stage for a comprehensive understanding of your Notice of Assessment.

Accessing your Notice of Assessment online through CRA My Account

Accessing your Notice of Assessment online through CRA My Account is a convenient and efficient method to obtain this important tax document. The Canada Revenue Agency (CRA) has made significant strides in digitizing its services, allowing taxpayers to access their tax information securely and quickly through their online portal. To use this method, you'll need to have a CRA My Account, which is a secure online service that provides access to your tax and benefit information. Setting up a CRA My Account is a straightforward process that requires some personal information and security measures. Once your account is active, you can log in anytime to view, download, or print your Notice of Assessment for the current tax year and previous years. This digital access eliminates the need to wait for physical mail or contact the CRA directly, saving you time and effort. One of the key advantages of using CRA My Account is the immediacy of access. As soon as your tax return is processed and your Notice of Assessment is generated, it becomes available in your online account. This means you can often view your assessment results within days of filing your return, rather than waiting weeks for a paper copy to arrive by mail. The online platform also offers additional features that complement the Notice of Assessment access. You can view your tax return status, check your benefit and credit payments, update your personal information, and even file your taxes directly through the platform. This integration of services makes managing your tax affairs more streamlined and user-friendly. Security is a top priority for the CRA, and accessing your Notice of Assessment through My Account is protected by robust encryption and authentication measures. You'll need to go through a multi-step verification process each time you log in, ensuring that your sensitive tax information remains confidential and secure. For those who are less comfortable with technology, the CRA provides detailed guides and support to help navigate the My Account system. They offer step-by-step instructions on how to register, log in, and locate your Notice of Assessment within the portal. Additionally, the CRA continuously updates and improves the user interface to make it more intuitive and accessible for all users. It's worth noting that while online access is highly convenient, it's still advisable to keep physical or digital copies of your Notice of Assessment for your records. The CRA My Account allows you to easily save or print your documents, ensuring you have backups for future reference or for situations where you might need to provide proof of assessment to third parties.

Requesting a copy by phone or mail from the Canada Revenue Agency

Requesting a copy of your Notice of Assessment by phone or mail from the Canada Revenue Agency (CRA) is a straightforward process that can be particularly useful for individuals who prefer traditional communication methods or lack internet access. This option ensures that all Canadian taxpayers can obtain this crucial document, regardless of their technological capabilities or preferences. To initiate the process by phone, you can contact the CRA's Individual Tax Enquiries line at 1-800-959-8281. When calling, be prepared to verify your identity by providing personal information such as your Social Insurance Number (SIN), full name, date of birth, and address. The CRA agent will guide you through the request process and may ask additional security questions to protect your privacy and prevent unauthorized access to your tax information. It's advisable to call during off-peak hours to minimize wait times and ensure a smoother experience. For those who prefer written communication, you can submit a request by mail. To do so, write a letter clearly stating your request for a copy of your Notice of Assessment, including the specific tax year(s) you need. Be sure to include your full name, current address, SIN, and a daytime phone number where you can be reached if the CRA needs to contact you for clarification. Mail your request to the tax centre that serves your area, which can be found on the CRA's website or by calling their general enquiries line. When using either method, it's important to note that processing times may vary. Generally, you can expect to receive your Notice of Assessment within 5 to 10 business days after the CRA processes your request. However, during peak tax seasons or due to unforeseen circumstances, it may take longer. If you haven't received your document within a reasonable timeframe, don't hesitate to follow up with the CRA. One advantage of requesting your Notice of Assessment through these traditional methods is the personal assistance you can receive. CRA agents can provide additional information or clarification about your assessment if needed. Moreover, for individuals with specific accessibility needs or those who require documents in alternative formats, such as large print or Braille, these methods allow for easier accommodation of such requests. While requesting a copy by phone or mail may not be as instantaneous as online methods, it remains a reliable and secure way to obtain your Notice of Assessment. This process ensures that all taxpayers, regardless of their technological access or comfort level, can easily acquire this important document for their records, financial planning, or when applying for various government programs and benefits.

Using tax preparation software to view your Notice of Assessment

Using tax preparation software to view your Notice of Assessment is a convenient and efficient method for accessing this important document. Many popular tax software providers offer integrated features that allow you to retrieve your Notice of Assessment directly within their platforms, streamlining the process and saving you time. One of the primary advantages of using tax preparation software for this purpose is the seamless integration with your existing tax information. Since you've likely already inputted your personal and financial details into the software when filing your taxes, the system can easily authenticate your identity and access your Notice of Assessment without requiring additional steps or information. Most tax software providers offer this service as part of their package or as an add-on feature. To access your Notice of Assessment through tax preparation software, you typically need to log in to your account and navigate to a section dedicated to tax documents or communications from the Canada Revenue Agency (CRA). From there, you can usually select an option to view or download your Notice of Assessment. The process is often user-friendly and intuitive, with clear instructions guiding you through each step. Some software providers even offer mobile apps, allowing you to access your Notice of Assessment on-the-go from your smartphone or tablet. This flexibility can be particularly useful when you need to quickly reference your assessment details while away from your computer. Another benefit of using tax preparation software to view your Notice of Assessment is the ability to easily compare the information with your tax return. This side-by-side comparison can help you quickly identify any discrepancies or changes made by the CRA, ensuring that you have a clear understanding of your tax situation. Many tax software providers also offer additional features to help you interpret and understand your Notice of Assessment. These may include explanations of key terms, breakdowns of calculations, and even suggestions for future tax planning based on your assessment results. It's important to note that while using tax preparation software to view your Notice of Assessment is generally secure, you should always ensure that you're using a reputable provider and that your software is up-to-date. This helps protect your sensitive financial information from potential security risks. Some popular tax preparation software options in Canada that offer this feature include TurboTax, H&R Block, and UFile. However, availability and specific features may vary depending on the software version and package you choose. In conclusion, using tax preparation software to view your Notice of Assessment offers a convenient, efficient, and often feature-rich method for accessing this crucial document. By leveraging the integration with your existing tax information and the user-friendly interfaces of these platforms, you can easily stay on top of your tax affairs and make informed financial decisions.

Troubleshooting and Special Situations

The Notice of Assessment is a crucial document in the Canadian tax system, serving as an official record of your tax return evaluation by the Canada Revenue Agency (CRA). While most taxpayers receive their assessments without issue, there are instances where troubleshooting and special situations may arise. This article delves into three key areas of concern: what to do if you haven't received your Notice of Assessment, how to obtain assessments for previous tax years, and addressing discrepancies or errors in your assessment. By exploring these topics, we aim to equip you with the knowledge and tools necessary to navigate potential challenges in the assessment process. Whether you're facing delays, need historical documentation, or have identified inaccuracies in your assessment, understanding how to approach these situations is essential for maintaining your tax compliance and financial well-being. As we examine these specific scenarios, you'll gain valuable insights into the inner workings of the CRA's assessment procedures and learn how to effectively communicate with the agency to resolve any issues. Ultimately, this comprehensive guide will enhance your understanding of the Notice of Assessment and empower you to handle various tax-related situations with confidence.

What to do if you haven't received your Notice of Assessment

If you haven't received your Notice of Assessment (NOA) within the expected timeframe, there are several steps you can take to address the situation and obtain the necessary information. First, it's important to remember that the Canada Revenue Agency (CRA) typically issues NOAs within two weeks of filing for electronic returns and within eight weeks for paper returns. If you've waited beyond these timeframes, it's time to take action. Begin by checking your online CRA account, as this is often the fastest way to access your NOA. The CRA usually posts electronic copies of NOAs to online accounts before mailing paper versions. If you don't have an online account, consider creating one to streamline future interactions with the CRA and access important tax documents. If your NOA isn't available online or you prefer not to use the online system, contact the CRA directly. You can reach them via phone, but be prepared for potentially long wait times, especially during peak tax seasons. When speaking with a CRA representative, have your Social Insurance Number (SIN) and other relevant personal information ready to verify your identity. Another possibility is that your NOA was mailed but got lost in transit. In this case, inform the CRA and request a reissue. It's crucial to ensure that the CRA has your current mailing address on file to prevent future mishaps. If you've moved recently and forgot to update your address, this could explain the missing NOA. In some instances, the delay in receiving your NOA might be due to processing issues with your tax return. The CRA may require additional information or documentation to complete the assessment. If this is the case, they will typically send a letter requesting the necessary details. Check your mail carefully for any correspondence from the CRA that you might have overlooked. If you filed your taxes through a tax preparer or accountant, reach out to them for assistance. They may have access to additional information or be able to contact the CRA on your behalf to inquire about the status of your assessment. For those who filed their taxes late, remember that the standard processing times may not apply. Late filings often take longer to process, which can delay the issuance of your NOA. Lastly, if you've exhausted all other options and still haven't received your NOA, consider filing a service complaint with the CRA. While this should be a last resort, it can help escalate your case and bring attention to the issue. Remember, your Notice of Assessment is an important document that confirms the CRA's review of your tax return and outlines any changes or amounts owing. It's crucial for various financial matters, including applying for loans or government benefits, so don't hesitate to take action if you haven't received it in a timely manner.

Obtaining a Notice of Assessment for previous tax years

Obtaining a Notice of Assessment for previous tax years can be a crucial step in resolving various financial and tax-related matters. While the process is generally straightforward for the most recent tax year, retrieving assessments from earlier years may require additional steps and patience. The Canada Revenue Agency (CRA) typically maintains records for up to 10 years, making it possible to access older assessments within this timeframe. To begin the process, you can log into your CRA My Account online, which provides access to Notices of Assessment for the current year and up to 10 previous years. If you haven't already set up an online account, you may need to do so using your social insurance number, date of birth, and other personal information. Once logged in, navigate to the "Tax Returns" section, where you can view and download your past assessments. For those who prefer traditional methods or lack internet access, contacting the CRA directly via phone is an alternative. Be prepared to verify your identity by providing personal information such as your social insurance number, full name, date of birth, and current address. The CRA agent can then guide you through the process of requesting assessments for specific years. In some cases, you may need to submit a written request for older assessments. This can be done by sending a letter to your local tax center, clearly stating the tax years for which you need the Notices of Assessment. Include your full name, current address, social insurance number, and signature to authorize the release of information. It's important to note that there may be processing times involved, especially for older assessments or during peak tax seasons. The CRA typically processes these requests within 2-4 weeks, but it can take longer in some instances. If you urgently need the assessment for legal or financial reasons, communicate this to the CRA, as they may be able to expedite the process. For individuals who have moved frequently or changed their name, additional verification may be required. In such cases, you might need to provide supporting documentation to prove your identity and connection to the requested tax years. Lastly, if you're unable to obtain a Notice of Assessment due to extenuating circumstances, such as natural disasters or personal emergencies that resulted in lost records, the CRA may be able to assist you in reconstructing your tax information for the relevant years. This process may involve providing additional documentation and working closely with CRA agents to piece together your tax history. By understanding these various methods and potential challenges, you can more effectively navigate the process of obtaining Notices of Assessment for previous tax years, ensuring you have the necessary documentation for your financial and legal needs.

Addressing discrepancies or errors in your Notice of Assessment

Addressing discrepancies or errors in your Notice of Assessment is a crucial step in ensuring that your tax information is accurate and up-to-date. If you notice any inconsistencies or mistakes on your Notice of Assessment, it's essential to take prompt action to rectify the situation. The Canada Revenue Agency (CRA) acknowledges that errors can occur, and they provide a process for taxpayers to request corrections or dispute assessments. The first step in addressing discrepancies is to carefully review your Notice of Assessment and compare it with the information you provided on your tax return. Look for any differences in reported income, deductions, credits, or other relevant details. If you identify an error, gather all supporting documentation that proves the correct information. This may include T4 slips, receipts for charitable donations, medical expenses, or any other relevant financial records. Once you've identified the discrepancy and collected the necessary evidence, you have two main options for addressing the issue. The first is to file a formal objection, which is a more complex process typically reserved for significant disputes or disagreements with the CRA's interpretation of tax law. The second, and more common approach for straightforward errors, is to request an adjustment to your return. To request an adjustment, you can use the "Change my return" option through your CRA My Account online, or submit a T1-ADJ form (T1 Adjustment Request) by mail. When filing your request, clearly explain the nature of the error, provide the correct information, and include any supporting documents that validate your claim. Be sure to reference your Social Insurance Number and the tax year in question on all correspondence. It's important to note that there are time limitations for requesting adjustments. Generally, you have up to 10 years from the end of the calendar year in which the tax year in question ended to request changes. However, it's advisable to address discrepancies as soon as possible to avoid potential interest charges or penalties. If the error is in your favor and results in a refund, the CRA will typically process the adjustment and issue the refund accordingly. Conversely, if the correction results in additional taxes owed, you'll be required to pay the difference, potentially with interest. In some cases, the CRA may request additional information or clarification regarding your adjustment request. Be prepared to provide any supplementary documentation or explanations promptly to expedite the process. If you're unsure about how to proceed or if the discrepancy involves complex tax issues, it may be beneficial to consult with a tax professional or accountant for guidance. Remember, maintaining open communication with the CRA and addressing discrepancies promptly can help ensure the accuracy of your tax records and prevent potential complications in the future. By taking a proactive approach to managing your Notice of Assessment, you can maintain a clear and accurate tax history, which is crucial for various financial and legal purposes.