How To Calculate Rrsp Contribution Room

Understanding RRSP and Its Importance

Detailed Explanation of RRSP

Registered Retirement Savings Plan (RRSP) is a type of Canadian account for holding savings and investment assets. It was introduced in 1957 to promote savings for retirement by employees and self-employed people. It is often compared to Individual Retirement Arrangements (IRAs) in the United States, but there are key implementation differences that affect how much can be contributed each year. An elucidation of how RRSPs are designed proves fundamental for anyone aspiring to build a worthwhile retirement savings plan.

Benefits of RRSP

An RRSP account provides numerous advantages for its holder. The contributed amount is deductible for tax purposes, reducing an individual's tax burden. Moreover, the income generated within the RRSP is usually exempt from tax as long as the funds remain in the plan. Once withdrawn, however, the funds will be taxed at the regular income tax rate. Consequently, the RRSP scheme is primarily a tax deferral strategy that provides potential long-term benefits.

Role of RRSP in Retirement Planning

The RRSP is a crucial tool for retirement planning. It ensures that individuals have a stable income after retirement without relying solely on government-provided pensions. Unlike regular savings account where capital appreciation is often eroded by inflation and taxes, RRSPs can hold a diversified portfolio of investments, thus offering chances for significant long-term growth.

Calculating RRSP Contribution Room

Understanding RRSP Contribution Limit

The Canadian government sets a limit on the amount that one can contribute to their RRSP each year to enjoy tax benefits. This limit, termed as the 'RRSP contribution room', is calculated based on a person’s earned income in the previous year, up to a certain maximum amount. This amount is usually 18% of the gross income earned in the previous year, subject to a maximum limit set annually by the Canada Revenue Agency (CRA).

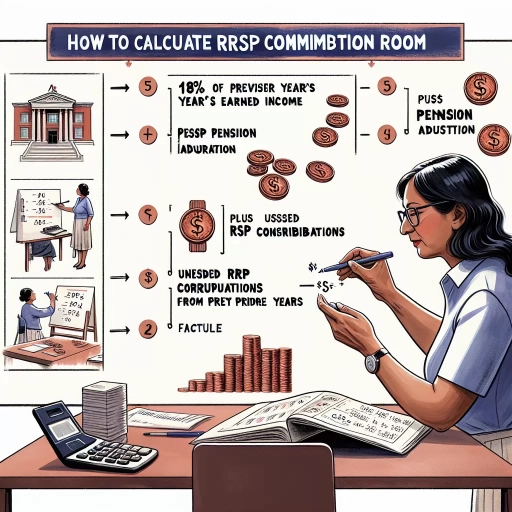

Steps for Calculating RRSP Contribution Room

For accurate calculation of the RRSP contribution room, a clear understanding of the calculation process is essential. Essentially, one should subtract any pension adjustments from the previous year's earned income, then multiply by 18%, and finally subtract any previous year's unused RRSP contribution room. In case the resultant figure exceeds the CRA-set maximum for that year, the excess figure is not tax-sheltered. These steps provide a simple but effective way to calculate the RRSP contribution room, ensuring maximum benefit from the plan.

Impact of Over-contributions

Although RRSP contributes significantly to tax optimizations, over-contributions beyond the defined contribution room can attract penalties. Any contribution that exceeds the predetermined limit by more than $2,000 is subject to a 1% tax penalty per month. This punitive measure is designed to encourage adherence to stipulated contribution limits and optimize the fair distribution of tax benefits among taxpayers.

Optimizing RRSP Contributions

Timely Planning

Contributing to RRSP requires good financial management and planning. Taxpayers should aim to make contributions earlier in the year. Early contributions allow for more growth within the tax-sheltered account, thus maximizing the investment's growth potential.

Tax-efficient Investments

It's essential to consider the type of investments held in an RRSP. Generally, it's best to hold tax-inefficient investments like interest-bearing bonds within the RRSP to gain maximum tax benefits. Conversely, more tax-efficient investments like Canadian dividend stocks might be better held outside of RRSPs. This strategic allocation can significantly enhance tax-saving benefits.

Consistent Savings

Consistency in savings plays a pivotal role in maximizing the benefits of the RRSP scheme. Making consistent contributions throughout the year not only eases the financial burden of making a single large contribution but also helps individuals to benefit from the power of compounding. Essentially, making regular contributions can result in a larger retirement savings pot in the long run.